Filing dates for 2022 taxes. February 20, 2023: Earliest day to file your taxes online. April 30, 2023 (May 1, 2023 since April 30 is a Sunday): Deadline to file your taxes. June 15, 2023: Deadline to file your taxes if you or your spouse or common-law partner are self-employed. You filed your return late and you owe tax for 2022. You failed to report an amount on your 2022 return and you also failed to report an amount on your return for 2019, 2020, or 2021. You knowingly, or under circumstances amounting to gross negligence, made a false statement or an omission on your 2022 return.

SteuerRatgeber 2022

This is the main menu page for the T1 General income tax and benefit package for 2022. Individuals can select the link for their place of residence as of December 31, 2022, to get the forms and information needed to file a General income tax and benefit return for 2022. Each package includes the guide, the return, and related schedules, and the provincial information and forms. You've come to the right place. TurboTax for Tax Year 2022 is now available. Whether you choose to do your taxes yourself, with some help, or hand them off to a tax expert- we've got you covered. We specialize in three things: taxes, taxes and taxes. Every day. March 31, 2023. Deadline to file your taxes (Canadians and non-residents, unless you and/or your spouse is self-employed) May 1, 2023. Deadline to pay outstanding taxes. May 1, 2023. Deadline to. $90,000 annual income - $50,197 (2nd bracket minimum) = $39,803. x 2nd bracket rate of 20.5% = $8,159.62 + 1st bracket maximum total tax of $7,529.55

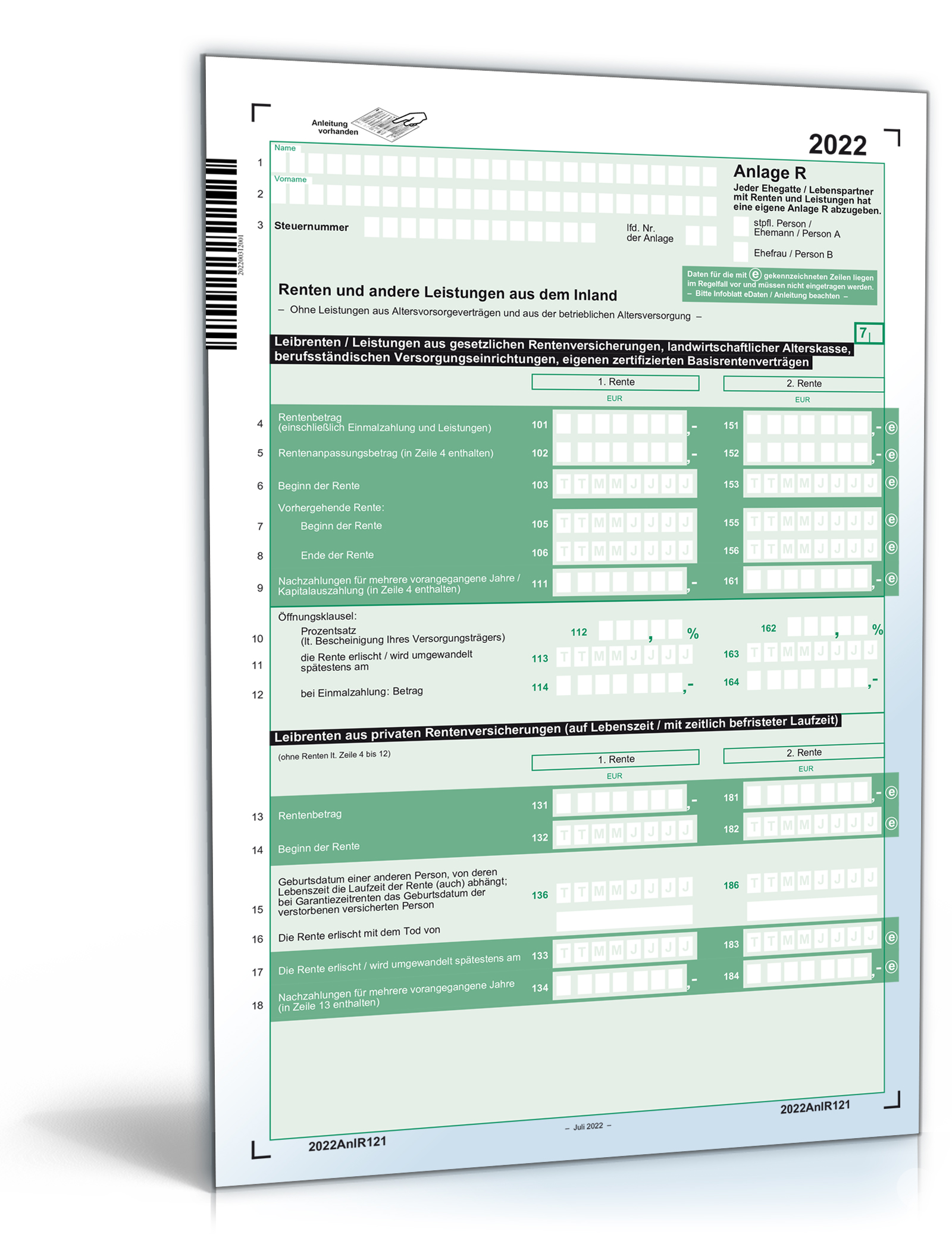

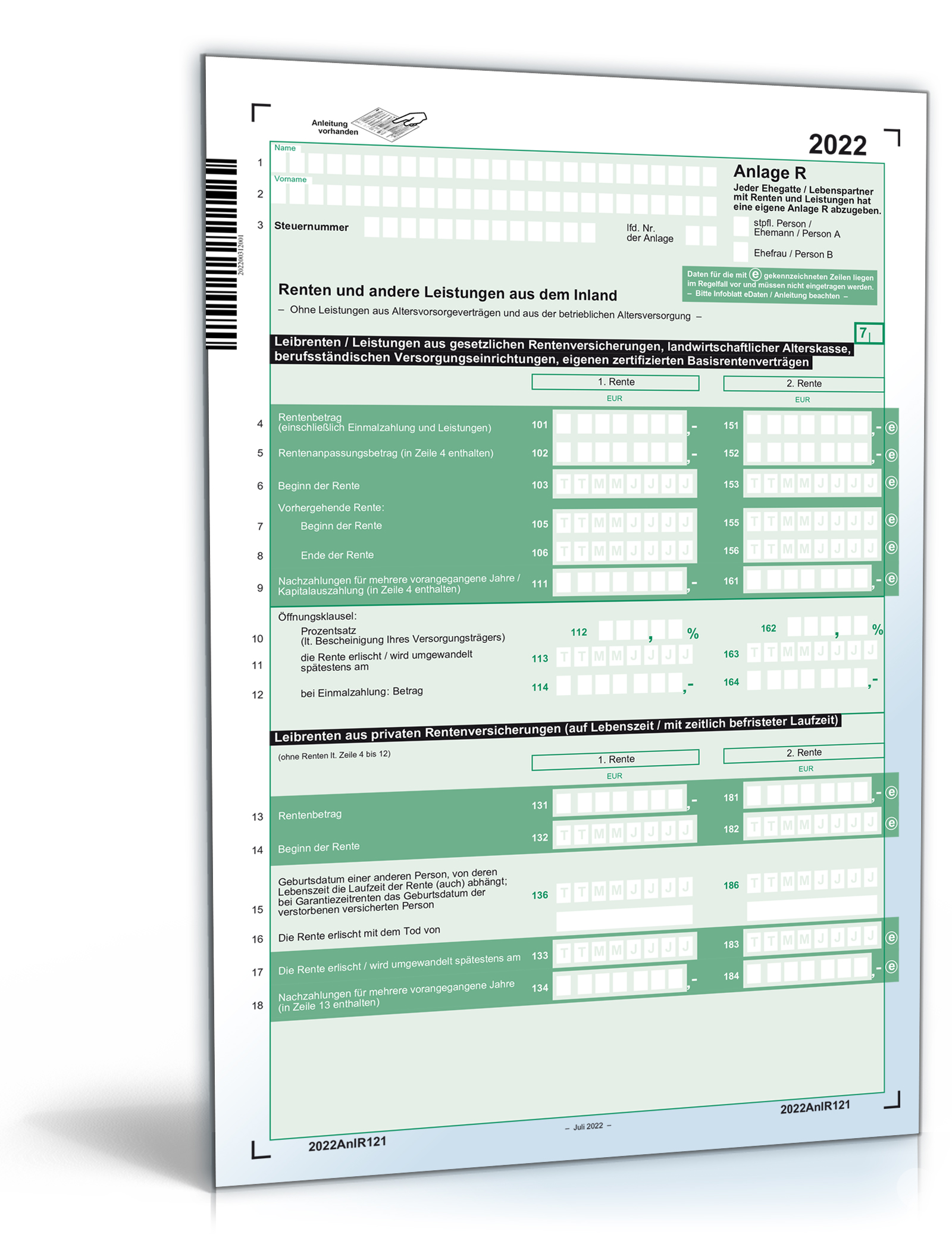

Anlage R 2022 Steuerformular zum Download

The federal basic personal amount comprises two elements: the base amount ($12,719 for 2022) and an additional amount ($1,679 for 2022). The additional amount is reduced for individuals with net income in excess of $155,625 and is fully eliminated for individuals with net income in excess of $221,708. Consequently, the additional amount is. Tax Rates -> 2022-2023 Tax Rates -> Ontario Personal Ontario 2023 and 2022 Tax Rates & Tax Brackets. The Ontario tax brackets and personal tax credit amounts are increased for 2023 by an indexation factor of 1.065 (6.5% increase), except for the $150,000 and $220,000 bracket amounts, which are not indexed for inflation. Get a quick, free estimate of your 2023 income tax refund or taxes owed using our income tax calculator. Plus, explore Canadian and provincial income tax FAQ and resources from TurboTax. Province Employment income Self-employment income Other income (incl. EI) RRSP contribution Capital gains & losses Eligible dividends Income taxes paid (Federal) CRA Newsroom What you need to know for the 2022 tax-filing season February 10, 2022 Ottawa, Ontario Canada Revenue Agency Last year, Canadians filed almost 31 million income tax and benefit returns. Having the information you need on hand to file your return makes the filing process that much easier.

Bild Steuer 2022 (für Steuerjahr 2021) Steuern Software Thalia

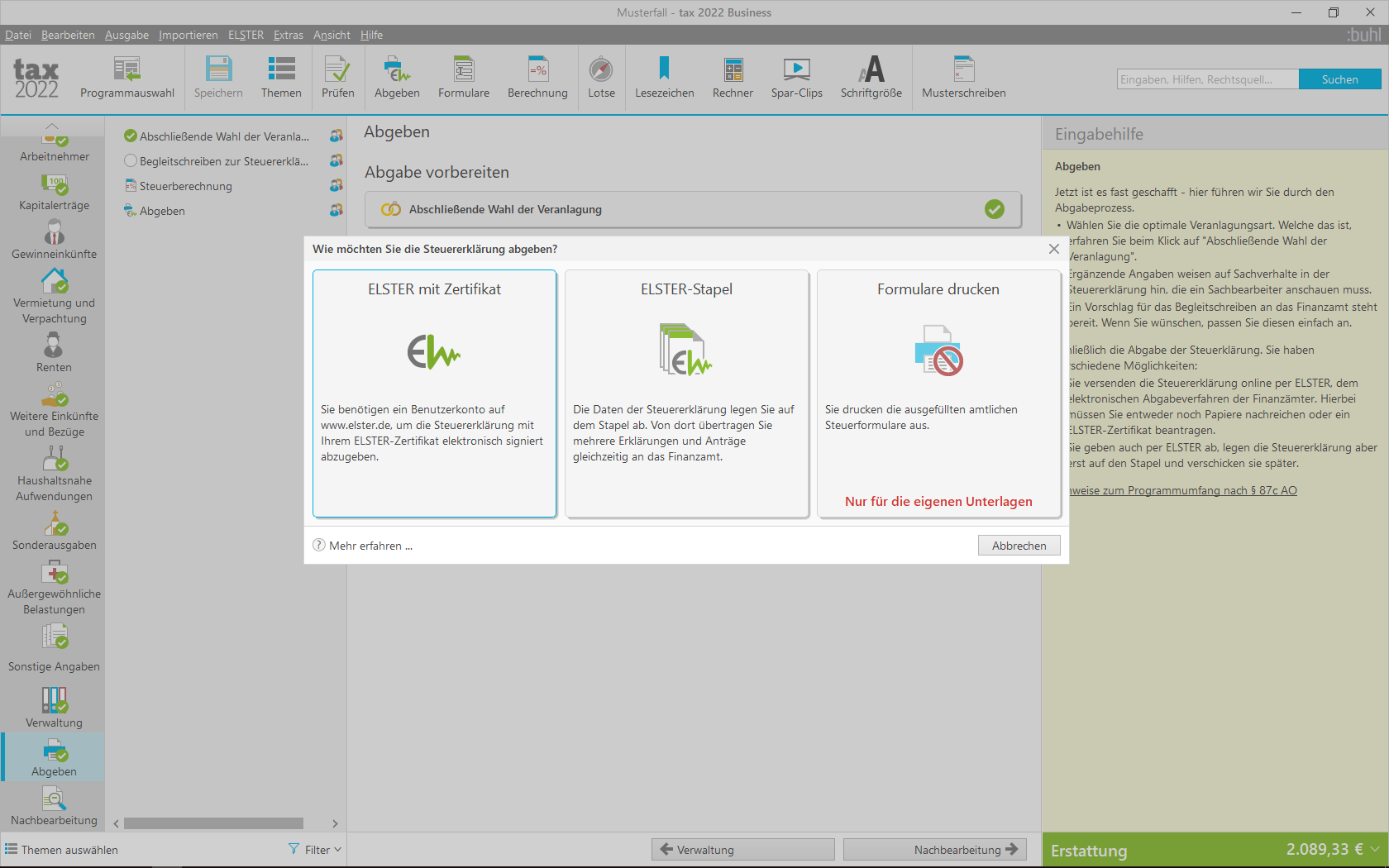

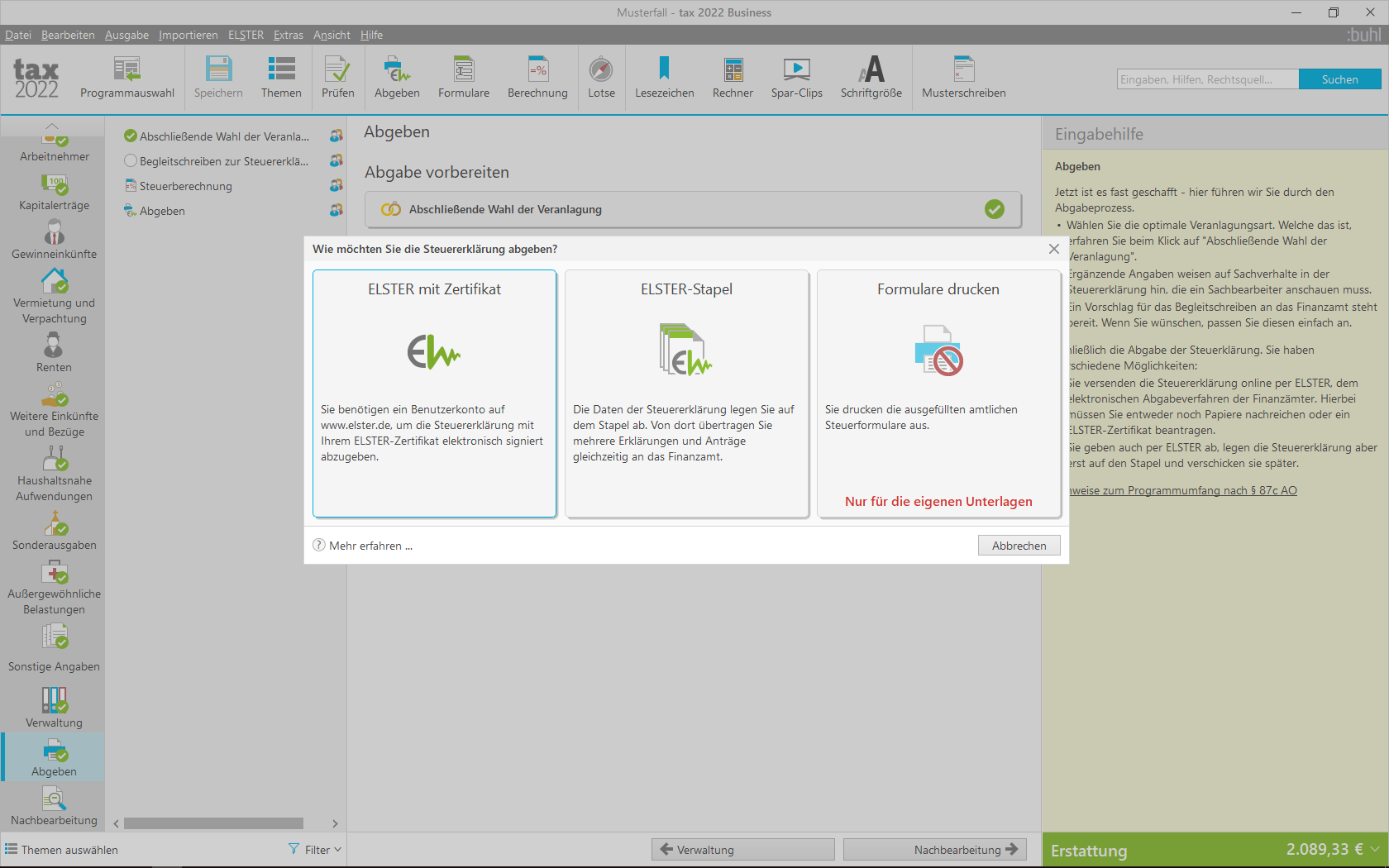

tax 2022 Download. Für die Steuererklärung 2021. Privatlizenz - Updates für das Steuerjahr 2021 inklusive. € 15,99 (Inkl. MwSt.) In den Warenkorb tax 2022 - alle Informationen auf einen Blick Aktuelle Version The tax rates in Ontario range from 5.05% to 13.16% of income and the combined federal and provincial tax rate is between 20.05% and 53.53%. Ontario's marginal tax rate increases as your income increases so you pay higher taxes on the level of income that falls into a higher tax bracket. Learn more about Ontario's marginal taxes.

Annual German tax return (Einkommensteuererklärung) A large proportion of taxpayers in Germany, both expats and German citizens, choose to submit an annual income tax return ( Einkommensteuererklärung) to the Federal Central Tax Office. If you get a larger refund or smaller tax due from another tax preparation method, we'll refund the amount paid for our software. TurboTax Free customers are entitled to a payment of $9.99. Claims must be submitted within sixty (60) days of your TurboTax filing date, no later than May 31, 2024 (TurboTax Home & Business and TurboTax 20 Returns.

tax 2022 Business kaufen Die Lösung für SteuerProfis Buhl

Gestiegene Pendlerpauschale ab dem 21. Kilometer ab 2022 Wer einen langen Fahrtweg zur Arbeit hat, profitiert bei der Steuererklärung 2022 noch mehr. Denn: Die Pendlerpauschale beträgt ab dem 21. Kilometer Fahrstrecke nicht mehr 0,35 Euro, sondern 0,38 Euro pro Kilometer. Bis zum 20. Kilometer gelten weiterhin 0,30 Euro. On April 1, 2024, carbon taxes will increase from $65 to $80 per tonne, which means taxpayers will be paying 17.6 cents per litre of fuel at the pump, compared to the previous rate of 14.3 cents.