The three way reconciliation in Excel is useful to compare transaction records from 3 different sources and match them to find any error in calculation. Below you'll see an overview of doing three way reconciliation in Excel and finding discrepancies among the transaction values. Download Practice Workbook Method-01: Using VLOOKUP Function to Reconcile Type the following formula in cell H5 and hit ENTER. =VLOOKUP (E5,$B$5:$C$12,2,FALSE) As a result, we will get the sales value of Coca-Cola from the central dataset ( B4: C12 ). For all other products, we can use the AutoFill feature.

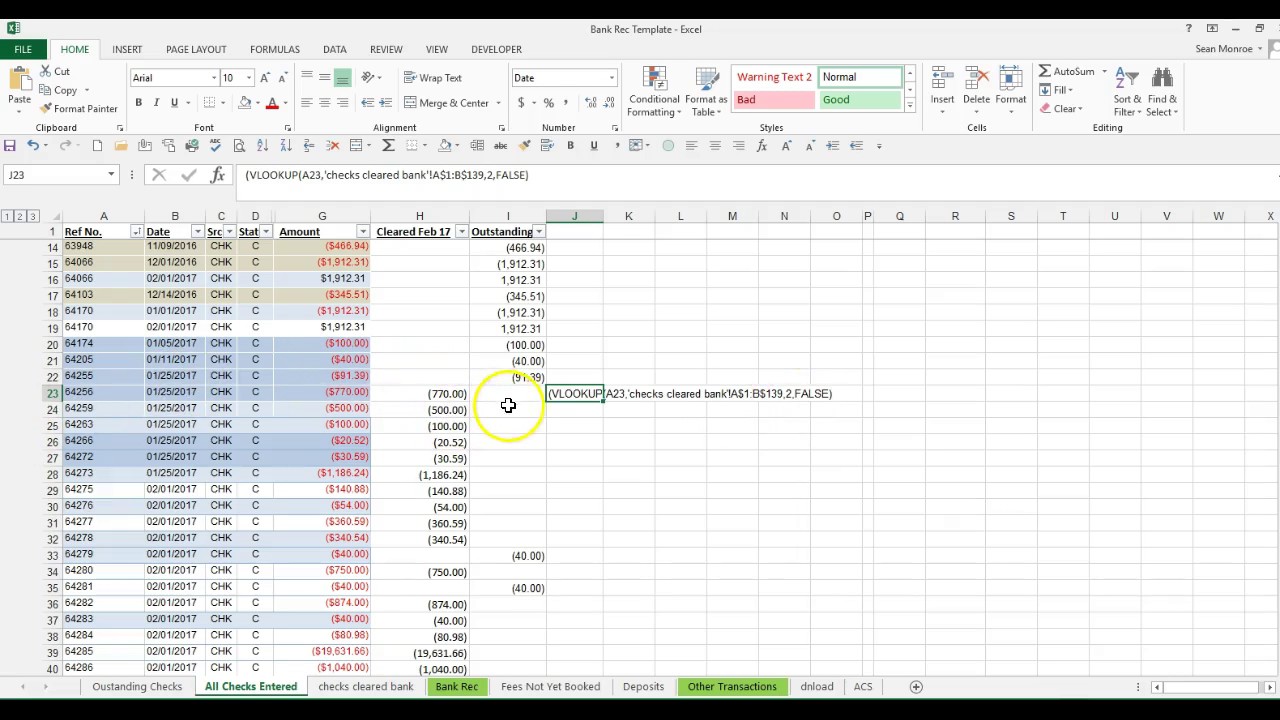

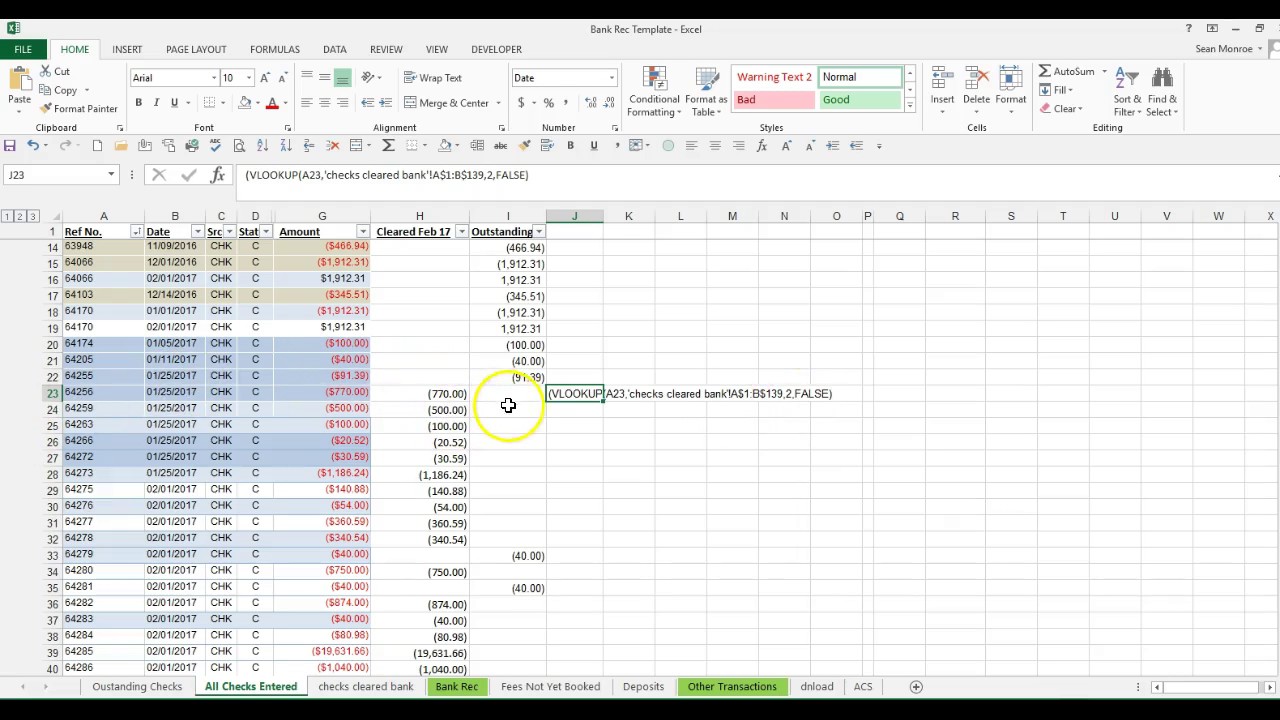

Quickly reconcile large number of checks using VLookup in Excel bank

Excel Bank Reconciliation Formula Here are a couple of Excel formulas we can use to get our reconciliation done before lunch. Step 1: In column B create a unique record for every pair (i.e. a pair being a debit and a credit that add up to zero). See how the first pair of 245's are given the value of 245-1, and the 245 in row 10 is given 245-2. 3 ways to reconcile transactions using Excel 2016 by Susan Harkins in Software on June 18, 2018, 11:47 AM PDT Here are a few quick methods of analyzing records to find out what's been paid and. 1. Applying Sort Command to Reconcile Data in 2 Excel Sheets In our first attempt, we will apply the Sort command to both the worksheets to check for any similarities or dissimilarities between them. See the below-given steps for this procedure. Step 1: Firstly, select the data range of cell B4:C10 from the first worksheet. Step 2: Key Takeaways To create a bank reconciliation template, you must first label all fields and set formulas accordingly. Next, choose the function for each row to ensure that you have calculated the totals properly. Prepare reports by sorting rows.

Free Bank Reconciliation Template in Excel

How it works: =SUMIF (range, criteria, [sum_range]) To leverage SUMIF effectively, create a formula that sums the amounts from your records and compares them with the corresponding amounts in the bank statement. Any unmatched sums indicate deposits in transit that have not cleared the bank. Vlookup - Finding Outstanding Checks An Easy Excel Tutorial to Quickly Reconcile data.🔶 Get the Practice Excel File Here : https://bit.ly/3g362go 🔶 Digital Products:🔷 https://gumroad.com/tek. The basic steps to prepare the reconciliation worksheet are: Create the summary query Create the detail query Create the reconciliation query Let's get to it. Note: The steps below are presented with Excel for Windows 2016. Procedure Format Examples Importance Reason for Difference What is Bank Reconciliation Formula? Bank reconciliation formula lets us compare if the account balance of a company's cash book and the bank's passbook is equal. It is a crucial process that every company performs to ensure the accuracy of their financial records.

Reconciliation Excel Spreadsheet

In this detailed Tutorial , learn how to automatically reconcile numbers in excel with an example. Let excel find for you the combination of smaller numbers. Matching transactions (reconciling) using Excel Pivot Tables | ExcelTutorialsLearn how to reconcile (or match) transactions using Excel Pivot Tables. Example.

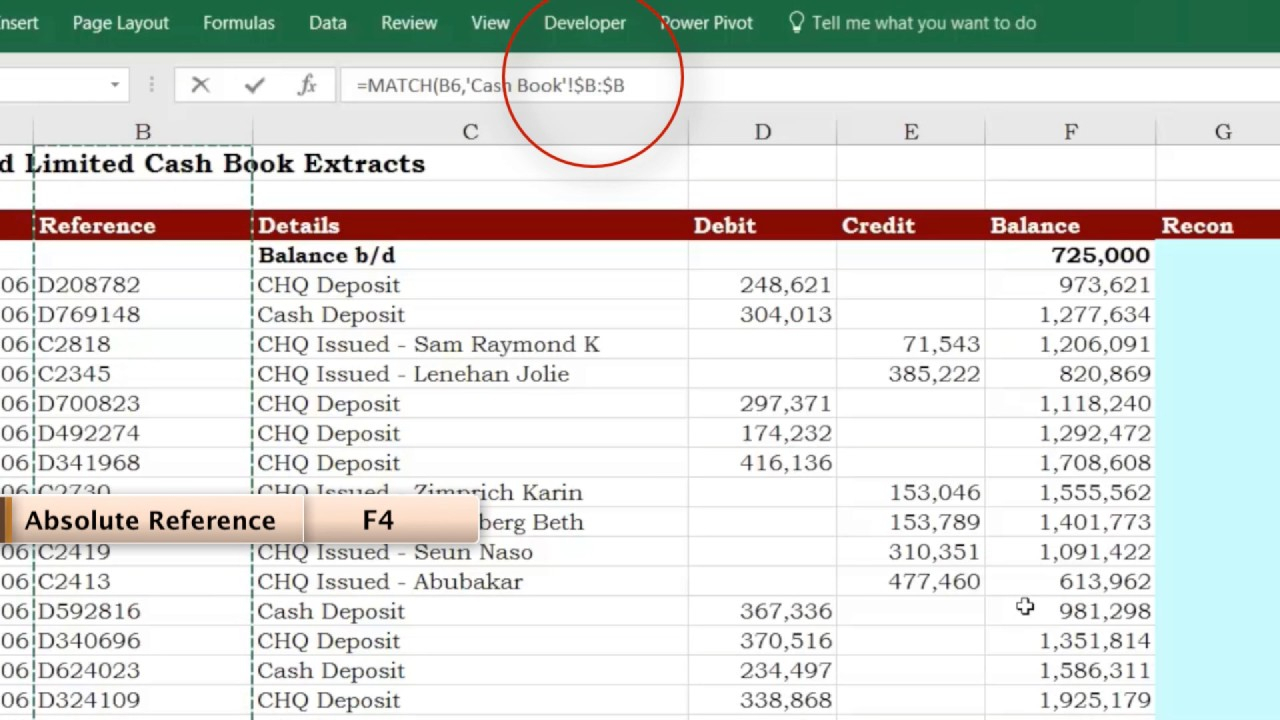

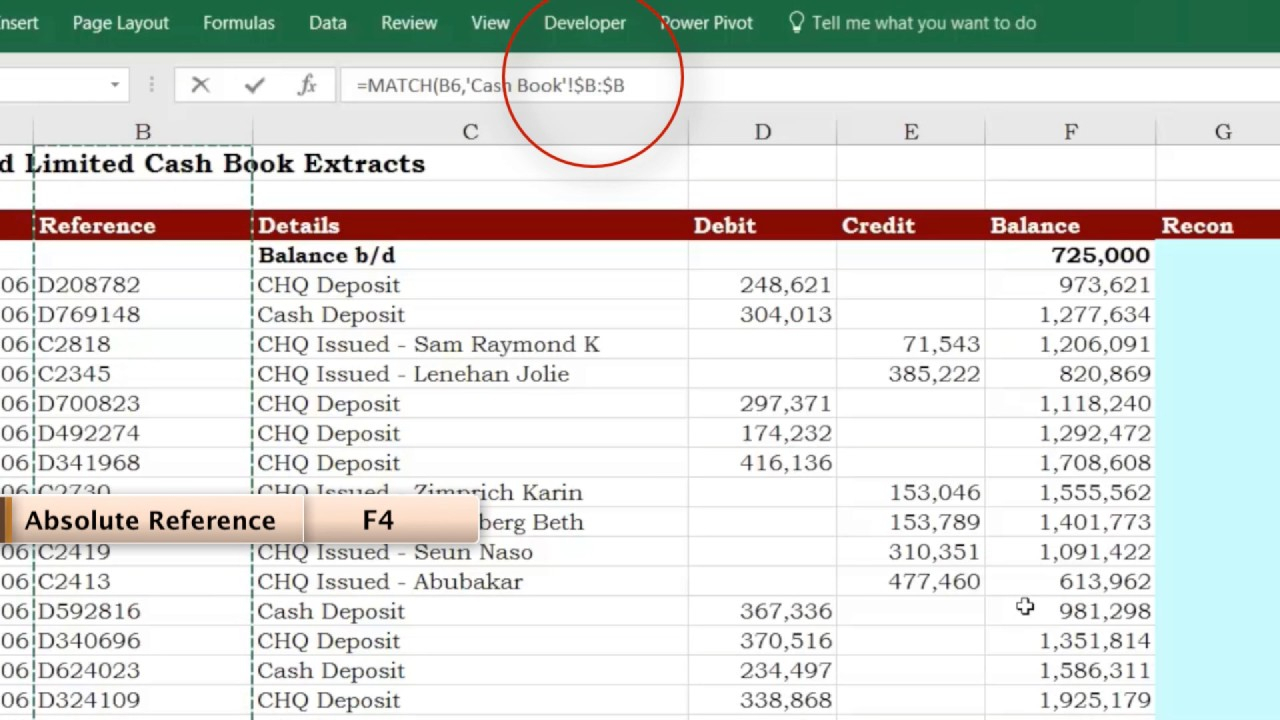

Perform same on the other sheets to to complete the reconciliation process. We have successfully done our bank reconciliation using excel. This whole process doesn't take more than 45mins to conclude by the time one masters these simple steps of performing bank reconciliation using excel formula. See image of complete bank reconciliation below ⭐ Step 01: Find out Mismatches in Bank Statement and Cash Book In this step, we will use the MATCH function first to find out which of the Transaction ID matches in the Bank Statement and the Cash Book. Then, we will use the Sort & Filter feature to find out the mismatches in both Bank Statement and Cash Book.

Free Bank Reconciliation Template in Excel

Accounting Accounts Receivable Last updated by Charles Hall on June 10, 2022 A simple excel accounts receivable template will reconcile and track all your customer invoices and provide other valuable information while saving you hours of time. Conclusion. Mastering ledger reconciliation in Excel is a game-changer for your business. This tool, when used effectively, can streamline your accounting process and reduce errors significantly. The steps are simple: set up the spreadsheet, input data accurately, reconcile differences and document results meticulously.