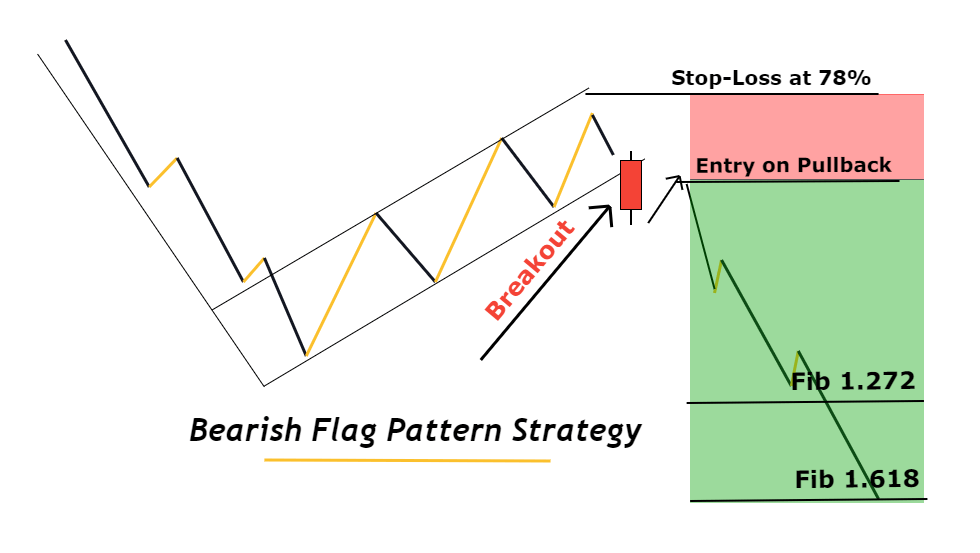

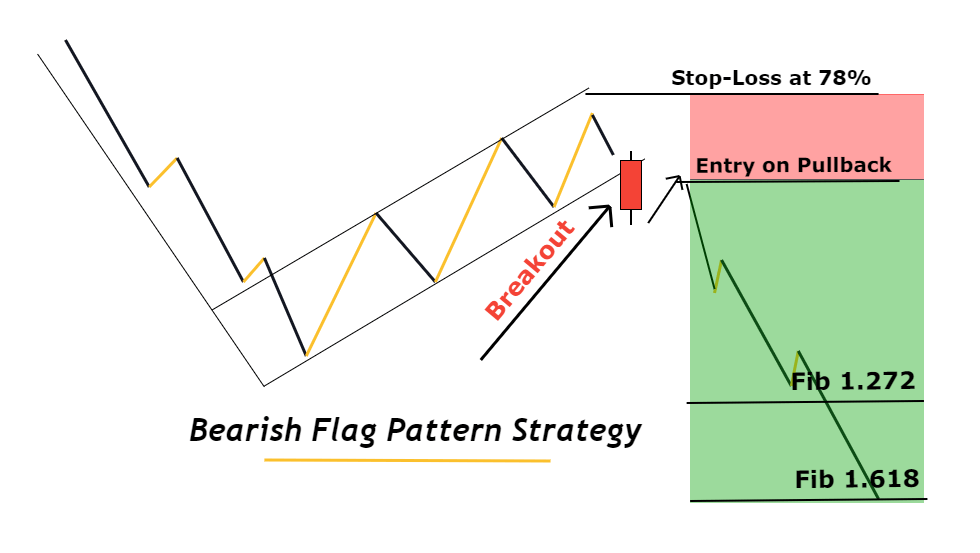

The bearish flag pattern is a powerful technical analysis tool used by traders to identify potential bearish trends in the foreign exchange (Forex) and gold markets. The bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause is finished. As a continuation pattern, the bear flag helps sellers to push the price action further lower.

Bearish Flag Pattern Explained with Powerful Trading Plan ForexBee

Bear flag patterns are one of the most popular bearish patterns. They consist of either a large bearish candlestick or several smaller bearish candlesticks down, forming the flag pole, followed by several smaller bullish candlesticks pulling back up for consolidation, which forms the flag. Flag patterns can be either upward trending ( bullish flag) or downward trending (bearish flag). The bottom of the flag should not exceed the midpoint of the flagpole that preceded it.. The bear flag pattern is a price chart formation that suggests a further extension of a prevailing downtrend. Bear flags consist of two parts: the flag pole and the flag. The flag pole is a pronounced downward price movement, while the flag is a period of sideways price action. A bear flag is a technical pattern that provides an extension/continuation to an existing downward trend. The bear flag formation is underlined from an initial strong directional move.

Bearish Flag Strategy Quick Profits In 5 Simple Steps

The bearish flag is a very simple continuation pattern that develops after a strong bearish trend. It doesn't really matter if your preferred time frame is the 5-minute chart or if you prefer a long-term chart. The bear flag pattern shows up with the same frequency on all time frames. The bear flag pattern is a significant instrument in technical analysis that uses a chart pattern to signify the continuation of an ongoing downward price trend. It represents a bearish market sentiment and reflects that the ongoing downtrend will likely persist after a brief consolidation period. The bearish flag is a bearish continuation pattern - in other words, it tells us that an existing downtrend will continue. The bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause is finished. As a continuation pattern, the bear flag helps sellers to push the price action further lower. After a strong downtrend, the price action consolidates within the two parallel trend lines in the opposite direction of the downtrend.

Bear Flag Chart Pattern Meaning, Benefits & Reliability Finschool

A bear flag is a bearish trend continuation pattern used in technical analysis by traders to identify new downtrends with traders entering sell trades when the price breaks below the support breakout point Bear flag patterns require a flagpole, upward sloping resistance trendline, and an upward sloping support trendline to form A bear flag is a technical analysis pattern that can indicate a potential price reversal in a financial market. It is formed when the price of an asset experiences a sharp decline, called the "pole," followed by a period of consolidation, which is commonly referred to as the "flag."

The bearish flag pattern is a crucial aspect of technical analysis in trading, signaling the potential continuation of a downtrend after a temporary pause. Often considered a popular and reliable chart pattern, the bearish flag can help traders anticipate further price depreciation in a financial market. What is a Bear Flag Pattern? In the technical analysis of financial markets, a flag is a classic pattern appearing on a chart that shows a tight consolidation in the price or exchange.

Bear Flag Pattern Explained New Trader U

A bear flag is a technical analysis charting pattern used to predict the continuation of a bearish trend. The pattern is composed of two parts: the flag and the flagpole. The flagpole is formed by a sharp sell-off that takes place at the beginning of the pattern, and the flag is created by the period of consolidation that follows. A bearish flag pattern is the opposite of its bullish counterpart. It forms during a downtrend and signals a continuation of the downward movement. Overview. The bearish flag pattern consists of a strong downward move, known as the flagpole, followed by an upward-sloping consolidation, which forms the flag. The pattern is confirmed when the.