BEARISH Tweezer Tops Bearish two candle reversal pattern that forms in an up trend. Evening Star Bearish three candle reversal pattern that forms in an up trend. BULLISH Hammer Bullish single candle reversal pattern that forms in a down trend Inverted Hammer Bullish single candle reversal pattern that forms in a down trend. BULLISH For example, chart patterns can be bullish or bearish or indicate a trend reversal, continuation, or ranging mode. And whether you are a beginner or advanced trader, you clearly want to have a PDF to get a view of all the chart patterns you want and need to use.

Bullish And Bearish Candlestick Charts Candle Stick Trading Pattern

provide an early indication of a reversal from a bullish to a bearish trend, typically with an opening price at or a gap above the close of the previous candle (a gap indicates space between the body of the previous candle and the open of the consequent candle). The pattern represents a potential top, and therefore a potential signal to sell. 10 Most Essential Advanced Chart patterns Final Word Advanced Cheat Sheet Candlestick Patterns Download (PDF File) Below, you can download for free our advanced cheat sheet candlestick patterns categorized into advanced bullish bearish candlestick patterns: Advanced Cheat Sheet Candlestick Patterns PDF [Download] Bullish pattern is confirmed when price crosses above its moving average. Wedges. Bullish or Bearish: A Continuation Wedge . consists of two converging trend lines. Like a Triangle, but its apex slants downwards at an angle. As it forms over time, volume diminishes and trend appears downward, but long-term range is still upward. Bullish pattern is A doji represents an equilibrium between supply and demand, a tug of war that neither the bulls nor bears are winning. In the case of an uptrend, the bulls have by definition won previous battles because prices have moved higher. Now, the outcome of the latest skirmish is in doubt. After a long downtrend, the opposite is true.

Candlestick Pattern Cheat Sheet Pdf Download Cheat Sheet

A 1-candle pattern. It can signal an end of the bearish trend, a bottom or a support level. The candle has a long lower shadow, which should be at least twice the length of the real body. The color of the hammer doesn't matter, though if it's bullish, the signal is stronger. Hammers occur frequently and are easy to recognize. Download Bullish Candlestick Patterns Cheat Sheet in PDF. Learning to identify and interpret bullish and bearish candlestick patterns is an invaluable skill for traders. That's why we've created a simple one-page cheat sheet summarizing the major bullish candlestick patterns cheat sheet. Keep it by your computer while analyzing charts so you. We will focus on five bullish candlestick patterns that give the strongest reversal signal. 1. The Hammer or the Inverted Hammer. The Hammer is a bullish reversal pattern, which signals that a. What are Chart Patterns Classic Chart Patterns Double Tops Double Bottoms Head and Shoulders Pattern Forex Chart Patterns Bullish Flags Bearish Flags Symmetrical Triangle Stock Chart Patterns Rectangle Patterns Channel Patterns Chart Patterns Cheat Sheet Most Profitable Chart Patterns Lastly What are Chart Patterns

Bullish and bearish belt hold candlestick patterns explained on E

Japanese candlestick patterns are the modern-day version of reading stock charts. Bar charts and line charts have become antiquated. Candlesticks have become a much easier way to read price action, and the patterns they form tell a very powerful story when trading. Japanese candlestick charting techniques are the absolute foundation of trading. The bullish breakaway pattern is usually formed at the end of a bearish move. This pattern is a trend reversal and translates into a bullish trend. However, there is a chance that the trend might not reverse quickly, and ideally, the trader should wait till a larger green candle appears to confirm this pattern.

Jun 10, 2021 Written by: John McDowell Recently, we discussed the general history of candlesticks and their patterns in a prior post. We also have a great tutorial on the most reliable bullish patterns. But for today, we're going to dig deeper, and more practical, explaining 8 bearish candlestick patterns every day trader should know. The Evening star pattern is a bearish reversal candlestick pattern. When the evening star candlestick pattern forms an uptrend, it signals that the trend will change. The evening star candlestick consists of 3 candles. The first is a bullish candle, the second is doji, and the third is a bearish candle representing the seller's power.

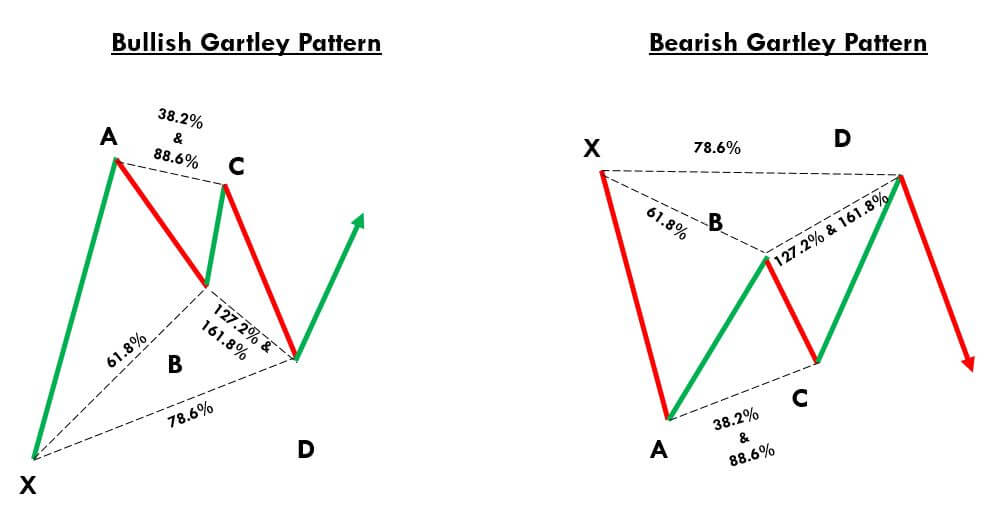

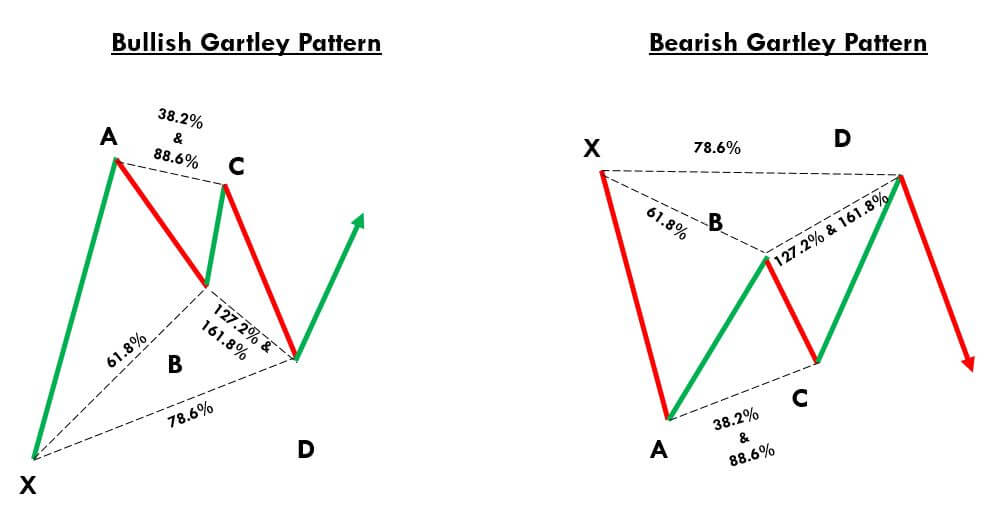

Identifying & Trading The Bullish & Bearish Gartley Pattern Forex Academy

List of top 19 chart patterns There are several repetitive chart patterns in the technical analysis, but here I will explain only the top 24 chart patterns. These patterns have a high winning probability. Double top The double top is a bearish reversal chart pattern that shows the formation of two price tops at the resistance level. Bullish Engulfing: The bullish engulfing pattern forms when a green candle completely engulfs a bearish candle. More clearly, in this pattern, the green candle (bullish candle) completely covers or, we can say, engulfs the red candle (bearish candle). Hammer: The hammer candle is a single candlestick pattern.