Calculate new autonomo quotas and income tax/IRPF for Spain In 2022, the Spanish government set in motion a scheme to gradually increase the social security payments for self-employed over a transitional period of 9 years from 2023 to 2031. Different Situations: Autonomo tax calculator 1. Single without children. Annual volume: €20,000 2. Single with no children. Annual volume: €40,000 3. Single with no children. Annual volume: €60,000 4. Single with no children. Annual volume: €80,000 5. Single with 1 child. Annual volume: €20,000 6. Single with 1 child. Annual volume: €40,000

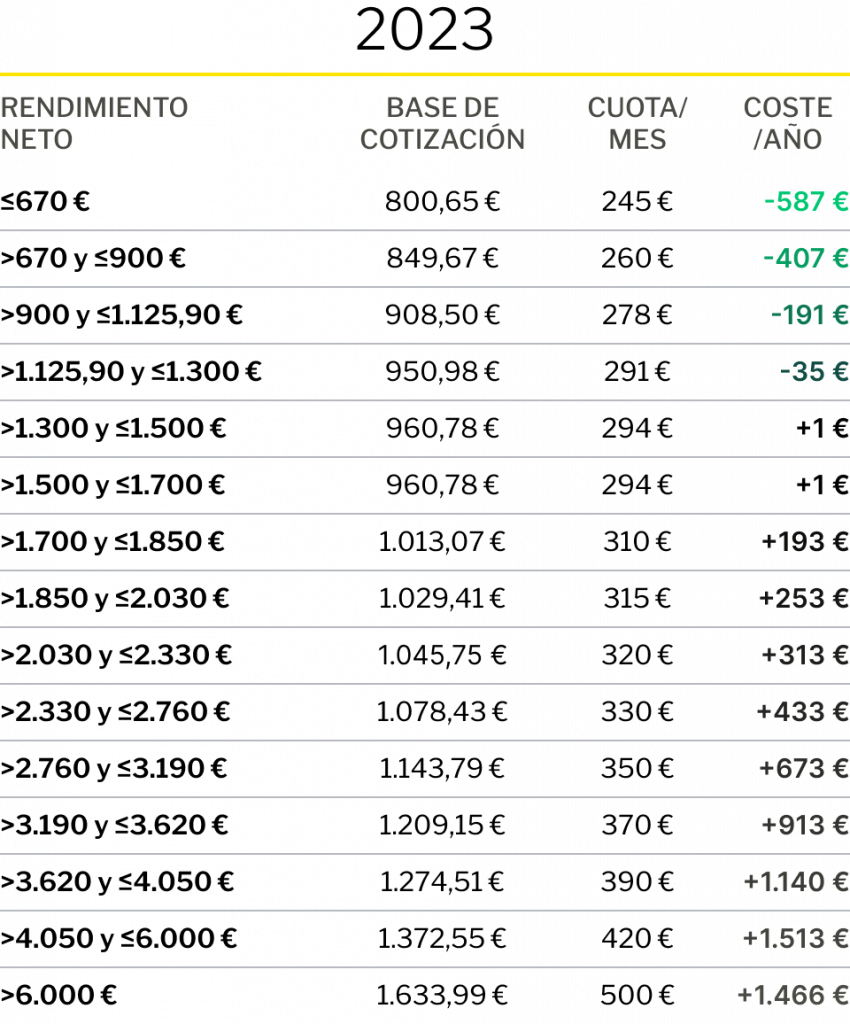

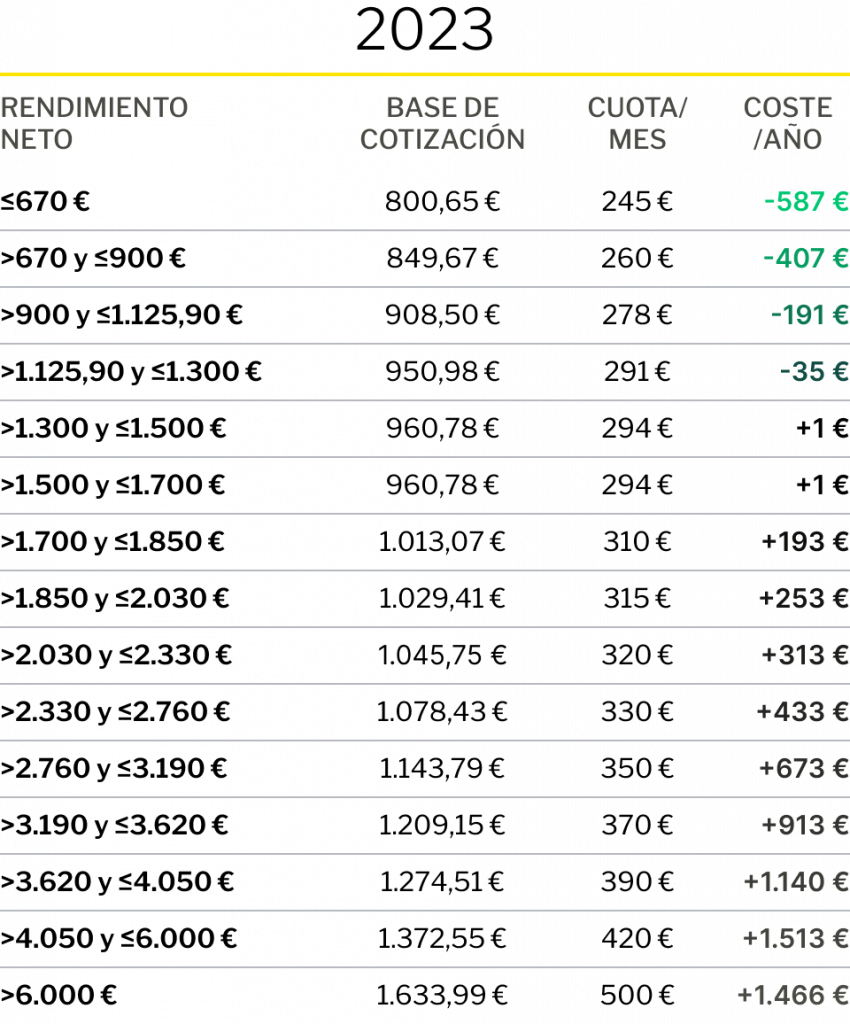

Nuevas Cuotas de Autónomos 2023, 2024 y 2025 AyS

Taxes Advertisement Every person that is self-employed in Spain is required to pay autónomo tax in Spain. The autónomo tax consists of three parts. The income tax, the vat tax, and social security contributions. Both income tax and vat tax are paid with a quarterly and annual tax return. Social security contributions are paid monthly. 1) Apply for a tax rebate (if you overpaid.) OR 2) Make an extra tax payment, if needed. YOUR GLOBAL TAX RATE The variable rates applicable to the taxable amount resulting from all your personal and business matters(after allowances and deductions are computed) can be seen in the tables below. 1. Common contingencies: 28.30%. 2. Professional contingencies: 1.3%. 3. Cessation of activity: 0.9%. 4. Continuous training: 0.1%. The sum of the 4 percentages is equal to the 30.6% that we talked about before, which means a minimum fee for self-employed workers of €294 (€960.60 x 30.6%). Autonomo Tax Calculator Can you just use the same tax calculator for regular income tax and add 300e per month on top of it? If you click the advanced button there are the options to enter deductions, family members, etc https://www.icalculator.info/spain.html 15 20 Share Sort by: Best Add a Comment nnnnebi • 3 yr. ago

Digital TDS Calculator Easy and Accurate Employee Tax Calculations

[GET] "https://admin.expatica.com/es/wp-json/wp/v2/yoast-redirects?origin=/finance/taxes/freelance-tax-spain-471615/":

Failed to fetch Taxes for freelancers in Spain are similar to what regular workers must pay, including income tax, IVA, and social security contributions. Autonomo Tax Calculator - If you are considering becoming self-employed in Spain, surely the first thing you will look for is an autonomo tax calculator. Then this guide is for you! We include here more than 20 different situations to help you calculate an estimate of what you will have to pay in taxes. #Guide: Autonomo Tax Calculator 📑 If you are considering becoming self-employed in Spain, then this guide is for you!We include here more than 20 different situations to help you calculate an. 1. Autonomo spain - tax returns. Autonomos (sole-traders) in Spain must make quarterly and annual income tax and VAT (known as IVA in Spain) returns. This will require the maintenance of records of all bills and invoices, with VAT receipts and payments noted separately. A Spanish accountant will then use this information to fill in the relevant.

Amt Tax Calculator Excel » Veche.info 24

The calculation of the annual amount to be paid is carried out at the beginning of the year and each quarter the entrepreneur pays a percentage of it in advance. In this way, the self-employed person pays the same amount of VAT every quarter regardless of invoicing. Spain's Social Security system has created an online calculator tool that allows you to work out how much you should pay based on your estimated income, plus see the range of different monthly payments you could choose to make based on your contribution base. You can find the calculator here, and The Local has put together a guide on how to use it.

Let's explore the 3 big taxes that any freelancer must pay in the country after becoming an "autónomo": Income tax or IRPF ("Impuesto de la Renta de las Personas Físicas") Provided that you are a freelancer in Spain who spends more than 183 days per year in the country, you will become what is called a tax resident. INCOME TAX CALCULATOR UPDATED 2023 CLICK HERE TO REGISTER INCOME TAX FOR SPANISH RESIDENTS INCOME TAX FOR NON SPANISH RESIDENTS HOW IT WORKS 1.- READ THE TAX INFORMATION RELATED TO BOTH TAXES (FOR RESIDENTS/NON RESIDENTS) You will find plenty of information about Income Tax for Residents and not Residents in this site.

Tax Calculator New Regime 2023 24 Excel Printable Forms Free Online

In Entre Trámites you can find several calculators that will allow you to easily estimate the information you want to obtain, such as your net self-employed salary, the income tax you must pay or other taxes that apply to you. Easy to use (with built-in explanation) With up-to-date information. With a wide variety of options depending on your. An online calculator to compare the tax burden of self employed people in the UK and Spain. IMPORTANT! This was created in 2014. You are able to edit the rates in the fields below yourself to reflect the current tax laws if you wish, but I make no guarantees that any of the calculations or advice below is still relevant.