1. Set Your Goals - Financially and Emotionally 2. Get Familiar with Trading Jargon and Analysis Methods 3. Develop a Trading Strategy 4. Set a Risk Reward Ratio 5. Always Learn and Grow 6. Make an Organized Trading Track Record Trading Plan Infographic Trading Plan Template FREE Downloads What is a Trading Plan Template? A trading plan is an integral part of a trader's strategy, outlining how trades are executed. It establishes rules for buying and selling securities, position sizing, risk management, and tradable securities. By following this plan, traders maintain discipline, consistency, and leverage proven strategies. Why you should create a trading plan

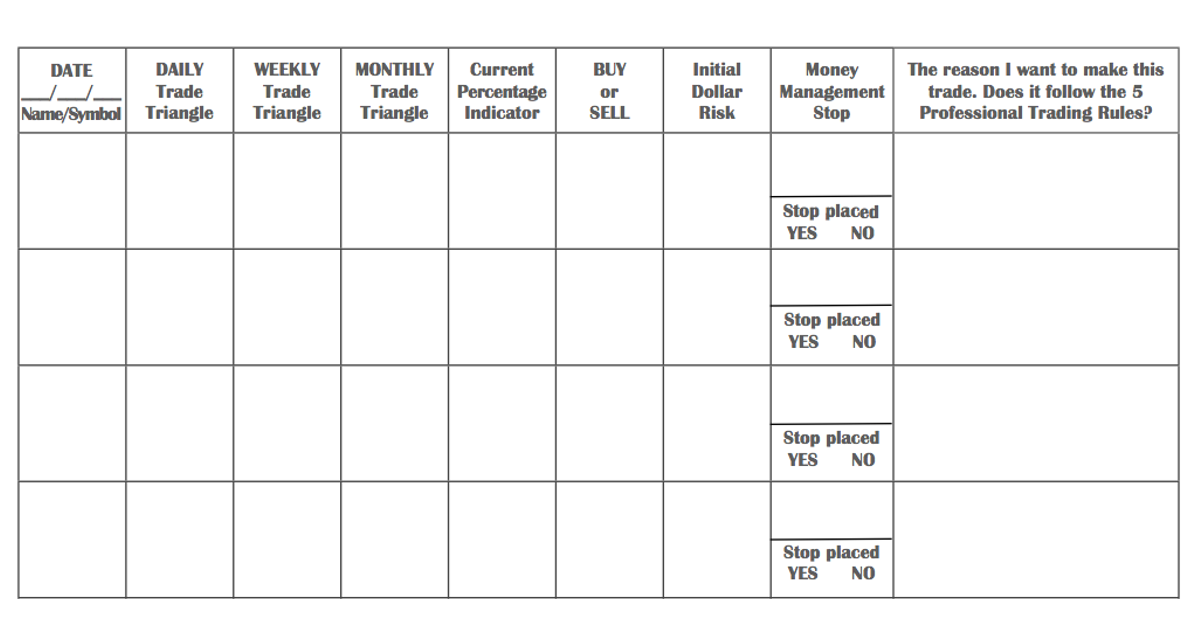

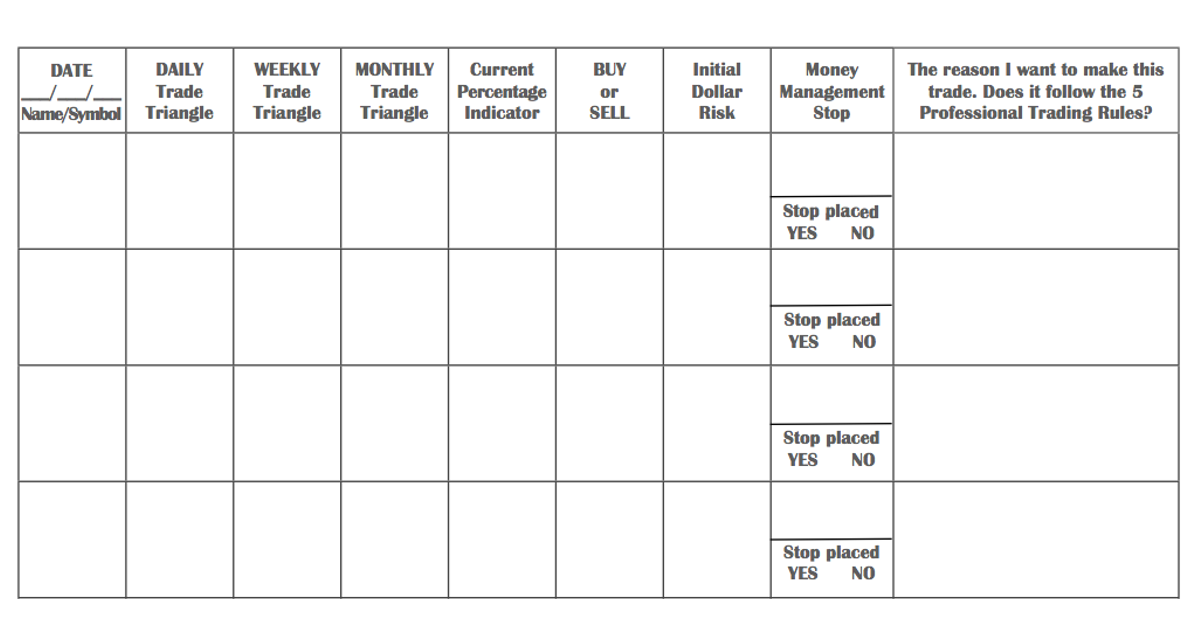

Free Trading Plan for Stock, Futures, Forex and ETF Trades

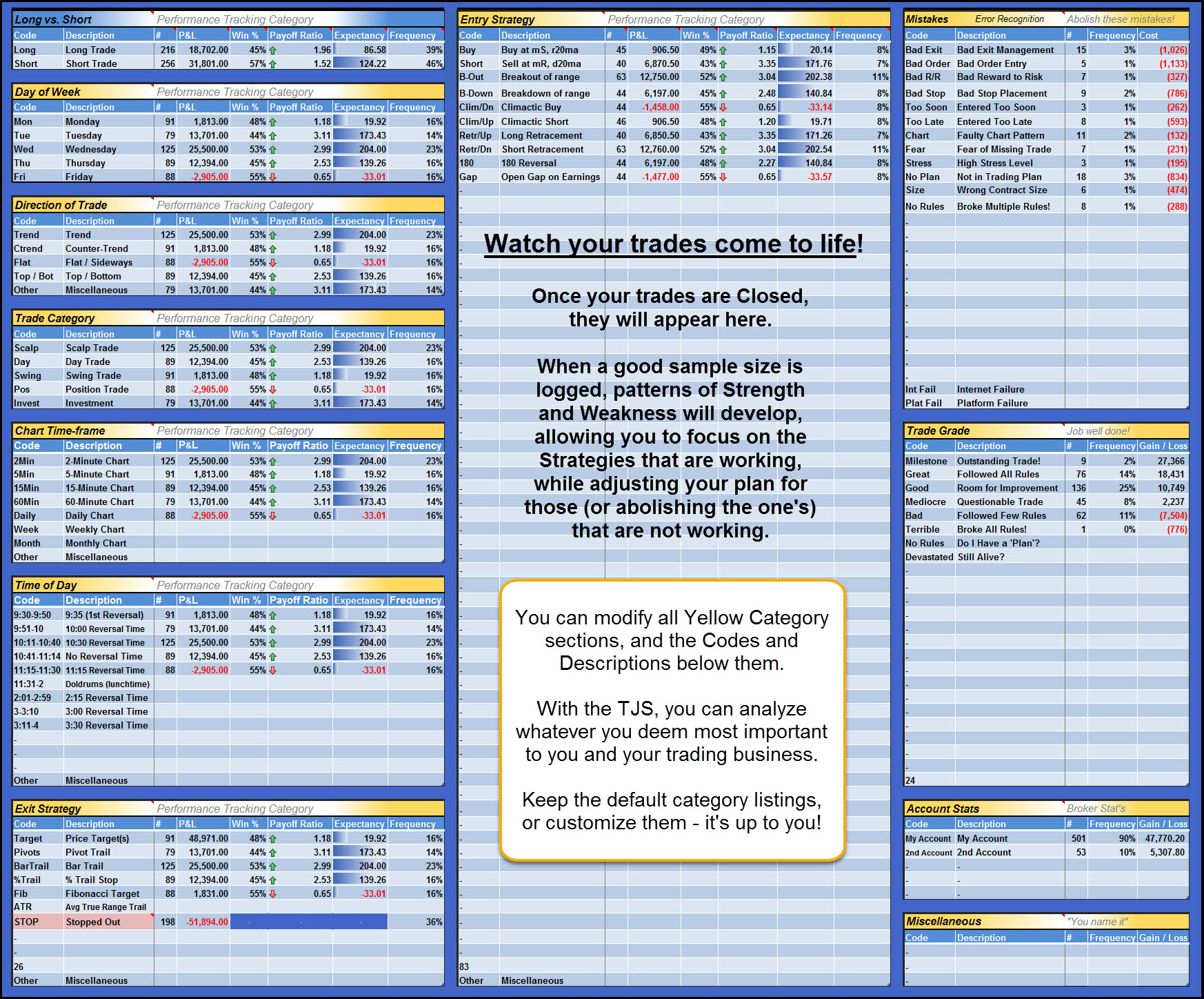

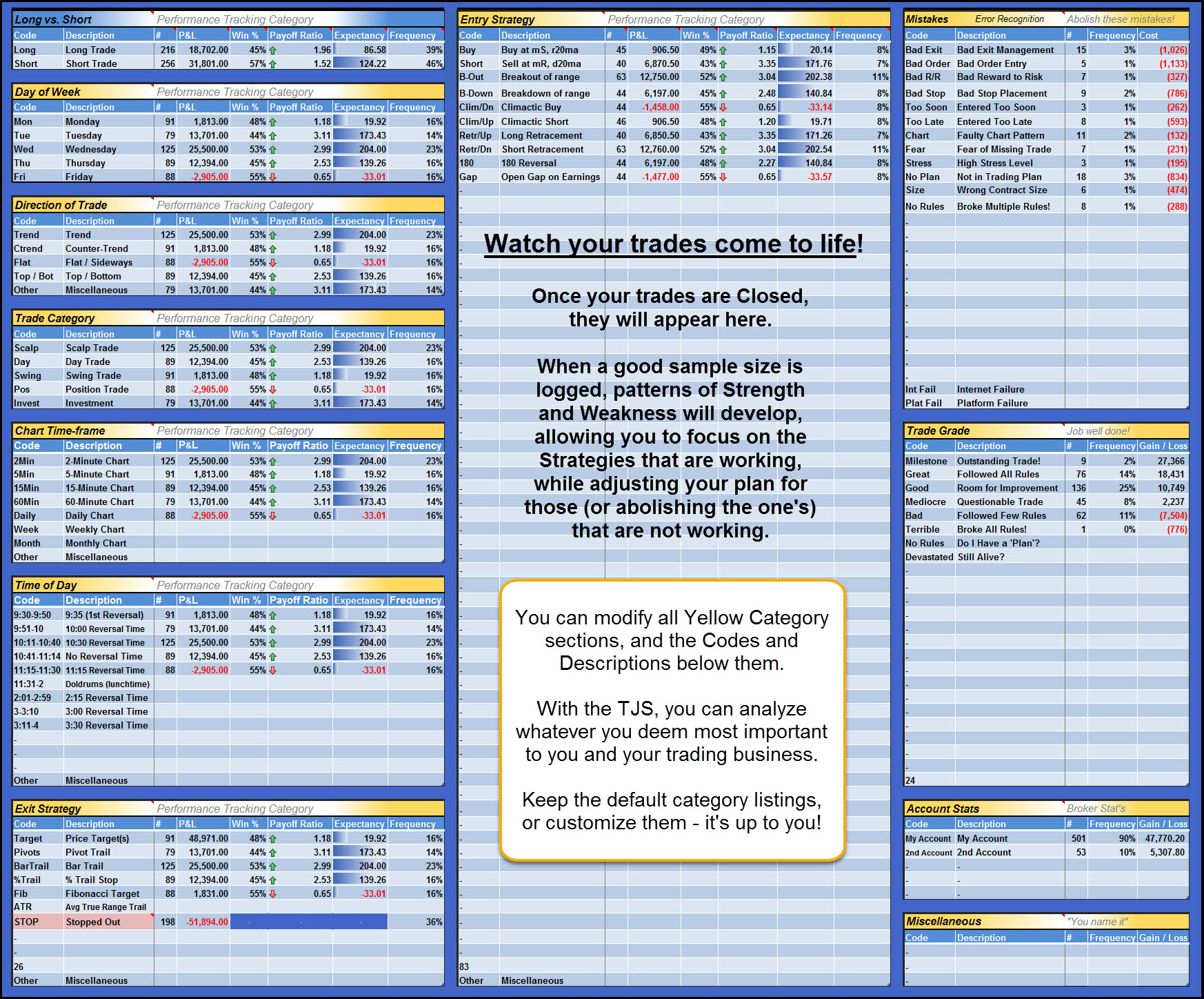

Download the trading plan template To figure out which trading strategies fit your personality and trading goals, it helps to see examples of trading plans. You will find actual plans for each of our veteran trading mentors in their trader profiles - including John Carter. Here is what to include in a trading plan: Why are you trading? A Trading Plandefines a trader's goals, expectations, routines, risk management, and trading strategies. A successful plan will include the logic underlying the strategies and processes a trader deploys. Elite traders already know they have won the game before placing a single trade for two reasons. Download a trading plan template [PDF and Google doc] Create one you'll actually stick to Like many traders, you've probably spent the weekend constructing a plan, you're all fired up for the market open on Monday and within days you've ignored it completely and are back to square one. Let's change that right now… What is a Trading Plan? A trading plan is a systematic method for identifying and trading securities that takes into consideration a number of variables including time, risk and the investor's objectives.

Trading Plan PDF

Trading Plan: 6 Steps to Create One + Examples By stockstotrade From StocksToTrade Trading Plan: Key Takeaways The keys to building a personalized trading plan… How to fit your plans to your unique trading style… Discover how trading plans help me find the day's potential movers within 60 seconds of the market open… Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917. 851191.1.0. Get up and trade with Fidelity. Build your confidence and learn about things to consider and how to approach a trading plan. This includes getting started, generating trade ideas, planning for the trade, placing a trade, and finally monitoring. A trading plan is a blueprint for traders to take up logical trades based on specific preset criteria. The two main ingredients of disciplined trading are developing a trading plan and sticking to it. Following are a few of the reasons why you need a trading plan: More objective decisions, Better discipline, More room for improvement, 1. Why use a trading plan template? 2. How to set up a trading plan 3. Trading plan essentials 4. Realistic trading goals 5. Trading plan outline 6. Track trading performance Why use a trading plan template? Having a strategy template can be a very useful part of the trading process, regardless of a trader's experience level.

Trading Plan Vorlage Genial Improve Your Trading by Keeping A forex Trading Journal Of

Here are 10 that every plan should include: 1. Goal Definition Firstly, if you are new to trading, you should determine financial objectives, risk tolerance, and time horizon. Steps for record keeping A trading plan is different to a trading strategy, which defines precisely how you should enter and exit trades. An example of a simple trading strategy would be 'buy bitcoin when it reaches $5000 and sell when it reaches $6000'. Learn more about trading strategies with IG Academy. Why do you need a trading plan?

Find Your Trading Style. 8. Trading Discipline. 9. Understanding the Stock Market. 10. Commodities Trading. A trading plan provides the framework for disciplined and successful trading. Find out. Step 4: Create the Well-Rounded Trade Plan. Here's the meat and potatoes. It is time to create a trading plan with the information you have compiled. Imagine you are training a robot with a set of instructions also known as algorithms.

Trading Plan template example Trading Journal Spreadsheet

Step 1 - Making the most of your skills. It is worth reiterating that to be a successful trader, you need to have a degree of genuine interest in the type of investments you are looking to trade. If you are risk-averse, it doesn't make sense to look at futures trading, which can be volatile, pressurized, and fast-moving. Your Trading Plan should be used as a guide for the type of information that you may wish to include in your own detailed trading plan. However, each of the following sections should be addressed in some form. A trading plan can be as simple or as complex as you want (or need) it to be.