Edit, Fill & eSign PDF Documents Online. No Downloads Needed. Get Started Now. Best PDF Fillable Form Builder. Professional Toolset. Quick and Simple. Subscribe for more This Depreciation Schedule template provides a simple method for calculating total yearly depreciation for multiple assets. - For each asset, choose between the Straight-Line, Sum-of-Years' Digits, Double Declining Balance, or Declining Balance with Switch to Straight-Line. "No installation, no macros - just a simple spreadsheet" - by Jon Wittwer

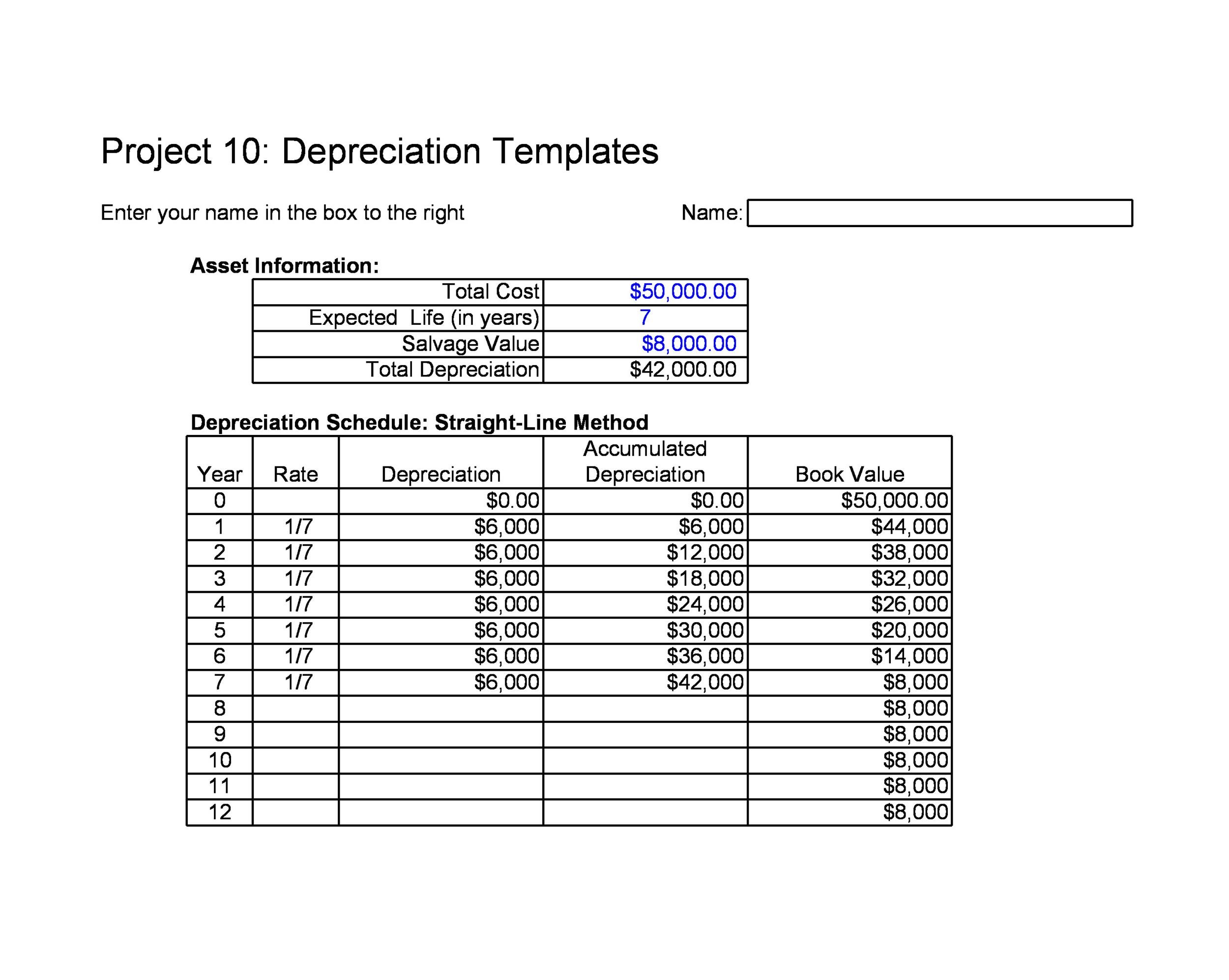

Straight Line Depreciation Schedule Excel Template For Your Needs

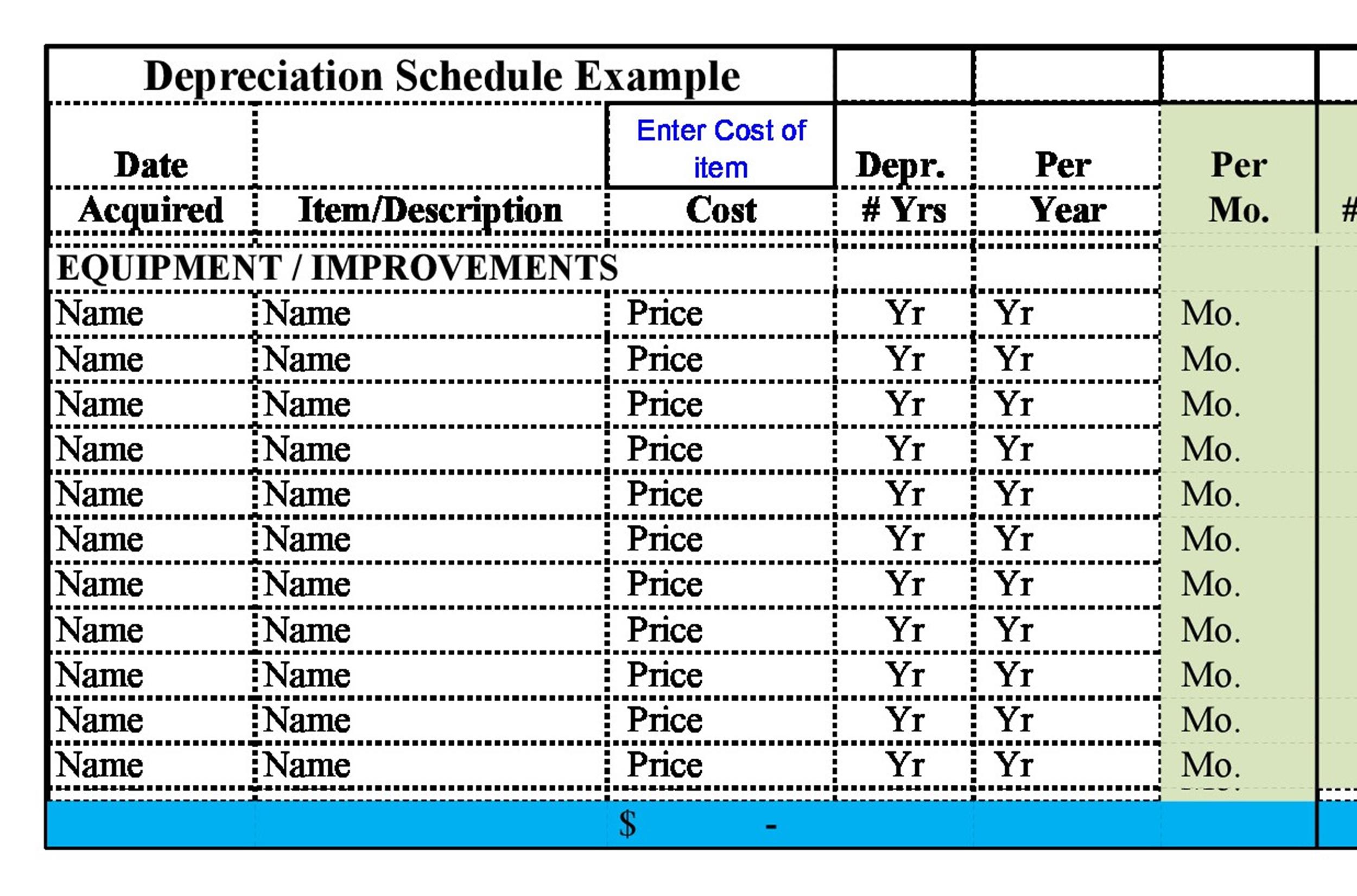

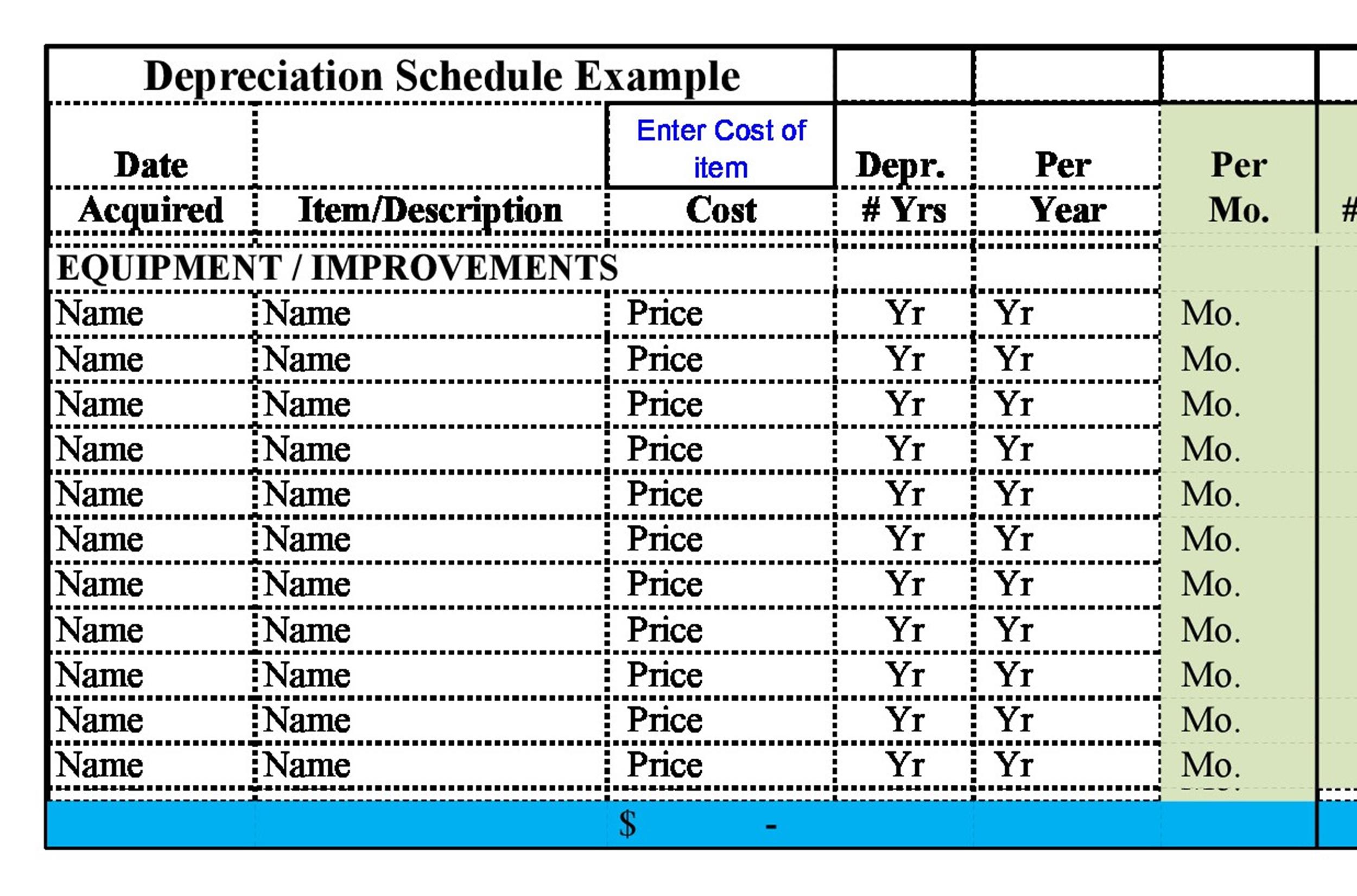

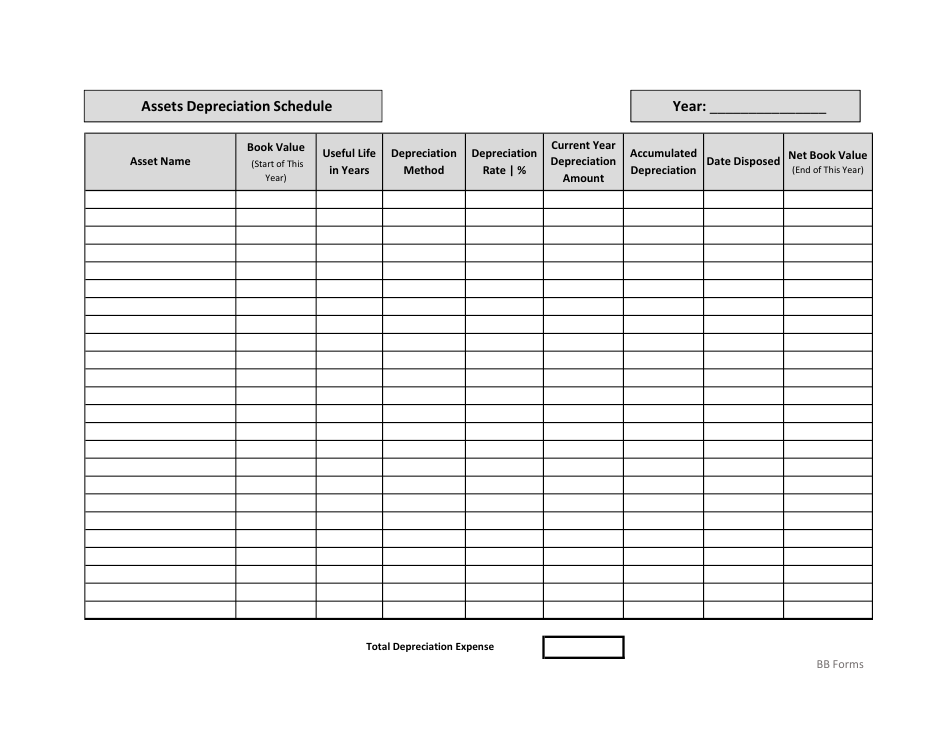

Download Free Simple Depreciation Schedule Templates Basic Depreciation Calculator Template 25 KB 1 file (s) 17 Downloads Download Blank Depreciation Schedule Worksheet 24 KB 1 file (s) 15 Downloads Download Business Depreciation Schedule Template 10 KB 1 file (s) 1 Downloads Download Capital Asset Depreciation Schedule Template A depreciation schedule is required in financial modeling to forecast the value of a company's fixed assets ( balance sheet ), depreciation expense ( income statement ), and capital expenditures ( cash flow statement ). Depreciation occurs as an economic asset is used up. Economic assets are different types of property, plant, and equipment (PP&E). Microsoft Excel Q. Can you show me how to calculate depreciation in Excel using different depreciation methods? A. There are many ways to calculate depreciation in Excel, and several of the depreciation methods already have a built - in function included in the software. Depreciation schedules serve as a roadmap to an asset's depreciation expenses. Businesses create depreciation schedules to outline how a fixed asset's costs are expensed over its useful life..

Straight Line Depreciation Schedule Excel Template For Your Needs

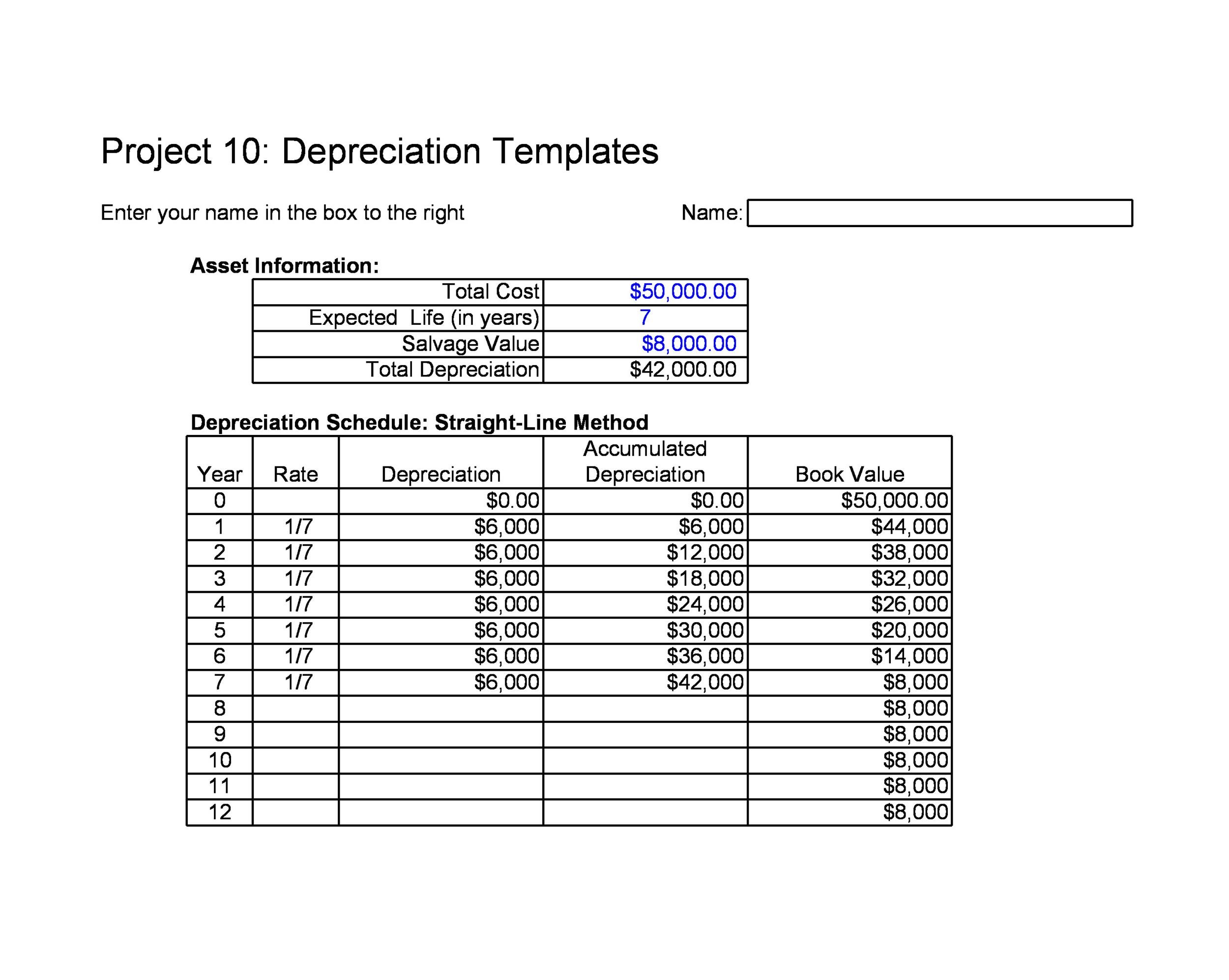

Download the Free Template Enter your name and email in the form below and download the free template now! With the straight-line depreciation method, the value of an asset is reduced uniformly over each period until it reaches its salvage value. The depreciation schedule records the depreciation expense on the income statement and calculates the asset's net book value at the end of each accounting period. Our Excel spreadsheet will allow you to track and calculate depreciation for up to 25 assets using the straight-line method. A depreciation schedule is a table you create to keep track of the depreciation of the expense of each of your fixed assets over the years. Depreciation Schedule Template - 9+ Free Word, Excel, PDF Format Download! Depreciation schedule templates are perfect for listing multiple assets while offering the option to select different depreciation methods for the purpose. These templates are perfect for creating financial reports related to small and mid-sized businesses.

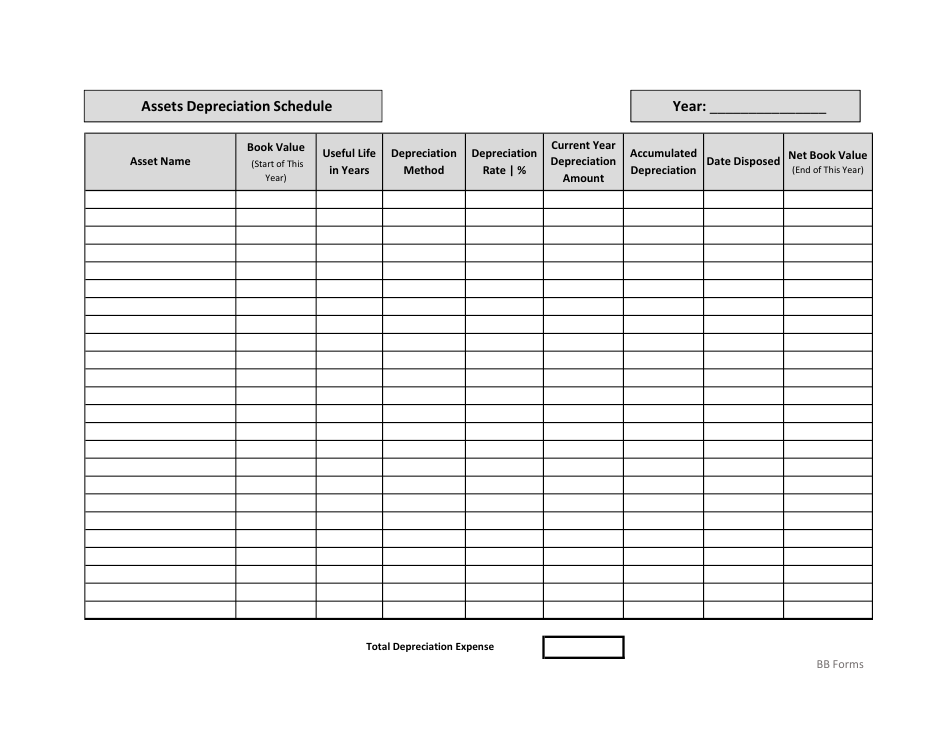

Assets Depreciation Schedule Template Download Printable PDF Templateroller

The term "depreciation schedule" refers to the diagram or table used by corporations to record the costs associated with depreciating each asset over time. You may keep track of the cost of depreciating each of your fixed assets over time by creating a table called a depreciation schedule. Depreciation Schedule Template - 9+ Free Word, Excel, PDF Format Download! Depreciation schedule templates are perfect for listing multiple assets while offering the option to select different depreciation methods for the purpose. These templates are perfect for creating financial reports related to small and mid-sized businesses.

A Depreciation Schedule Template will help you keep track of all expenses incurred under any accounts for tax purposes. Depreciation is essentially a non-cash expense. It is performed as a reduction in the value of an asset due to continuous use over time. It can be calculated as an average percentage of total asset value per year or period. Depreciation schedules are important tools for businesses and individuals to track the value of assets over time. The Visual Paradigm depreciation schedule excel templates provide a simple and easy-to-use interface to calculate and track the depreciation of assets, including fixed assets such as equipment, buildings, and vehicles. The templates.

9 Free Depreciation Schedule Templates in MS Word and MS Excel

A Depreciation Schedule is a dataset that represents the reduction in the amount of assets over the span of the asset's life. This schedule is used for calculating total yearly depreciation for several numbers of assets. Depreciation Terms: Cost (C): This is the cost of the asset. The Depreciation Schedule Template is used by the business organizations, companies, institutions and firms in order to keep record or track of all the financial transections in order to estimate the monthly depreciation level of the business. There is always an important person hired in a company who is given the responsibility of keeping.