Create a list of personal details you'd want on file with the employee's information. For instance, request full name, address, phone number and email address. 2. Educational background. Create a section that captures the employee's educational background, including the highest degree or diploma they've earned and their major. 3. Form W-2 (Wage and Tax Statement) You will also need to fill out Form W-2 and file it with the SSA. To complete this form, you'll need your new employee's Social Security number. If your.

Employee Information Printable Form New Hire Sheet Digital Etsy

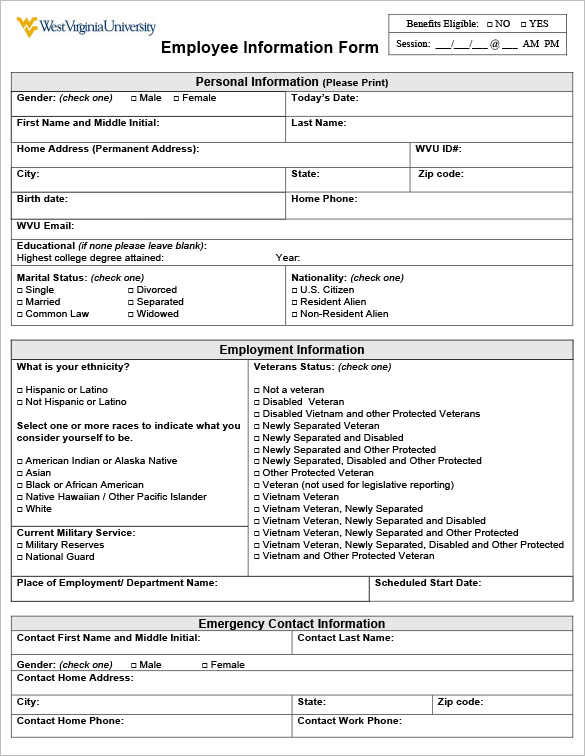

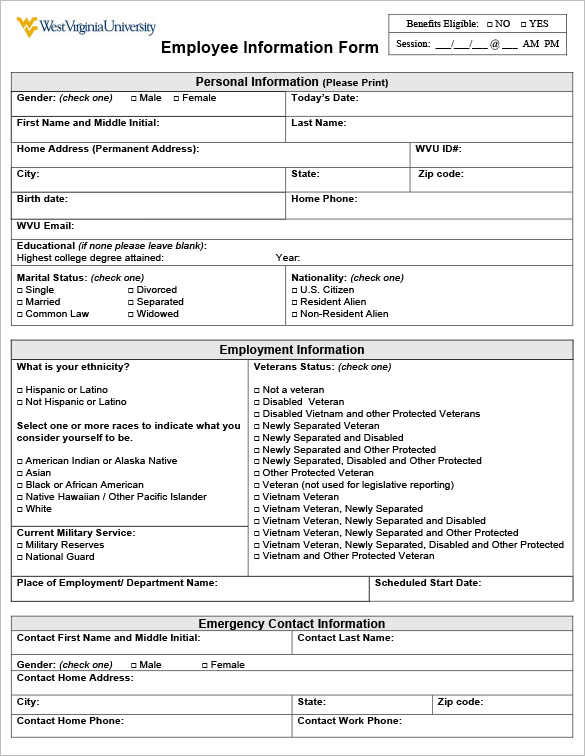

A standard employee information form includes the following sections: 1. Employee information. In this section, an employee provides personal data, such as their full name, address, phone numbers, e-mail address, birth date, marital status, Social Security number and the contact details of their spouse or partner. 2. Benefits information; New hire questionnaire; Federal and state forms. There are a few new hire forms that all U.S. employers need to have their employees fill out at the start of their onboarding process. Form I-9 . The Form I-9 verifies a new employee's identity and their eligibility to work in the United States. New employee forms are documents that the new hire must fill out before employment. These documents are meant to track the employee's hire date, tax information and compensation package details. Some industries may also have specific, industry-exclusive new hire paperwork such as a nondisclosure agreement or a noncompete contract. Employee information forms provide key data on employees that can be used to keep track of who worked for the company, when, and in what positions. It can also be used as an emergency contact information form in the event of any serious workplace injury. Having employees fill out a new hire information form should definitely be an item on your.

Printable Employee Information Form 20202022 Fill and Sign Printable Template Online US

Ask all new employees to give you a signed Form W-4 when they start work. Make the form effective with the first wage payment. If employees claim exemption from income tax withholding, then they must indicate this on their W-4. The amount of income tax withholding must be based on filing status and withholding adjustments as indicated on the form. A new employee information form collects vital new hire data that you need to have on file. Your form should include some basic information, like the new hire's name, contact information, and emergency contact details, as well as some pertinent employment-related details, like their role, hire date, and pay rate. Learn what you need to include in an employee information form and how you can create one for your own employees. Use the template to guide the process.. We rounded up several tips and put together an example new hire email to help you craft the perfect warm welcome for your company's newest team member. Job Offer Letter (With 6 Templates). New employee form tips. Here is a list of tips to review before you create new employee forms: Make sure the employee signs all applicable forms. In addition to confirming information is accurate, employees must sign forms to make their agreements official in addition to confirming their information is accurate.

New Hire Form Template charlotte clergy coalition

Employee Information Form. Please fill out all required fields below. You must also complete these additional forms: I-9, Federal W-4 and State W-4. 1. The Fair Labor Standards Act (FLSA) The FLSA establishes minimum wage, overtime pay, and other employment standards affecting employees in the private sector and in federal, state, and local governments.To ensure compliance, employers must maintain accurate records of employees' work hours, pay rates, and other related data. While the employee information form might not record daily hours.

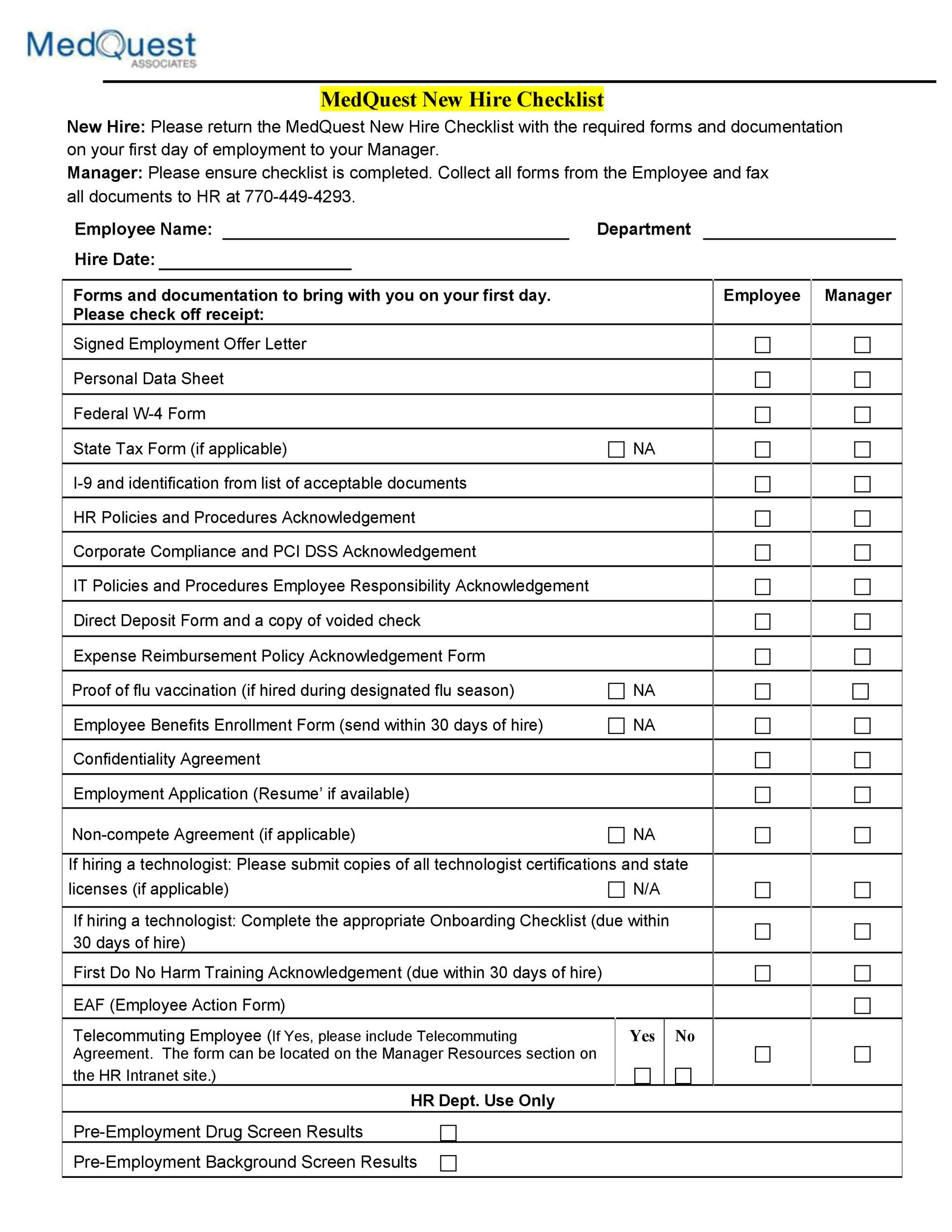

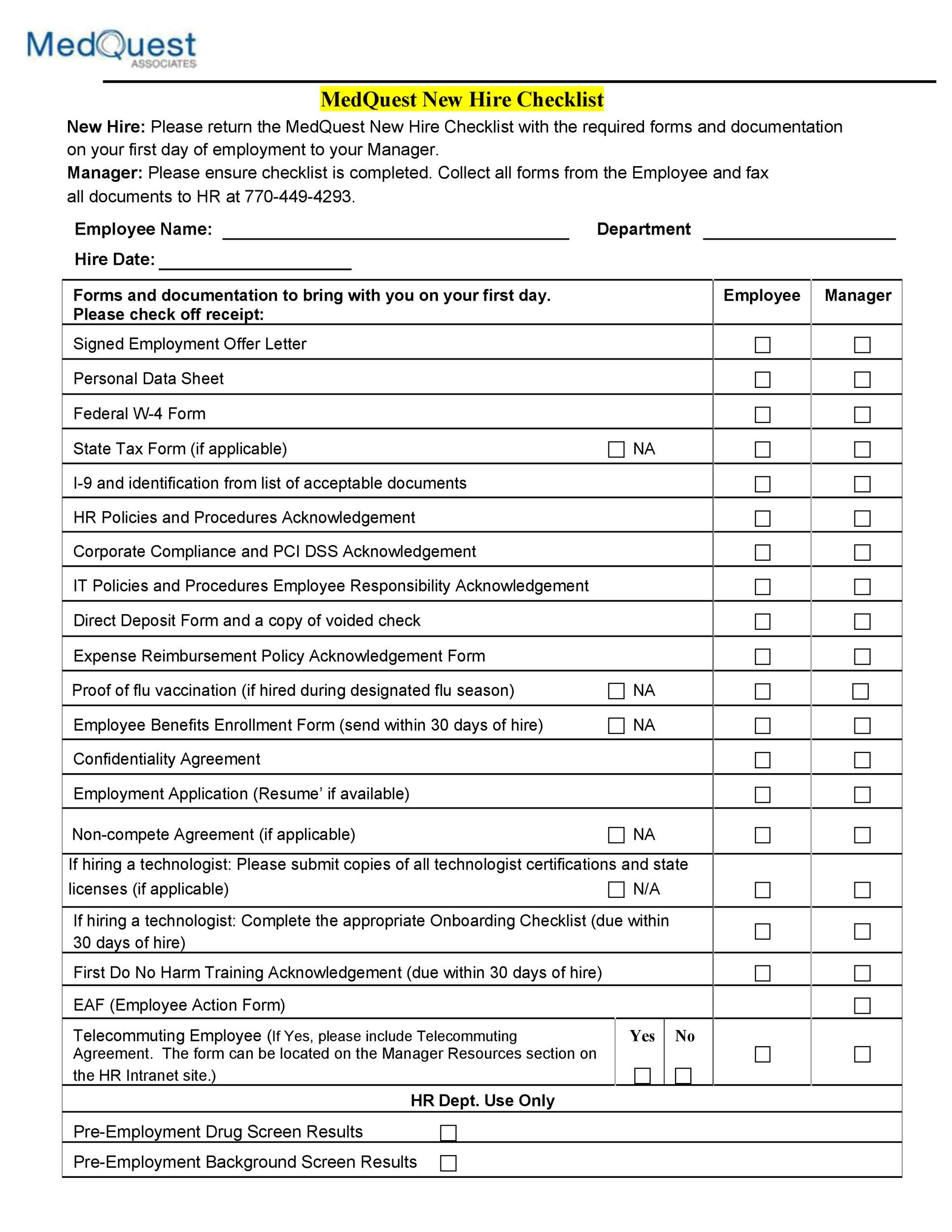

New hire forms are essential for several reasons: Legal Compliance: Certain forms like Form I-9 and Form W-4 are required by law. Form I-9 verifies an employee's eligibility to work in the United States, while Form W-4 is used to determine the amount of federal income tax to withhold from an employee's paycheck. Cloned 155. The New Hire Information Form is a hiring form used by businesses and employers to collect and store information and data about prospective employees. It is used for new employee onboarding and includes sections for employee contact information, employee authentication information, and employee information.

Printable New Hire Checklist Template Printable Templates

Additional Forms: 1. Signed offer letter. Although this isn't a form in the traditional sense, having a signed offer letter should be part of your new hire checklist. It states that the employee has officially accepted the job, and understands what this entails. For most people giving their signature means they're committed, which helps you. SF-144. Statement of Prior Federal Service. * Employee Address Form (for Bureau of Labor Statistics new employees only) W-4. Federal Withholding Form. * State Tax Withholding Forms. FMS-2231. * Fast Start Direct Deposit. SF-256.