The UPS Billing Center allows you to view invoices, manage payment methods and pay your bills for existing shipping accounts. Log In To Enroll Don't have a UPS account? Open one for free, or add an existing account to your profile. UPS is one of the world's largest customs brokers, and we can help simplify the customs process so you can see less customs delays and hit more deadlines.

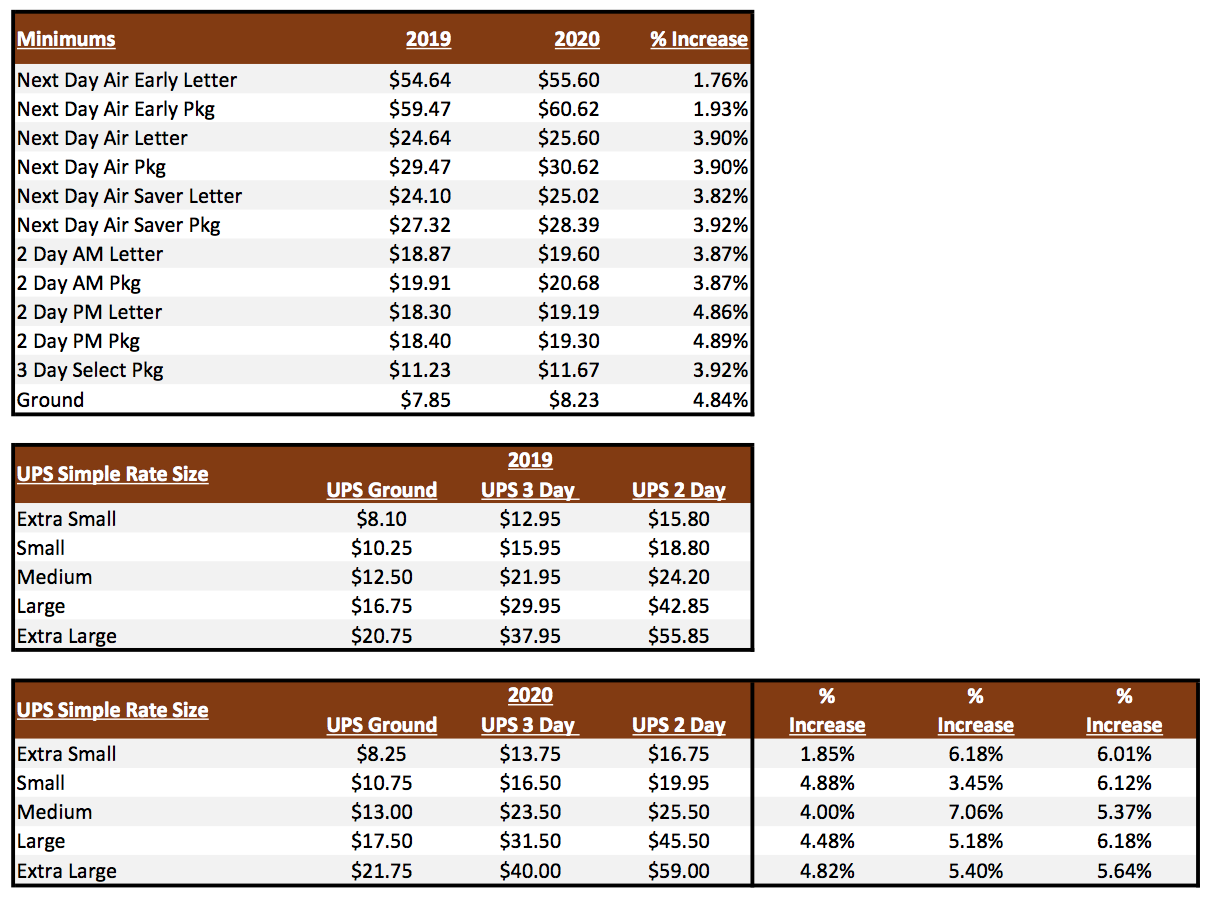

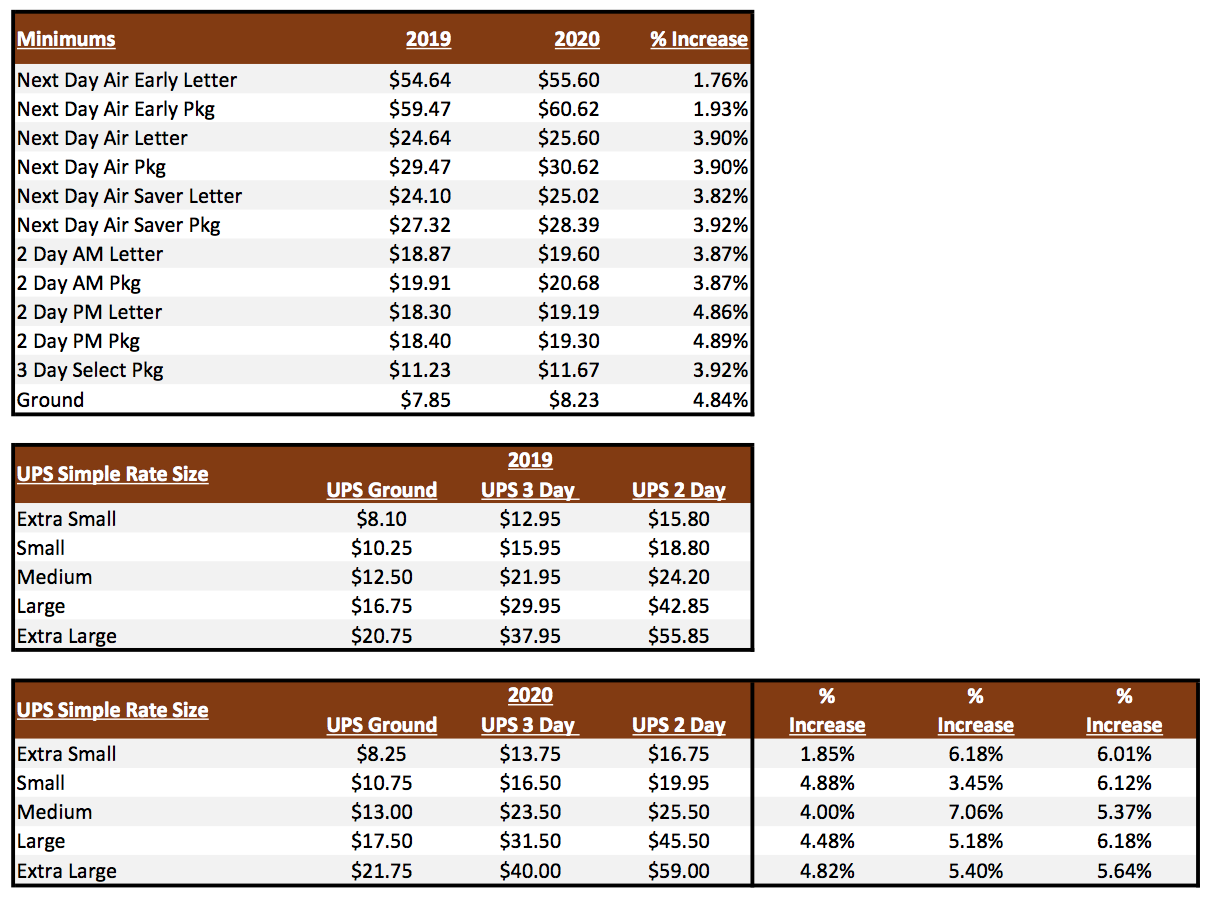

UPS Announces 2020 General Rate Increases Target Freight

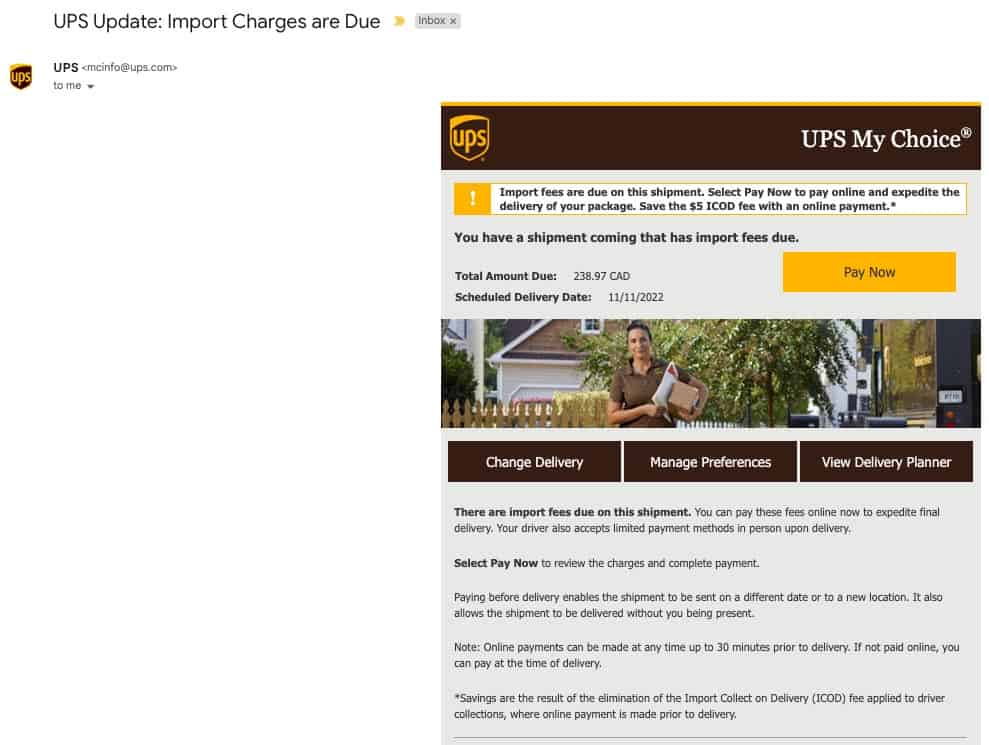

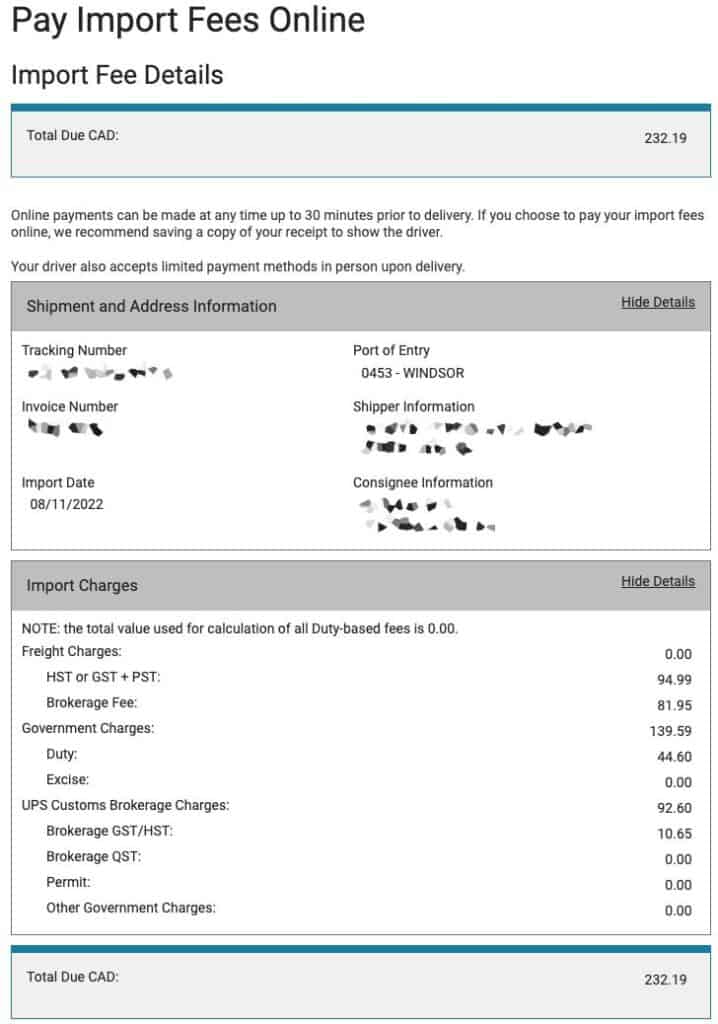

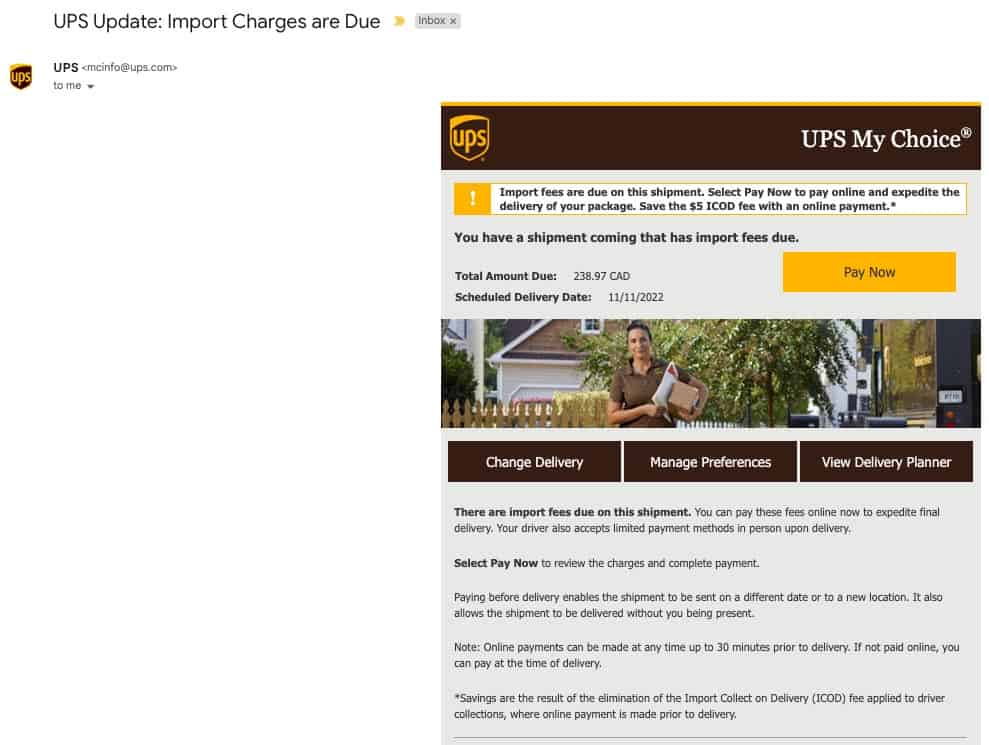

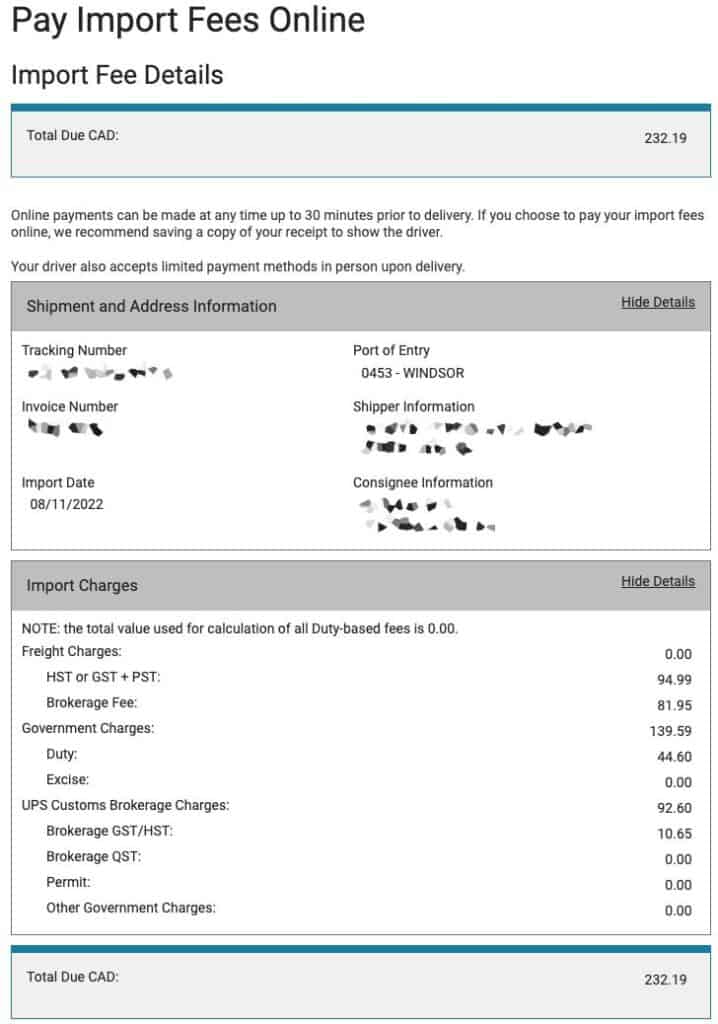

UPS Import Control Manage Costs and Minimise Delays Control the speed and cost of import shipments. Gain full visibility into your inbound supply chain. Prevent unauthorised charges. Limit delays or excess duties and taxes. Create Your Own Shipping Labels and Commercial Invoices Pay for your collect-on-delivery (C.O.D.) package online before it reaches its destination.. Your UPS driver may require a copy of this receipt to complete delivery. You can print this receipt, and receipts are available from this website for 30 days after payment.. UPS Customs Brokerage Charges: 32.77 Brokerage Fee: 29.00 Brokerage GST. As a general rule of thumb, the more express or "premium" service you pay for, the less likely you are to be subject to brokerage fees from UPS. Express UPS shipments cover more brokerage fees than UPS Standard service, but it isn't a 100% dogmatic rule, of course. Pay for your collect-on-delivery (C.O.D.) package online before it reaches its destination. This allows us to deliver your shipment even when you're not there.. UPS My Choice®. • The import fees for this package have been paid offline. • The package has already been delivered. • The package was refused.

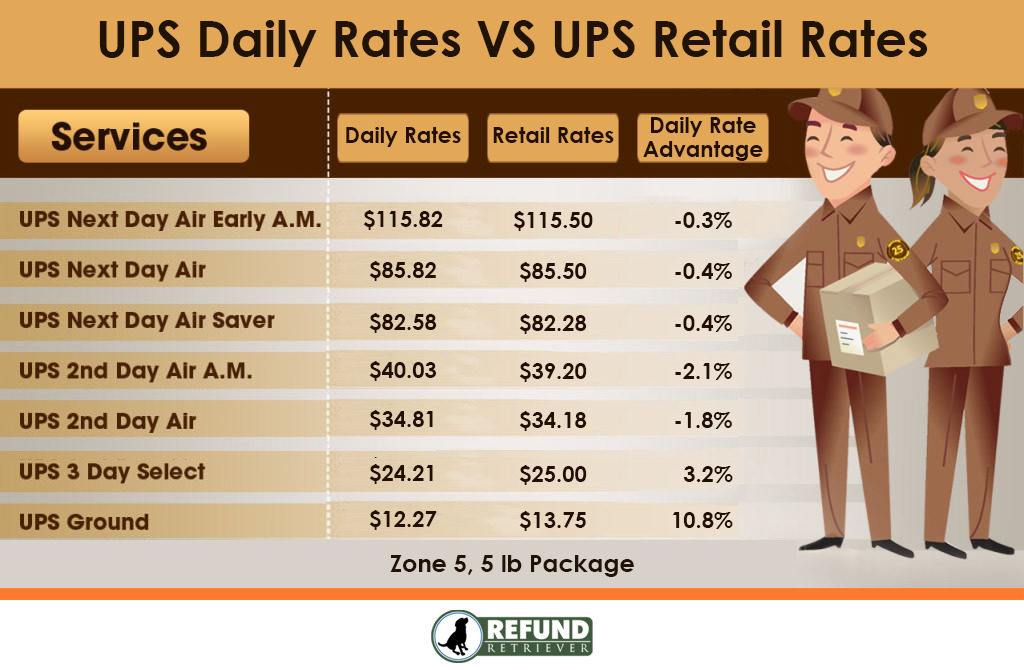

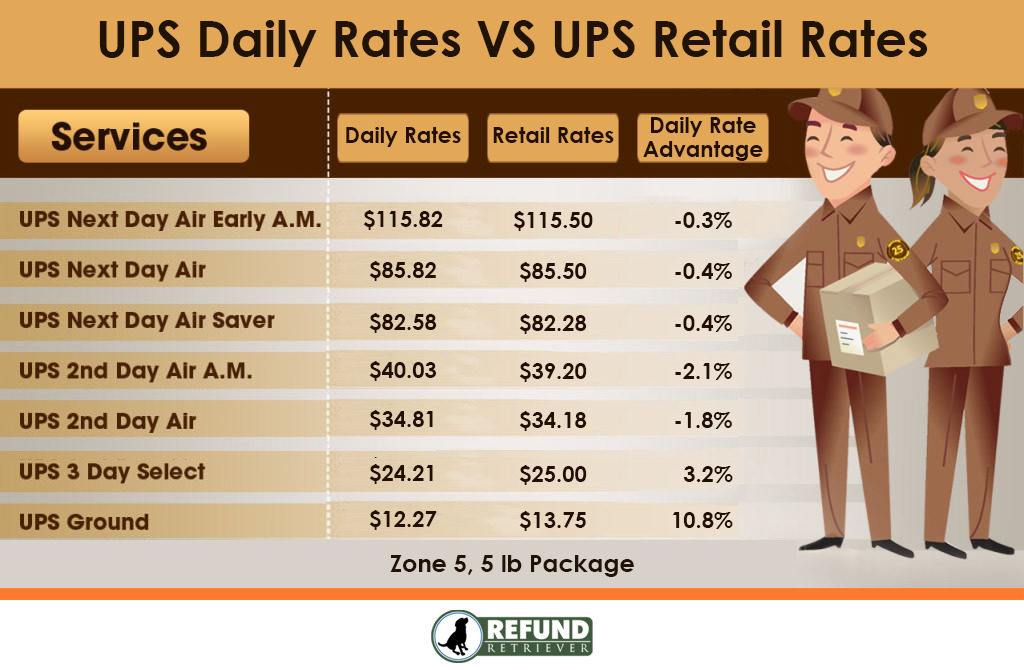

UPS Shipping Rates Daily Rates vs UPS Retail Rates

Brokerage fees are "service fees" that UPS assesses by acting as the customs broker to clear packages through countries' customs departments. Brokerage fees vary from country to country but are generally based on entry complexity, customs and other agency requirements, and the UPS service selection. Fees include, but are not limited to. To enable UPS to bring the shipment into the UK and meet our delivery commitment, UPS pays these charges on your behalf. The invoice details the Duty/VAT charges that HM Revenue and Customs (HMRC) levies on your recently imported shipment. Why didn't you contact me prior to delivery? What Are UPS Brokerage Fees? When an international shipment arrives in a country, UPS works with local customs to broker the owed duty and tax payment. They charge a brokerage fee depending on the value of the shipment . Brokerage fees only apply to UPS Standard or other services that have outsourced UPS to deliver the parcel. These fees will be listed on the bill you receive and must be paid at the time of delivery or before. UPS charges a handling fee for their customs handling, as they will pay the customs fees directly to HMRC and then ask you for reimbursement. If you decide not to pay this fee, you will not receive your package.

How To Avoid Paying UPS Brokerage Fees in Canada Self Clearance

Step 1: Import charges are accessed Step 2: Call UPS to initiate self clearance Step 3: Await UPS documentation via e-mail Step 4: Look for your closest CBSA Inland Office Step 5: Visit CBSA Inland Office to Pay Tax and Duties The UPS Billing Centre allows you to view invoices, manage payment methods and pay your bills for existing shipping accounts.

UPS applies tariff and customs brokerage fees based on the destination country's regulations, the value and nature of the goods being shipped, and any other applicable restrictions or requirements.. (GST), you may be required to pay these taxes upon delivery. These taxes are based on the value of the goods being shipped and can add a. How to pay Custom Fee? First time using, but probably my last time using. I know I need to pay the expensive custom charge. However, UPS is the only choice right now due to the pandemic. Before I actually confirm that I will change my EMS to UPS. I want to exactly know where can I pay the customs fee.

How To Avoid Paying UPS Brokerage Fees in Canada Self Clearance

Commercial shipments to international destinations other than the United States (including Puerto Rico and the U.S. Virgin Islands) containing restricted goods or goods valued over CAN$2,000 require submission of an export declaration to the Canada Border Services Agency (CBSA). If your item was $40, then you'll be paying almost 40% in broker fees. 40%!!!!!!! The higher the value of your package, the lower the percentage you pay for your broker fees BUT they still charge more money based on how much your package is worth. So you pay $16.75 for a $40 package, $30.40 for a $150 package, $71.80 for a $750 package and so on.