4,688.68 Jan 4, 5:39:30 PM GMT-5 · INDEXSP · Disclaimer Dow Jones Industrial Average 37,440.34 .DJI0.027% Nasdaq Composite 14,510.30 .IXIC0.56% Russell 2000 Index 1,957.73 RUT0.075% FTSE 100 Index. Screeners Personal Finance Crypto Sectors U.S. markets closed S&P Futures 4,835.25 +3.00(+0.06%) Dow Futures 38,052.00 +23.00(+0.06%) Nasdaq Futures 17,107.00 +16.50(+0.10%) Russell 2000.

Diseño del logotipo de la letra s y p, colores degradados coloridos syp con estilo masculino

Russell 2000 2,027.07 -31.27(-1.52%) Crude Oil 72.29 +0.64(+0.89%) Gold 2,074.30 +2.50(+0.12%) Advertisement SPDR S&P 500 ETF Trust (SPY) NYSEArca - Nasdaq Real Time Price. Currency in USD Follow. Get historical data for the S&P 500 (^GSPC) on Yahoo Finance. View and download daily, weekly or monthly data to help your investment decisions. S&P 500 INDEX TODAY | INX LIVE TICKER | S&P 500 QUOTE & CHART | Markets Insider Markets Stocks Indices Commodities Cryptocurrencies Currencies ETFs News Home S&P 500 S&P. S&P 500 is at a current level of 4769.83, up from 4567.80 last month and up from 3839.50 one year ago. This is a change of 4.42% from last month and 24.23% from one year ago. Report: S&P 500 Returns: Category: Market Indices and Statistics Region: United States: Source: Standard and Poor's: Stats. Last Value: 4769.83: Latest Period.

Lectura y Dictado Letra S y P PDF

1 Day SPX 0.18% DJIA 0.07% Nasdaq 0.09% Overview News From WSJ SPX 4 hours ago Can Charlie Munger's Investing Playbook Still Work? Even He Wasn't So Sure 12 hours ago The Score: Tesla, Xerox,. SPY is the ticker symbol for the SPDR® S&P 500® ETF, an exchange traded fund that tracks the performance of the S&P 500® Index. SPY, managed State Street Global Advisors, aims to replicate the performance of the S&P 500® Index as closely as possible by investing in the same stocks that are included in the index in the same weightings. ETF. France. PE500. The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and covers approximately 80% of available market capitalization. Research - Jan 11, 2023. Education. We measure growth stocks using three factors: sales growth, the ratio of earnings change to price, and momentum. S&P Style Indices divide the complete market capitalization of each parent index into growth and value segments. Constituents are drawn from the S&P 500®.

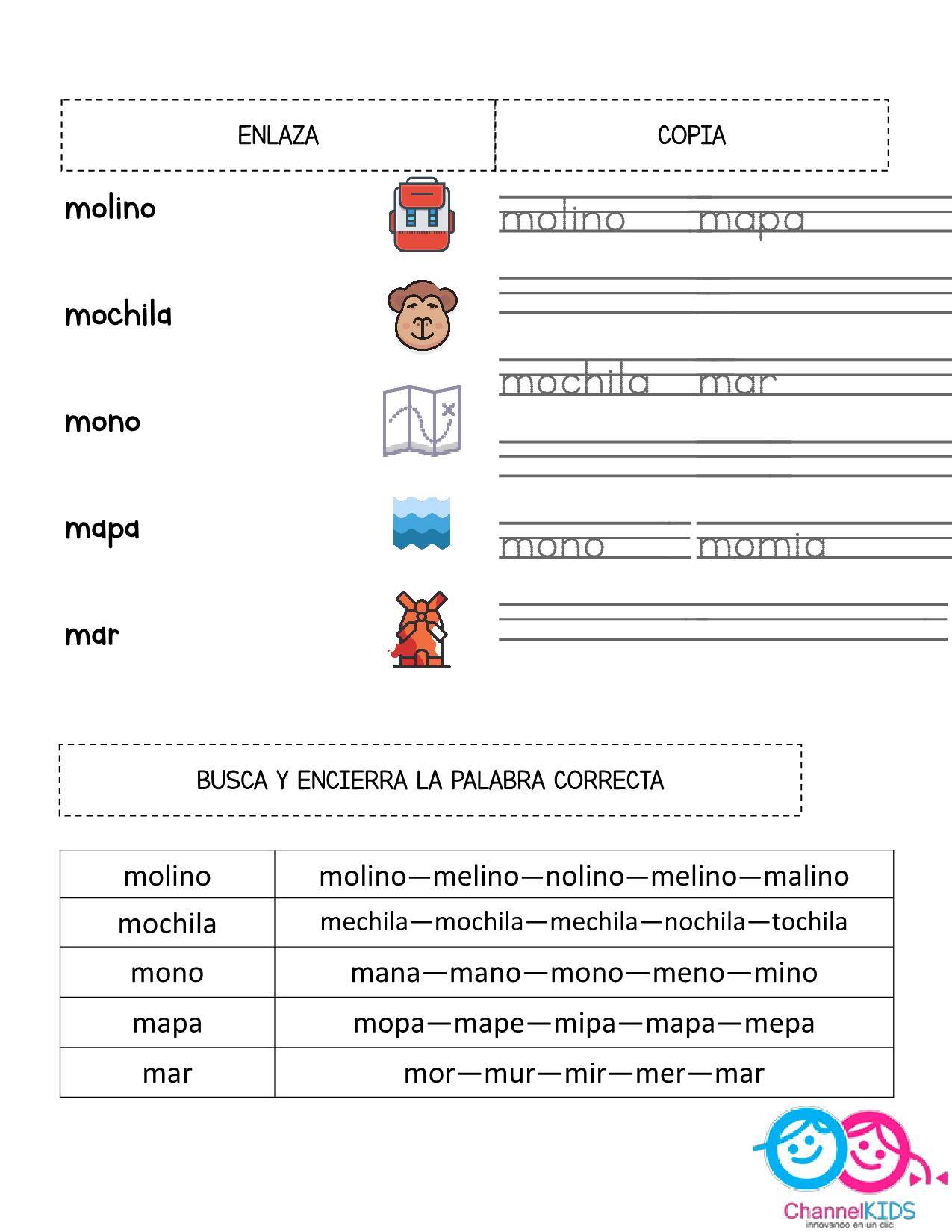

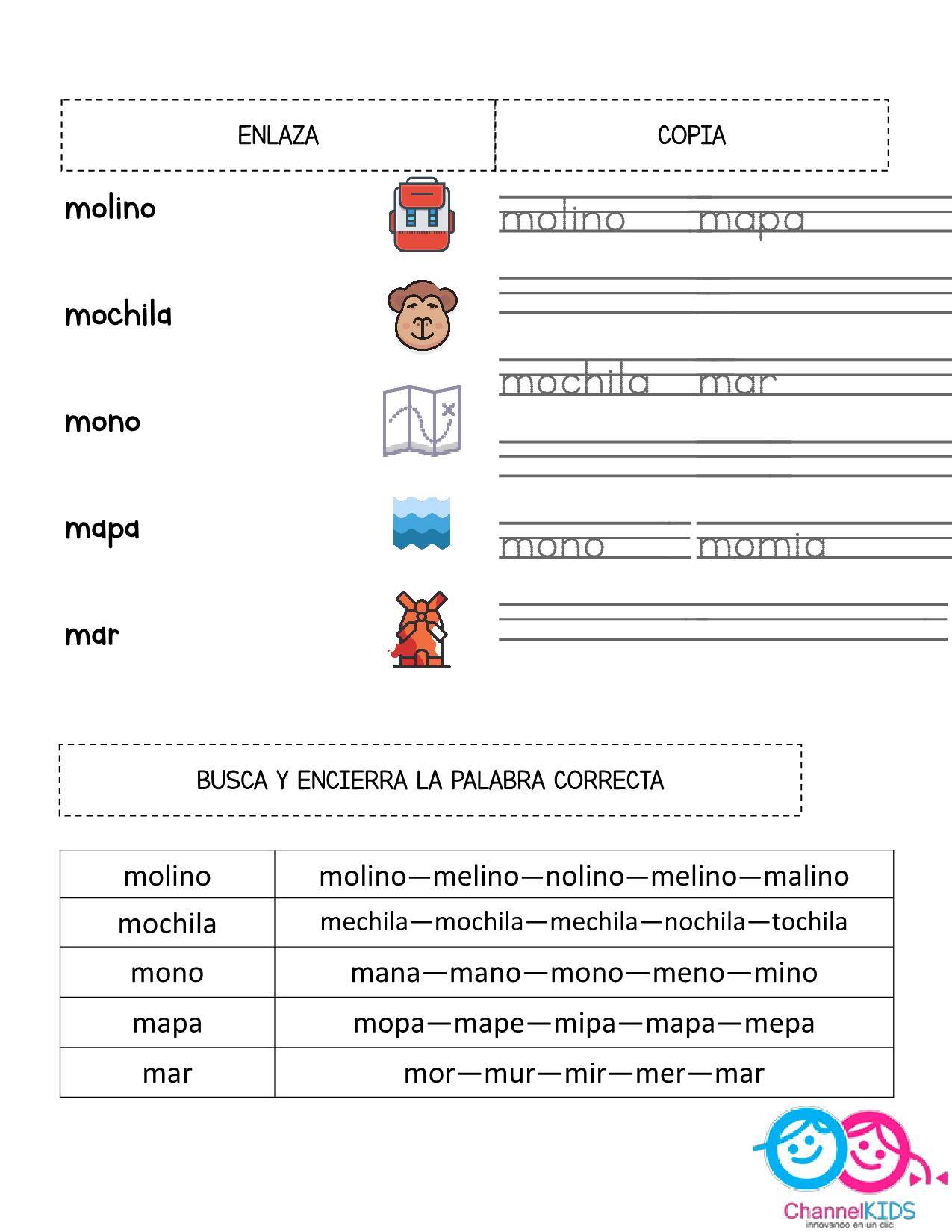

FONEMAS MSPL (2) Imagenes Educativas

Home SPY • NYSEARCA SPDR S&P 500 ETF Trust Follow Share $467.28 Pre-market: $466.55 (0.16%) -0.73 Closed: Jan 5, 4:16:48 AM GMT-5 · USD · NYSEARCA · Disclaimer search Compare to Invesco QQQ. Standard & Poor's - S&P: Standard & Poor's (S&P) is the world's leading index provider and the foremost source of independent credit ratings. Standard & Poor's has been providing financial market.

S&P Global Ratings Ratings360® Información para actuar Ratings360® ofrece a emisores calificados una visión holística de la historia crediticia de su organización en una única plataforma personalizada. S&P Global Ratings Preguntas Frecuentes: ¿Cómo afectará el nuevo memorando de entendimiento a las empresas mineras chilenas SQM y Codelco? 2015. $3.84. 2014. $3.35. SPY | A complete SPDR S&P 500 ETF Trust exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing.

Fonemas con la m,p y s de forma didáctica YouTube

Data Details. S&P 500 YTD return as of the most recent market close. Includes the total return as well as the price only return. The 2024 price return is calculated using the price change from the latest market close to the last trading day of 2023. Return calculated as of the market close on 2024-01-03. Basic Info. The S&P 500 index covers the 500 largest companies that are in the United States. These companies can vary across various sectors. The S&P 500 is one of the most important indices in the world as it widely tracks how the United States stock market is performing. The S&P 500 has had several major drawdowns that have been greater than.