USD erreichen wird. Dies stellt eine große Chance für Agraraktien dar, die sich auf vertikale Anbaumethoden konzentrieren. 11 Interessante Fakten und Statistiken Die globale Vertical Farming Branche wird bis 2026 voraussichtlich um mehr als 20% wachsen. Vertical Farming kann bis zu 70% weniger Wasser verbrauchen als traditionelle Landwirtschaft. Im Folgenden haben wir einige vielversprechende Vertical Farming Unternehmen aufgelistet. Nicht fehlen dürfen dabei auch ETF, um von der neuen Landwirtschaft zu profitieren: Aerofarms Aktie Future Farm Technologies Aktie Hydrofarm Aktie Affinor Growers Aktie Vertical farming ETF Über das Vertical Farming

7 Vertical Farming Aktien Investiere jetzt in Landwirtschaft

"Vertical farms" require significantly less land, water, fertilizer, pesticides, and power — and are clearly the future of food production for humanity. According to a trend analysis by Grand View Research, the global vertical farming market is expected to grow (heh) from $5.37 billion in 2021 to $33.02 billion by 2030. Kalera is a vertical farming company that uses technology to improve access to fresh and nutritious produce. The U.S.-based company has traded on a European exchange but announced plans in 2021. APPH stock recently listing through a SPAC business combination and traded for as high as $42.90 in early February. However, it has since trended lower, changing hands at $15.18 today. At a. The following are five of the best vertical farming stocks for 2023 and beyond, but note that vertical farming and greenhouse failures do occur before you invest. 1. AppHarvest. AppHarvest (NASDAQ.

7 Vertical Farming Aktien Investiere jetzt in Landwirtschaft

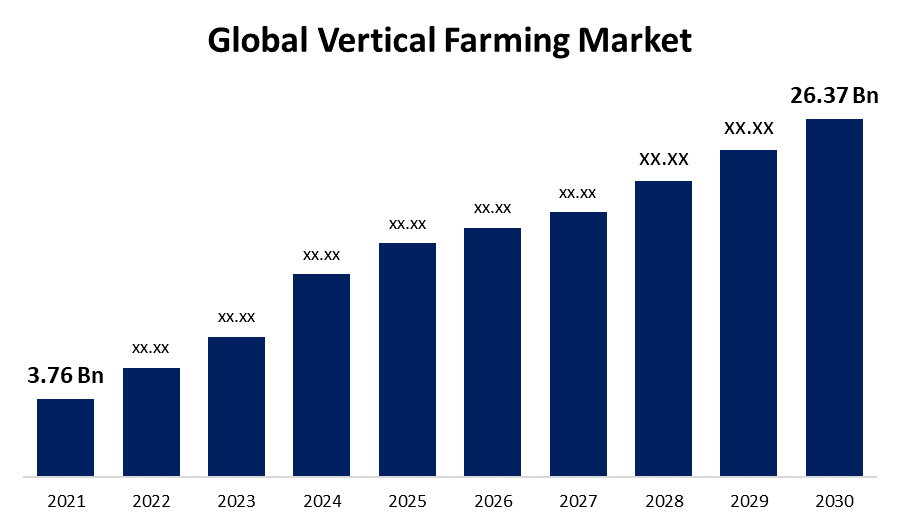

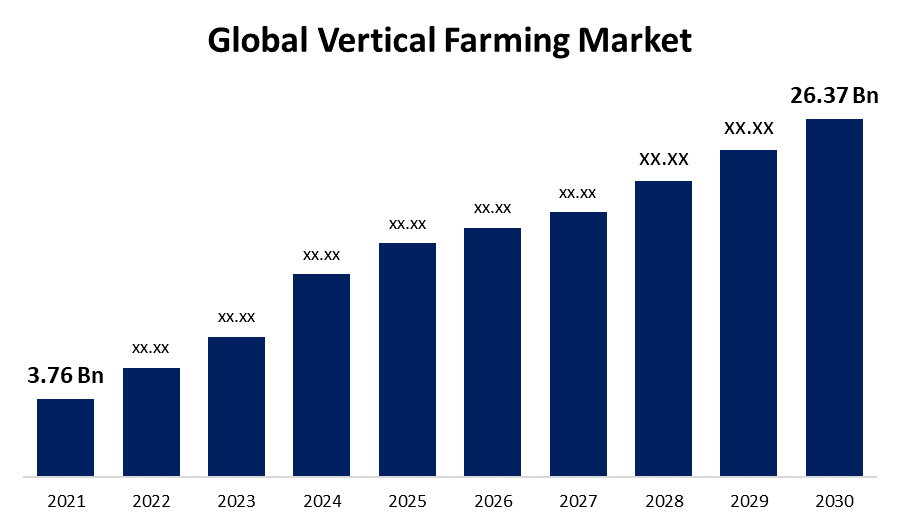

That's the best description for recent capital inflows into the vertical farming industry. Take a look: July 2017: Softbank invests $200 million in Plenty. August 2017: IKEA and the Sheikh of. GreenState AG from Winterthur in Switzerland. GreenState AG is a Swiss 360 modular and vertical farming company, that focuses on all aspects of indoor farming. Our technical solutions focus on hardware and software solutions that are closely related to the traditional agriculture, especially in the transfer of the traditional farming know-how. Meanwhile, t he global vertical farming market is forecast to grow at a compounded annual growth rate (CAGR) of over 23% between 2022 and 2026. Such an increase would mean a market value of $31.6. Vertical farming occupies the equivalent of 30 hectares of land worldwide, according to Rabobank analyst Cindy Rijswick, compared with outdoor cultivation of about 50m ha and 500,000 ha for.

Global Vertical Farming Market Analysis and Forecast 2030

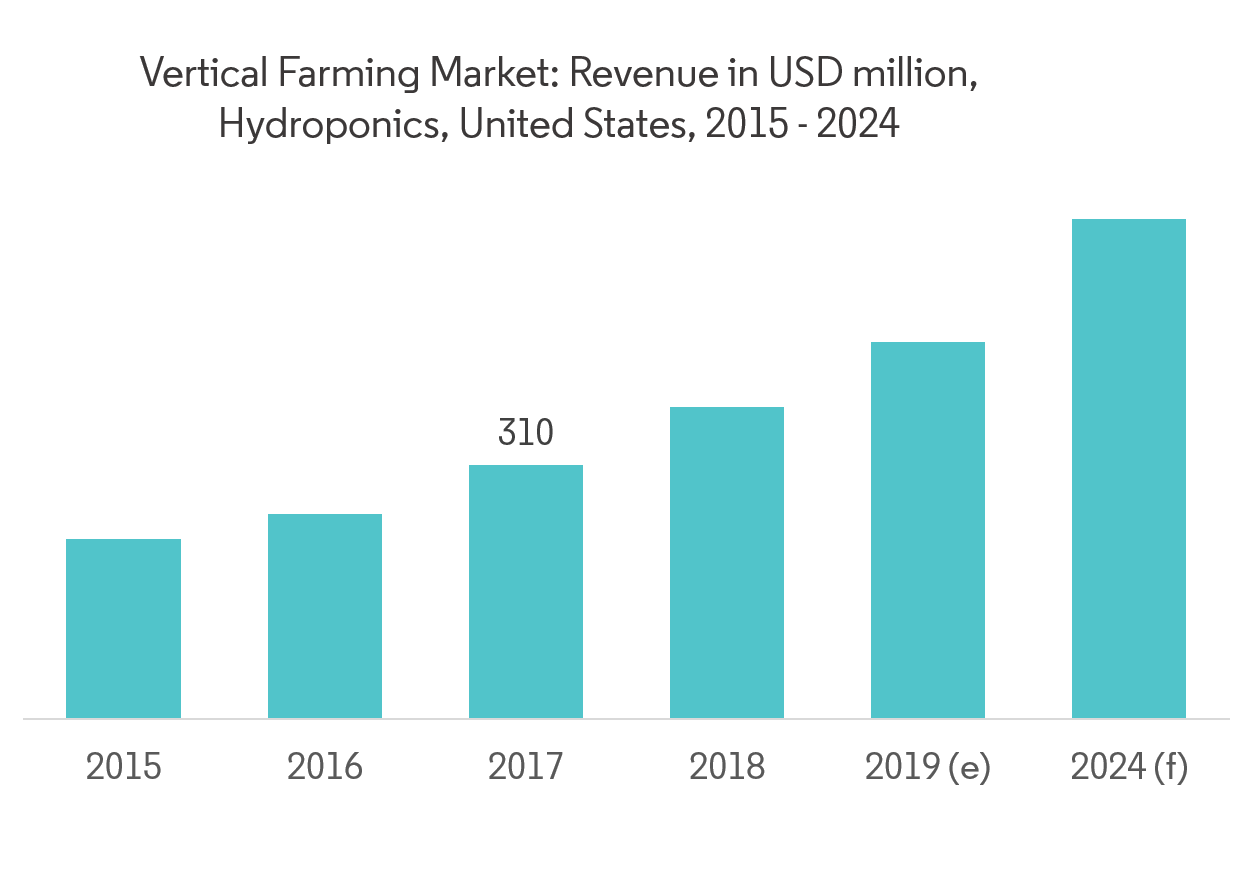

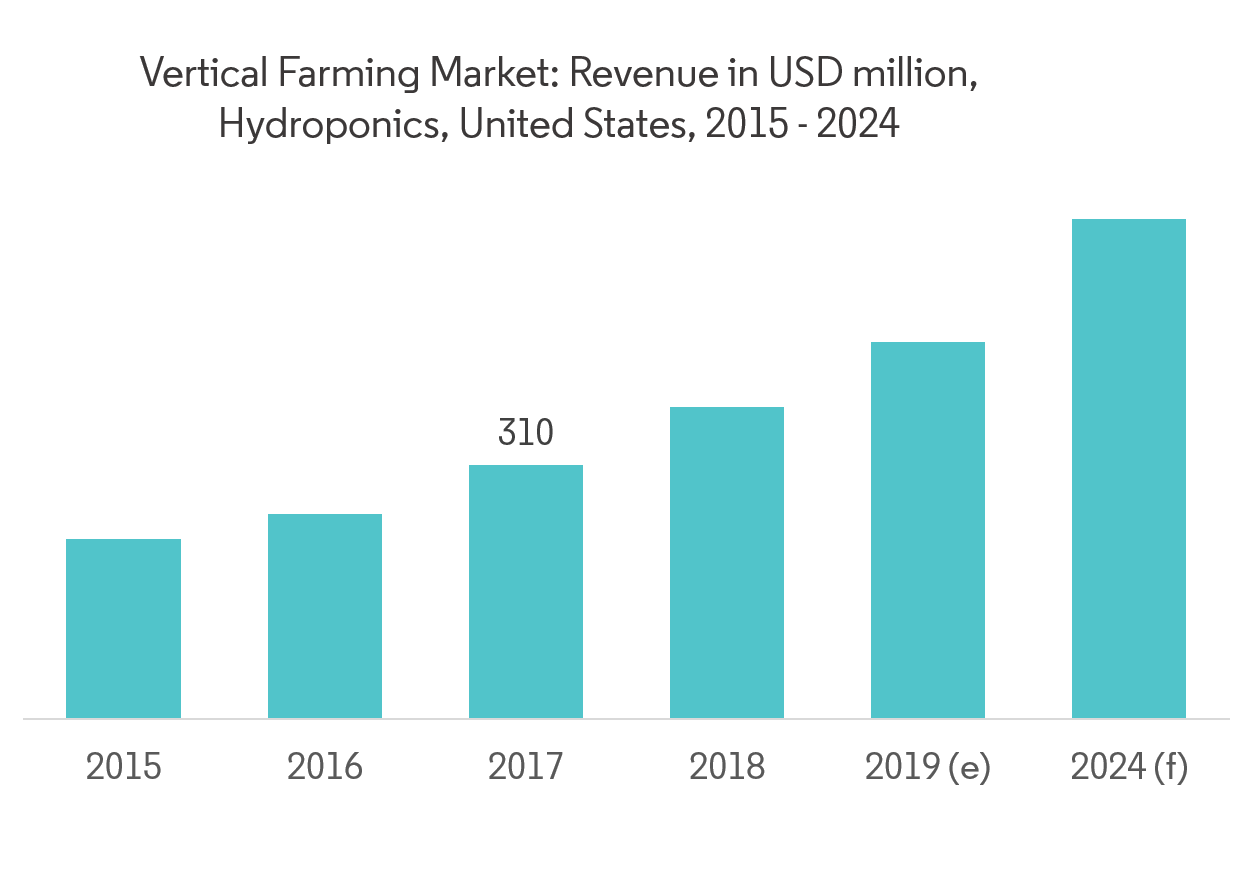

According to AgFunder, global investment in AgTech and FoodTech reached an all-time high of $15.8 billion in 2020. A consequence of the failings of the food & ag supply chain, worsened by COVID-19 during the past year, was that investors have been drawn to ag biotech, alternative protein, food waste mitigation, indoor farming, and robotics. Vertical farming systems have been constructed in buildings, tunnels, shipping containers and even abandoned mineshafts. As of 2020, there was an estimated 30 hectares of operational vertical farmland around the world. This vertical farmland is currently used to grow mostly different varieties of herbs, salads and leafy greens.

North America vertical farming market size was USD 1.62 Billion in 2022. The market growth can be attributed to several factors, such as the growing inclination towards climate control technology requirement of less water and energy for irrigation. This type of farming technique reduces the challenge of arable land. AppHarvest is one of the newer vertical farming stocks. Source: AppHarvest. AppHarvest (NASDAQ:APPH) went public in February last year via a reverse SPAC merger. It was the first publicly traded.

Vertical Farming Cost Analysis Farm House

In den USA wächst der Vertical-Farming-Sector derzeit jährlich um 25.2 Prozent. Erwartungen gehen davon aus, dass der Markt bis 2030 eine 31.6 Mrd. US-Dollar schwer sein wird, ausgehend von 3,3 Mrd. im Jahr 2020. 6 Anlegern steht eine Reihe von Möglichkeiten zur Verfügung, an diesem Wachstumspotenzial teilzuhaben. Vertical Farming Stocks & Shares. Please wait five to ten seconds whilst the latest stock prices are retrieved. Note, these prices are delayed, before making any investment decision please be sure to check the latest live price. Access Price Chart >. Access Price Chart >.