A merchant account is usually a third-party bank account that facilitates credit or debit card payments from customers to a business by holding card payments and then depositing them into a. The Best Merchant Account Service Providers of 2024. Square: Best overall. Stripe: Best for owners of multiple businesses and brands. Stax: Best for avoiding transaction fees. National Processing.

What is a Merchant Account? Everything You Need to Know

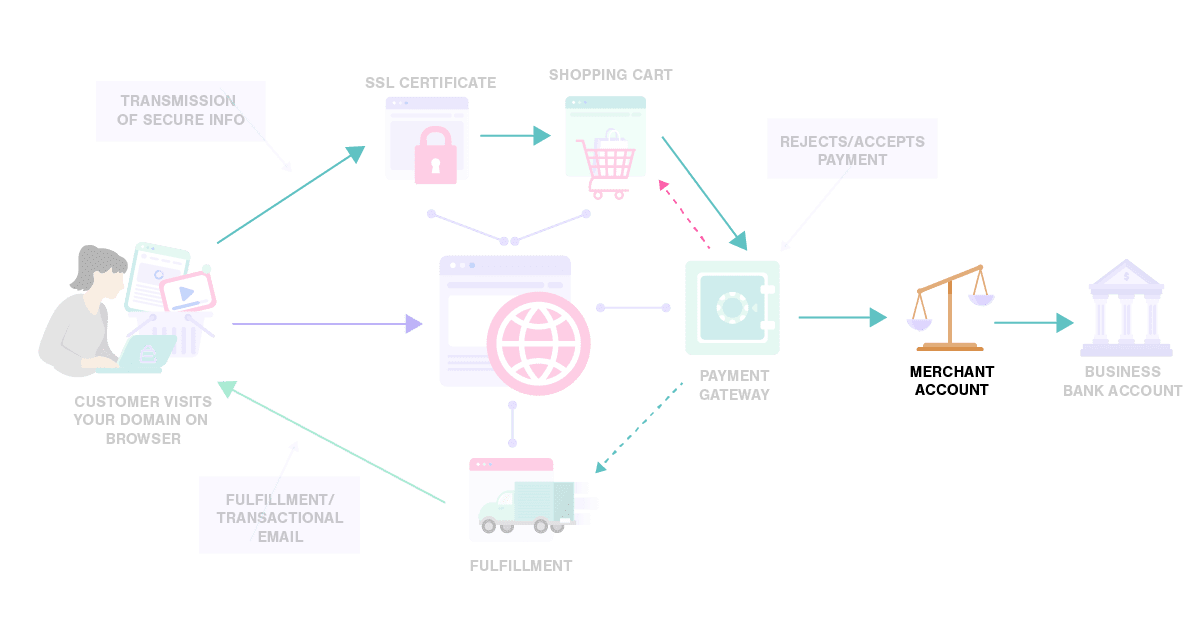

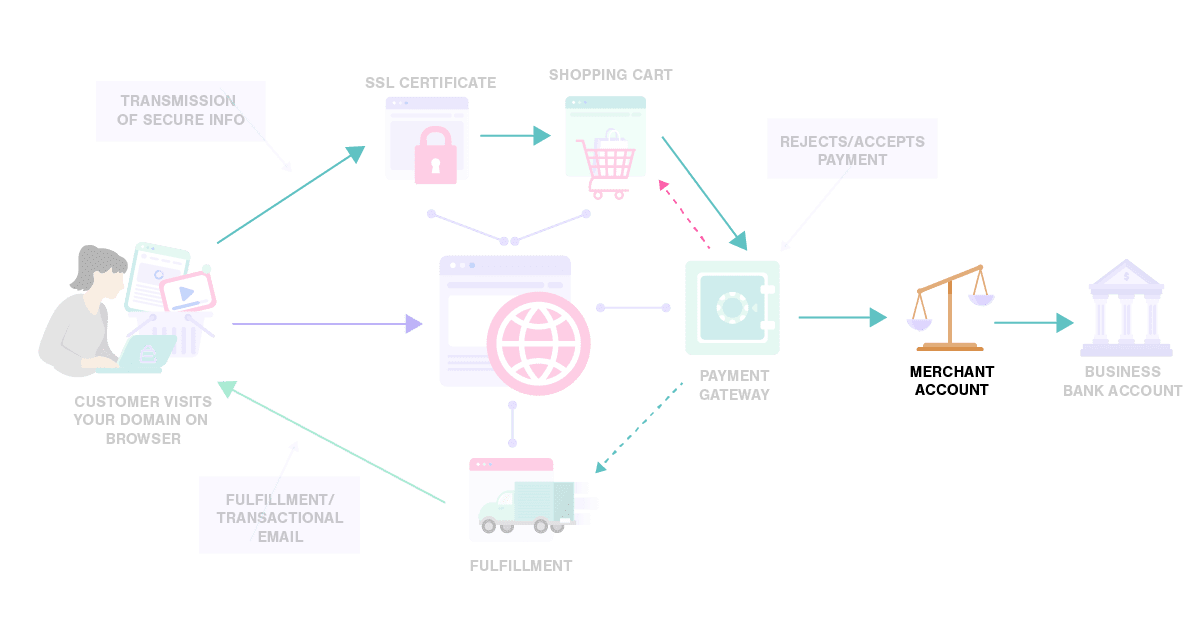

A merchant account is simply a bank account where funds from your processed credit and debit card transactions are deposited until they can be transferred to your regular business bank account. A merchant account is an essential tool for credit card processing online, in-store, and even on the go. A merchant account is a type of business bank account that allows a business to accept and process electronic payment card transactions. Merchant accounts require a business to partner with. A merchant account is a type of business bank account that allows businesses to process electronic payments such as debit and credit cards. The merchant account acts as the middleman between the. A merchant account is a type of bank account that allows your business to accept debit and credit card payments from customers. Your merchant account will front your business the funds—minus fees—from the credit card transactions you accept, before your customers pay off their card issuers.

What Is a Merchant Account? 2023 Guide for Small Businesses

A merchant account is a special type of bank account that makes it possible for businesses to accept multiple payment types. Generally, it allows your business to accept debit card and credit card payments online, in-person, and over the phone. The definition of a merchant account is: a type of bank account for businesses, looking to accept cashless payments.² Typically, businesses open a merchant account to receive credit and debit card payments. A merchant account is a business bank account required for businesses to accept debit and credit card transactions, as well as other forms of electronic payments. A merchant account acts as a. A merchant account is a type of bank account that allows businesses to accept payments by debit or credit cards. So a merchant account is an agreement between a retailer, a merchant bank and payment processor for the settlement of credit card and/or debit card transactions.

What is a Merchant Account and How to Open One CoinPayments

Merchant accounts are a must for any business that wants to accept credit card payments. Here's what a merchant account is, how they work, and how to get one. A merchant account is a business or commercial bank account that allows companies to accept and process credit cards, debit cards and other types of electronic payments. The aim is to help.

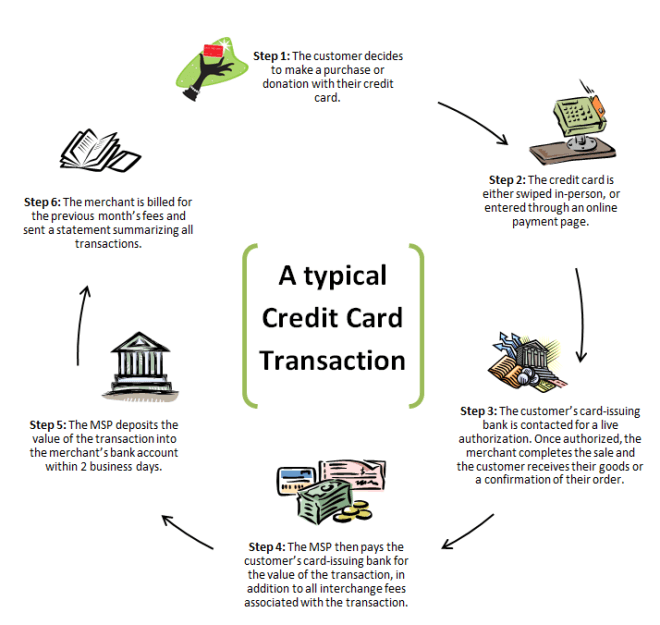

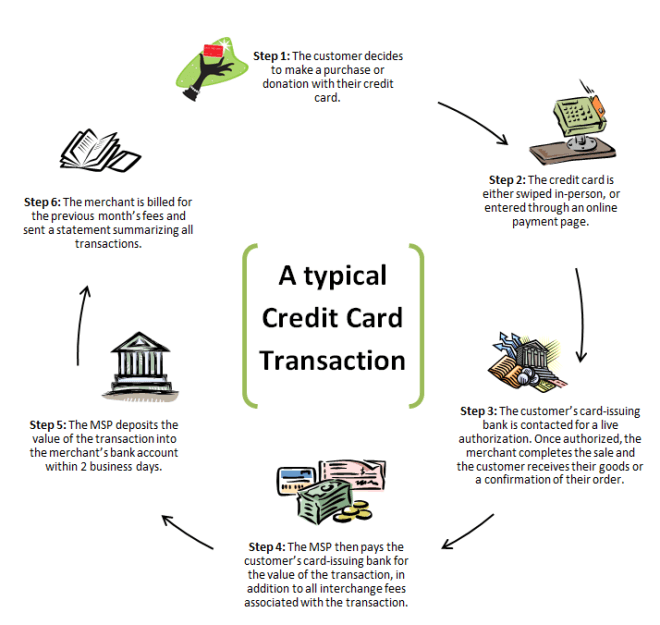

A merchant account is a particular type of bank account that business owners must establish in order to accept payments. Currently, consumers' most preferred payment methods are credit and debit cards. In 2021, consumers paid for 70 percent of their purchases with a credit or debit card. [1] Statista. A merchant account is a bank account that is specifically used for accepting customer payments, usually by credit card, debit card, or other electronic transfer. It's not a standard business bank account. A merchant account holds on to funds before they're transferred to the merchant's primary business bank account. Do I need a merchant account?

What is a Merchant Account? Dharma Merchant Services

A merchant account is a bank account that holds funds from credit card sales, while a payment processor is the system that manages the transfer of fund details between the merchant, the networks, and the card issuers, often through a payment gateway for electronic payments. The Best Merchant Account Services Providers For Small Business Your small business needs a merchant account to process credit card payments. Read on to discover our top picks for merchant account service providers. WRITTEN & RESEARCHED BY Jason Vissers Senior Staff Writer Jul 20, 2023 UPDATED