1) Create & Sign Balance Sheets In One Place. 2) Export & Print - 100% Free! 1) Create Your Custom Balance Sheet Instantly. 2) Customizable - Start By 2/15!

Accounting for Startups The Complete Guide Tide Business

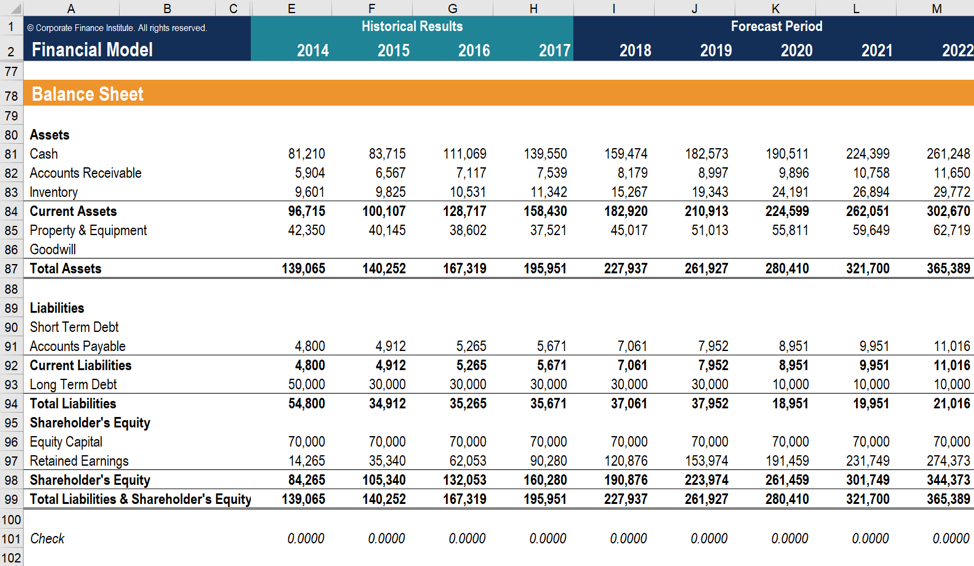

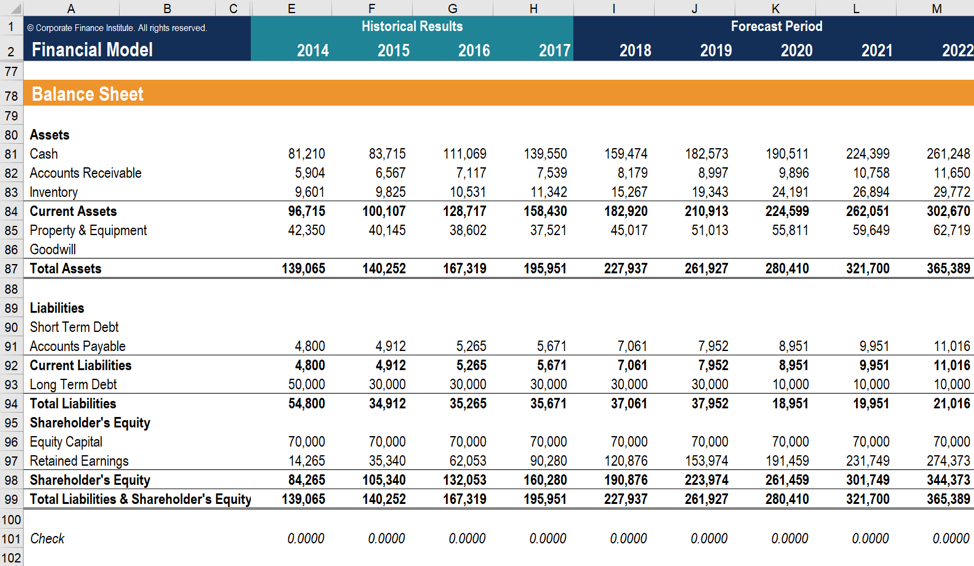

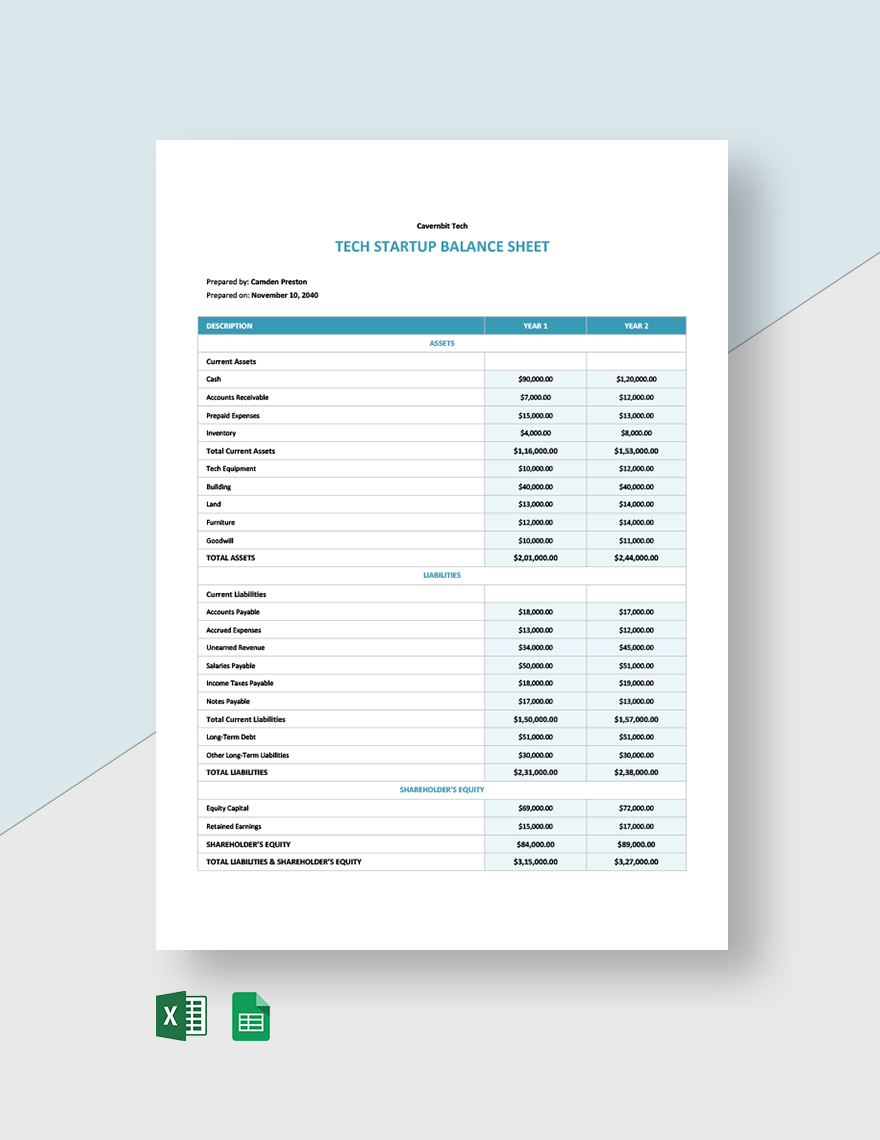

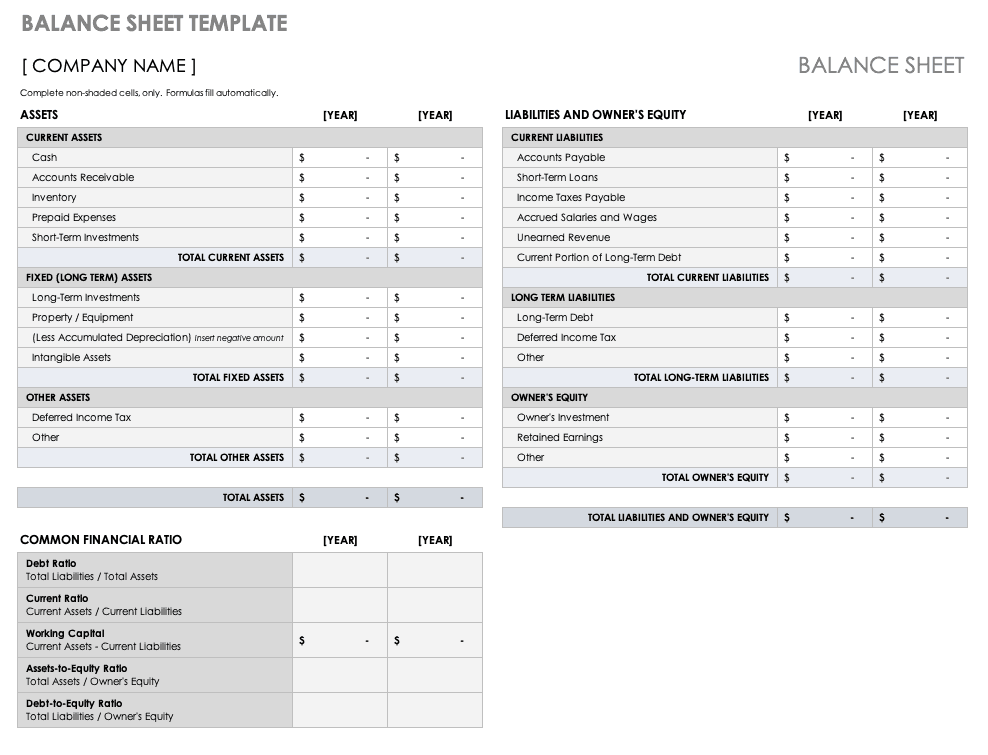

A startup balance sheet or projected balance sheet is a financial statement highlighting a business startup's assets, liabilities, and owners' equity. In other words, a balance sheet shows what a business owns, the amount that it owes, and the amount that the business owner may claim. A balance sheet is a summary of your startup's assets, liabilities, and equity to convey your company's financial position. Companies are required to create three financial reports quarterly and annually: the balance sheet, profit and loss (P&L) statement, and a cash flow statement. The totals must balance. The accounting equation format is the basis for the layout of a balance sheet: Assets = Liabilities + Owner's Equity. This is referred to as the accounting equation. A profit and loss statement, sometimes called an income statement, shows the sales and profit activity in a business over time. Building a Balance Sheet for a Startup Peter Lynch Exercises can help provide context for abstract concepts. In this post and the associated YouTube Short we are going to explore the balance sheet by walking through a simple example for a startup.

Startup Financial Modeling, Part 4 The Balance Sheet, Cash Flow, and Unit Economics

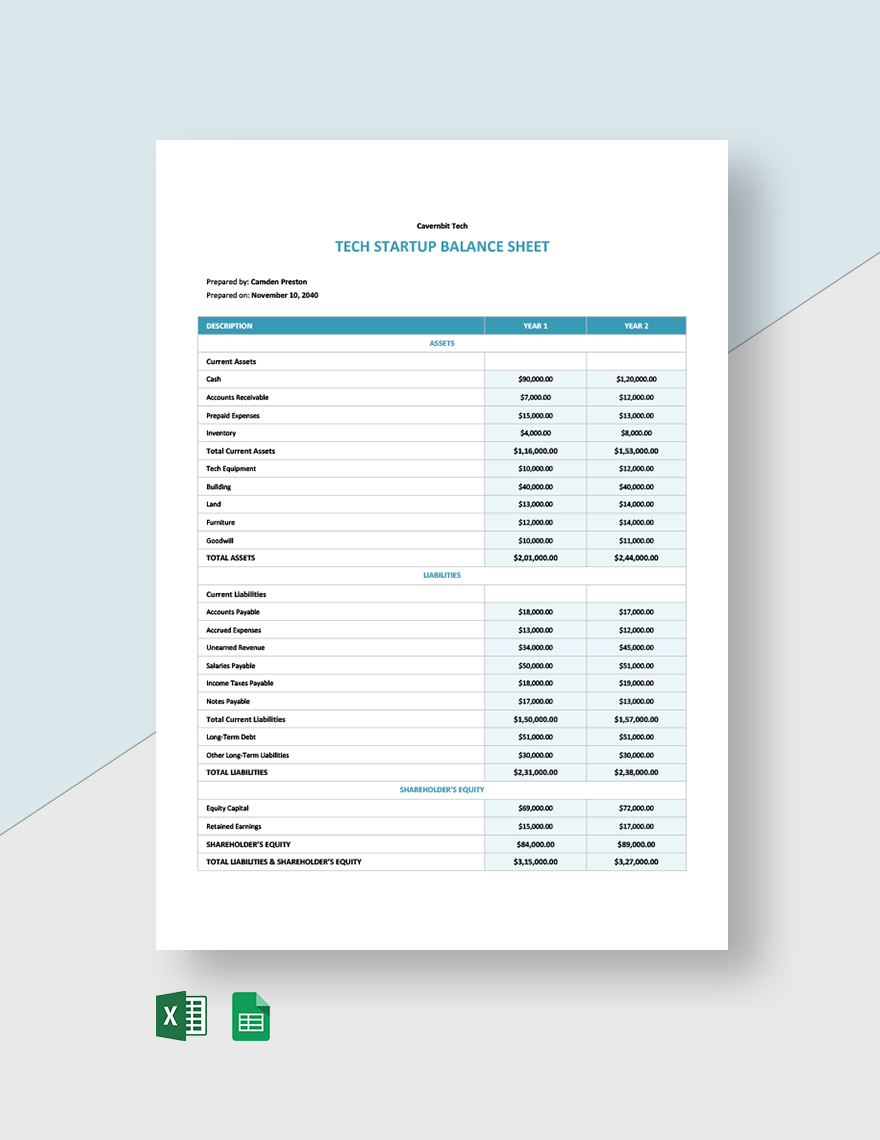

What is a startup balance sheet? A startup balance sheet could mean different things to different people depending on the context. For example, some companies might be considered a startup for years after launching the business in which case a startup balance sheet might just mean a balance sheet for an early stage business. In this video, Adam uses a free template and demonstrates how to make a balance sheet for a new startup or an opening balance sheet for your new business. Ou. It includes a balance sheet, income statement, cash flow statement, and break-even analysis. Get the template A startup financial statement contains financial documents you'll need to put together when you're trying to secure funds from lenders. A balance sheet is a financial statement that highlights what a startup business owes and owns as assets and liabilities. Apart from this, the balance sheet shows the startup owner's equity, which represents the total assets of a business that owners can claim. Components of A Balance Sheet Here are the three main components of a balance sheet:

Free Tech Startup Balance Sheet Template Download in Word, Google Docs, Excel, Google Sheets

The balance sheet is designed to give you a quick look at your company's assets, liabilities, and equity situation (past, present, and forecasted). Remember that the balance sheet is as of a certain date, meaning you need to pull the information pertaining to that date. Using the wrong data can lead to a balance sheet that does not balance. Most startups will pull the balance sheet monthly, quarterly, and annually, easiest if you have an accounting software (like Quickbooks or Xero.

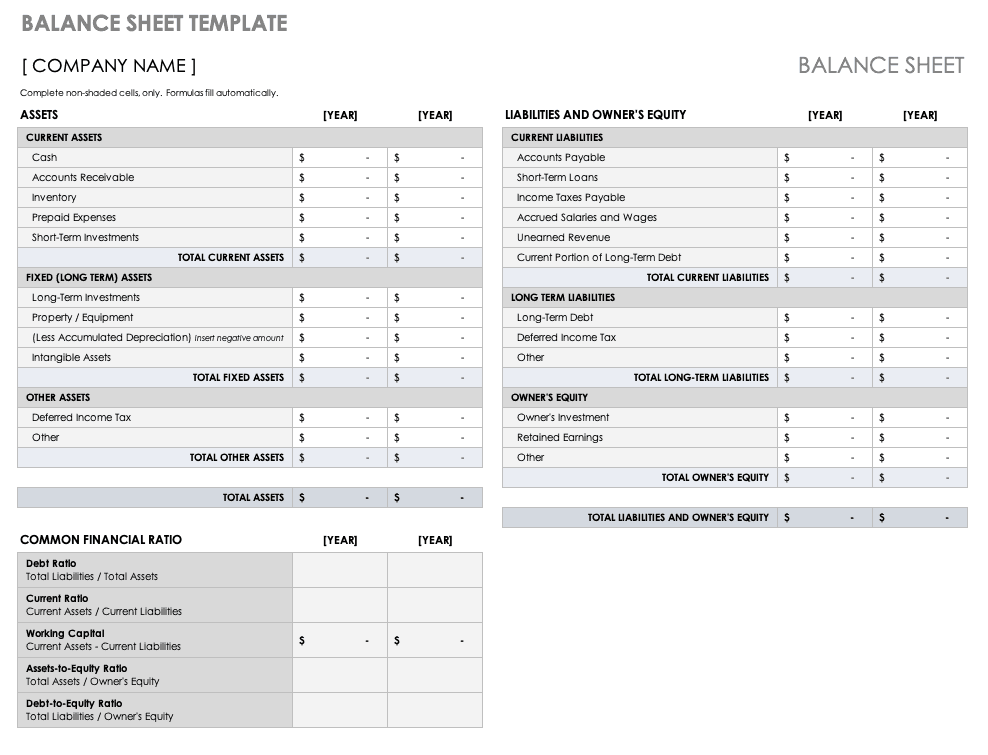

First, work on your startup budget and your startup costs worksheet. You'll need to do a lot of estimating. Note The trick is to underestimate income and overestimate expenses, so you can create a more realistic picture of your business over the first year or two. Then work on a profit and loss statement for the first year. Subtract the amount of liability from the amount of total assets to determine the net worth of the business. Balance sheets show the amount of debt, assets and net worth of a business. Initial, or.

Free Startup Plan, Budget & Cost Templates Smartsheet

Free Small Business Balance Sheet Templates Try Smartsheet for Free By Andy Marker | March 9, 2022 (updated April 28, 2023) We've compiled a collection of the most helpful free small business balance sheet templates for small business owners, accountants, and other stakeholders. A balance sheet is the real indicator of your startup's financial position, it tells a story on what your startup owns and owes. In this article, we will cover how to read a balance sheet, and use it as the tool to tighten up your startup operations.