Overview: American Express® Business Line of Credit offers credit from $2,000 to $250,000. The minimum draw amount is $500 for three- and six-month loan terms if your balance is greater than $500. A small-business loan is a source of capital that can help you stock your shelves, buy new equipment or expand your footprint. Business owners can access funding through traditional banks,.

Bank Ads on Behance

Low-interest business loans are available from bank, SBA and online lenders. You'll need good credit and strong finances to qualify. How much do you need? See Your Loan Options with Fundera. These loans provide a way for business owners to get the capital they need to scale up their businesses — or just cover operating expenses in slow seasons. The trouble? Getting those loans. Small business loans let eligible business owners borrow funds to cover company-related purchases and operating expenses. Whether you're just starting your business or trying to grow, the. Business Advantage Term Loan An unsecured term loan with no collateral Receive funds as a one-time lump sum Competitive interest rates Fixed payments over the life of the loan Qualifications Personal credit above 700 FICO ® Score is typically required 2 years in business $100,000 in annual revenue Apply now Learn more Compare loan options

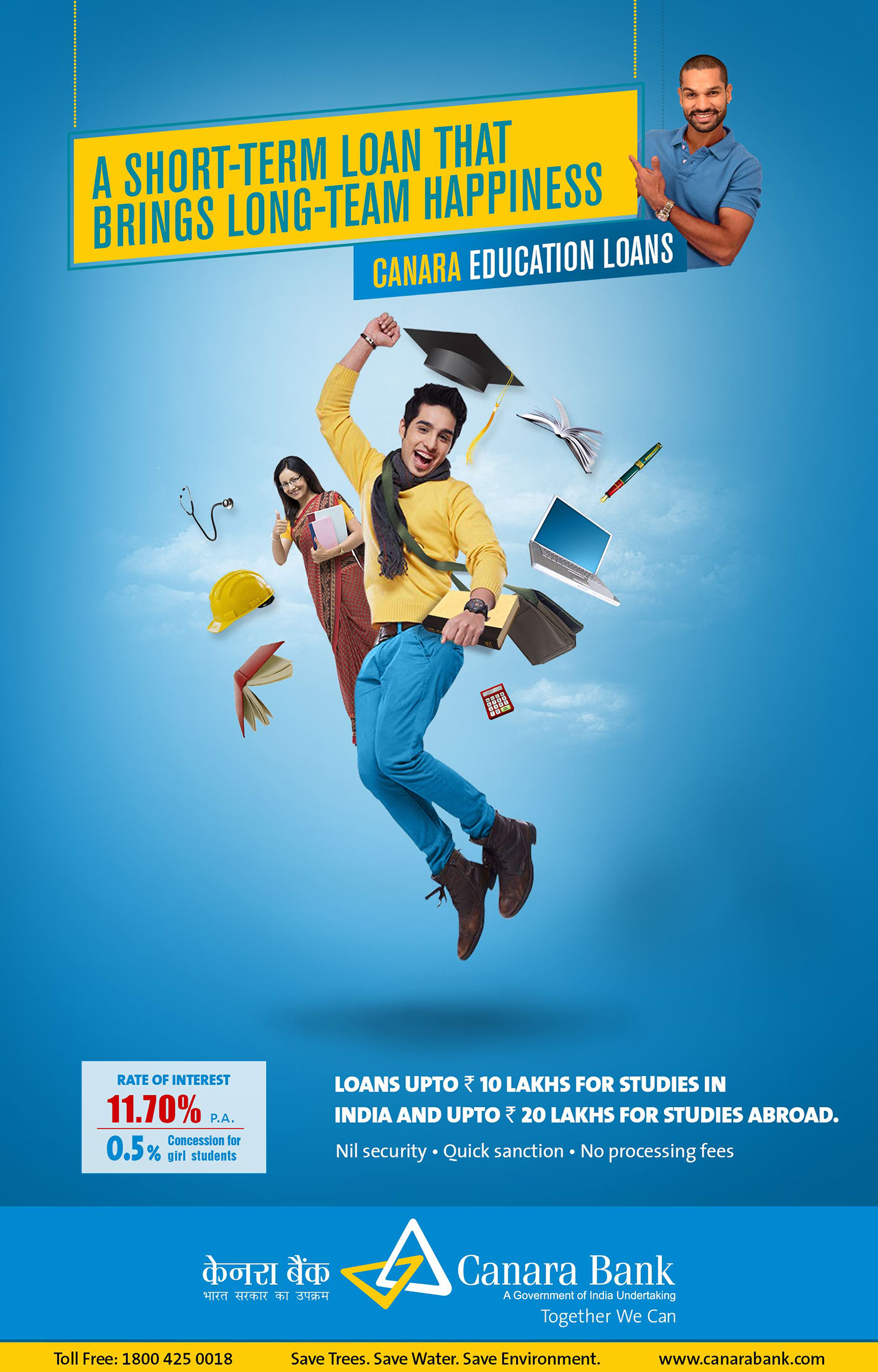

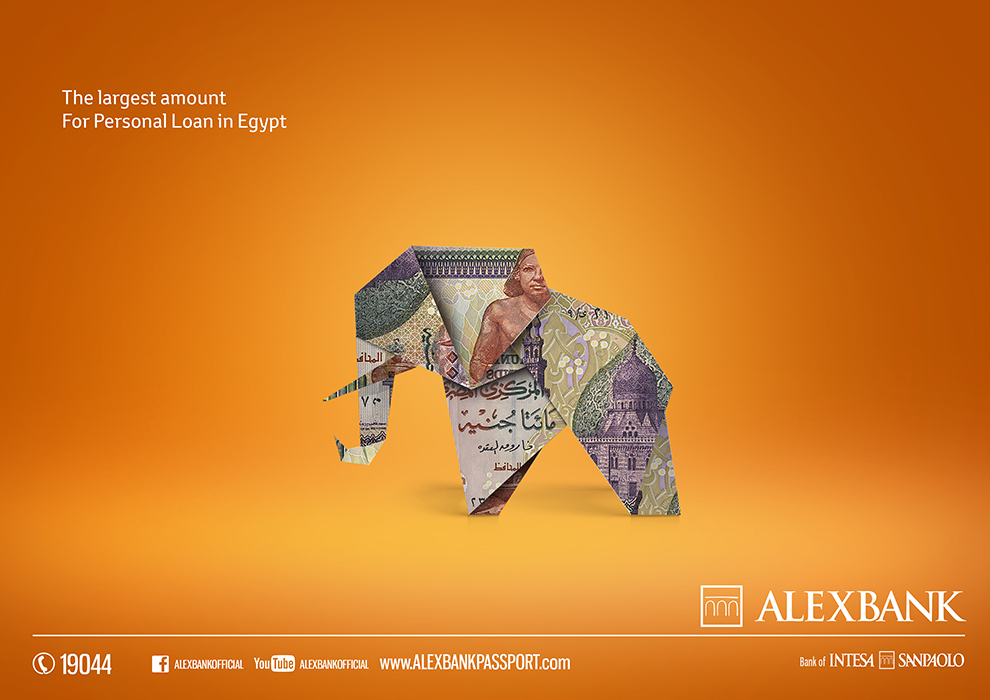

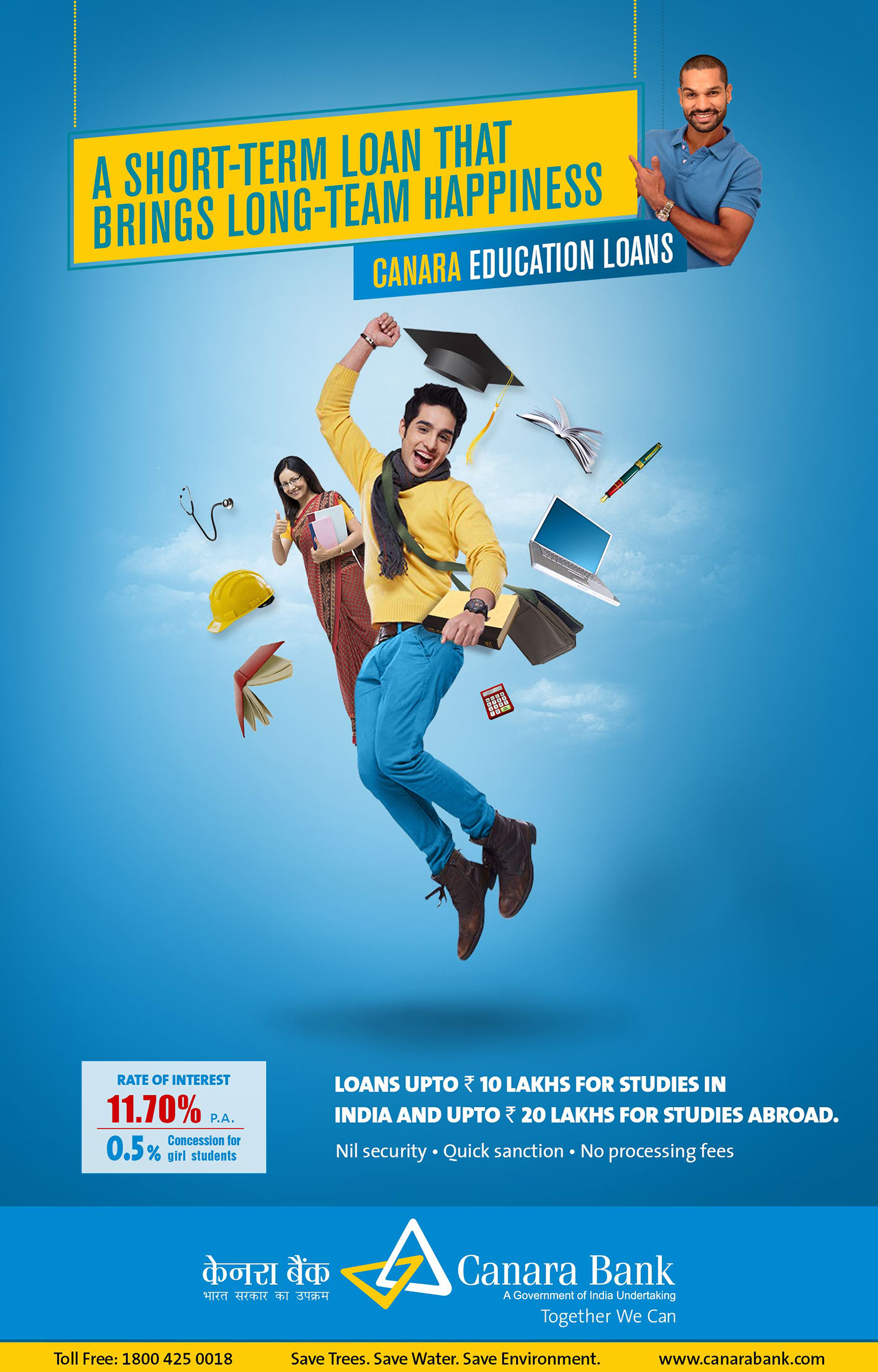

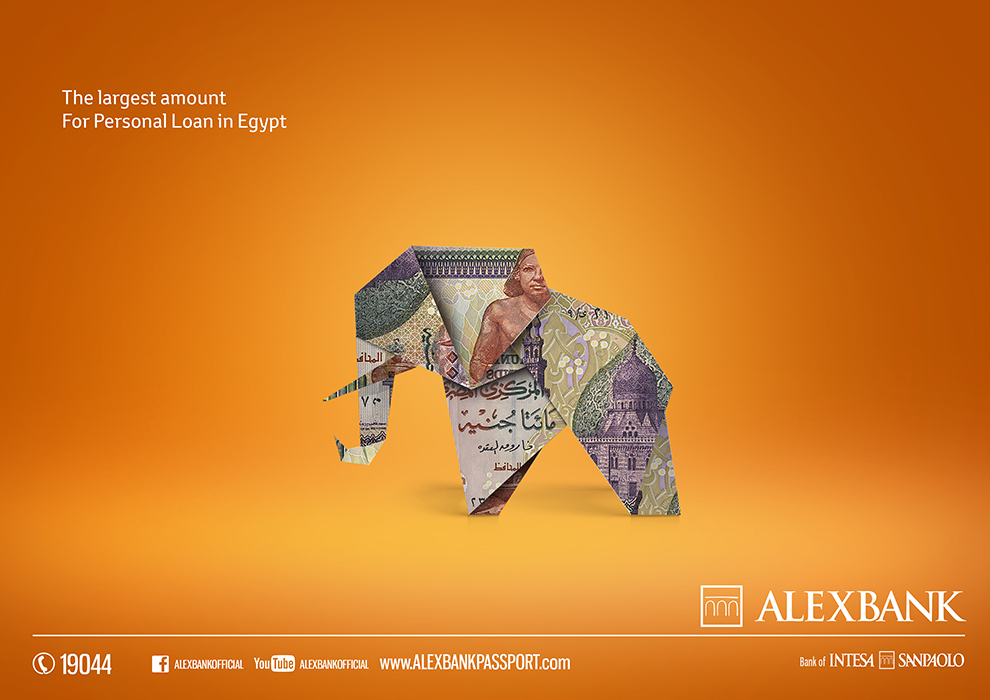

30 Creative Financial Services Ad Examples for Your Inspiration Banks advertising, Home loans

Small business loans can help launch your startup, cover overhead costs, purchase equipment, refinance debt — and more.. Bankrate.com is an independent, advertising-supported publisher and. The SBA's flagship 7(a) loan program also offers financing that borrowers can use to start businesses. But SBA 7(a) loans are tougher to get. The loans typically go to established businesses. Compare multiple loan offers to get the best deal. In addition to considering interest rates, repayment terms and fees, read all the details and disclosures associated with each loan you are. A business loan can help you purchase inventory, free up cash flow or even open a site or storefront. As of the second quarter of 2023, the average fixed rate for a business term loan sat at 7.31% - although rates on business loans can range anywhere from 3% to 60% and up.. Even lenders advertising unsecured business loans may require a.

Artisans' Bank small business loan ads Business Loans, Business Finance, Banks Advertising

Bottom line: Lendio offers the best loans for most small-business owners. As a lending marketplace, Lendio partners with more than 75 lenders. Just fill out its 15-minute application, and within 72 hours, Lendio will get back to you with a list of loan offers. Pick your favorite option, finalize your application, and enjoy your new loan. Best bad credit small business loans. Best for next-day funding: OnDeck. Best for microloans: Kiva. Best for borrowing higher amounts: National Funding. Best for secured loan options: Greenbox.

SBA 7 (a) real estate loan: Can borrow up to $5 million for up to 25 years towards real estate-related purchases and expansions. SBA 504 real estate loan: Loan amounts of up to $12.375 million for. To find the cost of a loan that uses factor rates, multiply the factor rate by the principal to determine how much you pay back. For example, if you have a factor rate of 1.30 on a loan of $10,000.

Creative Bank Loan Ads Advertisement Ngiklan

What is a Marketing Business Loan Used For? A marketing business loan is designed to pay for some or all of your marketing strategies. The strategies you use will depend on your unique business, target audience, and goals. Several examples you should consider include: But note that many lenders don't disclose the upper end of their rate range — so the rate you're offered will be significantly higher if you have poor credit. Business loan. Interest rate.