Fast, Easy, & Accurate Payroll Tax Systems With ADP®. Learn About Payroll Tax Systems! 1 Million+ Businesses Utilize Our Fast & Easy Payroll. Sign Up Today And Join The Team. Get Special Deals & Easily Upgrade Your Payroll Services. Save Time & Money Today! Compare the Best Payroll Services for 2024. Get Free Reviews & Try Now!

Payroll Payout Pays 500/hr, every hour! Things just got real

Starting January 15th, boom 97.3 and Alpine Credits are on a mission to get you out of the red and into the black, by paying you $100 an hour every weekday at 9am, 1pm and 5pm. If you hear your name, call us back within 10 minutes at 416-872-0973 to get on boom's payroll! There's even MORE MONEY to be won when you Refer-A-Friend. Go to boom973.com and navigate to the Payroll Payout contest page. Complete all the required registration fields, including desired times to have your name drawn (Options are Monday - Friday at 9am, 1pm & 5pm). Entries will close at 4:00pm EST on Friday May 24 th, 2024. Payroll Payout - Rules & Regulations | boom 97.3 - 70s 80s 90s Music Make-A-Wish Minute WIN On-Air Concerts & Events Contact Us Last Played Boom 97.3 plays a variety of 70s 80s 90s music from U2 to the Bee Gees, Bon Jovi to Duran Duran from the Eagles to Michael Jackson. We take you back to the carefree times in your life. Payroll Payout - FAQ | boom 97.3 - 70s 80s 90s Have a question about Payroll Payout? Here are a few frequently asked questions that hopefully should answer them for you. If your answer isn't below or have a different question, call us at 416-482-0973. If I signed up before, do I need to sign up again? I think I missed a name, was my name called?

(3).jpg)

Frank FM's Payroll Payout Presented by Whited RV 107.5 Frank Maine

1 0:42 START HERE - boom 97.3's Payroll Payout Playlist - Songs all about Money! boom 97.3 2 3:48 Pet Shop Boys - Opportunities (Let's Make Lots of Money) (Version 2) (HD) Pet Shop Boys. boom 97.3 - 70s 80s 90s See U2 in Las Vegas! See Today's Random Answer! Win $100 an hour with Payroll Payout! Sign up now! Payroll Payout Win a trip to Las Vegas to see U2 at Sphere Win a trip to Las Vegas to see U2 at Sphere boom 97.3 and tripcentral.ca want to send you and a friend to fabulous Las Vegas to see the biggest band in the wor… Multiply the total taxable wages for the payroll period by the current SDI rate. To do this, you'll need to know the most current rate, which at the moment is 1.2% (You can check the rate here .) Using the rate of 1.2% — or 0.0120 — an employee who earned $500 in wages would pay a $6 SDI tax. (500 x 1.0120 = 506). If you hear your name starting January 16, call us back within 10 minutes at 416-872-0973 to get on boom's payroll! Here's How You Win: 1 PLAY boom 97.3 at work, in your car and at home.

Thanks for playing Montreal…here’s a quick recap of The Beat’s Payroll

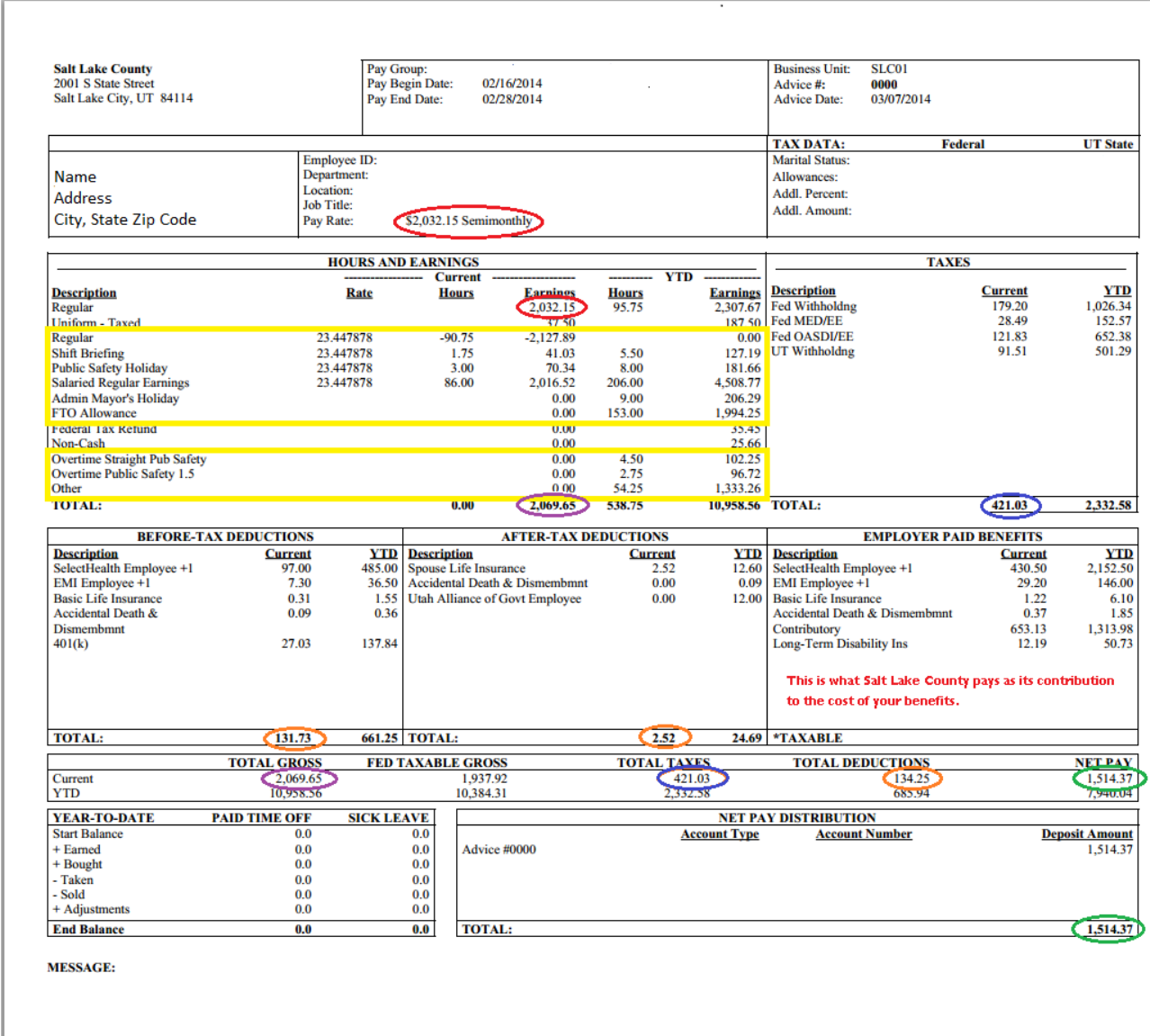

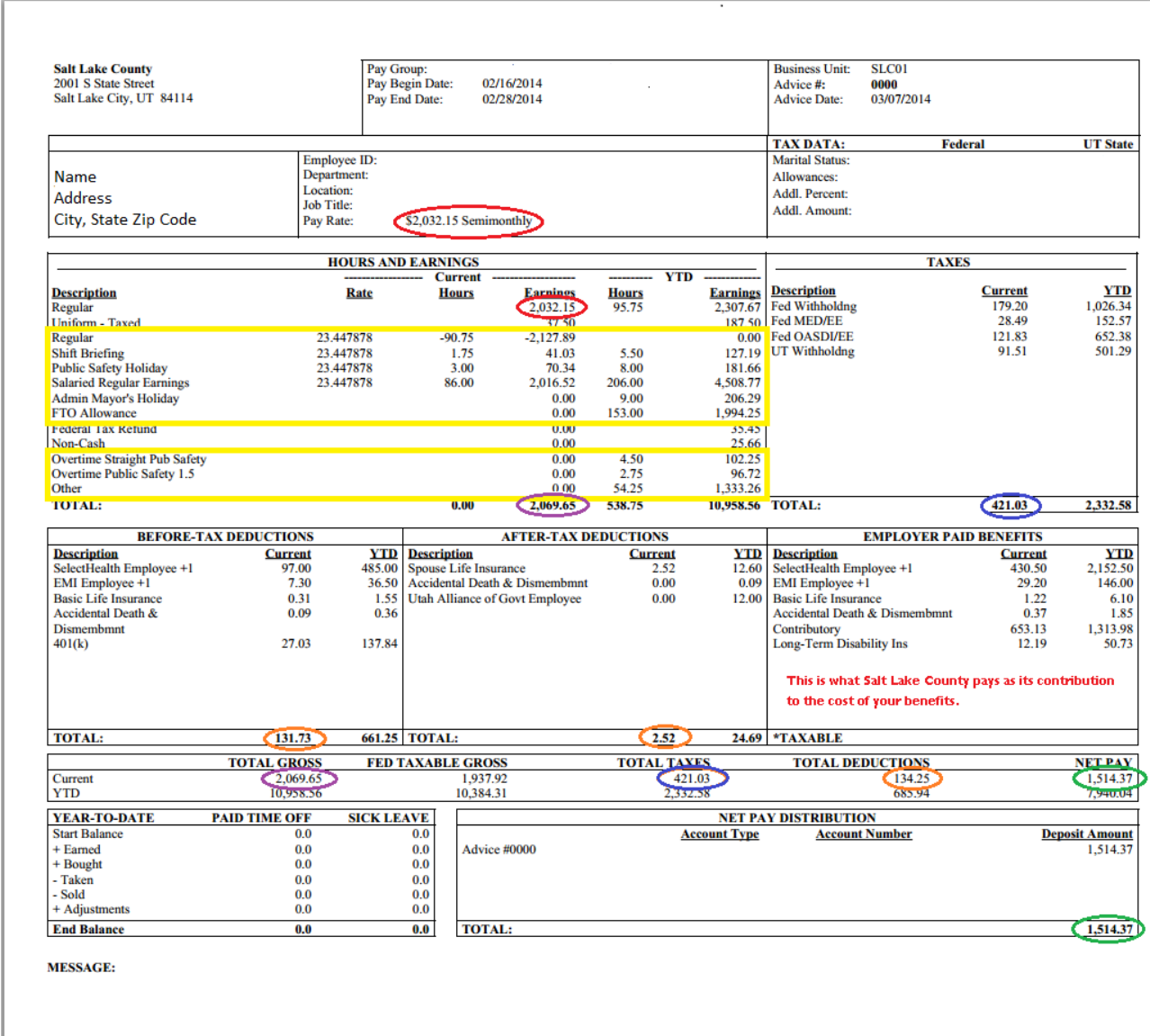

Noun. ( en noun ) A list of employees who receive salary or wages, together with the amounts due to each. The total sum of money paid to employees. (computing) The series of accounting transactions that ensure that employees are paid correctly, and that all taxes etc are properly deducted; the department in a company responsible for it. Payroll. The Payroll Office, within the office of Finance and Administration, is responsible for the processing of all employee wages and related deductions. Payroll works closely with Human Resources to ensure that all payroll activities are performed accurately, efficiently, and in accordance with district policies, bargaining unit agreements.

March 7, 2018 · Follow Sign up for Payroll Payout to make $100/hr - or $150/hr on More Money Mondays! Listen for your name weekdays at 9a, 1p & 5p. Get started here--> http://www.boom973.com/payrollpayout/ See less Most relevant Tonie Gallippi Good afternoon, I've been listening to your station since day one. I love it. For example, if you earn $50,000 from a W-2 employer and have payroll taxes withheld, and also earn $100,000 in self-employment income, you'll only need to pay Social Security tax on the first.

Payroll Pay Stub Template Excel Templates

Leave Payout Process. Complete the following steps when processing a Payroll Adjustment form for a leave payout: Print the detailed leave report for the last cycle that the employee worked and calculate any manual adjustments (accruals & leave used that is not reflected). Complete the Payroll Adjustment form with the total payout due in the. Employers are required to pay employees, at their regular rate, for all paid-time-off that the employee has accrued. Mandatory Vacation Time: California employers are not required to give vacation time. Sick leave is another matter. California passed a law in 2015 mandating that employers provide at least 3 days of paid sick leave a year.

(3).jpg)