Thousands Of Funds, Shares And More All At Your Fingertips with HL. Risk Of Loss. Buy & Sell Shares With HL - The UK's #1 Platform For Private Investors. Risk Of Loss Invest like a Pro with Investorean! Find the Best Stocks Supported by Your Broker. Get Ahead of the Game with Investorean - The Fastest and Most Efficient Stock Screener

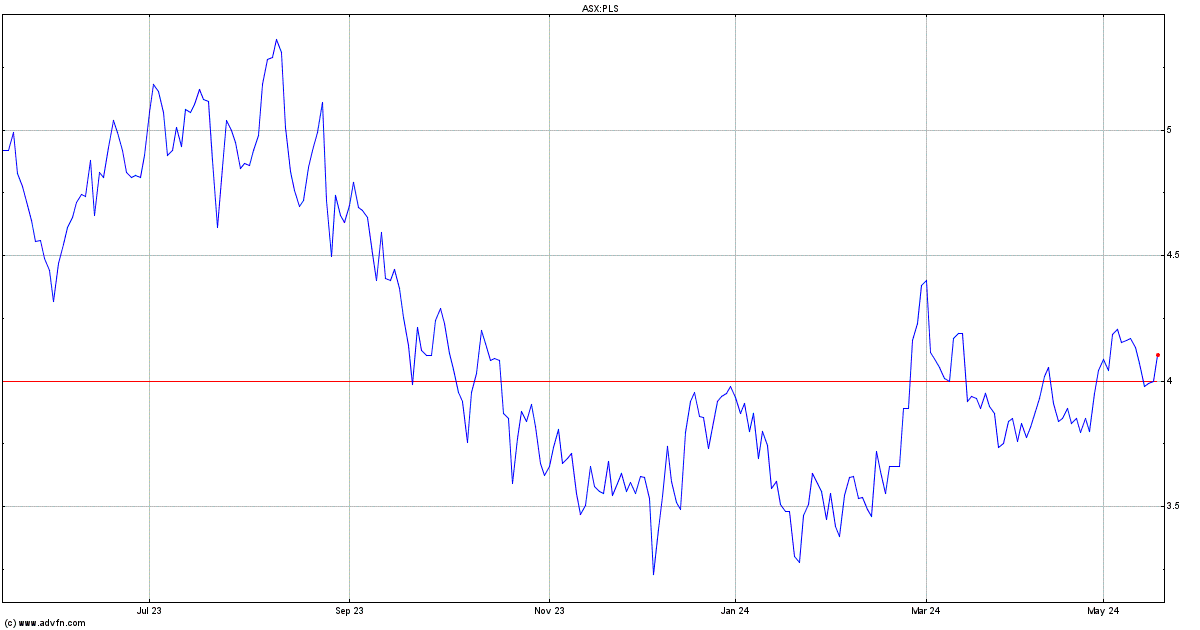

Pilbara Minerals Share Price. PLS Stock Quote, Charts, Trade History, Share Chat, Financials

Pilbara Minerals Share Price Forecast 2030: 15.40: 16.20: Pilbara Minerals Share Price Forecast 2025 . If we look at the financial trends of the company, it was continuously incurring losses, but this year it has made the highest profit of $561 million. Pilbara Minerals has given good returns of 70% in last one year (from 2022 - 2023) and 30%. Pilbara Minerals Fair Value Forecast for 2023 - 2025 - 2030 In the last three years, Pilbara Minerals's Price has grown, moving from $0.00 to $1.10 - an increase of 100.00%. In the following year, the 13 analysts surveyed believe that Pilbara Minerals's Fair Value will decrease by 57.33%, reaching $0.47. Pilbara Minerals stock price forecast* for tomorrow, and next weeks based on the last 30 days [60% OFF VIP SALE] Portfolio is UP +117% in 2023 - Try Now Risk-Free - Money-back guarantee!. You'll find the Pilbara Minerals share forecasts, stock quote and buy / sell signals below. Pilbara Minerals Ltd (PLS:ASX) forecasts: consensus recommendations, research reports, share price forecasts, dividends, and earning history and estimates.

Pilbara Minerals Share Analysis Report, ASXPLS Guidance & Forecast

Pilbara Minerals Stock Forecast 2023. In the last five quarters, Pilbara Minerals's Price Target has risen from $3.81 to $4.49 - a 17.85% increase. Eleven analysts predict that Pilbara Minerals's share price will fall in the coming year, reaching $3.95. This would represent a decrease of -12.03%. Meanwhile, Albemarle shows in its most recent presentation that Lithium prices above 20k/t will be required to incentivize miners to operate new sites to fill the expected supply deficit by 2030. Future criteria checks 1/6. Pilbara Minerals's revenue and earnings are forecast to decline at 9.1% and 21.7% per annum respectively. EPS is expected to decline by 24.1% per annum. Return on equity is forecast to be 21% in 3 years. Get the latest Pilbara Minerals Ltd (PLS) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and investment decisions.

Pilbara Minerals share price forecast Green energy push to keep PLS rising?

Price target. 4.01 0.00 0.00%. The 19 analysts offering 1 year price forecasts for PLS have a max estimate of — and a min estimate of —. On Friday, Pilbara Minerals Ltd (PLS:ASX) closed at 3.83, 23.55% above the 52 week low of 3.10 set on Dec 06, 2023. Data delayed at least 20 minutes, as of Dec 22 2023 05:10 GMT. Latest Pilbara Minerals Ltd (PLS:ASX) share price with interactive charts, historical prices, comparative analysis, forecasts, business profile and more.

The miner's EPS for the 12 months ending June 2022 was 19 cents per share. Levi Spry of UBS has maintained a buy rating on Pilbara Minerals shares. Though, Spry's price target is set at $4.50. WalletInvestor's Pilbara Minerals share price prediction suggests the PLS stock price will rise to AUD2.94 per share in 2022. For 2023 until 2025, WalletInvestor estimated stock price to rise to AUD3.502 (2023-end), AUD4.05 (2024-end), and AUD4.6 (2025-end). David Franklyn, Executive Director & Head of Funds Management of Australian.

pilbara minerals stock chart Yetta Joyner

Pilbara Minerals' stock was trading at $2.63 at the beginning of 2024. Since then, PILBF stock has increased by 0.8% and is now trading at $2.65. View the best growth stocks for 2024 here. Future criteria checks 0/6. Pilbara Minerals's revenue and earnings are forecast to decline at 9.1% and 21.7% per annum respectively while EPS is expected to decline by 24.1% per annum.