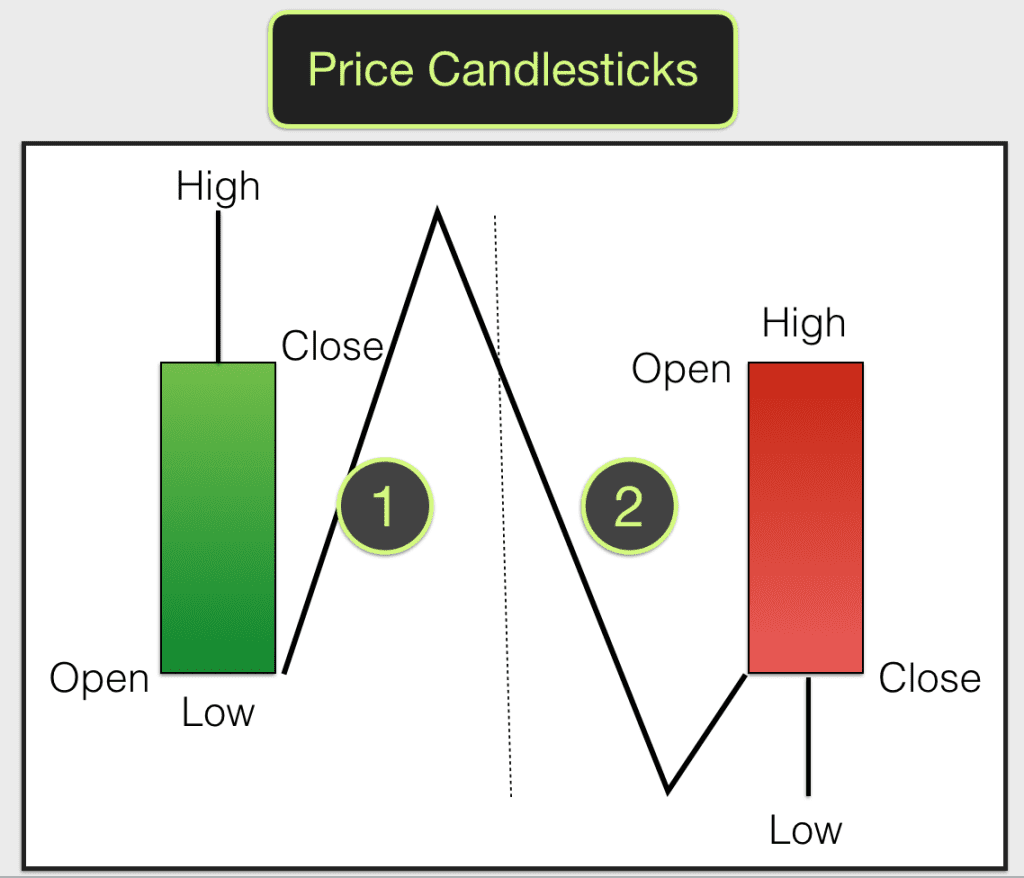

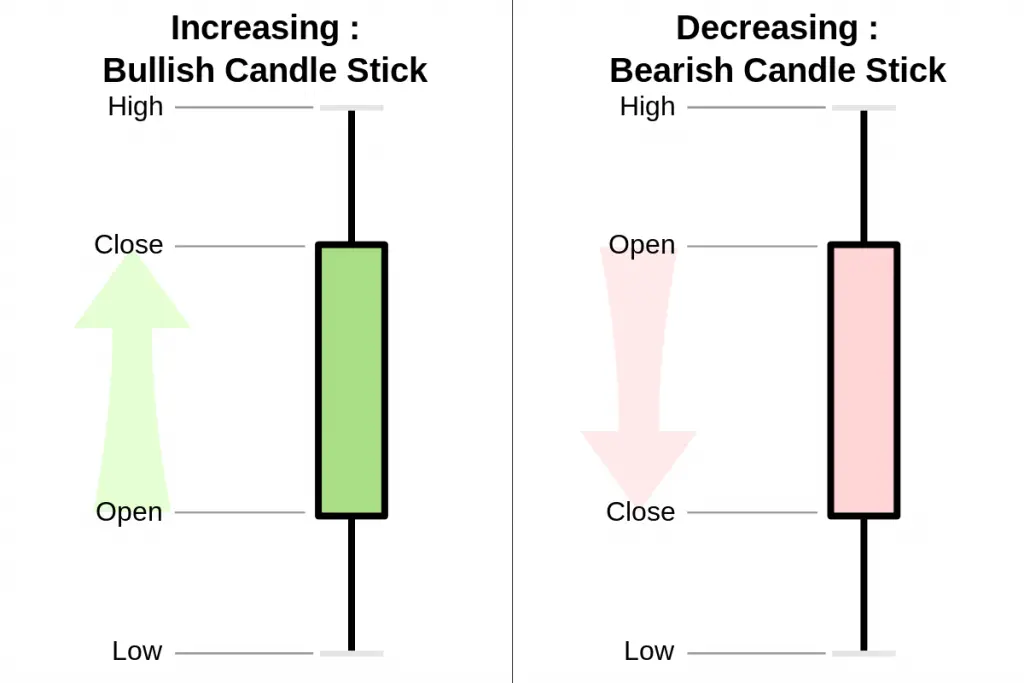

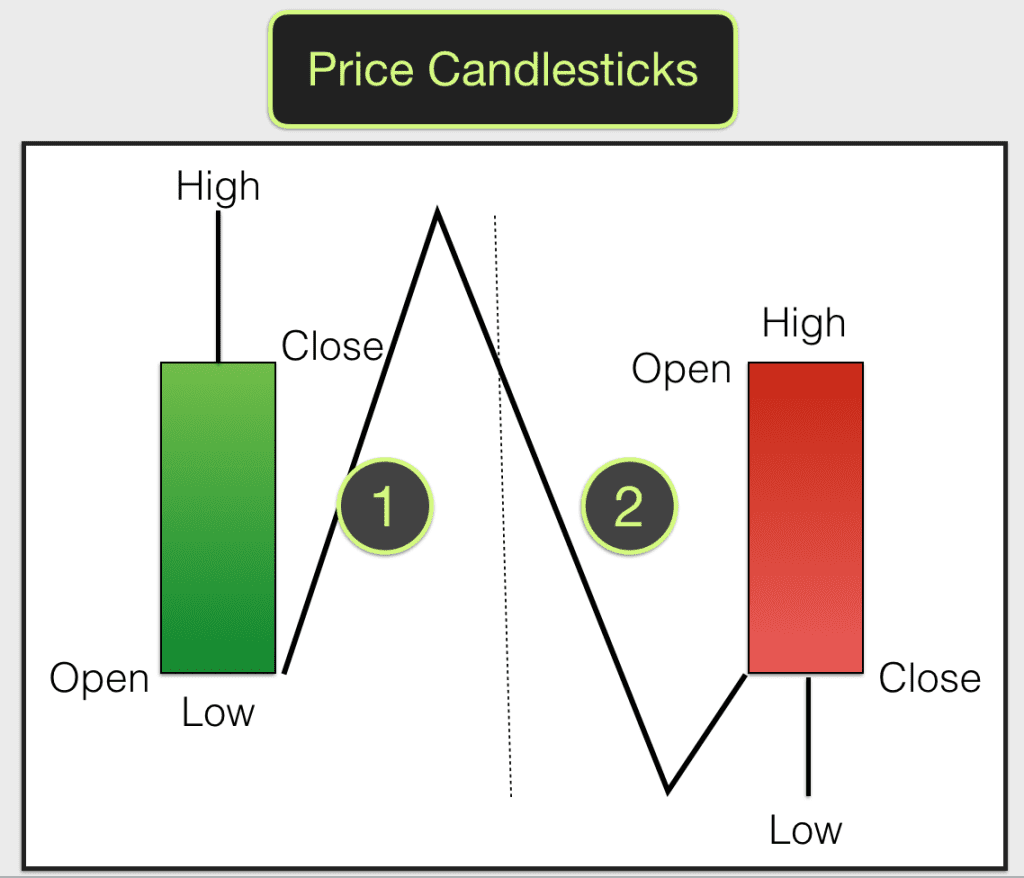

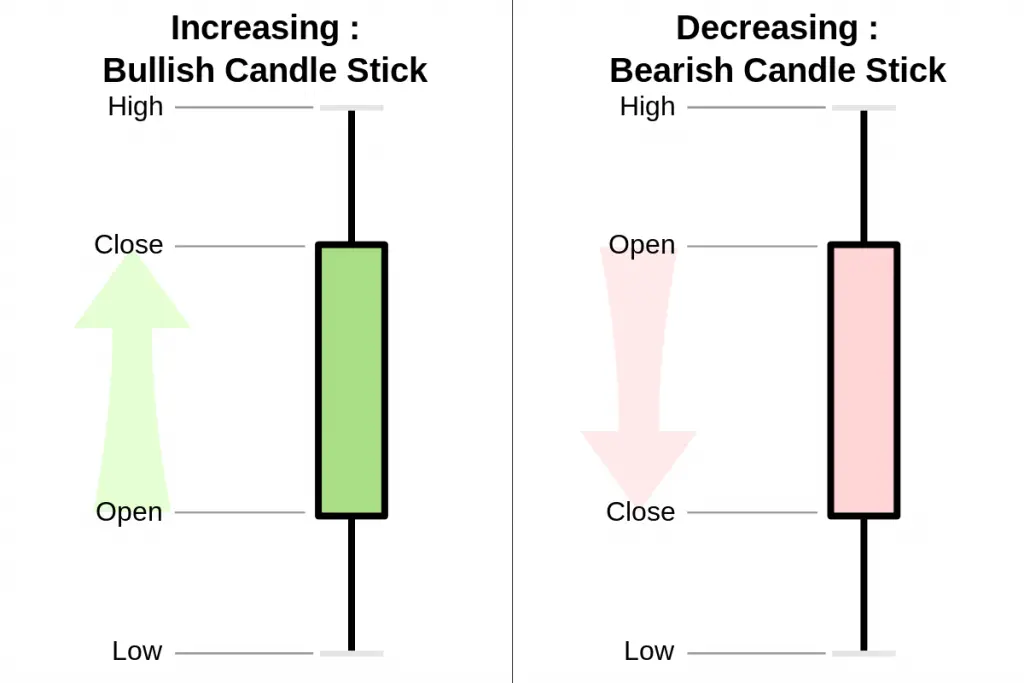

A candlestick is composed of three parts; the upper shadow, lower shadow and body. The body is colored green or red. Each candlestick represents a segmented period of time. The candlestick data summarizes the executed trades during that specific period of time. For example a 5-minute candle represents 5 minutes of trades data. Traders use the candlesticks to make trading decisions based on irregularly occurring patterns that help forecast the short-term direction of the price. Key Takeaways Traders use candlestick.

Candlestick Patterns Every trader should know PART 1

A candlestick is a way of displaying information about an asset's price movement. Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars. This article focuses on a daily chart, wherein each candlestick details a single day's trading. A candlestick is a way of displaying information about an asset's price movement. Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars. This article focuses on a daily chart, wherein each candlestick details a single day's trading. Candlestick trading explained Candlesticks are used in technical analysis and can help traders to accurately predict market movements. They will look at the shape and color of candlesticks to get a sense of trends and patterns in a given market. Source: Bloomberg Forex Candlestick Doji Technical analysis Support and resistance Aesthetics Candlestick charts are a visual representation of market data, showing the high, low, opening, and closing prices during a given time period. Originating from Japanese rice traders in the 18th century, these charts have become a staple in modern technical analysis.

Day Trading Charts The Best Free Candlestick Charts Explained

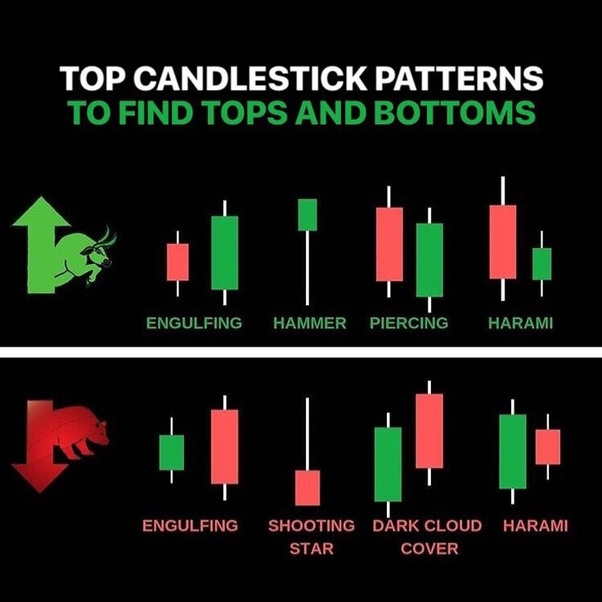

Candlestick patterns are technical trading tools that have been used for centuries to predict price direction. There are dozens of different candlestick patterns with intuitive, descriptive. White Spinning Tops- A type of candlestick formation where the real body is small despite a wide range of price movement throughout the trading day.This candle is often regarded as neutral and used to signal indecision about the future direction of the underlying asset. Usually in an uptrend when far away from resistance, it is considered a continuation pattern. The charts can also be used to keep a trader in a trade after a trend begins. It's usually best to stay in a trade until the Heikin-Ashi candles change color. A change in color doesn't always mean. The first candlestick is a red one, and the second is green. A green one "engulfs" the red one because the body has a lower opening price and a higher closing price. This can indicate that it is going to rise. Note that no indicator works 100% of the time, so this is a possible indication, not a guaranteed one.

How to Use Candlestick Patterns for Day Trading StoneX Financial Inc

Two candles form it, the first candle being a bearish candle which indicates the continuation of the downtrend.. Trade better with Candlestick- In this webinar, the trainer, Mr Piyush Chaudhry, will help you understand candlesticks, spot candlestick patterns, differentiate between reversal and continuation patterns and understand when are. Ultimate Candlestick Patterns Trading Course (PRO INSTANTLY) Wysetrade 1.12M subscribers Subscribe Subscribed 138K Share 3.5M views 1 year ago PRICE ACTION SERIES [In Order] 📈 FREE CHARTING.

30 m 1 h D NASDAQ:AAPL 1 m 30 m 1 h D Indicators Want to learn more about how to read candlestick charts and candlestick patterns? Get started with our free training HERE Learn more about how to use this chart and all its features by watching this video: New Candlestick Chart Lookup (fixed audio) Watch on Shopping Cart No products in the cart. Pushkar Raj Thakur : Business Coach 5.8M views 2 years ago Learn All #CandlestickPatterns Analysis for #StockMarket Trading & #TechnicalAnalysis in 3 Free Episodes.👉👉Open Free Demat Account on.

How to Read Candlestick Charts New Trader U

The National Candle Association (NCA) is the only trade association representing US candle manufacturers and suppliers, and serves as the leading technical authority on candle manufacturing, science, and safety. About candles SAVE THE DAte As the name suggests, a single candlestick pattern is formed by just one candle. So as you can imagine, the trading signal is generated based on 1 day's trading action. The trades based on a single candlestick pattern can be extremely profitable provided the pattern has been identified and executed correctly.