The Hanging Man occurs when two criteria are present: an asset has been in an uptrend, and the candle has a small body and a long lower shadow. Understanding the Hanging Man The Hanging Man is. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. Hammer The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend.

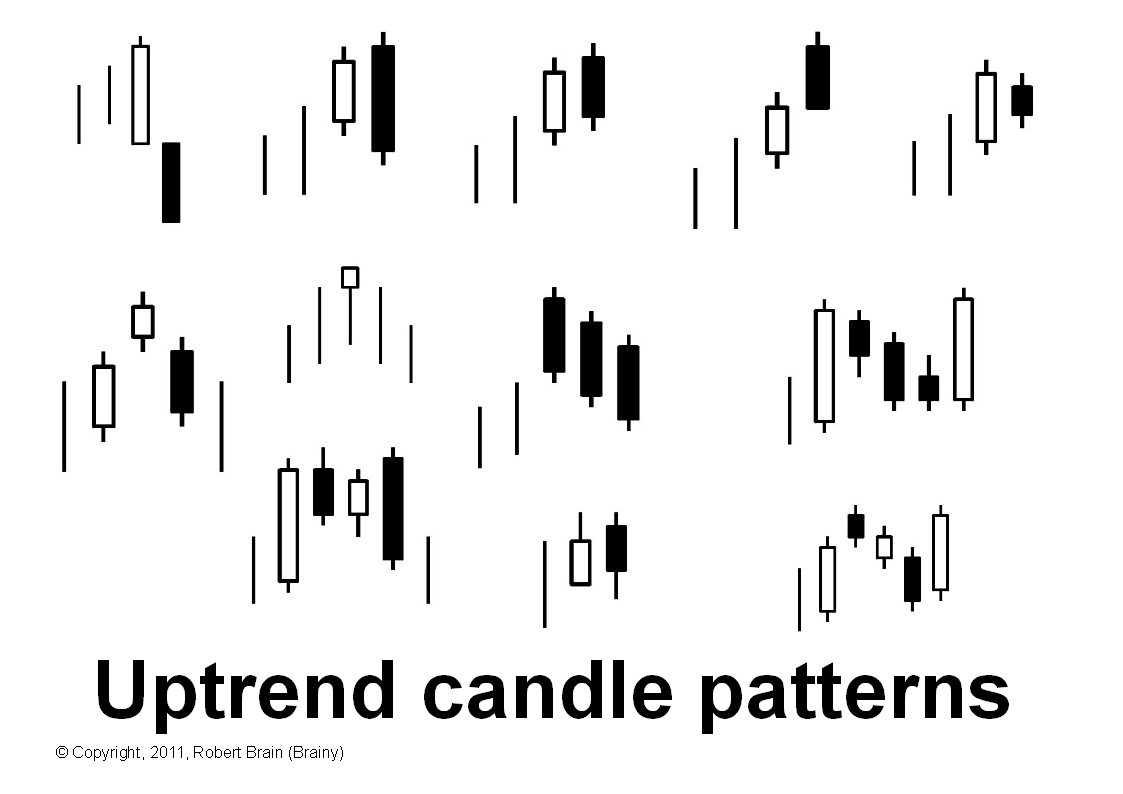

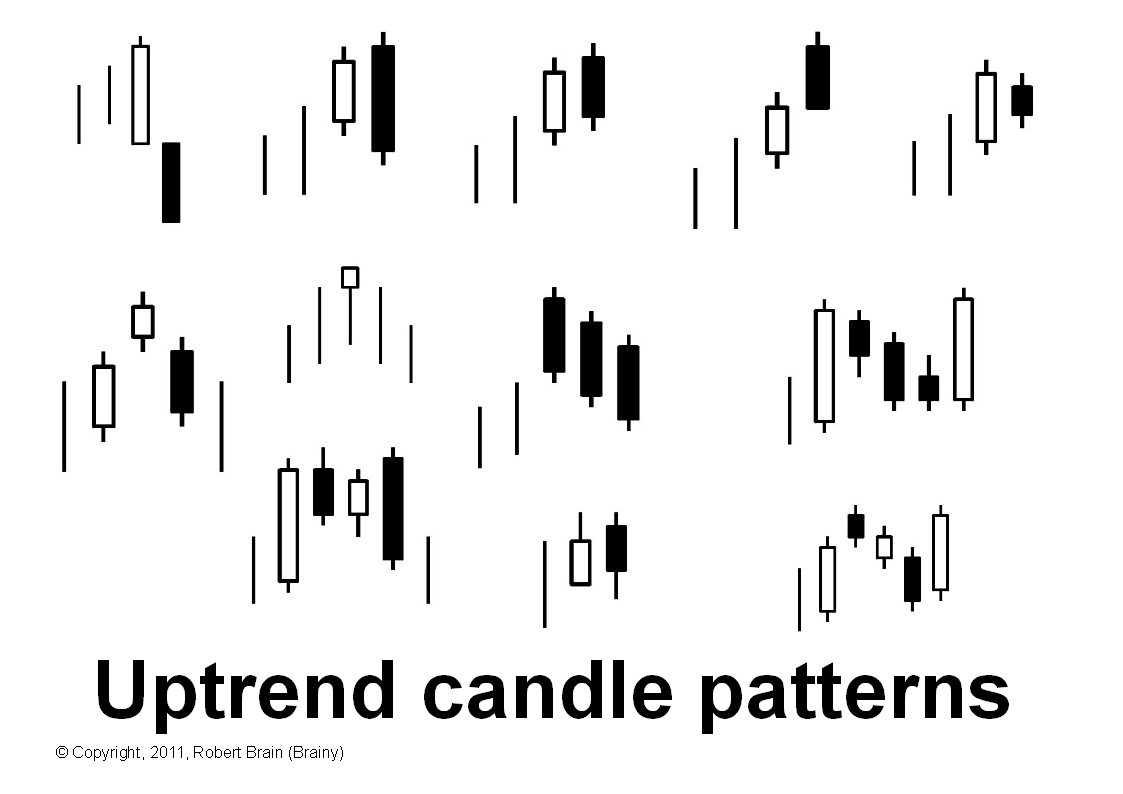

Basic of candlestick Continuation candlestick pattern in Uptrend

Trading Technical Analysis Advanced Candlestick Patterns By Justin Kuepper Updated June 21, 2021 Reviewed by Somer Anderson Fact checked by Katrina Munichiello Candlestick patterns provide. A hanging man candlestick occurs during an uptrend and warns that prices may start falling. The candle is composed of a small real body, a long lower shadow, and little or no upper shadow.. Continuation of an uptrend Upside Tasuki Gap A bullish candle forms after a gap up from the previous white candle. The next candle opens lower and closes lower than the previous one. If the gap is not filled, the bulls have maintained control and it's possible to enter a buy trade or increase an existing long position. Candlesticks patterns are used by traders to gauge the psychology of the market and as potential indicators of whether price will rise, fall or move sideways. Some patterns are referred to as.

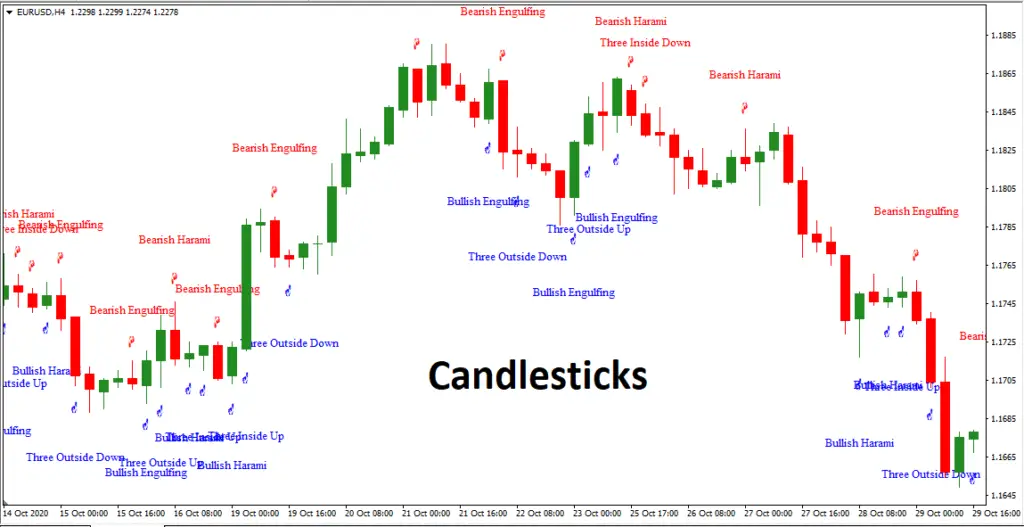

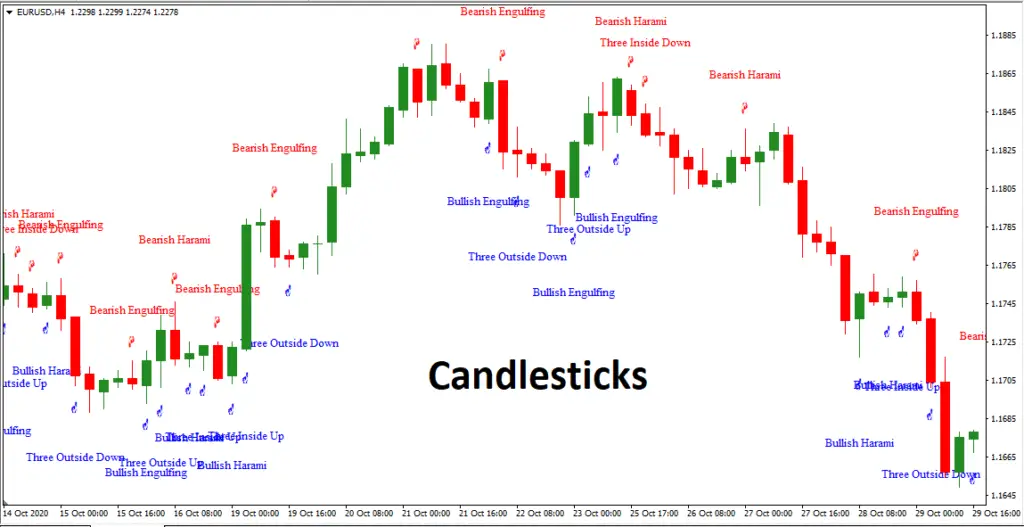

Candles and Candlestick charts

Bearish engulfing pattern: This is a two-candle pattern indicating a reversal of the previously established uptrend. You can also find these occurring at the bottom of a downtrend, but they're referred to as bullish engulfing patterns. Three specific criteria create a bearish engulfing reversal: The first candle is bullish and continues the. The candlesticks are used to identify trading patterns that help technical analyst set up their trades. These candlestick patterns are used for predicting the future direction of the price movements. The candlestick patterns are formed by grouping two or more candlesticks in a certain way. An inside day candle is considered bullish when it satisfies the following criteria: The candle's closing price is greater than its opening price. The inside day occurs within a pronounced uptrend. A forex trader may be inclined to execute a buy or long inside day trading strategy if deemed bullish. Bearish Inside Day Candle It follows an uptrend and has two candlesticks. The first is green and closes properly below the opening of the second candlestick. The second candlestick is red and closes below the middle of the body of the first candlestick. This pattern is thought to suggest the market is going to enter a downtrend.

Candle Stick Chart Market Uptrend Stock Vector Illustration of

A candlestick is a way of displaying information about an asset's price movement. Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars. This article focuses on a daily chart, wherein each candlestick details a single day's trading. Presented as a single candle, a bullish hammer (H) is a type of candlestick pattern that indicates a reversal of a bearish trend. This candlestick formation implies that there may be a potential uptrend in the market. Some of the identifiable traits and features of a bullish hammer include the following:

Candlestick patterns are technical trading tools that have been used for centuries to predict price direction. There are dozens of different candlestick patterns with intuitive, descriptive. It is characterized by a large, downward-moving candle that appears after an uptrend. The bearish kicker candlestick pattern indicates a potential shift from bullish to bearish. It is also considered a valuable and strong reversal signaling tool for traders and investors to identify possible selling opportunities.

Candlesticks Pattern Trend Following System

Hanging man or hangman candlestick refers to a bearish single-candlestick formation found at the topmost point of an uptrend. Traders utilize this pattern in the trend direction of pattern changes. It also signals the trend reversal of the market as soon as the bull appears to lose its momentum. It aims to indicate a potential bearish reversal. The abandoned baby pattern is a 3-bar reversal pattern.The bullish abandoned baby follows a downtrend. It has a big red candle, a gapped down doji and then a big green gapped up candle.The bearish abandoned baby follows an uptrend. It has a big green candle, a gapped.