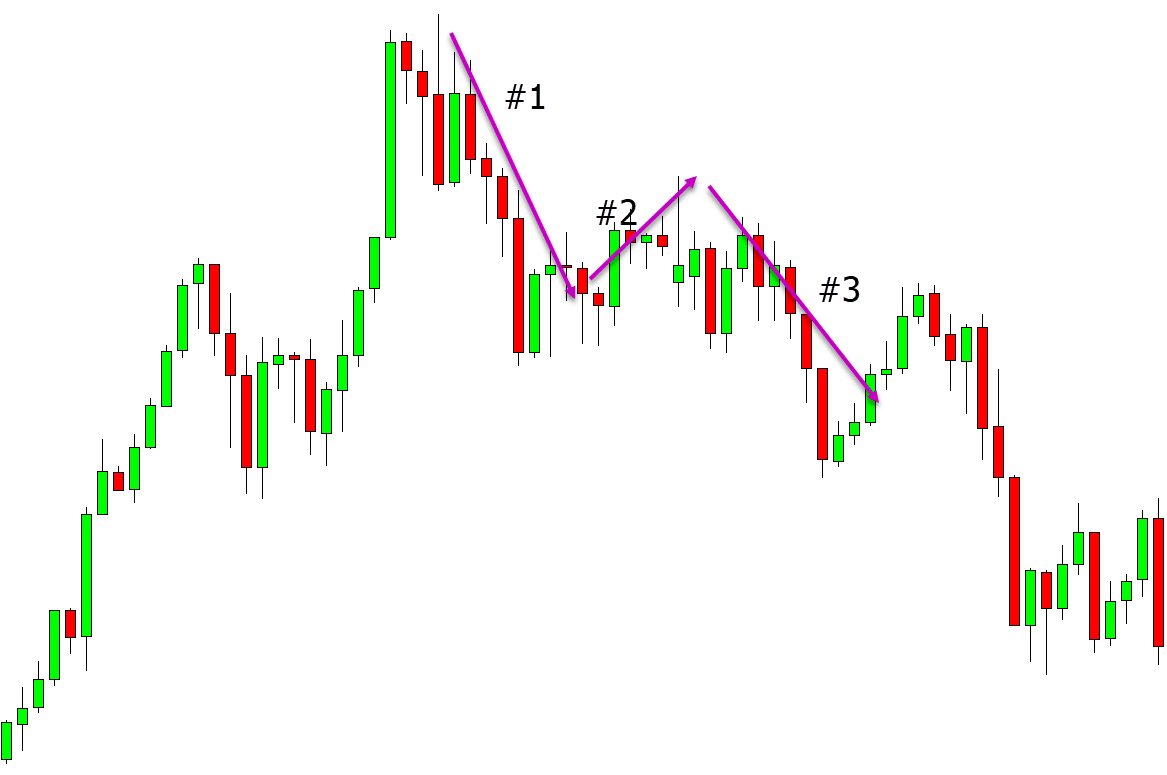

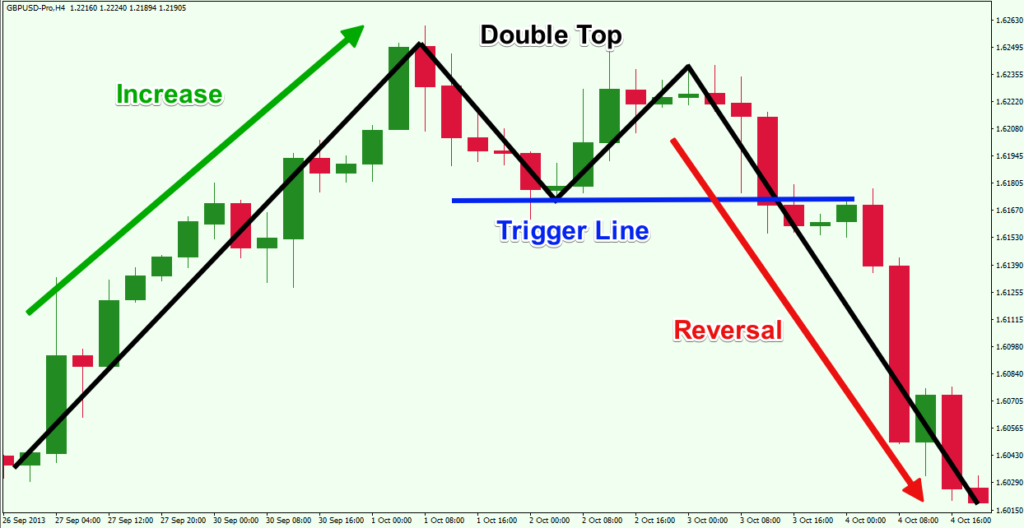

You're familiar with reversal chart patterns like head and shoulders, double top, triple top, etc. But when you attempt to trade these reversal chart patterns, you find yourself caught on the wrong side of the trend over again. Then you wonder to yourself: "Wait a minute, what's going on?" "Why am I getting stopped out consistently?" What Are Reversal Chart Patterns As the name suggests, trend reversal chart patterns indicate potential trend reversals or bounces after a sustained price move. Unlike continuation patterns, reversals mark a turning point in sentiment and momentum.

Top Forex Reversal Patterns that Every Trader Should Know Forex

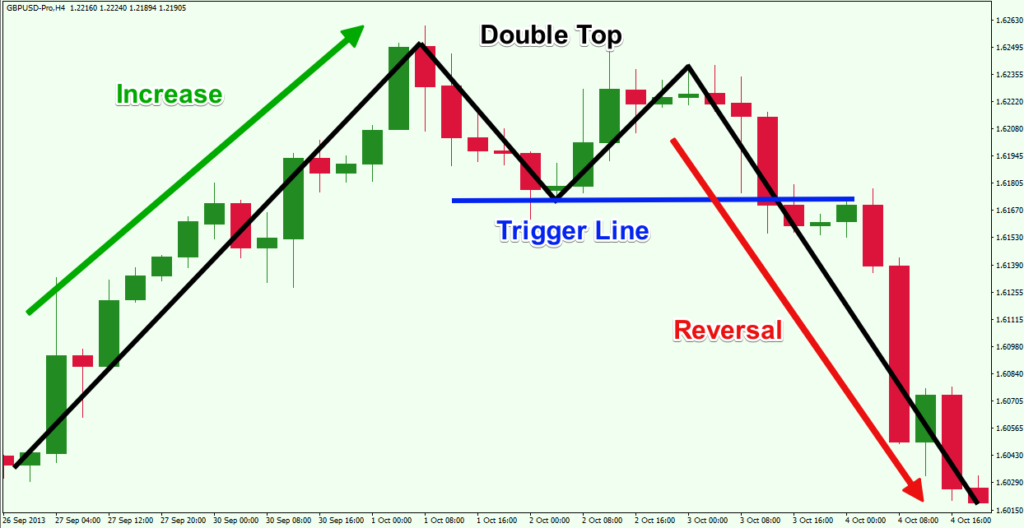

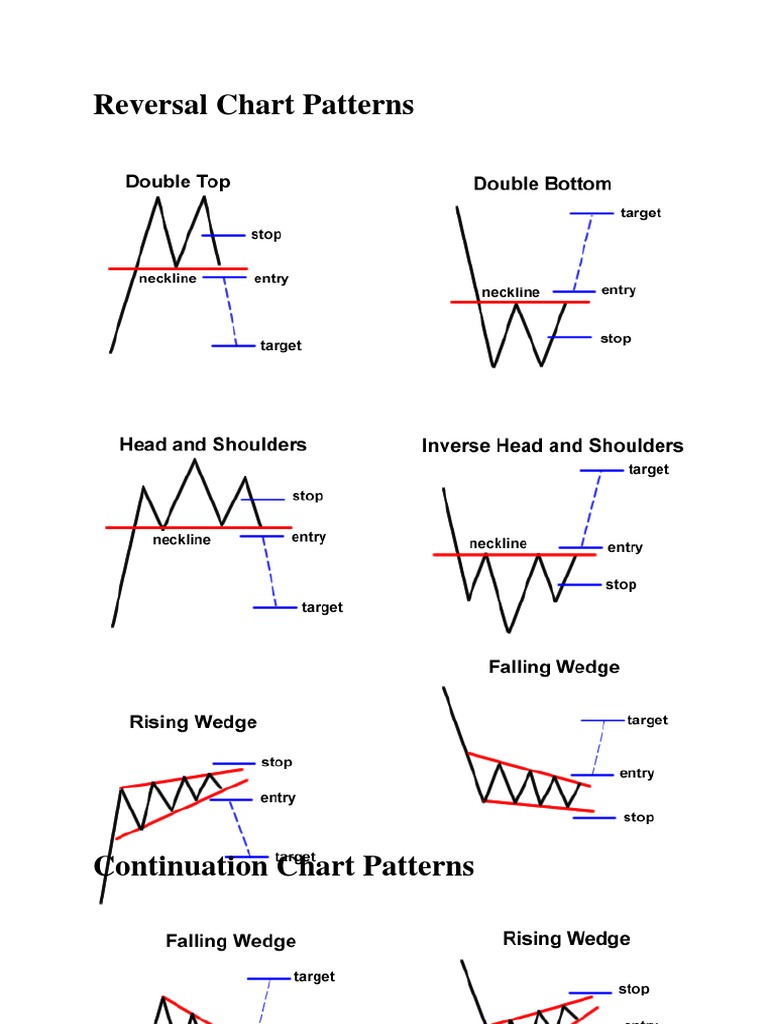

When a price pattern signals a change in trend direction, it is known as a reversal pattern; a continuation pattern occurs when the trend continues in its existing direction following a. Reversal patterns refer to chart arrangements that happen before a chart starts a new trend. For example, a bullish reversal pattern will typically happen during a downward trend and lead to a new bullish trend. These patterns can help you make better decisions about when to enter a trade. A chart pattern (or price pattern) is an identifiable movement in the price on a chart that uses a series of curves or trendlines. These patterns may repeat and occur naturally due to price action, and when they can be identified by market analysts and traders, they can provide an edge to trading strategies and help them beat the market. What are Reversal Patterns? Types of Reversal Patterns How to Trade Reversal Patterns? Three factors to consider before trading reversal patterns: Important Reversal Chart Patterns & How To Trade Them 1. Head and Shoulders 2. Inverse Head and Shoulders 3. Double Top 4. Double Bottom 5. Triple Top 6. Triple Bottom

Reversal Chart Patterns

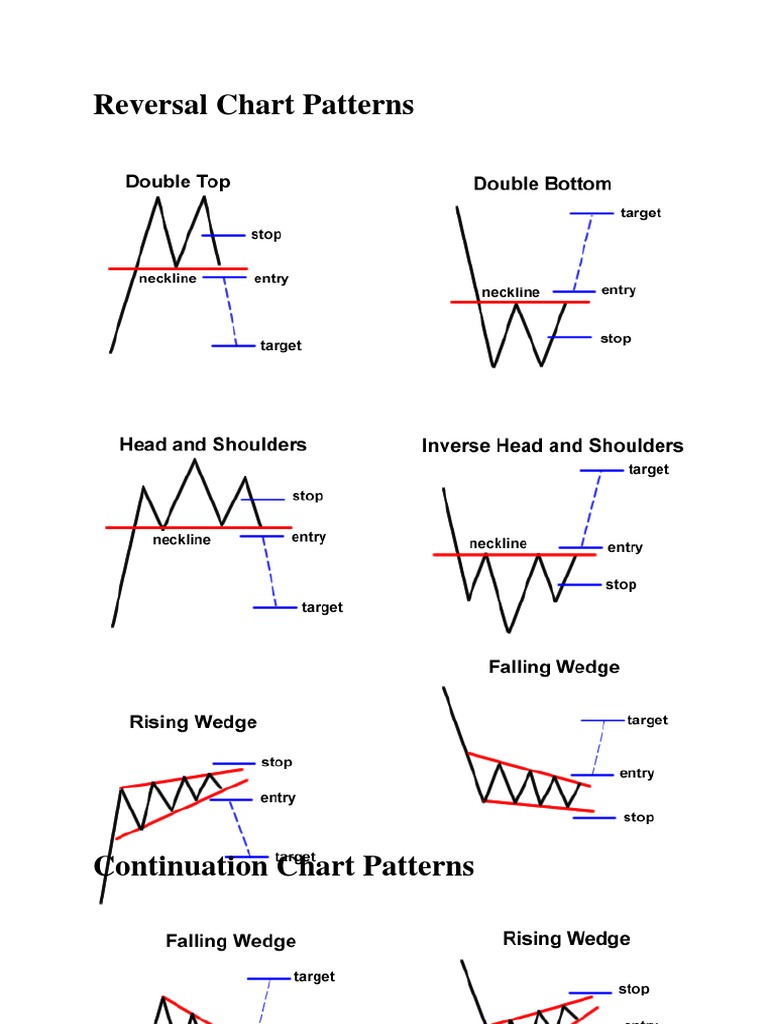

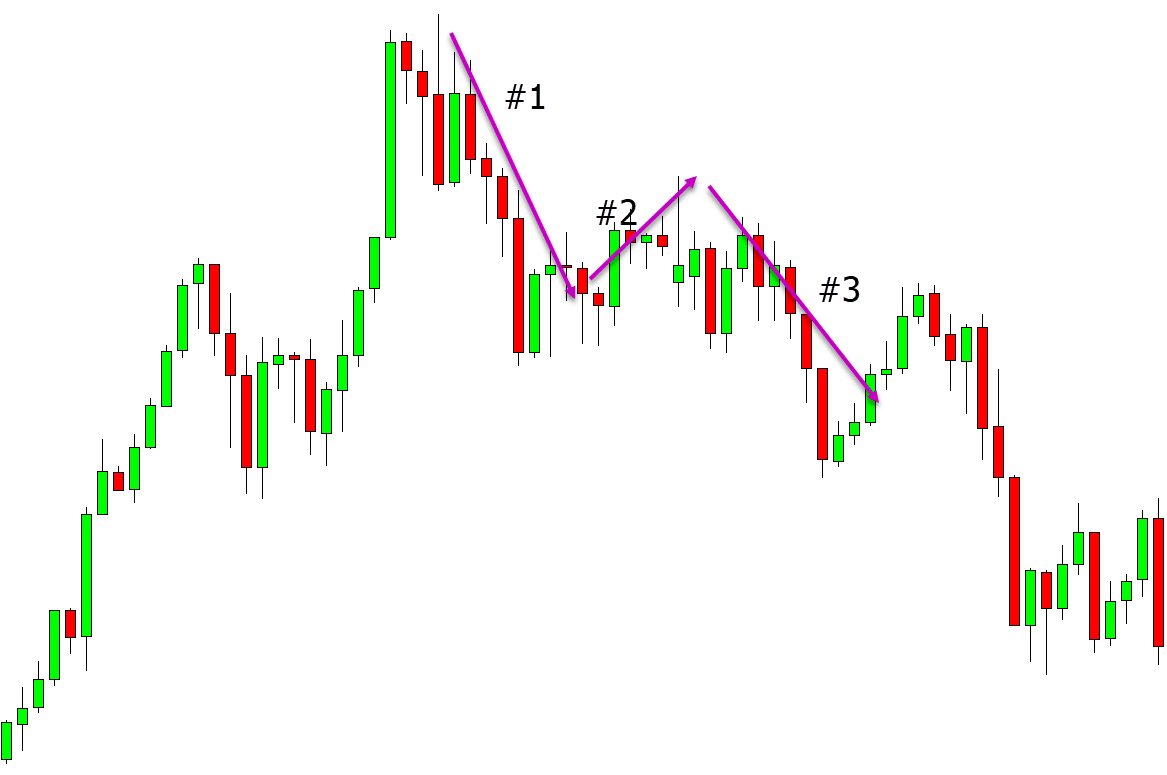

Step #3: Identify the trend-to-pattern ratio. The trend-to-pattern ratio is your next clue on this thrilling trading journey. Calculate the number of bars in the trend versus the trend reversal pattern. And as you can see: The trend reversal pattern is 3:1 so…. A reversal is anytime the trend direction of a stock or other type of asset changes. Being able to spot the potential of a reversal signals to a trader that they should consider exiting their. A reversal pattern is a transitional phase that marks the turning point between a rising and a falling market. If prices have been advancing, the enthusiasm of buyers has outweighed the pessimism of sellers up to this point, and prices have risen accordingly. Here is a list of the reversal chart patterns: - Rising wedge / Falling wedge - Ascending broadening wedge / Descending broadening wedge - V bottom / V Top - Double Bottom / Double Top - Triple bottom / Triple top - Diamond bottom / Diamond top - H&Si / H&S - Rounding Bottom / Rounding top

The Best Trend Reversal Indicators and How to Use Them

A reversal is when the direction of a price trend has changed, from going up to going down, or vice-versa. Traders try to get out of positions that are aligned with the trend prior to a. A reversal pattern indicates a change in direction from a rising market to a falling market and vice versa. We can use this pattern to predict the upcoming movement and open or close our trades accordingly. Head & Shoulders Pattern The Head &Shoulders pattern is a very unique reversal pattern.

The 123 reversal chart pattern strategy is a three-swing price formation that indicates a potential reversal in trend. It is formed by three price swings or waves with three swing points, which is where the name of the pattern comes from. The 123 pattern reversal starts with the price swing not making the expected higher high (in an uptrend) or. One of the most well-known reversal chart patterns is the Head and Shoulders. This pattern appears when a security's price experiences three peaks: a higher peak (the head) between two lower peaks (the shoulders). The Head and Shoulders pattern is completed when the price breaks below the neckline, which is drawn by connecting the lows of the.

The Essential Guide To Reversal Chart Patterns TradingwithRayner

Trend reversal patterns are essential indicators of the trend end and the start of a new movement. They are formed after the price level has reached its maximum value in the current trend. The main feature of trend reversal patterns is that they provide information both on the possible change in the trend and the probable value of price movement. What are Reversal Chart Patterns? In order to talk about reversal chart patterns, it needs to be preceded by a trend. The reversal pattern will then signal a reversal of the current trend. We have mentioned that the reversal pattern that occurs on the top of the trend is called a distribution and the reversal pattern that occurs at the bottom.