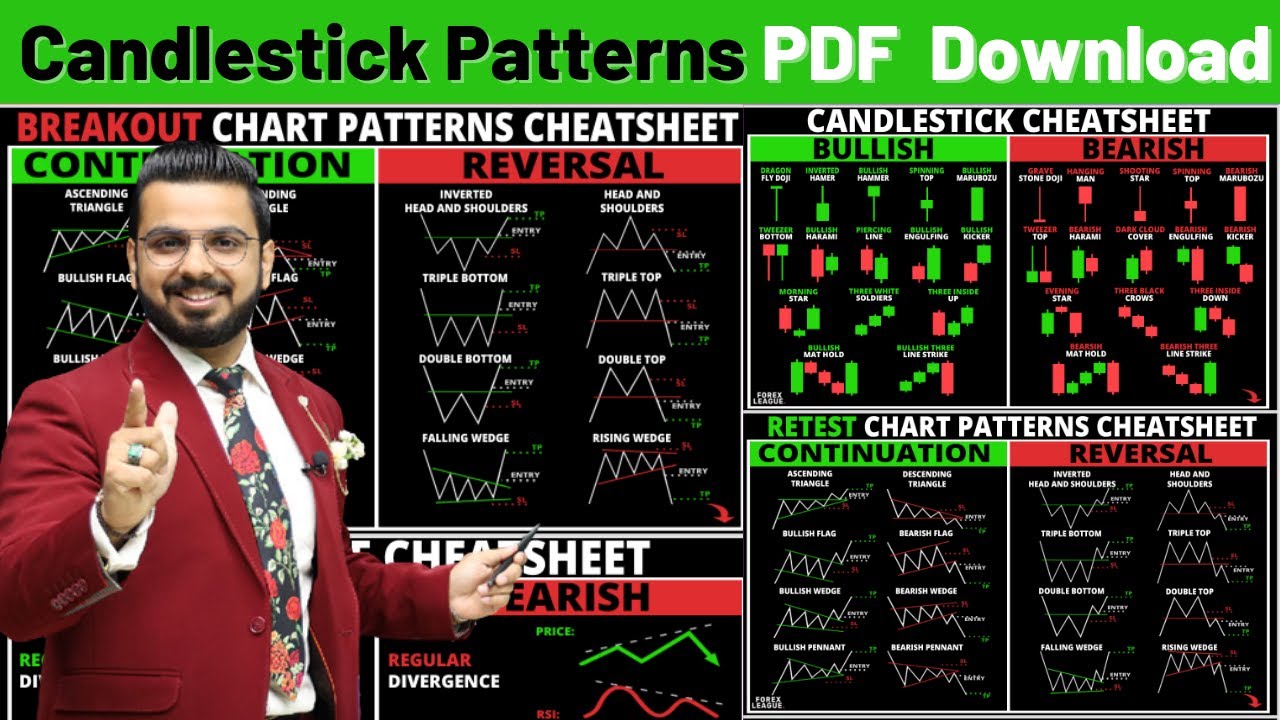

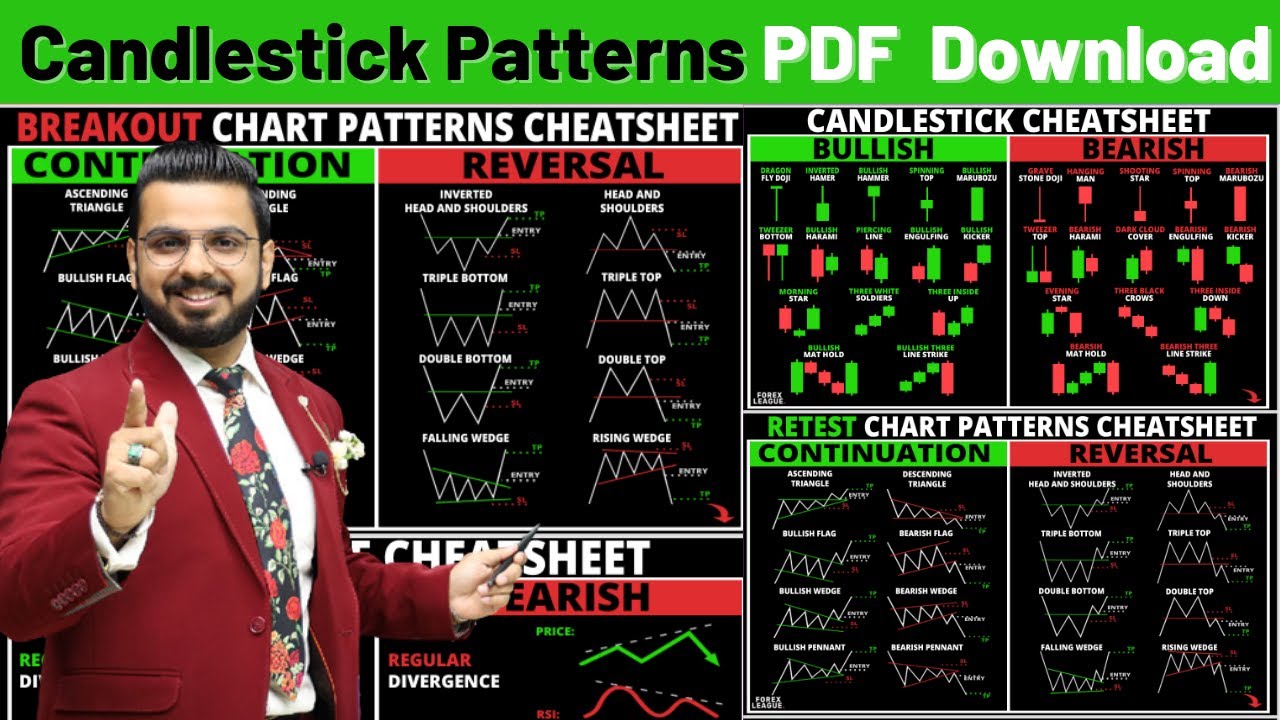

This is a short illustrated 10-page book. You're about to see the most powerful breakout chart patterns and candlestick formations, I've ever come across in over 2 decades. This works best on shares, indices, commodities, currencies and crypto-currencies. By the end you'll know how to spot: Table of Contents 35 Powerful Candlestick Patterns PDF Overview Introduction To Candlestick A candlestick is a tool used in technical analysis to represent the price movement of a stock, commodity, or currency with open, close, high, and low. One candlestick includes four data points: high, low, open, and close.

Candlestick patterns dictionary Candlestick patterns, Candlesticks, Stock chart patterns

1. An indication that an increase in volatility is imminent. This affords traders. the opportunity to create trades that speculate not so much on direction, but rather on an increase in volatility on a breakout in any specific direction. 2. In the context of a trend, a harami/inside bar can be indicative of exhaustion. Agenda Trading Patterns Construction of Common Chart Patterns Understanding Patterns and Their Limits Defining Patterns A pattern is bounded by at least two trend lines (straight or curved) All patterns have a combination of entry and exit points Patterns can be continuation patterns or reversal patterns If you find it more convenient to print out your learning materials, here's our printable candlestick patterns cheat sheet in PDF form. Download PDF. Candlestick chart basics. A candlestick chart is a type of price chart used to describe the price movements of stocks, derivatives, commodities, cryptocurrencies and other tradeable assets. QUICK REFERENCE GUIDE CANDLESTICK PATTERNS BULLISH BEARISH BEARISH Hanging Man Bearish single candle reversal pattern that forms in an up trend. Shooting Star Bearish single candle reversal pattern that forms in an up trend. BEARISH Bearish Engulfing Bearish two candle reversal pattern that forms in an up trend. Bearish Harami

Candlestick Pattern Cheat Sheet Bruin Blog

Dragon Fly DOJI - A Doji with the open and close at the bar's high. Long Legged DOJI - A Doji with long upper and lower shadows. The Individual Candles. Spinning Top - A bar with a small body and small range, after a multi-bar move. High Wave - A bar with a small body and wider range, after a multi-bar move. A candlestick is a chart that shows a specific period of time that displays the prices opening, closing, high and low of a security, for example, a Forex pair. It is a fundamental component of technical analysis because it can help you understand the movement of the market at a glance. Unlike the previous two patterns, the bullish engulfing is made up of two candlesticks. The first candle should be a short red body, engulfed by a green candle, which has a larger body. While the second candle opens lower than the previous red one, the buying pressure increases, leading to a reversal of the downtrend. 4. 1 The Trading Triad Candlestick patterns give you very specific turning points, or reversals. These appear in several ways: as single candlesticks, two-part patterns, or three-part patterns. On a bar chart, you look for reversals by tracking a long-term trend line or picking up on popular technical signals like the well-known head and shoulders.

Japanese Candlestick Patterns Cheat Sheet Pdf Candle Stick Trading Vrogue

Jun 4, 2021 Written by: John McDowell Trading without candlestick patterns is a lot like flying in the night with no visibility. Sure, it is doable, but it requires special training and expertise. To that end, we'll be covering the fundamentals of candlestick charting in this tutorial. 5 Single candlestick patterns ( Part 1 ) 29 5.1 Overview 29 5.2 The Marubozu 30 5.3 Bullish Marubozu 31 5.4 The Stoploss on Bullish Marubozu 34 5.5 Bearish Marubuzo 35 5.6 The trade trap 37 6 Single candlestick patterns ( Part 2) 39 6.1 The Spinning Top 39 6.2 Spinning tops in a downtrend 41 6.2 Spinning tops in an uptrend 43 6.3 The Dojis 45

Below, you can download for free our advanced cheat sheet candlestick patterns categorized into advanced bullish bearish candlestick patterns: Advanced Cheat Sheet Candlestick Patterns PDF [Download] What are Advanced Candlestick Chart Patterns? In essence, advanced chart patterns are not different from standard chart patterns. How to master any candlestick patterns in less than 60 minutes so you can avoid wasting months trying to "cramp" all the different patterns into your brain. The secret to reading candlestick patterns that nobody tells you — so you can better time your entries & exits — and even "predict" market turning points. A common mistake.

Candlestick chart patterns cheat sheet pdf aslclip

The evening star pattern occurs during a sustained uptrend. On the first day we see a candle with a long white body. Everything looks normal and the bulls appear to have full control of the stock. Tn the second day, however, a star candle occur. For this to be a valid evening star pattern, the stock must gap higher on the day of the star. December 9, 2023by AliFx Download FREE PDF 📄 Candlestick patterns are a key part of trading. They are like a special code on a chart that shows how prices are moving. Imagine each pattern as a hint about what might happen next in the stock market. History of Candlestick Charting