Site best viewed at 1420 x 768 resolution in Edge, Mozilla 40 +, Google Chrome 45 + Browse Getty Images' premium collection of high-quality, authentic Sbi Bank stock photos, royalty-free images, and pictures. Sbi Bank stock photos are available in a variety of sizes and formats to fit your needs.

SBI चेक बुक के लिए अप्लाई कैसे करे 2023 चेक बुक अप्लाई करने का 4 सबसे आसान तरीका

Find Cheque Book stock images in HD and millions of other royalty-free stock photos, 3D objects, illustrations and vectors in the Shutterstock collection. Thousands of new, high-quality pictures added every day. Step 3: After login, a new page will appear here click on Request & Enquiries option. Step 4: A drop-down menu appears.Here click on the Cheque Book Request option.. Step 5: On the next screen, all your Account details will be displayed. Select the account for which you want cheque book. (You can issue one cheque book at a time) Step 3: Choose the account for which you want to request a cheque book. There are additional drop-down menus to fill, such as the multi-city option, the number of cheque books, and the number of cheque leaves.the number of cheque books, and the number of cheque leaves. A State Bank of India customer can apply for a cheque book by visiting the bank branch or by using the Net banking facility. As per the bank's website, "You can request for a cheque book online. Cheque book can be requested for any of your Savings, Current, Cash Credit, and Overdraft accounts.

Hello Friends इस Post में हम बात करने वाले है कि कैसे आप बिना Bank गएँ, New

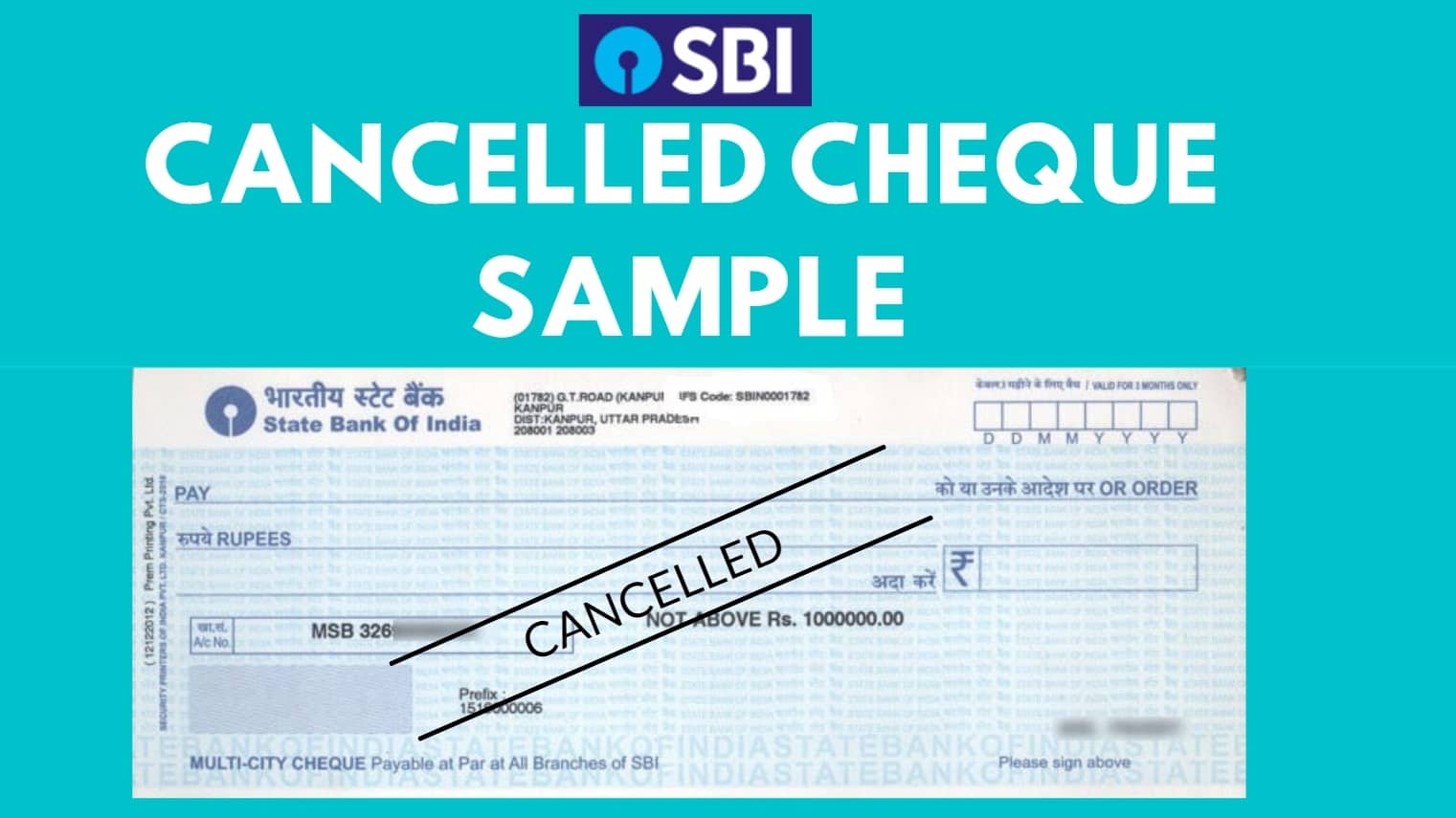

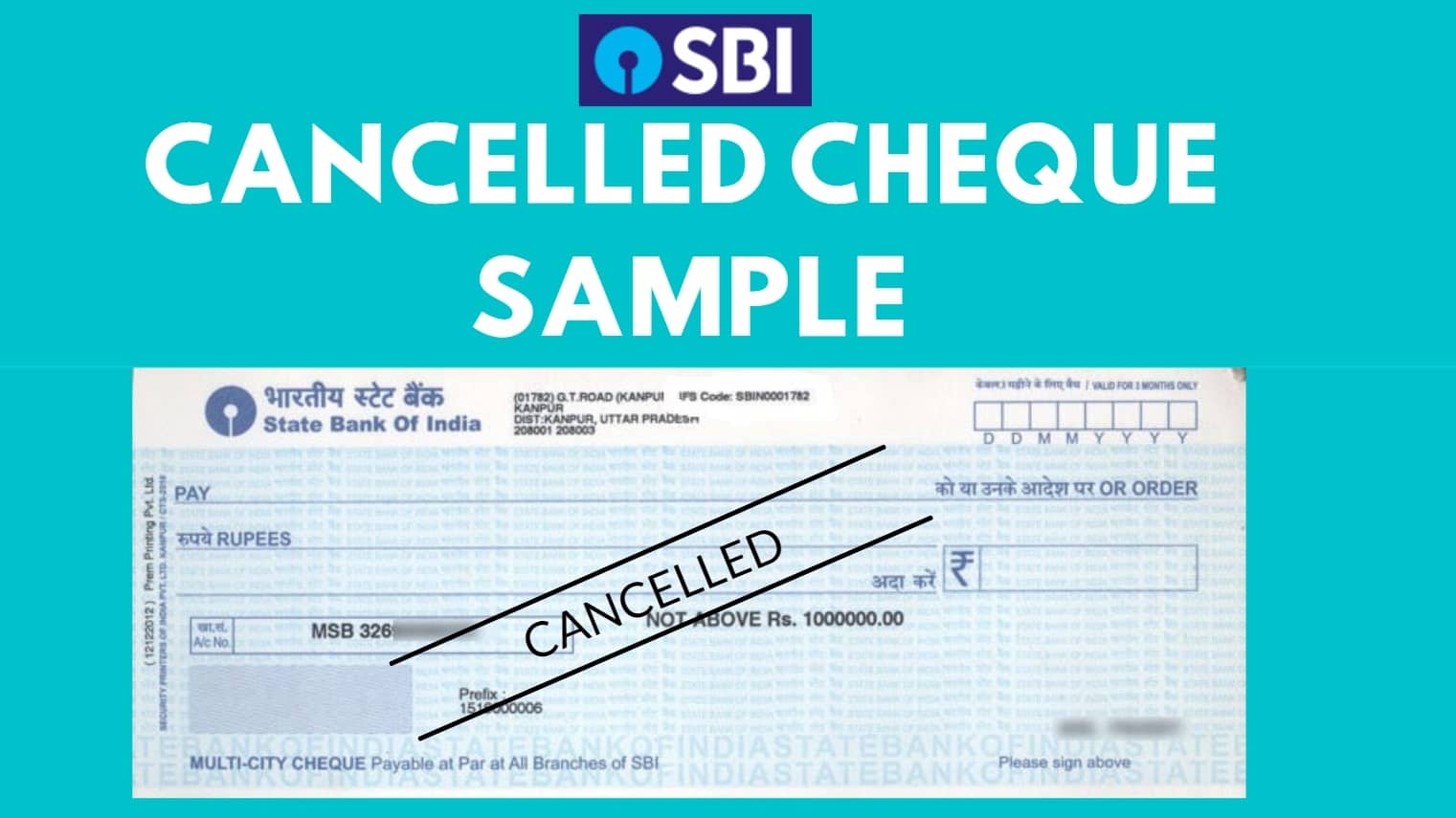

Write a Cheque in SBI: State Bank of India is undoubtedly the largest and most trusted bank in India.It provides its account holders with a variety of banking products and options. One such product is Cheque Book. While filling up SBI Account Opening form i.e., when you open a bank account in SBI, you get the option to apply for a cheque book.You can also apply for SBI cheque book at a later. While opening a new account in the State Bank of India, they usually offer a cheque book with ten leaves; If you have used all of the State Bank of India (SBI) cheque book and looking for an option to SBI request cheque book request online, you can easily make requests a new state bank of India chequebook through SMS or Online Banking. Place SBI Cheque Book Request Online through SBI Net Banking. To be able to place a SBI Cheque Book Request online through SBI Net Banking you should have this facility enabled, requesting SBI Cheque Book through Online SBI Net Banking is one of the easiest methods to get cheque book delivered to you as there will be no formality to fill up the form and in just a few clicks you will easily. What is cancelled cheque? Cancelled cheque is required for most of the bank verification document. Once you cancelled the cheque and click the image from your camera. Then forward for your financial proof.. A cancelled cheque will help you to provide information of IFSC code, Account number and branch code to fulfill and for a valid proof of it.

How to make SBI Cancelled Cheque?

New User Registration / Activation; How Do I; Customer Care; Lock & Unlock User; SBI's internet banking portal provides personal banking services that gives you complete control over all your banking demands online. Browse Getty Images' premium collection of high-quality, authentic State Bank Of India stock photos, royalty-free images, and pictures. State Bank Of India stock photos are available in a variety of sizes and formats to fit your needs.

Search the web using an image instead of text. Reverse image search engine. Search by image: Take a picture or upload one to find similar images and products. Identify landmarks, animals, even celebrities in a photo. 4 | P a g e Description of Service Service Charge 2. Issue of Multi City Cheque books: Savings Bank (SB) For all Segments Savings Bank First 10 cheque leaves free in a financial year.

SBI CHEQUE BOOK unboxing YouTube

You can transfer money from your State Bank account to accounts in other banks using the RTGS/NEFT service. The RTGS system facilitates transfer of funds from accounts in one bank to another on a "real time" and on "gross settlement" basis. This 11-digit CIF number is used by banks to decode the information of their customers about the loans, Demat, and KYC (identity proof & address proof)