Shooting Star: A shooting star is a type of candlestick formation that results when a security's price, at some point during the day, advances well above the opening price but closes lower than. The inverted shooting star is a bullish analysis tool, looking to notice market divergence from a previously bearish trend to a bullish rally. An inverted shooting star pattern is more commonly known as an inverted hammer candlestick. It can be recognized from a long upper shadow and tight open, close, and low prices — just like the shooting.

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals

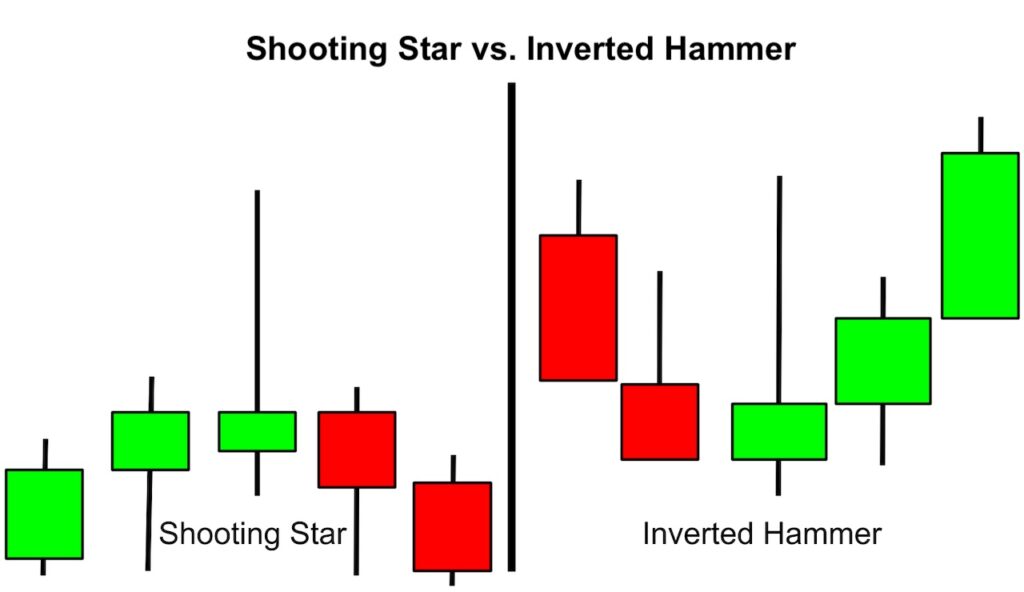

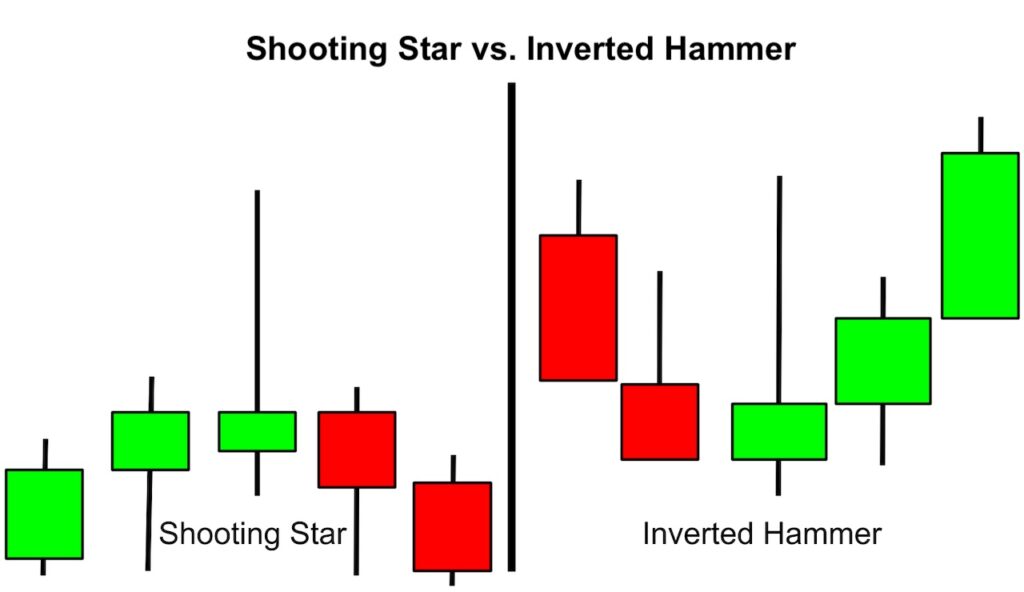

A shooting star candlestick pattern is a chart formation that occurs when an asset's market price is pushed up quite significantly, but then rejected and closed near the open price. This creates a long upper wick, a small lower wick and a small body. The upper wick must take up at least half of the length of the candlestick for it to be. Shooting star patterns are found in uptrends. In technical analysis, a shooting star is interpreted as a type of reversal pattern presaging a falling price. The Shooting Star looks exactly the same as the Inverted hammer, but instead of being found in a downtrend it is found in an uptrend and thus has different implications.Like the Inverted hammer it is made up of a candle with a small lower. A shooting star candlestick pattern is a chart formation that occurs when an asset's market price is pushed up quite significantly, but then rejected and closed near the open price. This creates a long upper wick, a small lower wick and a small body. The upper wick must take up at least half of the length of the candlestick for it to be. A shooting star is a single-candle bearish pattern that generates a signal of an impending reversal. Similar to a hammer pattern, the shooting star has a long shadow that shoots higher, while the open, low, and close are near the bottom of the candle. It is considered to be one of the most useful candlestick patterns due to its effectiveness.

What Is Shooting Star Candlestick? How To Use It Effectively In Trading

A bearish shooting star candle formed on March 6, after the price initially rose for three consecutive days to the $16.5 price level. Note that this price increase occurred on relatively low volume. Furthermore, the bearish shooting star pattern formed at an earlier support level which then acted as resistance. Raining Profits. The blue arrows on the image measure and apply three times the size of the shooting star candle pattern. After we short Apple, the price enters a downtrend. After the first bearish impulse on the chart, the price creates a range between $107.30 and $107.40 per share. A shooting star formation is a bearish reversal pattern that consists of just one candle. It is formed when the price is pushed higher and immediately rejected lower so that it leaves behind a. The shooting star is a bearish reversal candlestick that appears after a significant price advance. Therefore, it appears at the top of an uptrend suggesting that the price has peaked and the upward momentum is waning. In contrast, the inverted hammer is a bullish reversal candlestick pattern that occurs at the bottom of a downtrend.

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals

A shooting star pattern is a bearish candlestick pattern that appears after an uptrend. It has a small body, a long upper wick, and little or no lower wick. The long upper wick represents the bulls' failed attempt to push the price higher, while the small body indicates that the bears are gaining control. This pattern indicates a potential. A shooting star candlestick is a technical analysis indicator. It is a Japanese candlestick pattern indicating a potential price trend reversal. It appears at the end of a bullish price trend. This candlestick pattern is characterized by its long upper shadow and a short lower shadow, with the candle body closer to the lower point.

What Does a Shooting Star Candlestick Mean? It is a bearish reversal pattern that consists of one candle. The candlestick pattern is formed when the price of an asset is pushed higher and then rejected back lower in the same session. This leaves a large upper wick rejecting higher prices. Shooting star. A shooting star, meanwhile, is a doppelgänger of an inverted hammer. But like the hanging man, a shooting star will appear at the crest of an uptrend instead of the trough of a downtrend.. It looks the same as a morning star, but with a green candle at the beginning - after an extended uptrend - and a red one at the end.

Herb and Crystal Shooting Star Candle Etsy

Step #2: The Shooting Star Candle should come after a strong bullish trend. The location, or where the shooting star candlestick develops, matters a lot. This whole ingredient is what makes the bearish shooting star candle performs with such a high degree of accuracy. We need a strong uptrend that has two important features: A shooting star is a candlestick pattern with two candles, typically forming at the top of a trend. It resembles a shooting star with a long tail and small body, signaling potential resistance levels and entry points in the market. fci, rsi, stochastic. How to identify: