Our services include BAS preparation , Plan Management ,payroll management and taxation. We will ensure that all your accounts are balanced, accurate and compliance Quickly Compare Income Protection & Find the Best Cover For You. Compare Income Protection & Apply Directly Online or Speak to an Adviser.

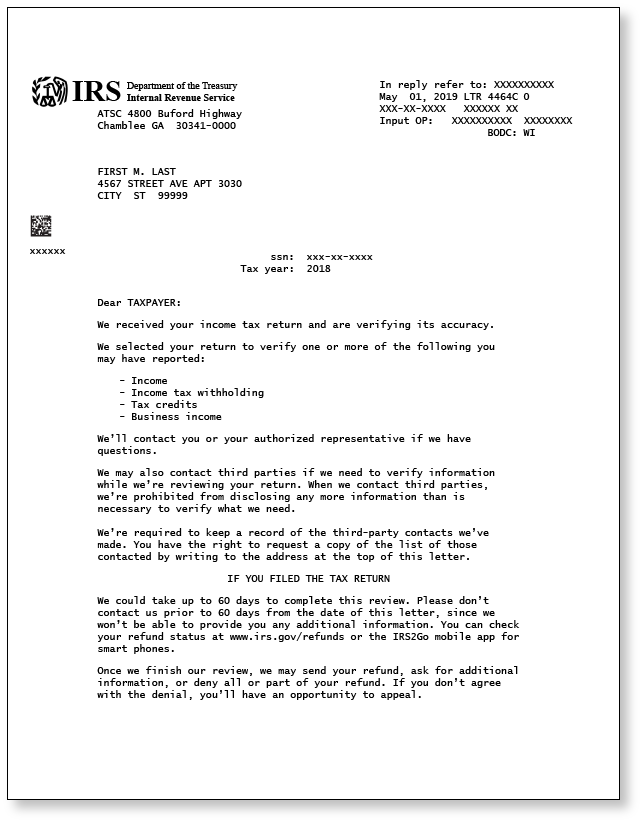

IRS Letter 4464C Sample 2

Letter 1: Do you need to lodge? Sample income schedule summary Below is a sample income schedule for the lodgment letter titled Do you need to lodge? Keep in mind that your schedule will contain your own details and may not look exactly like this one. If you agree Individual tax return instructions 2023. Prior year tax return forms and schedules. PAYG payment summaries. Forms and guidelines | Statements | Individuals (non-business) Searching for lost super. Superannuation standard choice form. Find out more about our approved forms and the related legislation. 2023 individual tax return cover letter DOCX · 23 KB 2023 payg annual update client letter DOCX · 22.7 KB 2023 remission application letter to ATO DOCX · 25 KB 2023 sample minutes adopt smsf investment strategy DOCX · 20.6 KB Annual resolution directors minutes DOCX · 18.9 KB Annual resolution members minutes DOCX · 18.7 KB What you need to do Supporting documents Receiving your letter You may receive a letter if the income amount that your employer (or employers if you have more than one job) reported to us doesn't match the amount in your tax return. Employment income is the money you receive from working.

14 INFO TAX LETTER DRAFTING PRINT FREE DOWNLOAD PDF ZIP

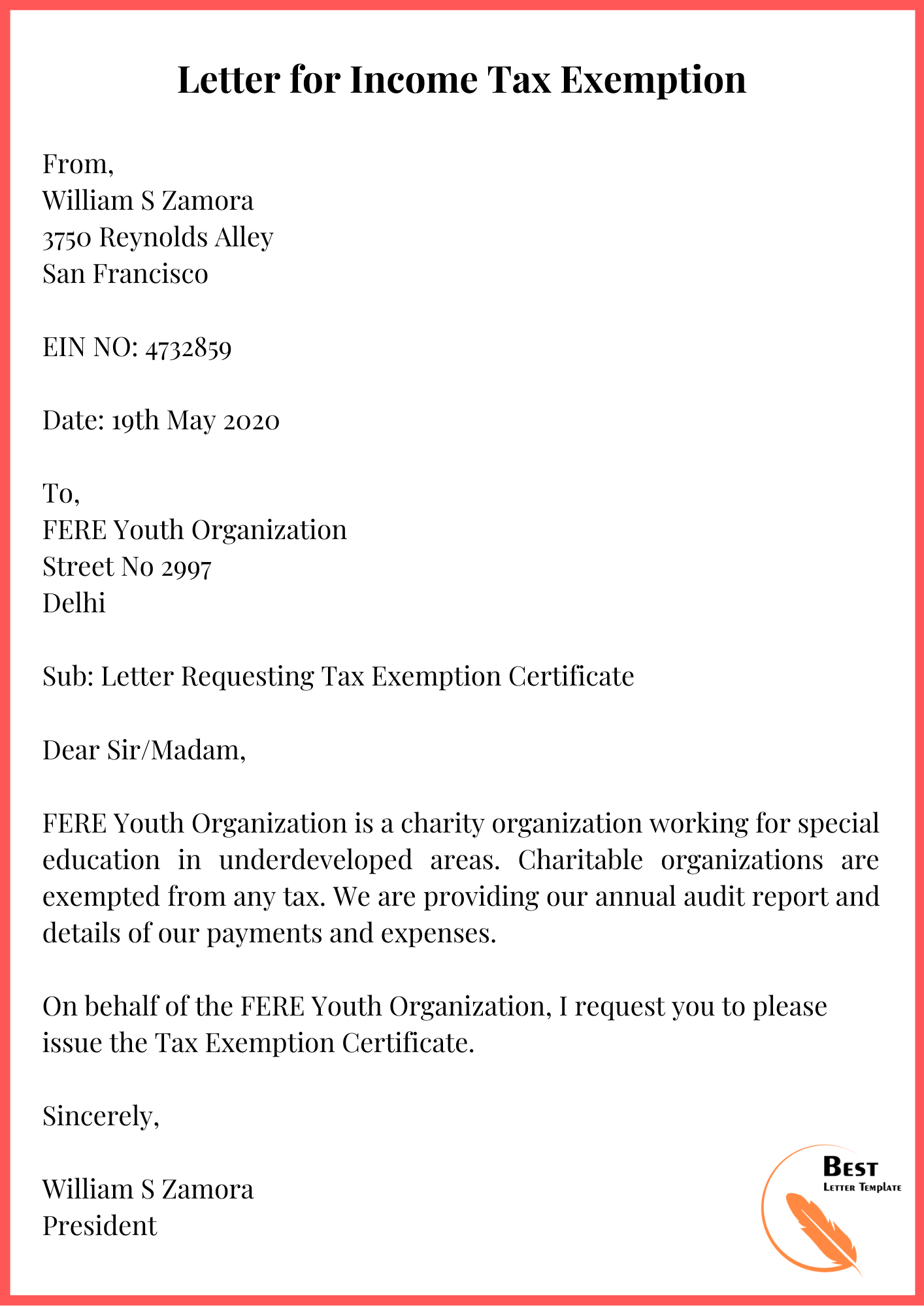

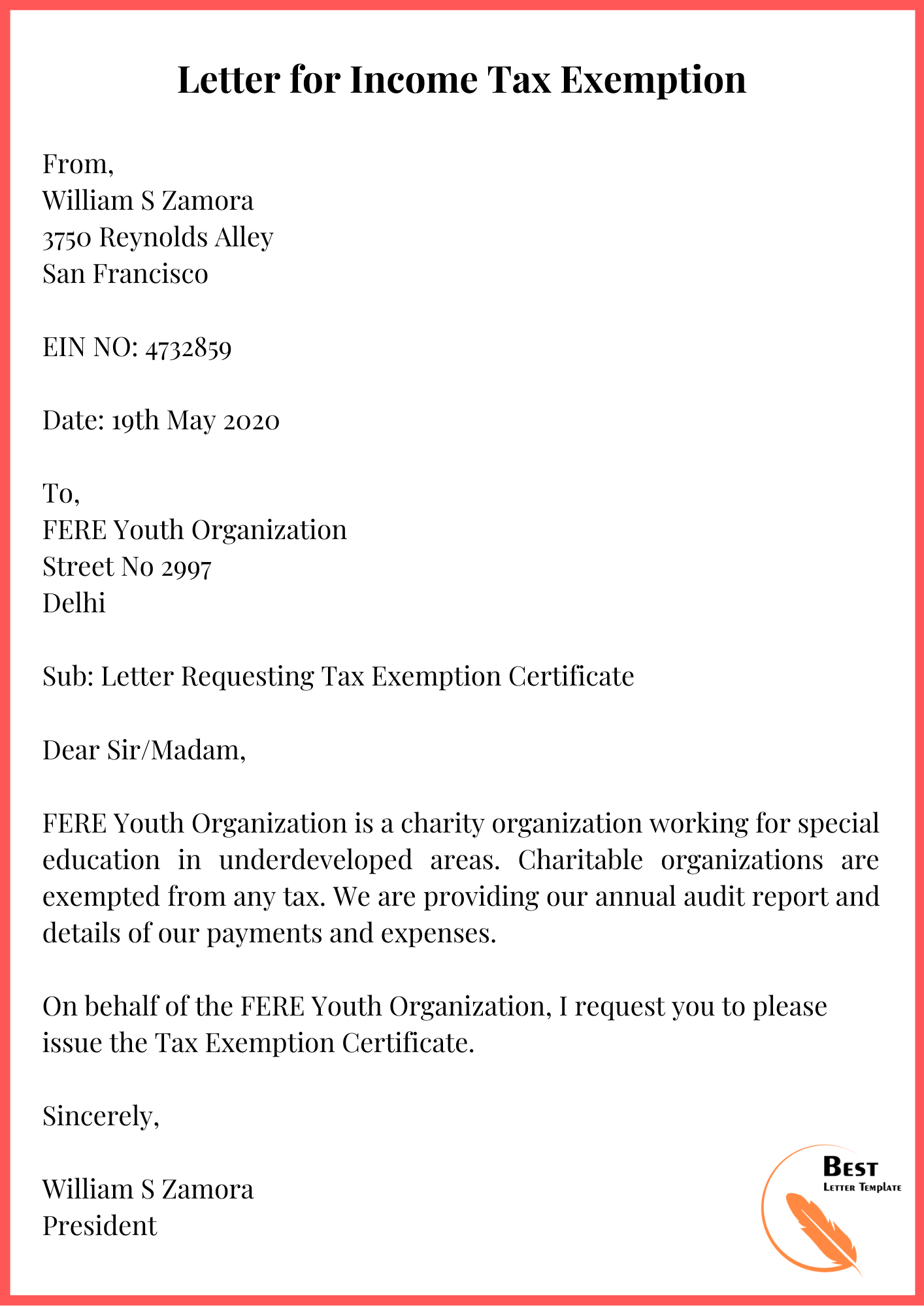

This article shows you what to include in your tax return letter to your clients, and includes a free template. His income tax returns for the financial years ending in June 2016, 2017 and 2018 were lodged through a local tax agent as a non-resident and the only income declared was his Australian sourced interest income. No tax is withheld from his income earned in Saudi Arabia. Assumptions Income Tax Letter Format: When it comes to filing taxes, one of the most important documents that taxpayers need to be familiar with is the income tax letter or Business Letter. This document is sent by the tax authorities to individuals, businesses, and organizations to notify them of their income tax obligations for a given tax year. Here's a Letter to Income Tax Department Format: Your Name and Address: Start your Request letter by writing your name, address, and contact details such as your phone number and email address. This information will help the department to contact you in case they need more information or clarification.

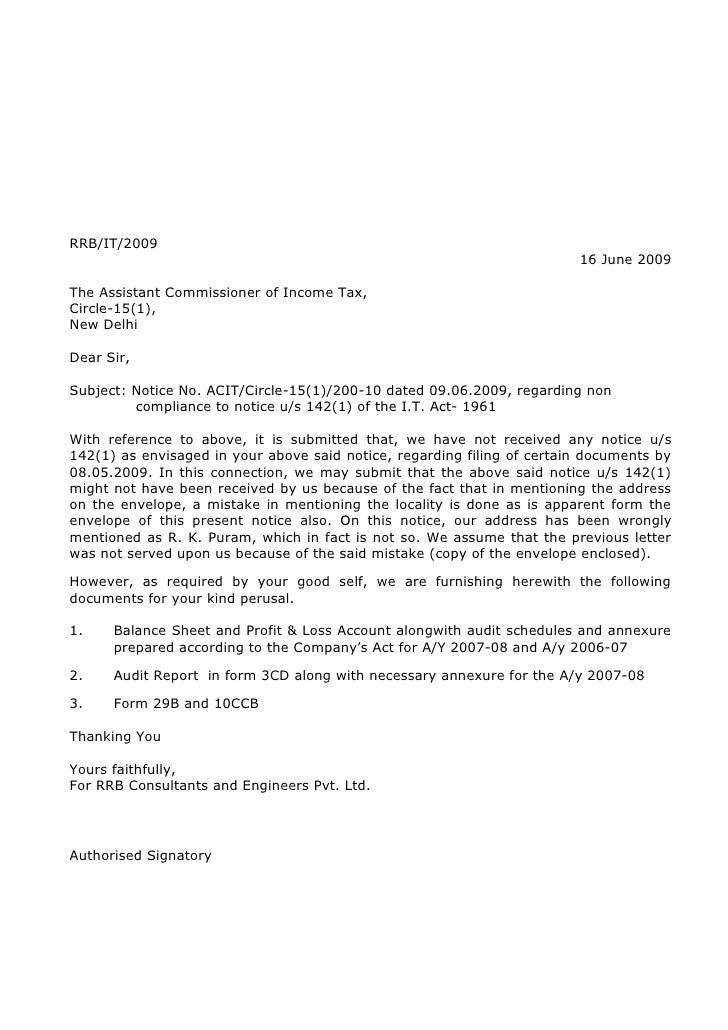

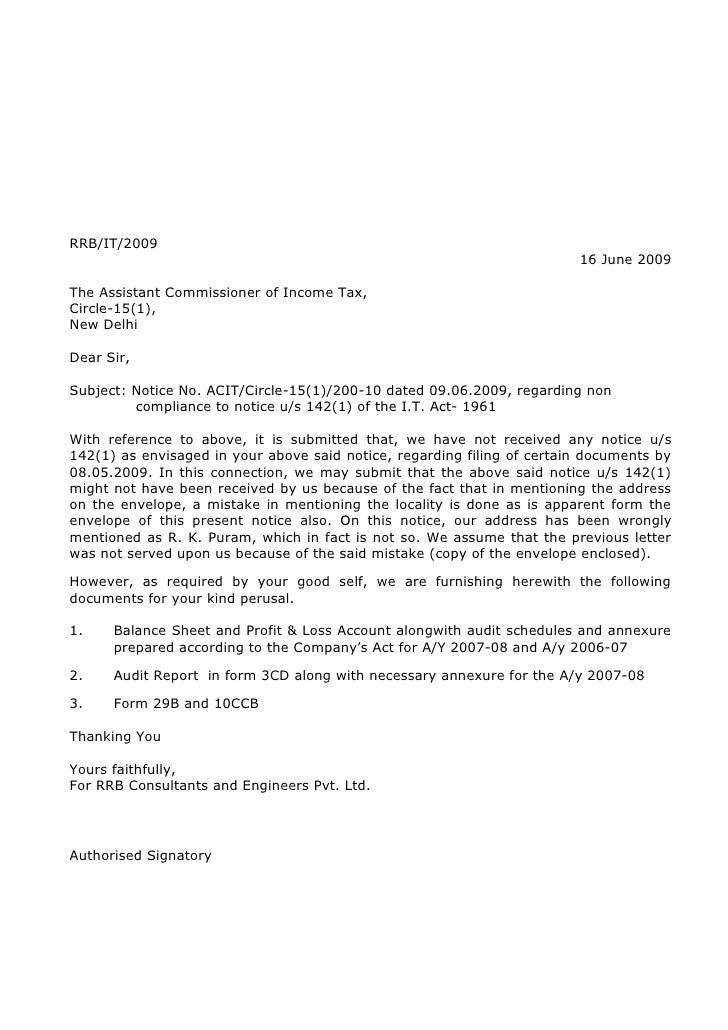

Rrb tax letters

Sample 1: Income Tax Notice Reply Letter Format Sample 2: Email Format about Income Tax Notice Reply Letter Format Sample 3: Income Tax Notice Reply Letter Format The income tax notice reply letter format should be concise, polite, and provide all the necessary information requested by the Income Tax Department. Here is the format you can follow: Sample Income Tax Letter with Examples. The examples given below will provide you with detailed information about the formats of various tax letters. Grantor Tax Information Letter. From, 2020 Federal Grantor Information Ralph Furley 17378 Someplace Delhi. Date: 1st Oct. 2020. To, Grantor name and address

A proof of income letter, otherwise known as a salary verification letter, is an official document that proves you're currently employed and earning a salary. Providing a proof of income letter is common for those needing to prove they have a job to secure a loan or sign a lease. Income tax 2024 proof submission: Employees should declare investment proofs from January onwards. Personal finance experts provide tips for smooth processing and avoiding notices.

Tax Letter Template Format, Sample, and Example in PDF & Word

The quickest and easiest way to review and print copies of your tax documents is by using our online services (linked through myGov ). The documents you can review and print are: lodged income tax returns from 2010 onwards notice of assessments from 2010 onwards Authorisation Letter Format to Appear before Income-tax Officer. In order to appear before any statutory authority on behalf of someone else, you would need a written authorisation letter from that person. The authorisation letter should be duly signed and also sealed, if needed. The letter should accompany self-attested identification proofs.