Do business globally from day one with the only business account you need. sign up today. Boost your team's efficiency with business debit cards and simple spend controls. Send Money Fast To Over 200 Countries & Territories Around The World. Western Union New Customers Get £0 Fee* On 1st Transfer. *FX Gains Apply.

AMP Saver Account AMP

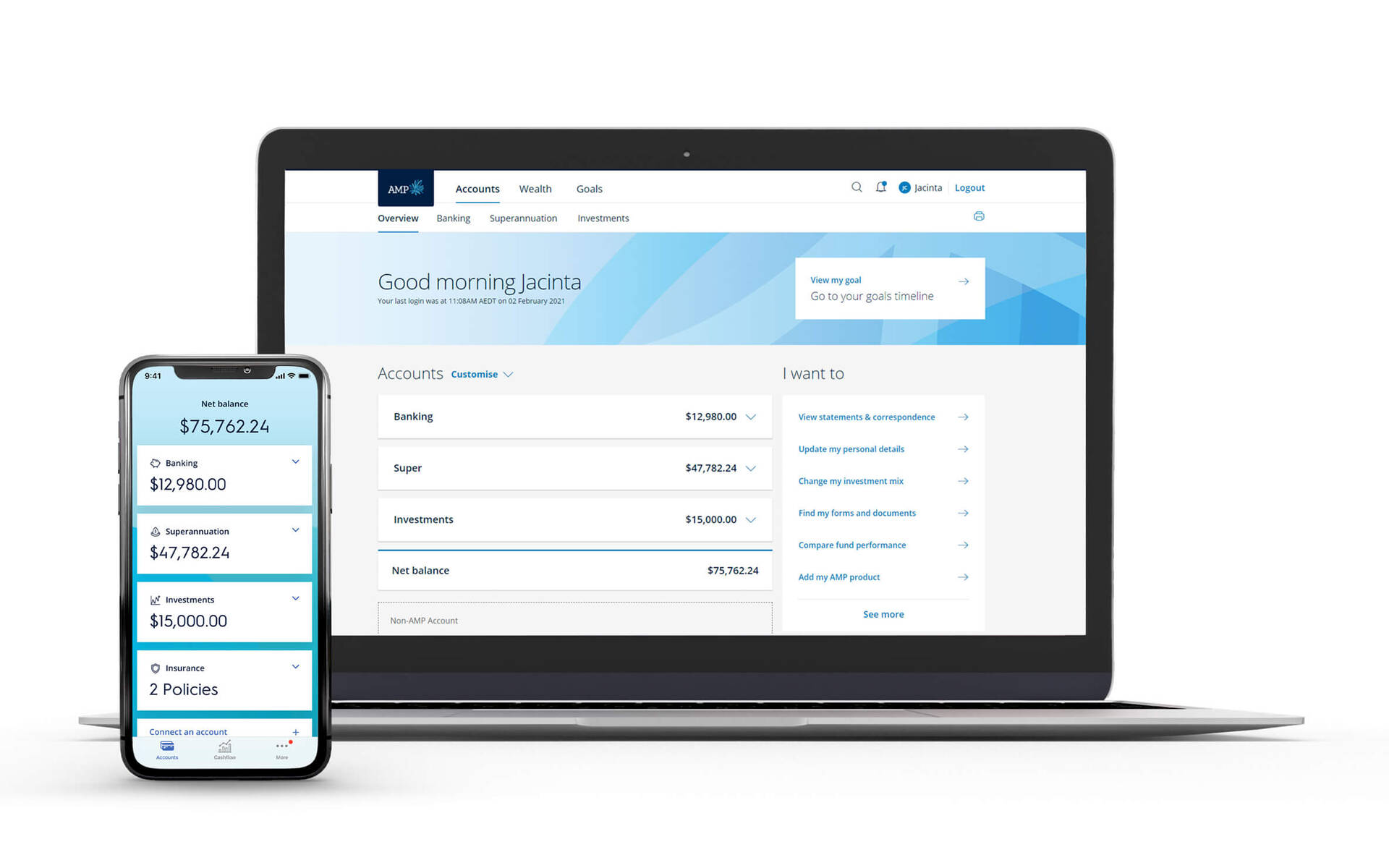

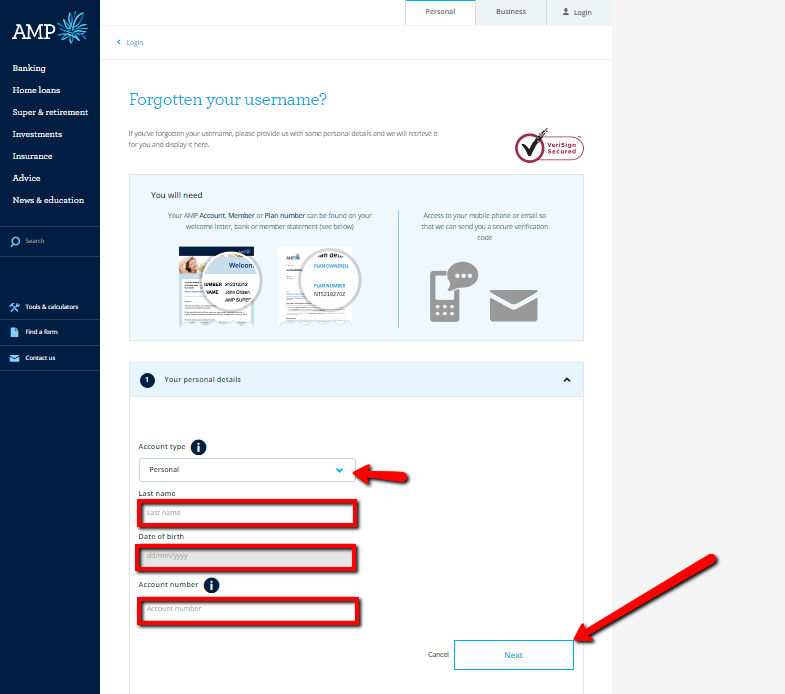

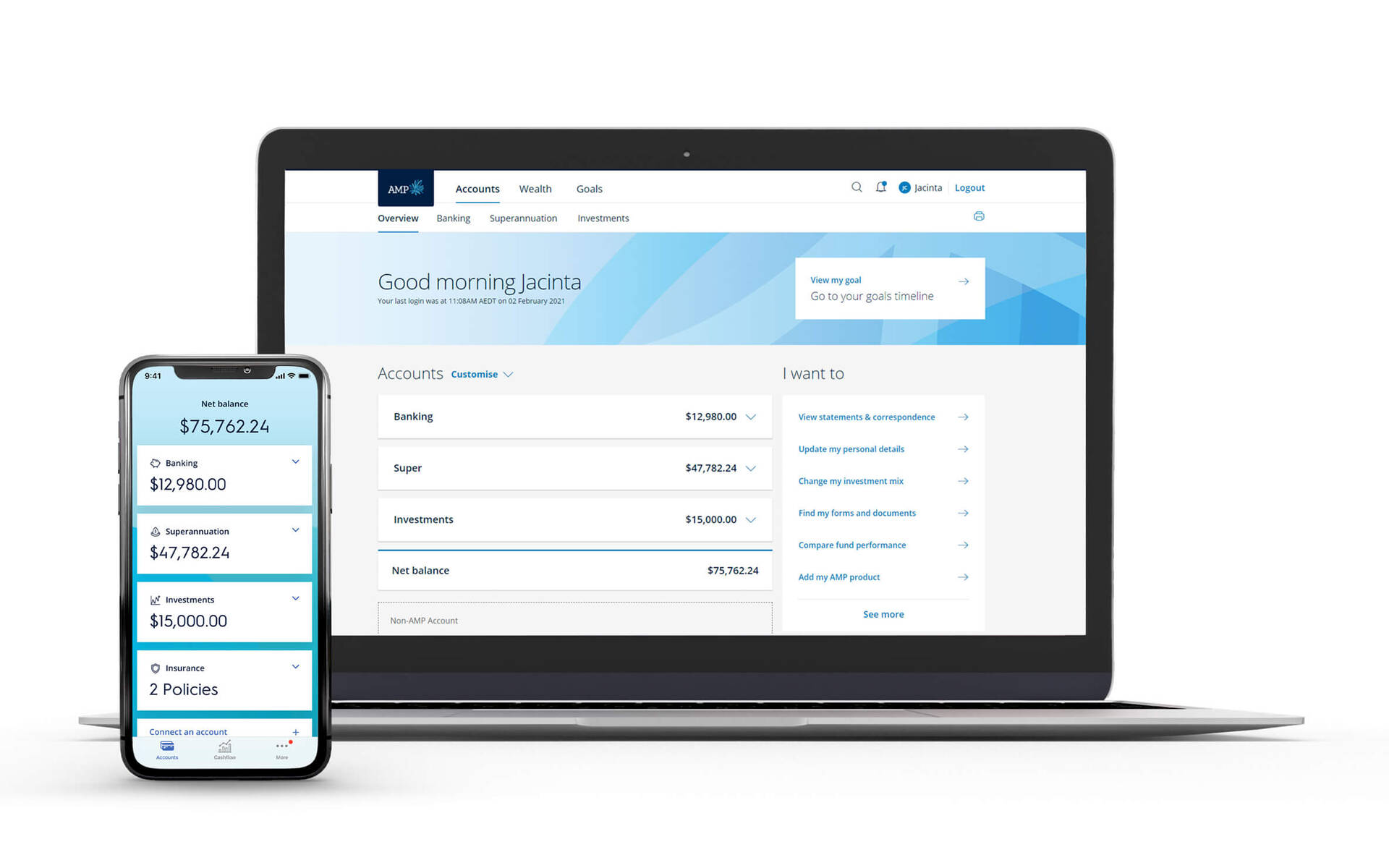

Ways to bank My AMP app My AMP app Securely manage your banking, super, insurance and investments wherever you are, using your smartphone or tablet. Access your accounts via the app and choose to connect with other financial providers to view your AMP and non-AMP accounts all in the one place. Quick access Manage your AMP banking, super, insurance, and investments anywhere, anytime Account management: • View bank and wealth statements and correspondence • Retrieve login details • Set up banking and super alerts via iPhone, iPad or Apple Watch • Log in securely via PIN or Face ID Transactional features: About this app arrow_forward Account management: • View bank and wealth statements and correspondence • Retrieve login details • Set up banking and superannuation alerts • Log in securely via. You can now register for My AMP online banking and begin to use the My AMP mobile app. Simply download the app or visit amp.com.au to get started. You need to complete this step so that you can manage your banking online. Activate your Visa debit card

AMP Bank Online Banking Login CC Bank

BankingTech AMP Bank and Salt Bank tap Starling's Engine platform for digital banking offerings Written by Tyler Pathe 16th November 2023 Australia's AMP Bank and Salt Bank in Romania have been named as the two latest adopters of Starling Bank's Banking-as-a-Service (BaaS) technology platform Engine. Starling Bank extends BaaS to AMP and Salt Bank Home Ways to Bank The Nationwide Banking app The Banking app is made to make managing your money simpler. Now it's even easier to securely bank how you want, when you want. An app that meets our members' needs Our Banking app is just for members. A safe and secure way to manage your everyday banking needs. iPhone and Android app Access your finances on the move and have your super, banking, investments and insurance all at your fingertips. Are you an employer? It's easy to make super contributions for your staff AMP eSuper and AMP Super Online are online services that enable employers to easily manage their super payments for employees. The My AMP app lets you manage your AMP banking, super, insurance, and investments anywhere, anytime via your iPhone or iPad. - connect with your other financial providers and view all your accounts in one place - set up a budget to monitor your income and spending - vie… Global Nav Open MenuGlobal Nav Close Menu Apple Bag+ Search apple.com Cancel

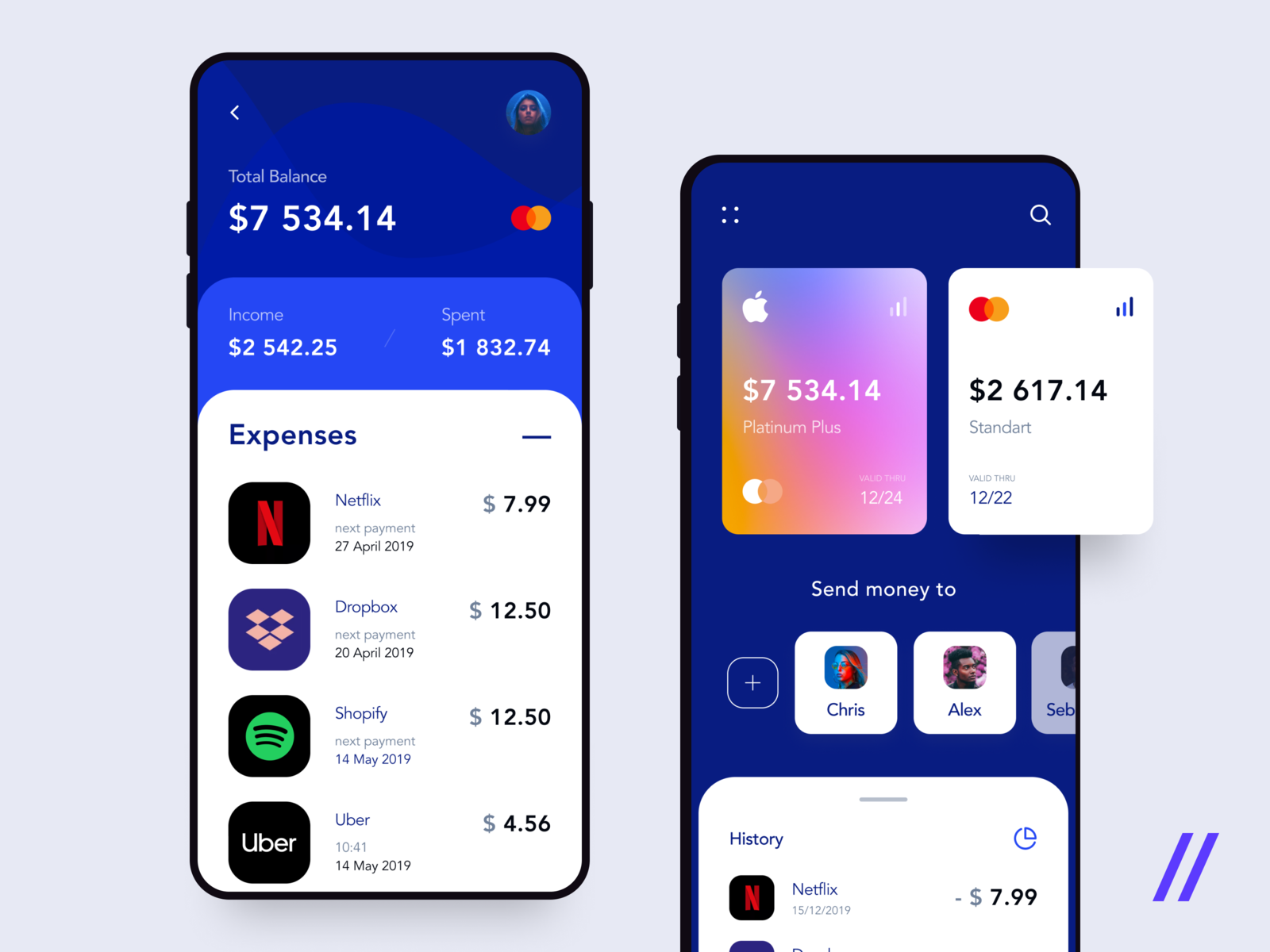

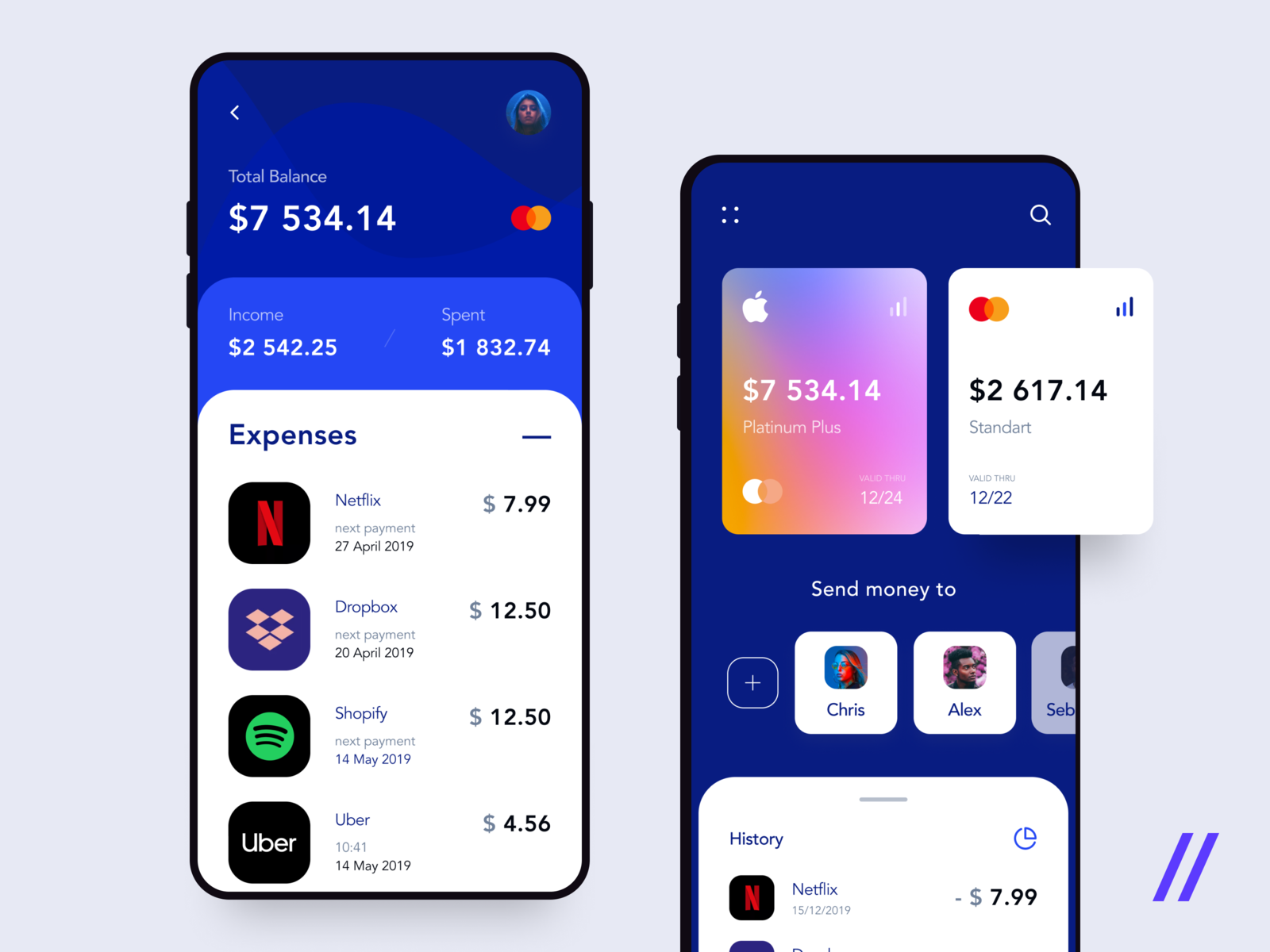

Banking Mobile App Ui Ux Design On Behance Gambaran

Next phase of AMP Bank strategy. AMP today announced that it is progressing with the next phase of its Bank strategy with the launch of a new digital bank offer targeting the small business and consumer markets. The solution will be built in FY24 and launch in Q1 2025, operating on a separate technology platform, as a new division to AMP Bank. The My AMP app lets you manage your AMP banking, super, insurance, and investments anywhere, anytime:

ATM withdrawal fee: Free up to £500 a day. Visit Chase. Chase, a JP Morgan subsidiary, launched as a digital bank in the United Kingdom in 2021 and has since become one of the country's most popular banking applications. However, it must be stressed that Chase is a separate entity from JP Morgan. A free app for Android, by AMP Limited. AMP is a financial institution and mobile banking and payments app where you can manage your accounts and access your banking services, from wherever you are. The app can help you check and pay your bills, deposit and withdraw cash, send money via SMS and email, buy travel insurance, and register for online services such as MP3 and QUIZ.

Top 10 Banking App UI/UX Design Case Studies — Interface Market

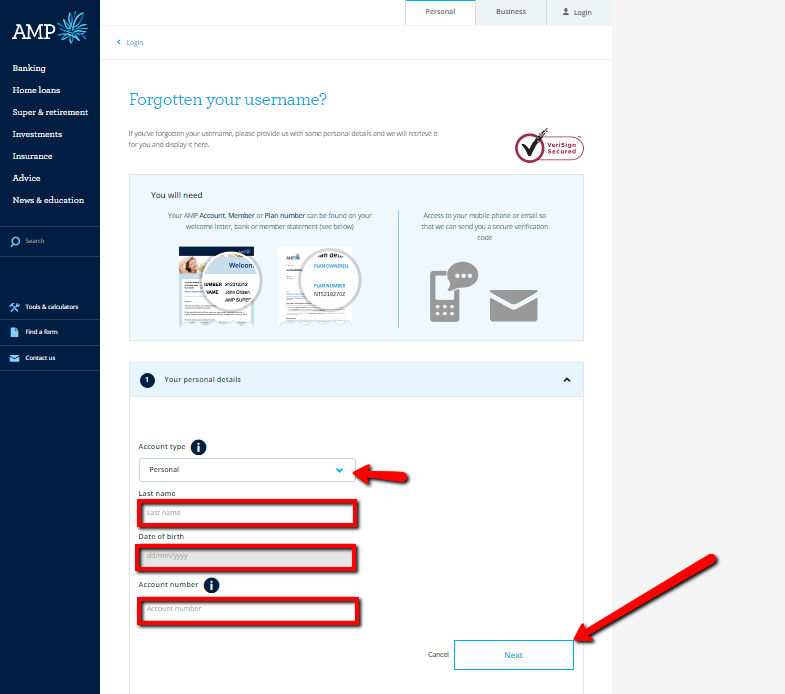

Manage your AMP banking, super, insurance, and investments anywhere, anytime Account management: • View bank and wealth statements and correspondence • Retrieve login details • Set up banking and super alerts via iPhone, iPad or Apple Watch • Log in securely via PIN or Face ID Transactional features: Good for: Beginners and managing subscriptions. Cost: Emma - free; Emma Pro - £59.99 a year, with the first seven days free.. Pros: Very easy to set up and use.Cashback and rewards for.