A value-added tax identification number or VAT identification number ( VATIN [1]) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES [2] website. VAT number adalah singkatan dari Value Added Tax atau Goods and Service Tax (GST) yang lebih dikenal sebagai Pajak Pertambahan Nilai (PPN) di Indonesia. PPN sendiri merupakan pajak yang dikenakan dalam setiap proses produksi maupun distribusi barang.

How to find a business's VAT number? Experlu

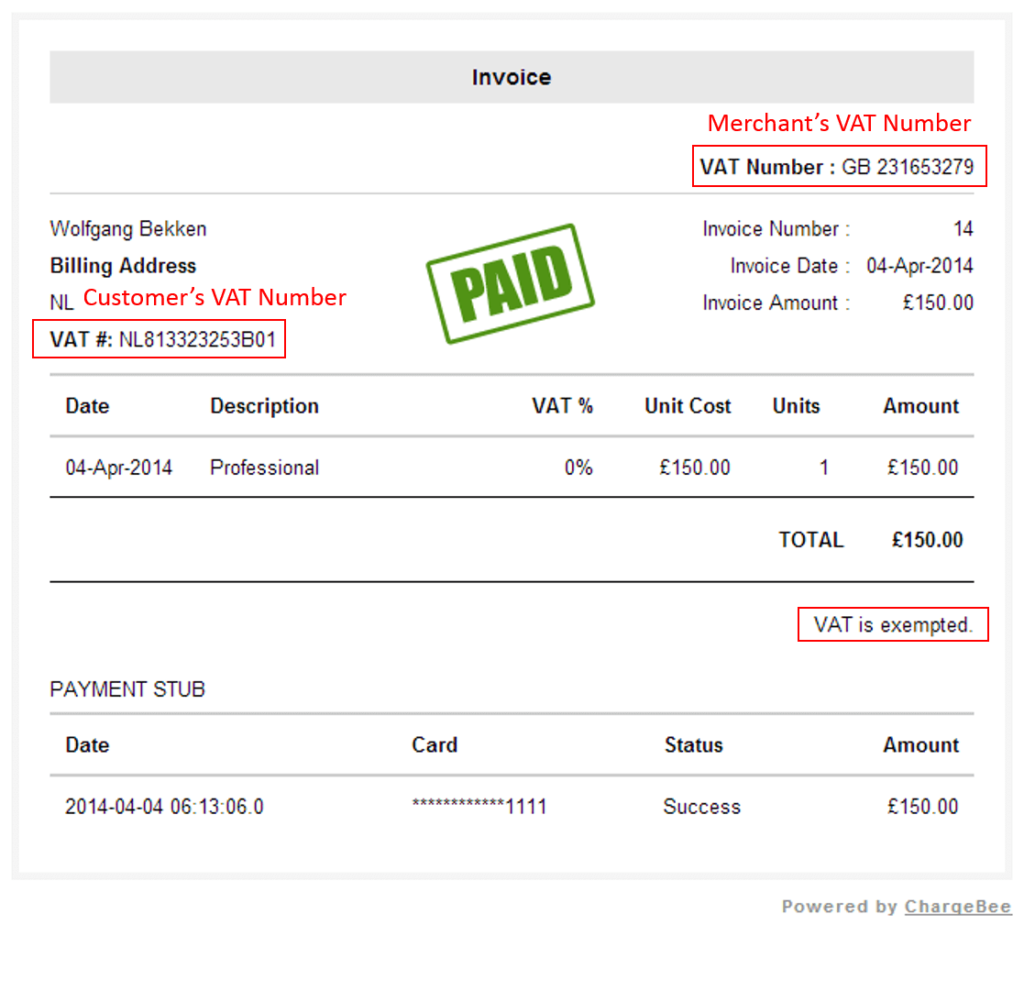

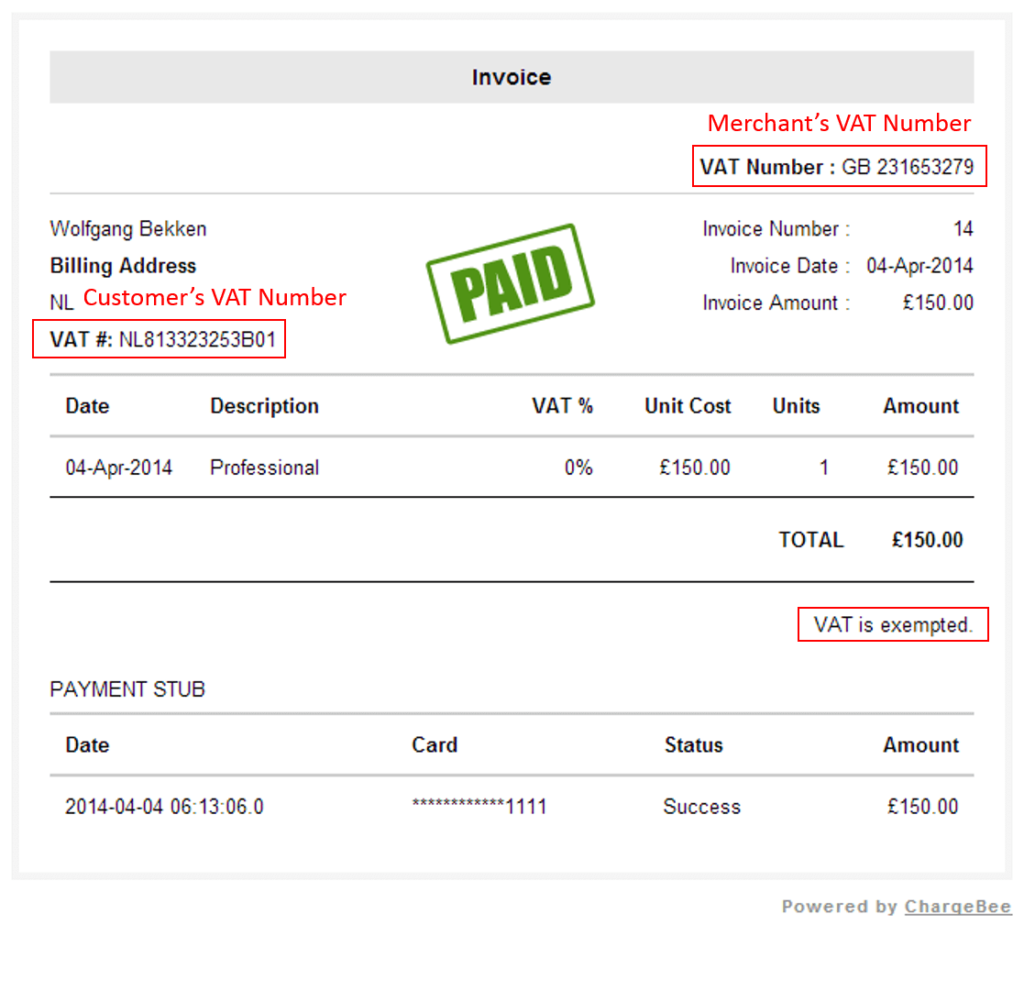

VAT Number atau Nomor Pajak Value Added adalah nomor identifikasi pajak yang diberikan oleh pemerintah pada bisnis yang diwajibkan untuk mengumpulkan pajak nilai tambah dari pelanggan dan membayarkannya pada negara. VAT Number biasanya diberikan pada bisnis yang telah mencapai batas omset tertentu. VIES (VAT Information Exchange System) is a search engine (not a database) owned by the European Commission. The data is retrieved from national VAT databases when a search is made from the VIES tool. Standard Type: 10% Zero Rated - 0% Exempted - 0% 1. 10% Standard Type- ( All other taxable goods and services- general Rate For domestic delivery) The goods which are delivered by taxable organizations. Providing taxable services to the accounts of taxable goods The importance of VAT numbers. Used to identify tax status of the customer. Help to identify the place of taxation. Mentioned on invoices (except simplified invoices in certain EU countries) Sometimes also known as a VAT registration number, this is the unique number that identifies a taxable person (business) or non-taxable legal entity that.

VATnumber. What is that and how to get it? CloudOffice

The VAT Identification number identifies all companies in the European Union and is indispensable for intra-European trade. It can be obtained by registering vor VAT. When trading within the EU (intra-community supply/service) a VAT ID for making sure that taxes are paid is mandatory. So the VAT ID number is then needed to identify all sellers. Syarat agar suatu penyerahan barang dan jasa dikenakan PPN, menurut Pato dan Marques (2014), harus memenuhi lima syarat kumulatif sebagai berikut. Pertama, PPN dikenakan atas transaksi penyerahan, baik penyerahan barang maupun jasa, yang masuk dalam ruang lingkup penyerahan yang dikenakan PPN. Kedua, penyerahan tersebut harus memiliki "nilai. What is VAT tax in Indonesia? Value-Added Tax (VAT) is the tax imposed on most products and services in Indonesia. It is the consumption tax applied to each of the production stages up until the final stage, which is selling the product. VAT rates in Indonesia The VAT rates in Indonesia are as follows: the value of transactions with buyers in Indonesia exceeds IDR 600,000,000.00 in 1 year or IDR 50,000,000.00 in 1 month; and / or the amount of traffic or access in Indonesia exceeds 12,000 in 1 year or 1,000 in 1 month. The applicable VAT rate is 10 percent.

Handling VAT Identification No. and Group VAT ID AppVision Kft.

Validation results include company's name and address, if provided. You need company's tax identification number (TIN), which is also used to check VAT registration status. Enter Thai TIN in the following format: TH and number that can have 13 digits. Please note that prefix TH is added for convenience. VAT adalah pungutan atau pajak yang dikenakan dalam setiap proses produksi maupun distribusi barang. Jika ditilik dari singkatannya, VAT adalah singkatan dari Value Added Tax atau Goods and Services Tax (GST) atau yang lebih sering dikenal sebagai Pajak Pertambahan Nilai (PPN) di Indonesia.

Berikut ini adalah beberapa cara untuk mendapatkan VAT Number: 1. Registrasi di Kantor Pajak: Langkah pertama yang harus dilakukan adalah mendaftarkan perusahaan Anda di Kantor Pajak terdekat. Anda perlu mengisi formulir aplikasi dan menyertakan dokumen-dokumen yang diminta oleh Kantor Pajak. The rate of VAT for the supplies made by Zoom to customers in Indonesia (i.e., digital services) is currently 11%. Generally, VAT is collected by the business operator who supplies goods or services to its customers. The VAT is invoiced by the supplier along with the transaction price and collected from the customer.

VAT Produk Digital Luar Negeri Berlaku Agustus 2020 Klikpajak

1. Look at an invoice or insurance document to find a VAT number. If a company uses VAT taxes in their prices, they'll usually list the company's VAT number somewhere on the document. Check for VAT numbers near the letterhead on top of the page or by the information at the bottom. What is a VAT number and how can I get one? Getting a VAT number means obtaining a tax identification number in a foreign country to carry out trading taxable activities. You should not confuse getting a VAT number with setting up a branch (permanent establishment) or incorporating a subsidiary.