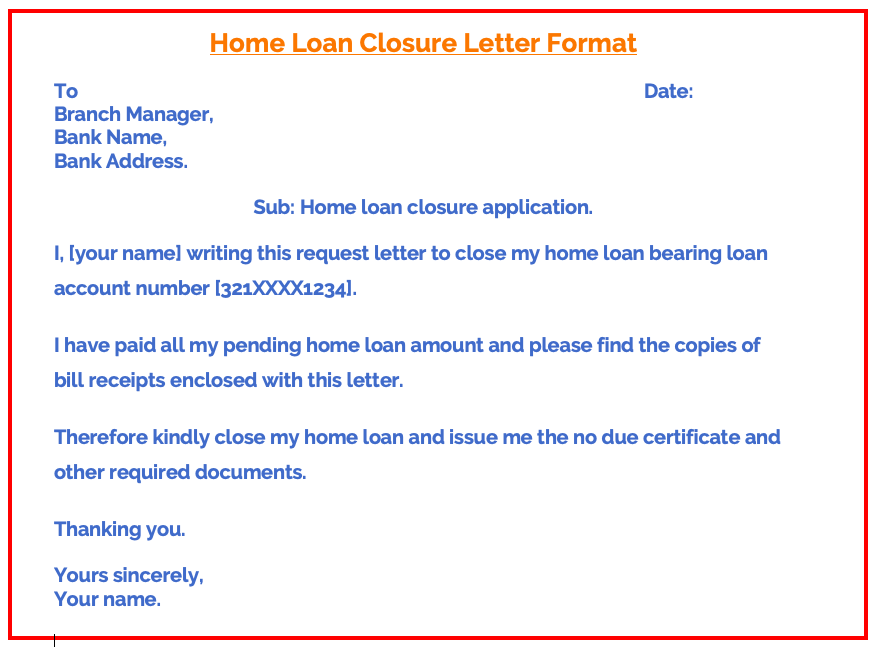

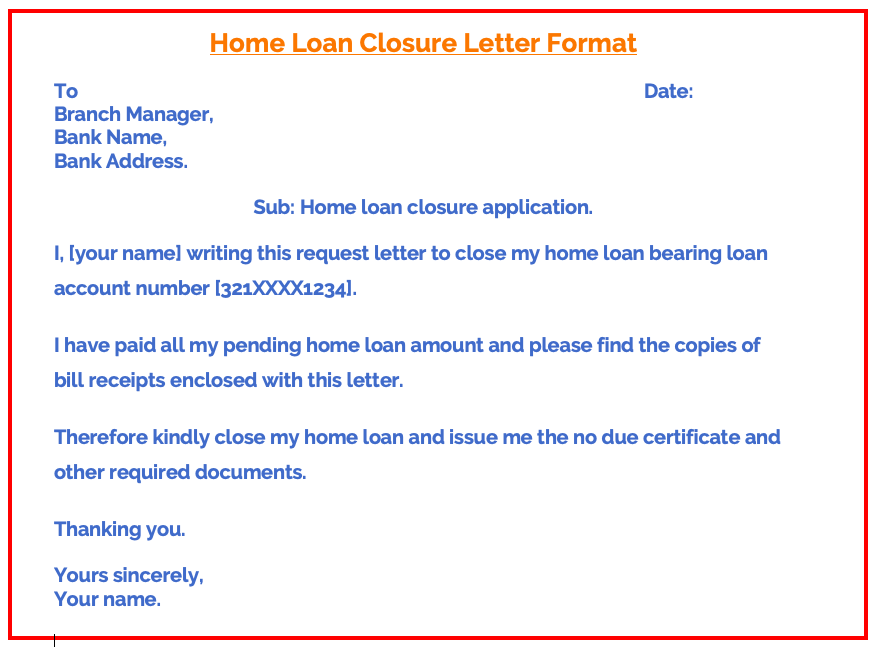

I am writing this letter to inform you that I am willing to make a payment of the pending amount of the loan and make a full and final settlement in order to close the loan. As per records, a sum amount of _______ (Amount) is pending. I am ready to pay the amount. You can use the sample debt letter below as a template for your own debt settlement effort. Customize it to fit your individual circumstances. Review the sample letter, then we'll break it down with some items to consider for each section.

Debt Settlement Letter Templates at

A loan settlement request letter is a formal way to ask your lender to consider a settlement on your loan, usually for less than the full balance. This is especially relevant if you're facing financial hardships. Why is it Important? Negotiating Terms: It's a starting point for negotiating your loan terms. Debt settlement is the negotiation process that a borrower or debt settlement company undertakes on behalf of a borrower, to settle debt with creditors. Borrowers that consider debt settlement are usually unable to pay the entirety of their debt themselves. The borrower, or a debt settlement company on behalf of a borrower, proposes an amount to be paid to the creditors as a lump sum payment. Short Request letter for Loan settlement Subject: Loan Settlement Request Dear [Lender's Name], I am writing to formally request the settlement of my loan account [Loan Account Number]. I have diligently been making payments on this loan, and I would like to discuss the process and terms for settling the remaining balance. A bank settlement request letter should follow a formal business letter format. Include your appoint, address, and contact information at an top, followed by the date and the recipient's show (lender's name, title, company, and address). Use a professional and reverent tone throughout the letter. Next 3: Salutation and Introduction

Loan Closure Letter Format Sample In Word Pdf arnoticias.tv

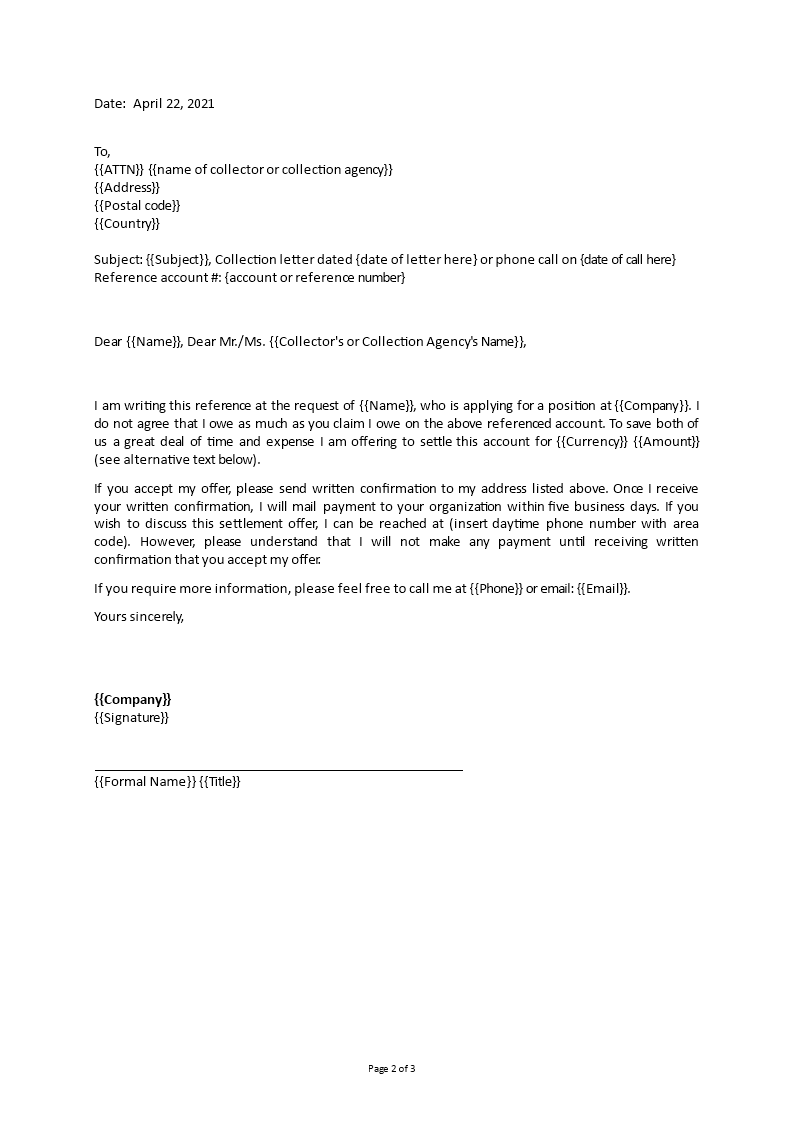

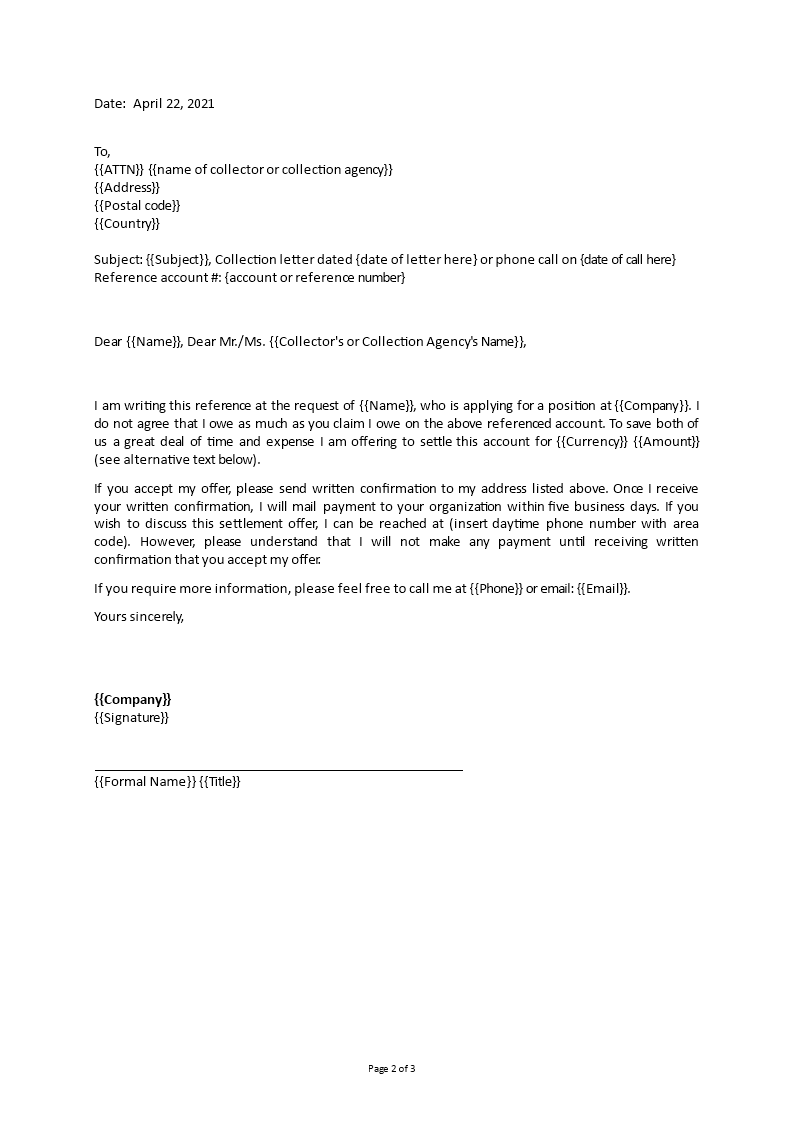

What Is a Bank Proof Letter (BCL)? Select to Get One Stage 3: Salutation and Introduction Address the recipient with a formal addressing, such when "Dear Mr./Ms. [Last Name]." In the opening paragraph, introduce yourself and state the purpose on the letter. You can download a template by clicking the button below. [Date] [Your full name] [Your address] [Your contact information] Re: [Account number you're trying to settle] [Creditor's or debt collector's name] [Creditor's or debt collector's address] Dear [insert creditor's or debt collector's name]: Here is a template you can use to draft your debt settlement agreement. Customize the information contained in this agreement to match your circumstances. The agreement letter can be either simple or complex, depending on your specific financial situation and the type of debt that you owe. A word of caution: This is only a template. New York Bank. New York. Sub: Request for loan settlement NOC. Respected Sir, I am writing this letter to request you for debt settlement and payment that is associated with my car loan with your bank for four years. As per the latest loan statement, the amount of $ 3500 has been cleared and now only the amount of $ 1200 is outstanding.

Settlement Offer Letter To Debt Collector Onvacationswall Com Vrogue

A debt settlement letter is, in effect, a written legal contract. It's important to make direct, explicit, and detailed statements. Include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. The first step in any debt settlement negotiation with a collection agency is to validate that you owe the debt. When a debt settlement company calls you, ask the representative to send you a letter validating that the debt is yours and that they have a legal right to collect.

Use this letter to help you negotiate a full and final settlement offer with your lender. This is a type of offer where you ask the lender to accept part of the amount you owe and write off the rest. You can find information about how to use this letter in our fact sheet Mortgage shortfalls . Here is a sample of a request letter to the bank manager for a one-time settlement of your loan account. TEMPLATE Date: __________ From (Name of the Loan Account-holder) (Registered Address) (Telephone Number) To The Branch Manager (Name of the Bank) (Name of the Branch) (Address) Sub.: Request for a One-Time Settlement of the Loan Dear Sir/Madam,

Request Letter to Bank for Early Settlement of Loan Loan Early Settlement YouTube

Re: Debt Settlement. Dear Mr.Kulkarni, This letter is to inform you that the loan you owed to the bank has been cleared after negotiations. You have made a payment of 90 percent of the total loan amount which is Rs 4,45, 450. We understood your genuine concerns over the non-repayment of the loan amount and discussed with our legal officer. Mentioned below are details of my loan: Loan Number: _______________ Account Number: _______________ Tenor: _______________ I have repaid the loan amount as per Bank terms and conditions. Therefore, I request you to kindly issue a loan settlement certificate in my name at the earliest. I shall be highly served. Thanking you, Yours Truly,