24/5 Support From CMC Markets, A Market Leading Provider. Enjoy tight spreads, lightning-fast execution and 24/5 client support. Get the $30 forex welcome no deposit bonus from HotForex. Best forex brokers for Indonesian clients: get all latest reviews,

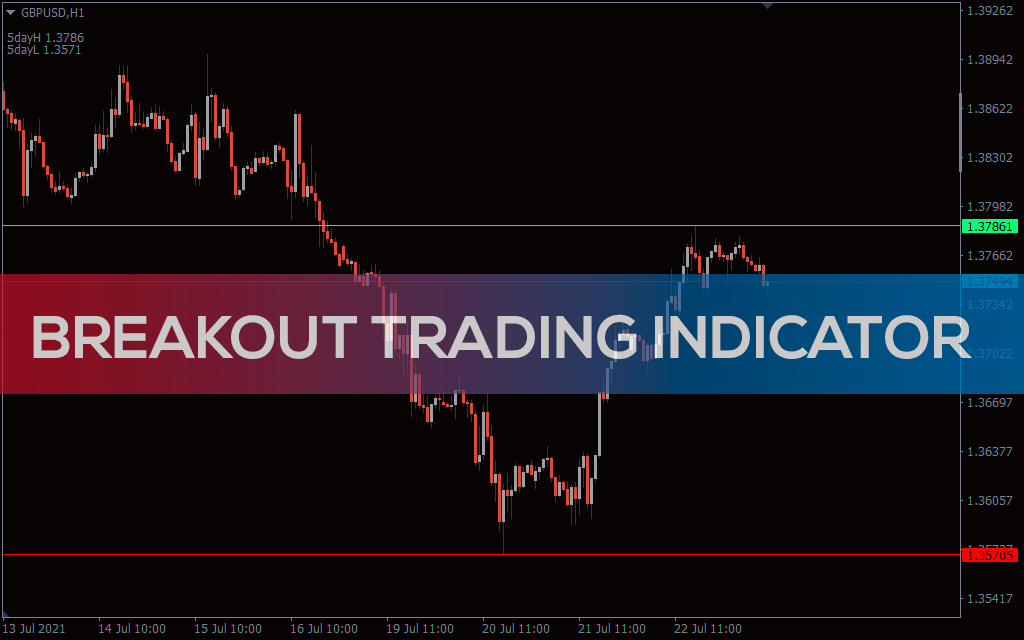

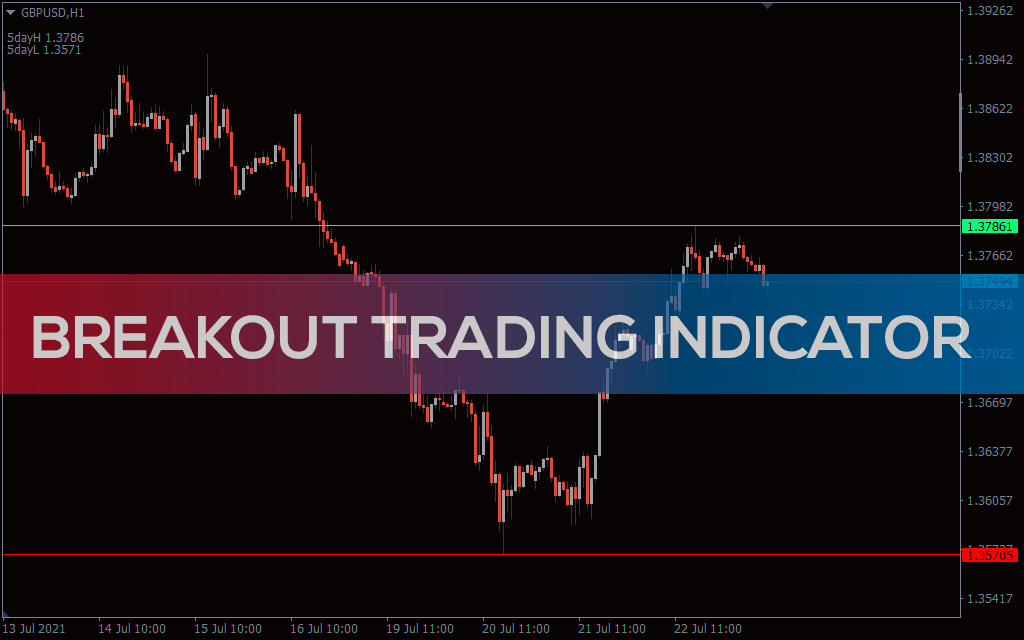

Breakout Trading Indicator for MT4 Download FREE IndicatorsPot

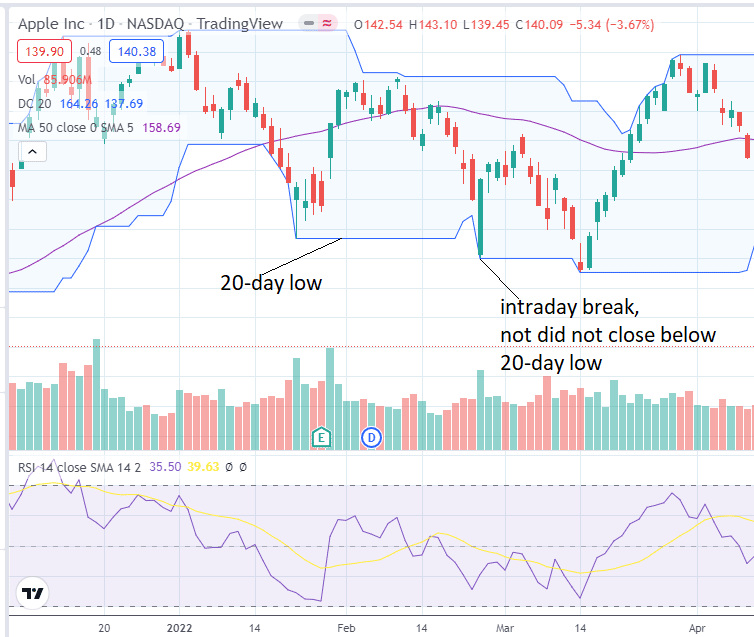

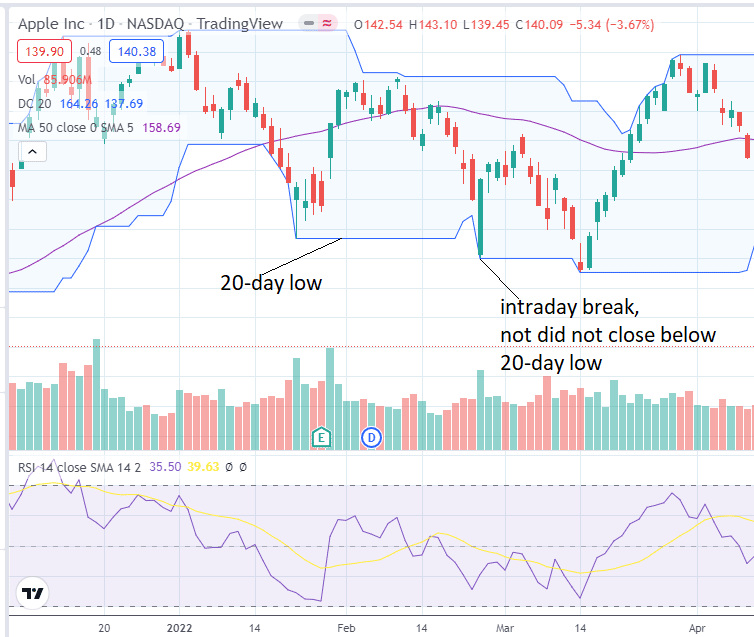

Breakout trading indicator There are three main approaches to tackling breakouts in the market. First, you can use some chart patterns to predict the direction of a breakout. Some of the most popular chart patterns to trade breakouts are: Ascending and descending triangles Step #1: Identify a Clear Price Range or a "V" Shape Swing High and Mark That Price Level on the Chart. Step #2: Wait for a Break and a Close above the Resistance Level. Step #3: Buy at the Breakout Candle Closing Price Only If the VWMA Is Stretching Up. The breakout trading strategy involves buying or selling an asset when the market breaks above or below out of a trading range. There are primarily two types of breakouts that traders commonly encounter: Continuation Breakouts and Reversal Breakouts. One way to do this is by using breakout indicators, which can help identify potential price breakouts and trends before they happen. There are several different types of breakout indicators that traders can utilise to enhance their trading strategies. One popular type of breakout indicator is Bollinger Bands.

Breakout Indicator Forex Trading Australia Proprietary Trading Learn to trade Forex

Forex Indicators Breakout Trading Indicators Breakout Trading Indicators Author: The Forex Geek | Published: March 3, 2023 Table of Contents What is the Breakout Trading Indicators? A breakout is a potential trading opportunity that occurs when an asset's price moves above a resistance level or moves below a support level on increasing volume. The first step in trading. The goal of breakout trading is to be able to recognize a good setup and ride a stock's momentum as it begins to break above resistance and set new highs. There are many different indicators that can point to a good potential breakout setup. Here's a perfect example of what a breakout trade might look like. Breakouts provide possible trading opportunities. A breakout to the upside signals traders to possible get long or cover short positions.. Technical Indicator: Definition, Analyst Uses, Types.

Trading Breakouts within Price Action & Multiple Indicators

A breakout strategy aims to enter a trade as soon as the price manages to break out of its range. Traders are looking for strong momentum and the actual breakout is the signal to enter the position a nd profit fro m the market movement that follows. Traders may enter the positions in the market, which means they will have to closely monitor the. A breakout trader looks for price, a technical indicator, or a data point to move beyond a support or resistance level. A breakout trader can use price, a technical indicator, or.

Breakout Trading Indicator MT4 4 customer review Best breakout trading indicator for MetaTrader 4 users. Determines daily, weekly, and monthly price breakout levels. Ideal for forex and stocks. Categories: MT4, Levels, Informational Download Size: 16.51 KB Type: .zip Updated on: 13.12.2023 Recommended Brokers for Breakout Trading Indicator. The indicator offers a large variety of features :. 1241 39 Targets For Many Indicators [LuxAlgo] LuxAlgo Nov 30, 2023 The Targets For Many Indicators is a useful utility tool able to display targets for many built-in indicators as well as external indicators.

breakout trading indicators Options Trading IQ

Trade The Breakout. Our breakout indicator looks for a specific price pattern to occur and pinpoints the precise time to take the breakout trade. The breakout indicator will draw a channel around the breakout signal box. Created by our Senior Traders, this indicator is the product of countless years of research and development. Breakout Signals. Breakout signals are signals that are sent directly to your phone. In this way, the user does not need any indicators and can rely upon the signals instead. Common breakout signals are identifying liquidity. Liquidity is needed in order for price to break through a resistance and support level; therefore, our liquidity signals.