A balloon mortgage is a type of loan repayment option with a short term and a large lump sum payment due at the end of the loan. As we mentioned, the balloon payment is the final payment which pays off the remaining balance after the last period of the monthly payment. Since the monthly fixed payment is computed with a more extended, usually 20-30 year amortization schedule, the balloon. When you enter "0" for both "Periodic Payment" and "Final/Balloon Payment," you are setting up the calculator to calculate a level payment for the entire term of the loan. That is the final payment will not be a balloon payment. Click "Calc" and here are the results. $737 is the "regular" payment amount for a 30-year loan.

Balloon Loan Payment Calculator Excel Templates

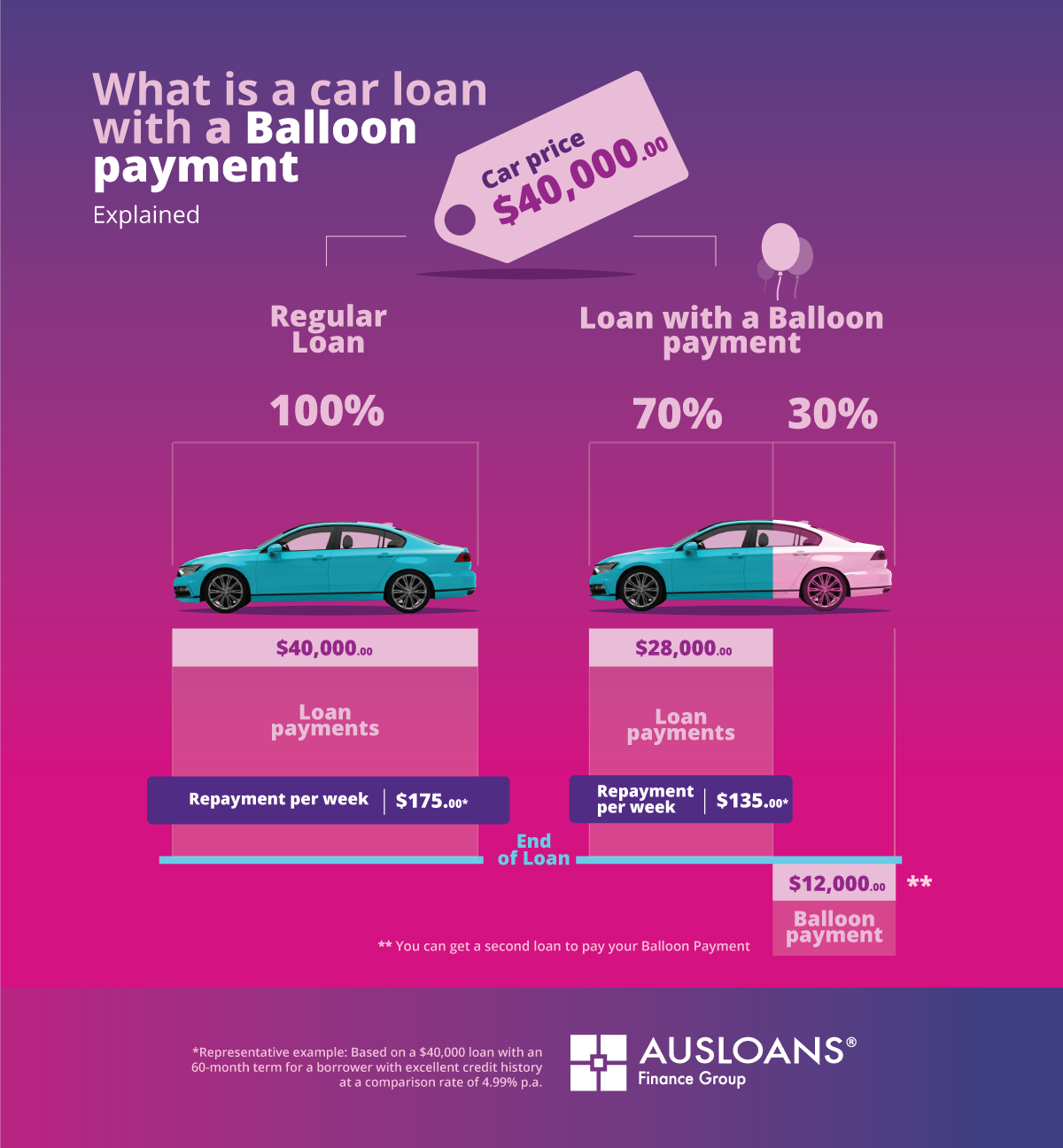

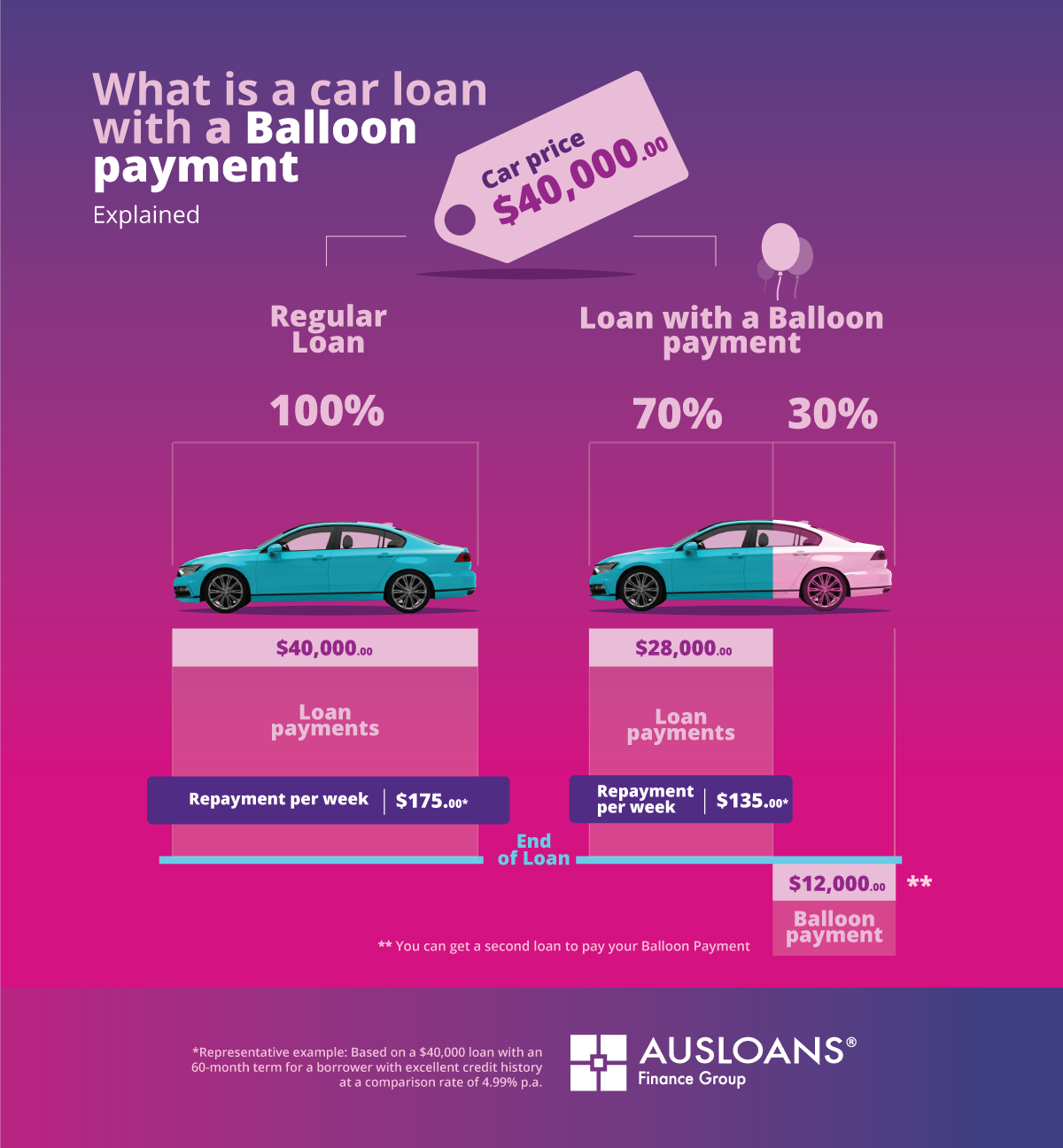

A balloon payment loan allows the borrower to pay part of the cost of a car, along with interest on the total price, during the loan term. The term can be 24 months, 36 months, 48 months, or longer, just like a traditional loan. Some lenders may restrict the length of the payment plan. BALLOON PAYMENT. This amount is set before you sign the loan contract and is determined based on the balloon factor, which is the estimated percentage of the vehicle's value at the end of the loan term. For example, if a new car is worth $24,000 now and will be worth an estimated $15,000 in three years, then the balloon factor is 62.5%. A balloon loan is a type of loan that includes lower monthly payments in exchange for a larger one-time payment at the end of your loan term. If you plan to finance your car purchase, you may be offered the option of a balloon loan. But beware: While a reduced monthly payment could be ideal for your budget, a balloon loan could lead you to take. A balloon loan can be an excellent option for many borrowers. A balloon loan is usually rather short, with a term of three to five years, but the payment is based on a term of up to 15 years. There is, however, a risk to consider. At the end of your loan term, you will need to pay off your outstanding balance.

Free Balloon Loan Calculator for Excel Balloon Mortgage Payment

Balloon Loan Calculator. Download free for Microsoft® Excel®. A balloon loan or balloon mortgage payment is a payment in which you plan to pay off your auto or mortgage loan in a big chunk after a number of small regular monthly payments. To determine what that balloon payment will be, you can download the free Excel template below which. Enter: 90,000 = Loan Amount. 60 = Months. 4.25 = Interest Rate. 677.05 = Monthly Payment. Press the Balloon Only button and you will see that you can pay off the mortgage with a balloon payment of $66,328.13. You are getting a $150,000 mortgage loan with a 3 year fixed interest rate of 4.5%. AFG Calculator. Welcome to Auto Financial Group's calculator site. AFG can help you find an auto loan that meets your needs with AFG's Balloon Lending Program. Get started by building the vehicle of your choice here, and then compare the low AFG Balloon Lending payments to a conventional loan in the payment options table on the next page. The interest rate is 4.50%. (Note that a lender may offer different interest rates for auto balloon loans and traditional auto loans. In fact, loans with a balloon payment tend to be a higher risk for lenders, who therefore may charge a higher interest rate. But, for the sake of comparison, we'll assume the rate is the same.)

Balloon auto loan calculator KerryannCamryn

This calculator will calculate the monthly payments, the interest cost, and the balloon payment for any combination of balloon loan terms. Plus, the calculator also includes an option for including a monthly prepayment amount, as well as an option for displaying an amortization schedule with the results. Finally, the calculator includes a. Use this calculator to figure monthly loan payments. This calculator includes options for upfront payments, loan fees and an optional balloon payment.. Balloon loans are commonly associated with mortgages and commercial loans, as well as car loans. Most balloon loans are arranged with a short term, which is typically around 5 or 10 years for.

Your input can include complete details about loan amounts, down payments and other variables, or you can add, remove and modify values and parameters using a simple form interface. how much can I spend on a car; $15,000 car loan at 2.8%; $19,000 car loan with a $3k balloon payment; 20% down payment on a $20k car loan at 2% interest for 72 months Ending balloon payment. $786,023.60. Based on the table above, your monthly principal and interest payment will be $5,928.82, with total monthly payments amounting to $213,437.44. If you arrange for interest-only payments, it will be $5,386.69, and your total interest charges will be $188,999.38.

Balloon Payment Car Loans All Your Questions Answered

Balloon loan calculators are not limited to specific loan types. They can be applied to various loan scenarios, including car loans. If you are considering financing a vehicle with a balloon payment, a balloon loan calculator for cars can be of great assistance. This calculator considers factors specific to car financing, such as the vehicle's. Balloon loans feature short terms of three to five years with payments made affordable to fit any budget. Depending on your situation, it could be the ideal loan. Just consider that at the end of your loan term, you'll need to pay off your outstanding balance by either refinancing or converting the balloon loan to a traditional loan at current.