5,000,000 members are already taking advantage of our discounts. Become a member for Free! We believe the best kit should be available to everyone - no matter what level. Benner Cycle is a chart depicting market cycles between the years 1924 to 2059. The chart was originally published by Ohioan farmer Samuel Benner in his 1884 book, "Benner's Prophecies of Future Ups and Downs in Prices". [1] [2] The chart marks three phases of market cycles: [3]

investing on the waves The Benner cycle

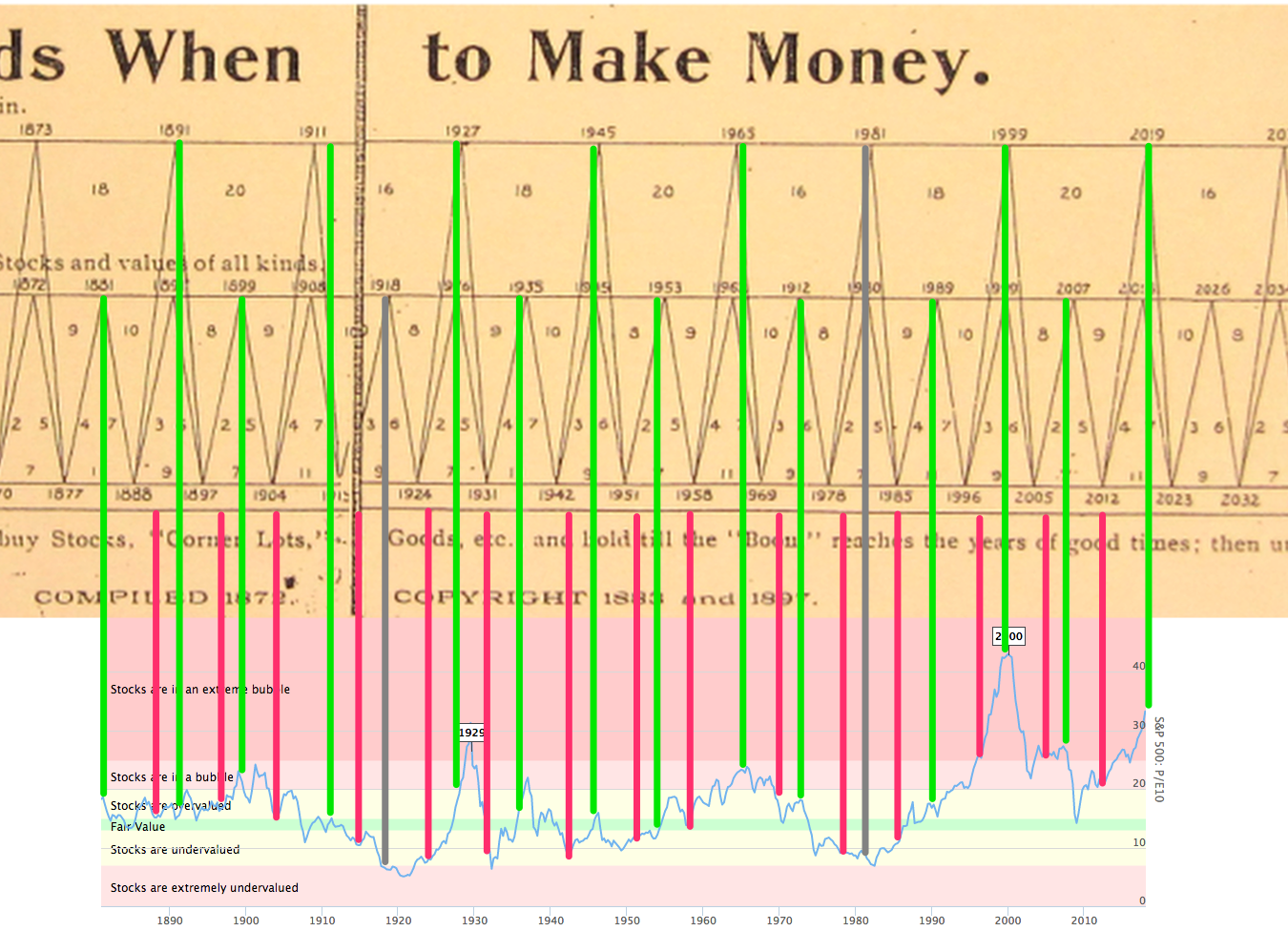

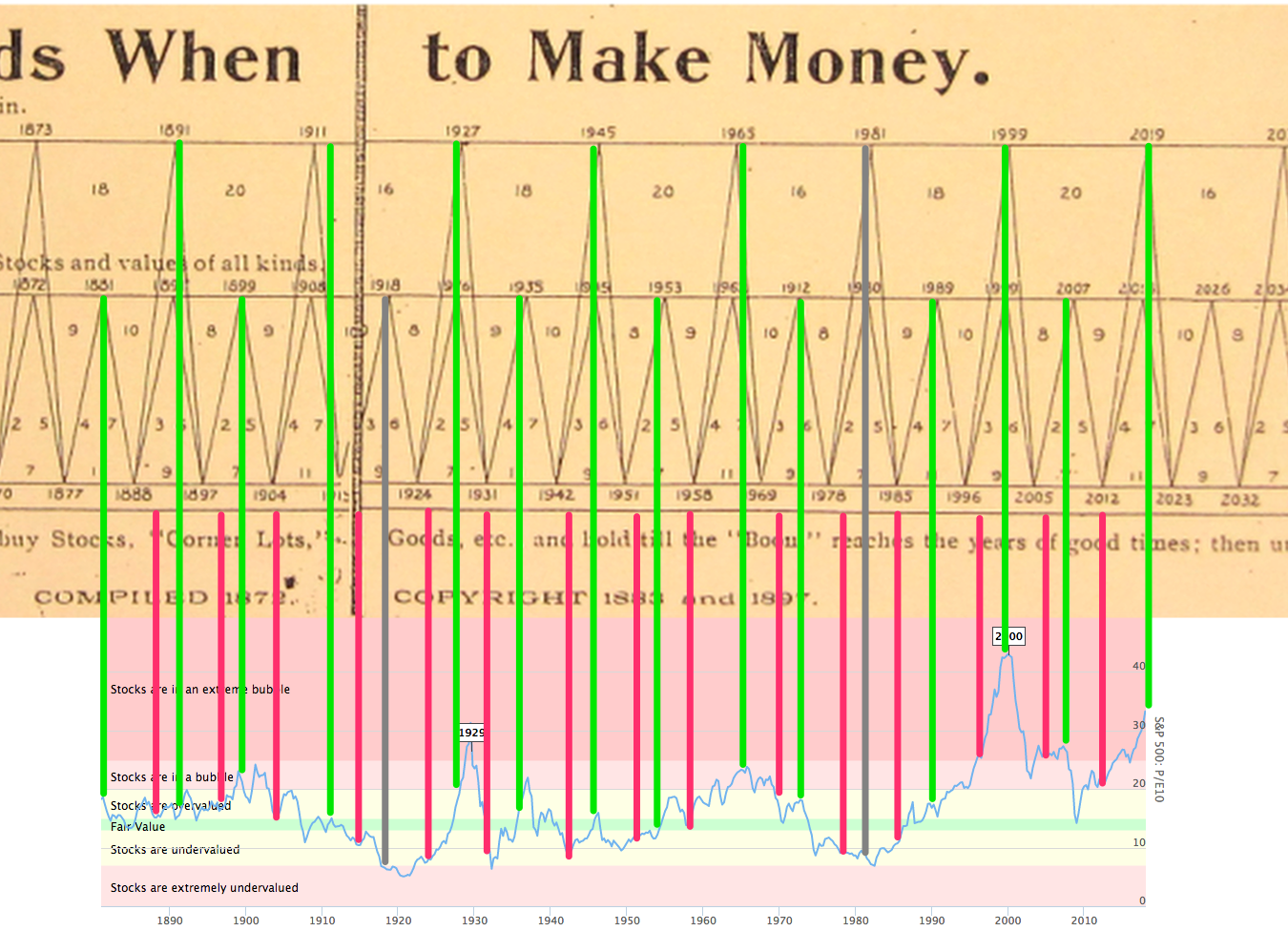

The Benner cycle also uses a 27-year cycle in pig iron prices with lows every 11,9,7 years and peaks coming in at 8, 9, 10 years. Studying market history helps you learn how these cycles affect price, and how they still affect price today. Now, the year is 2021, and on the Benner Cycle, we are just coming out of a panic cycle. What Is Benner Cycle? In 1875, Samuel Benner, an Ohio farmer, published a book called "Benners Prophecies: Future Ups And Down In Prices". The book had charts of prices of pig iron, corn, hogs, and cotton. As Benner said it was to inform others on how to make "money on pig iron, corn, hogs, and cotton." Exploring the origins of the " Periods When to Make Money " Chart, also known as the Benner Cycle, historical records present a complex narrative. The first diagram traced back to the late 1800s, cites dual origins: George Tritch in 1872 and Samuel Benner in 1875. The Benner Cycle: Sure Thing or an Illusion? Posted by Price Action Lab Blog on October 30, 2023 Photo by Alesia Kozik We tested the performance of the Benner Cycle and also examined its philosophical underpinnings. Is the cycle the "sure thing", as its inventor claimed, or an illusion?

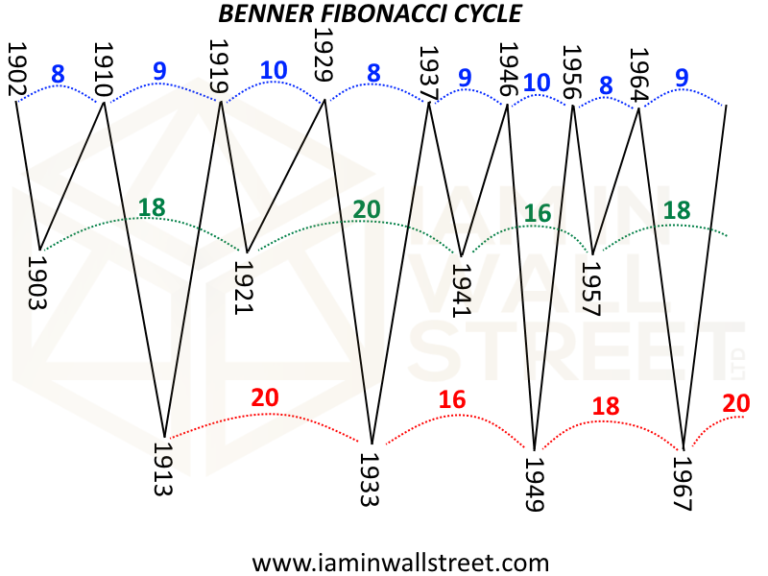

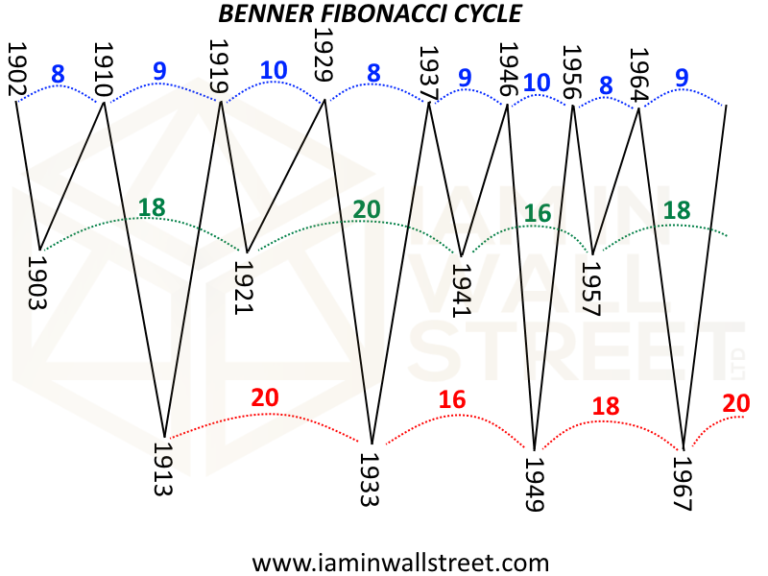

Do not the Benner Fibonacci Cycle I Am In Wall Street

David Mcminn Figures (11) Abstract and Figures In 1875, Samuel Benner published a book on fluctuations in the US economy. He presented three main cycles in his treatise - a 8-9-10 year cycle of. The Benner Cycle includes: -an 11 year cycle in corn and pig prices with peaks alternating every 5 and 6 years. -cotton prices which moved in a cycle with peaks every 11 years. -a 27 year cycle in pig iron prices with lows every 11, 9, 7 years and peaks in the order 8, 9, 10 years. The Benner cycle also uses a 27-year cycle in pig iron prices with low prices every 11, 9, 7 years and peaks coming in at 8, 9, 10 years. Studying market history will help you learn how these cycles affect the price and how they still affect the price today. Now the year is 2024, and according to the Benner cycle, we are just coming out of a. In this fascinating and insightful video, we explore the mysterious Benner Cycle, a century-old forecasting model that has accurately predicted market patter.

The 56 Year Benner Cycle Business Insider

The Benner Cycle is a model that Benner developed to predict the ups and downs of the stock market. It consists of three lines: A, B, and C. The A line represents years of market panics, which. Benner's original cycle had a limited range, only going up until 1891. However, George Tritch, another 19th century forecaster, is believed to have extended the cycle all the way to 2059, and even annotated the chart with specific instructions on when to buy and sell stocks.

Synsense: The Benner Cycle is a market phenomenon characterized by a series of four stages: Accumulation, Markup, Distribution, and Markdown. During the Accumulation stage, a stock is undervalued and neglected by the market, causing it to have a low price. During the Markup stage, the stock gains momentum and starts to rise due to increased demand. The Benner Cycle was purportedly created in 1875 to identify potential "boom" and "bust" periods in the economy. Stock market results within various favorable and unfavorable periods appear compelling. In Part I, we examine the performance of the S&P 500 Index during the major favorable and unfavorable periods in the past 100 years.

Prophets of Wall Street (Cycles part 2) Silvan Frank

The 54 year cycle arises from panics every 16, 18, 20 years (upper line Diagram 1). According to Benner (1875), "it takes panics 54 years in their order to make a revolution or to return to the same What is the Benner Cycle? Is the Benner Cycle accurate? The Great Depression, 1929 to 1941 Oil Crisis, 1973 Black Monday, 1987 Dot Com Bubble, 1995 to 2002 The Financial Crisis, 2007 to 2008 What are the 4 phases of the investment cycle? Which phase begins after the end of the bullish phase? What market cycle are we in now?