1. An indication that an increase in volatility is imminent. This affords traders. the opportunity to create trades that speculate not so much on direction, but rather on an increase in volatility on a breakout in any specific direction. 2. In the context of a trend, a harami/inside bar can be indicative of exhaustion. This is a short illustrated 10-page book. You're about to see the most powerful breakout chart patterns and candlestick formations, I've ever come across in over 2 decades. This works best on shares, indices, commodities, currencies and crypto-currencies. By the end you'll know how to spot:

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim

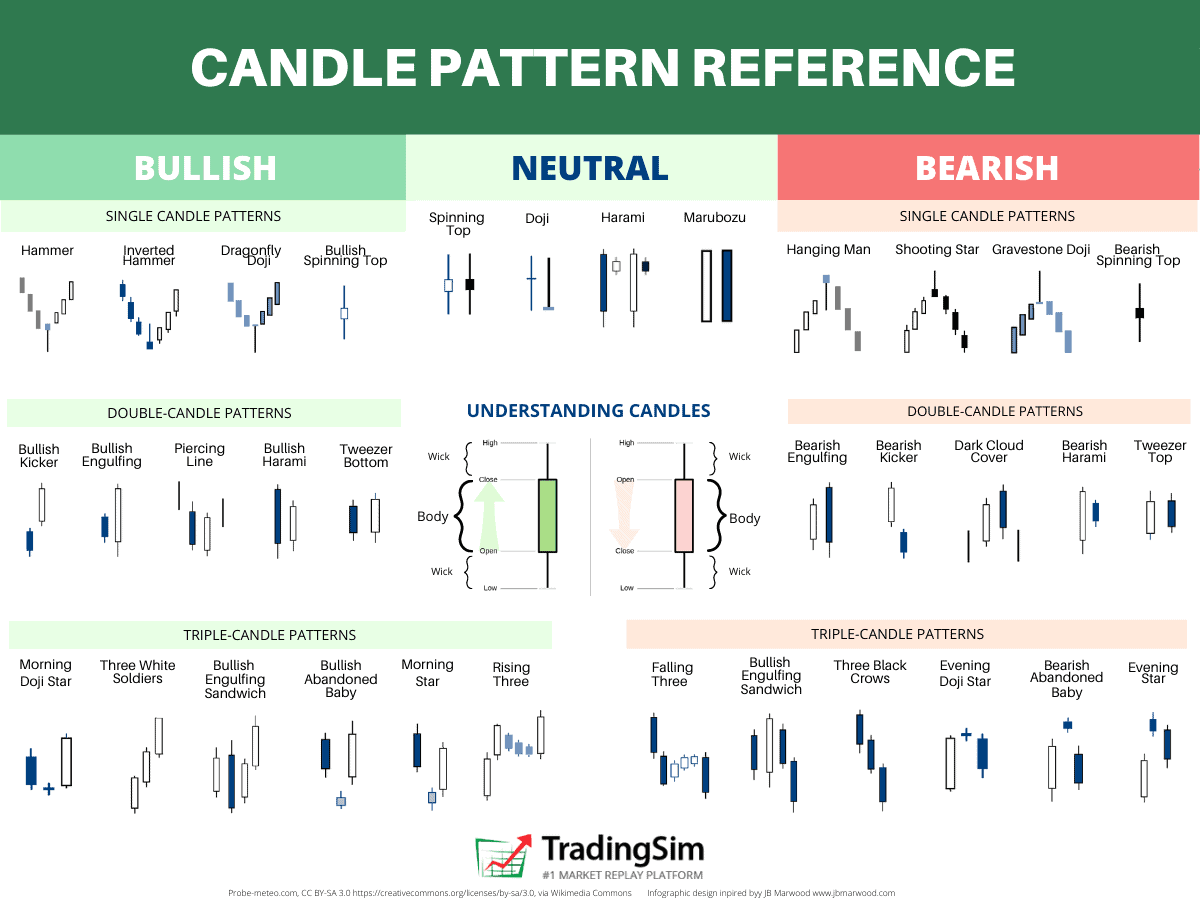

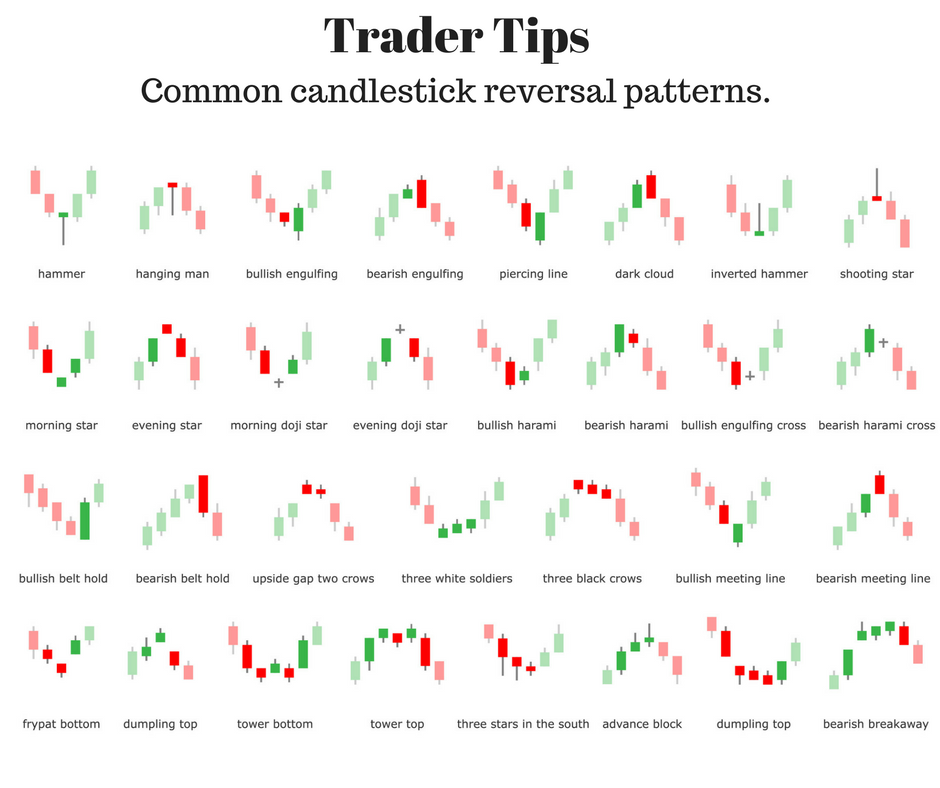

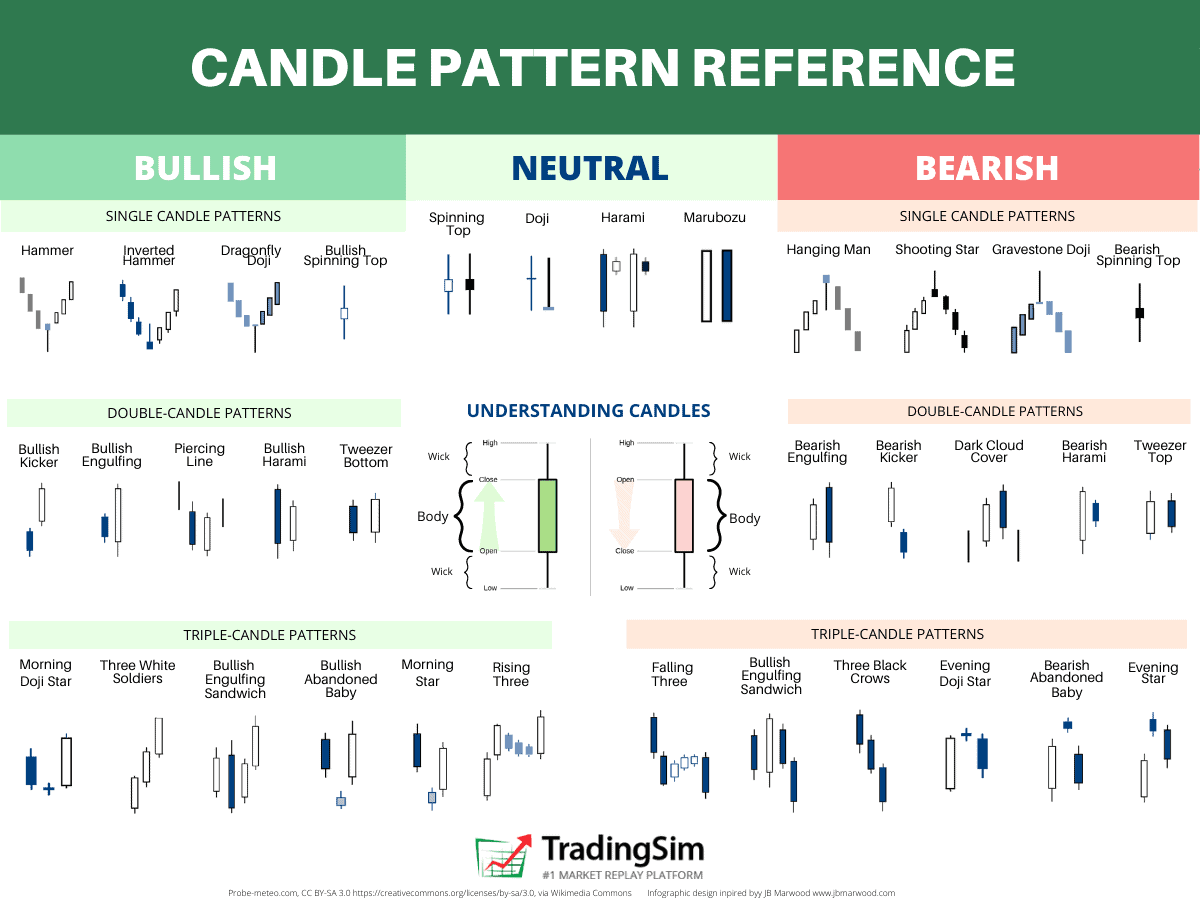

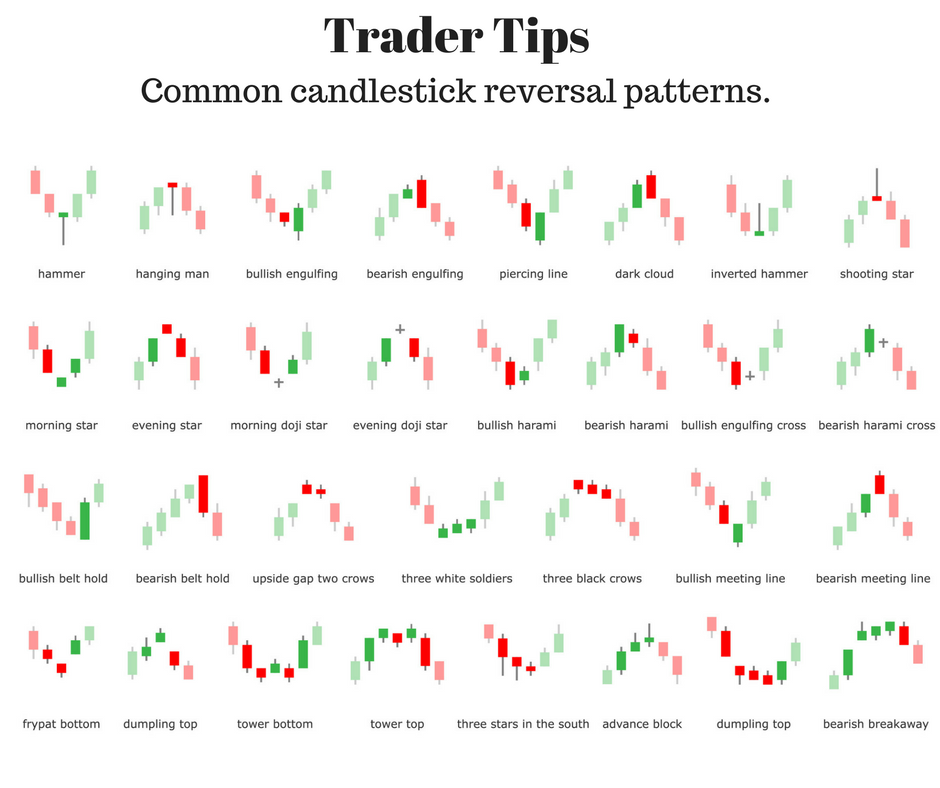

You can download the 35 powerful candlestick patterns pdf through button given below. 35 Powerful Candlestick Patterns PDF Download Download This is basic part of technical analysis in trading, like chart patterns. If you like to improve your trading abilities more, then check out this " Chart Patterns Cheat Sheet " PDF I made exclusively for you. 1. THE CANDLESTICK TRADING BIBLE. Content Introduction. 4. Overview. 6. History of Candlesticks. 8. What is a Candlestick. 11. Candlestick Patterns. 14. The Engulfing Bar Candlestick. 16. The Doji Candlestick Pattern. 20. The Dragon Fly Doji Pattern. 22. The Gravestone. QUICK REFERENCE GUIDE CANDLESTICK PATTERNS BULLISH BEARISH BEARISH Hanging Man Bearish single candle reversal pattern that forms in an up trend. Shooting Star Bearish single candle reversal pattern that forms in an up trend. BEARISH Bearish Engulfing Bearish two candle reversal pattern that forms in an up trend. Bearish Harami Dragon Fly DOJI - A Doji with the open and close at the bar's high. Long Legged DOJI - A Doji with long upper and lower shadows. The Individual Candles. Spinning Top - A bar with a small body and small range, after a multi-bar move. High Wave - A bar with a small body and wider range, after a multi-bar move.

Candlestick Chart Pdf mzaeryellow

1 The Trading Triad Candlestick patterns give you very specific turning points, or reversals. These appear in several ways: as single candlesticks, two-part patterns, or three-part patterns. On a bar chart, you look for reversals by tracking a long-term trend line or picking up on popular technical signals like the well-known head and shoulders. Below, you can download for free our advanced cheat sheet candlestick patterns categorized into advanced bullish bearish candlestick patterns: Advanced Cheat Sheet Candlestick Patterns PDF [Download] What are Advanced Candlestick Chart Patterns? In essence, advanced chart patterns are not different from standard chart patterns. Introduction The Candlestick signals are in existence today because of their statistical probabilities. As can be imagined, the signals would not be in existence today if they did not produce profits. Profits noticeable through history, significantly more than random luck or normal market returns. Candlestick Patterns (Every trader should know) A doji represents an equilibrium between supply and demand, a tug of war that neither the bulls nor bears are winning. In the case of an uptrend, the bulls have by definition won previous battles because prices have moved higher. Now, the outcome of the latest skirmish is in doubt.

Candlestick Patterns And Chart Patterns Pdf Available Toolz Spot

Unlike the previous two patterns, the bullish engulfing is made up of two candlesticks. The first candle should be a short red body, engulfed by a green candle, which has a larger body. While the second candle opens lower than the previous red one, the buying pressure increases, leading to a reversal of the downtrend. 4. WHAT IS A CANDLESTICK? A candlestick depicts the battle between Bulls (buyers) and Bears (sellers) over a given period of time. Before we get down to the nitty-gritty, (spoiler alert: awesome candlestick formation images are coming your way) it's important for you to understand what a candlestick actually is.

Download FREE PDF Candlestick patterns are a key part of trading. They are like a special code on a chart that shows how prices are moving. Imagine each pattern as a hint about what might happen next in the stock market. History of Candlestick Charting Candlestick charting started over 200 years ago in Japan with rice traders. According to Investopedia.com, it is commonly believed that candlestick charts were invented by a Japanese rice futures trader from the 18th century.His name was Munehisa Honma. 2 Honma traded on the Dojima Rice Exchange of Osaka, considered to be the first formal futures exchange in history. 3 As the father of candlestick charting, Honma recognized the impact of human emotion on markets.

printable candlestick patterns cheat sheet pdf Google Search Stock

January 20, 2022 by Ali Muhammad Introduction In the candlestick patterns dictionary, 37 candlestick patterns have been discussed in each post. These patterns have a high winning ratio because we have added proper confluences to each candle to increase the probability of winning in trading. 3.3 History of the Japanese Candlestick 16 3.4 Candlestick Anatomy 16 3.5 A note on time frames 20 4 Getting started with Candlesticks 24 4.1 History tends to repeat itself - The big assumption 24 4.2 Candlestick patterns and what to expect 25 4.3 Few assumptions specific to candlesticks 26 5 Single candlestick patterns ( Part 1 ) 29 5.1.