A Chit fund offers you the unique advantage of allowing you to borrow from your future savings. Example: Assume a chit fund scheme with 50 members that will run for 50 months, with each paying a monthly instalment of ₹10,000/- to create a ₹5,00,000/- pot. In a chit fund scheme, a group of people contribute periodically towards the chit value for a duration equal to the number of investors (members or subscribers). The amount collected is given to the person, who is either selected through a lucky draw (lottery system) or an auction.

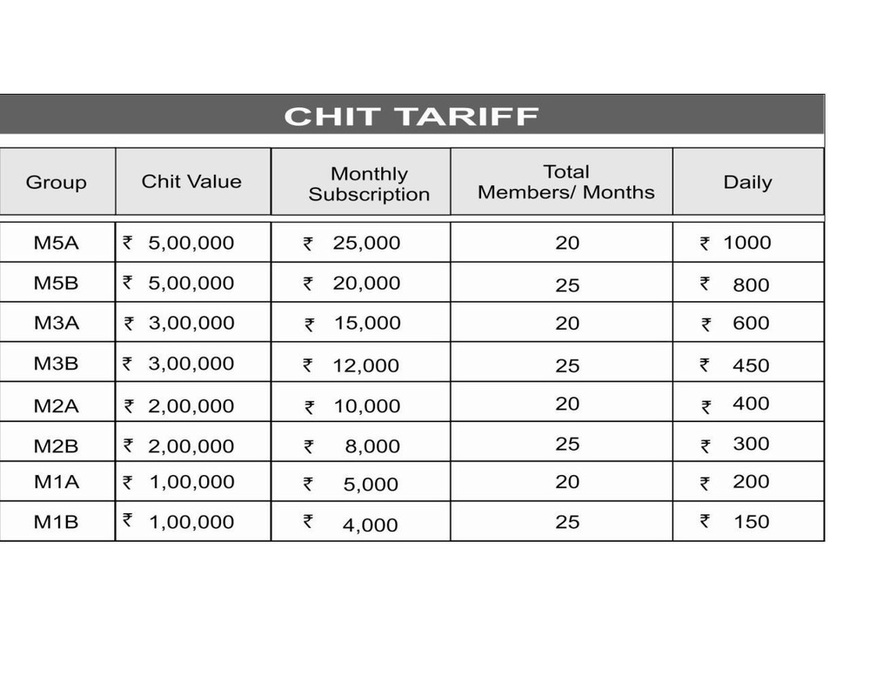

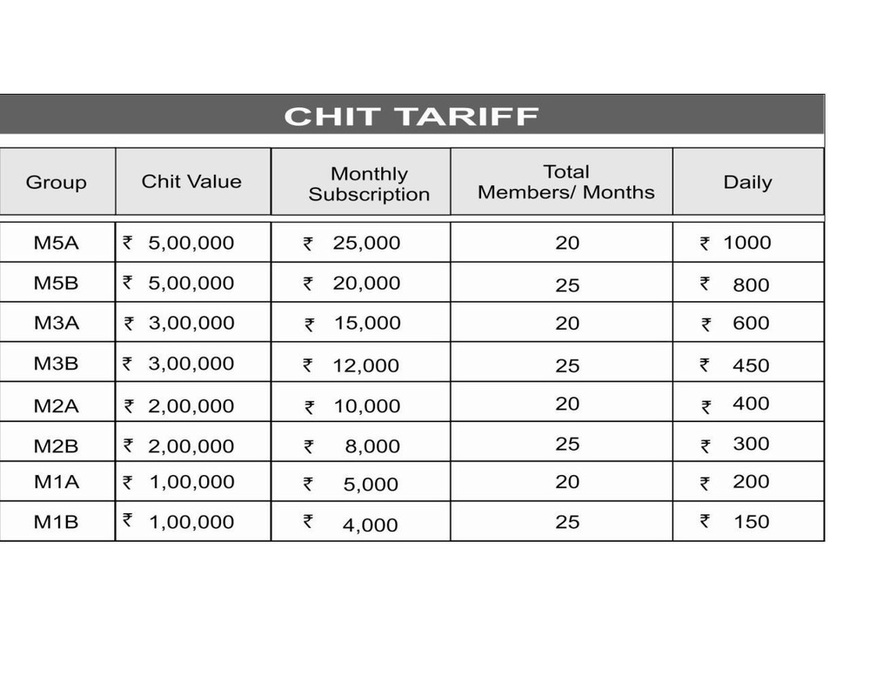

Plans MJT Chit Funds

How Does a Chit Fund Work? The following are the five stages of chit fund business model: Stage 1. Set-up The first stage involves the chit fund company launching a particular chit fund scheme, allowing people to become members of the chit. Stage 2. Chit Contribution This calculator returns the CAGR value based on Chit fund cash flows using Excel's XIRR and IRR functions. 20. No.of EMIs (once per every member i.e. 1 x no.of members) EMI (Total Chit Amount/No.of Members or EMIs) Chit Organizer commission (5% of Chit amount every month) Current Bank Interest Rate for Regular FD (Annual) 10.99. Month. EMI. Overall EMI Till that Mont. A chit fund is a financial instrument that is a combination of savings and borrowings. It has been a part of India's financial system for more than a century. At its most fundamental level, in.

Lok Sabha passed the Chit Funds (Amendment) Bill, 2019.

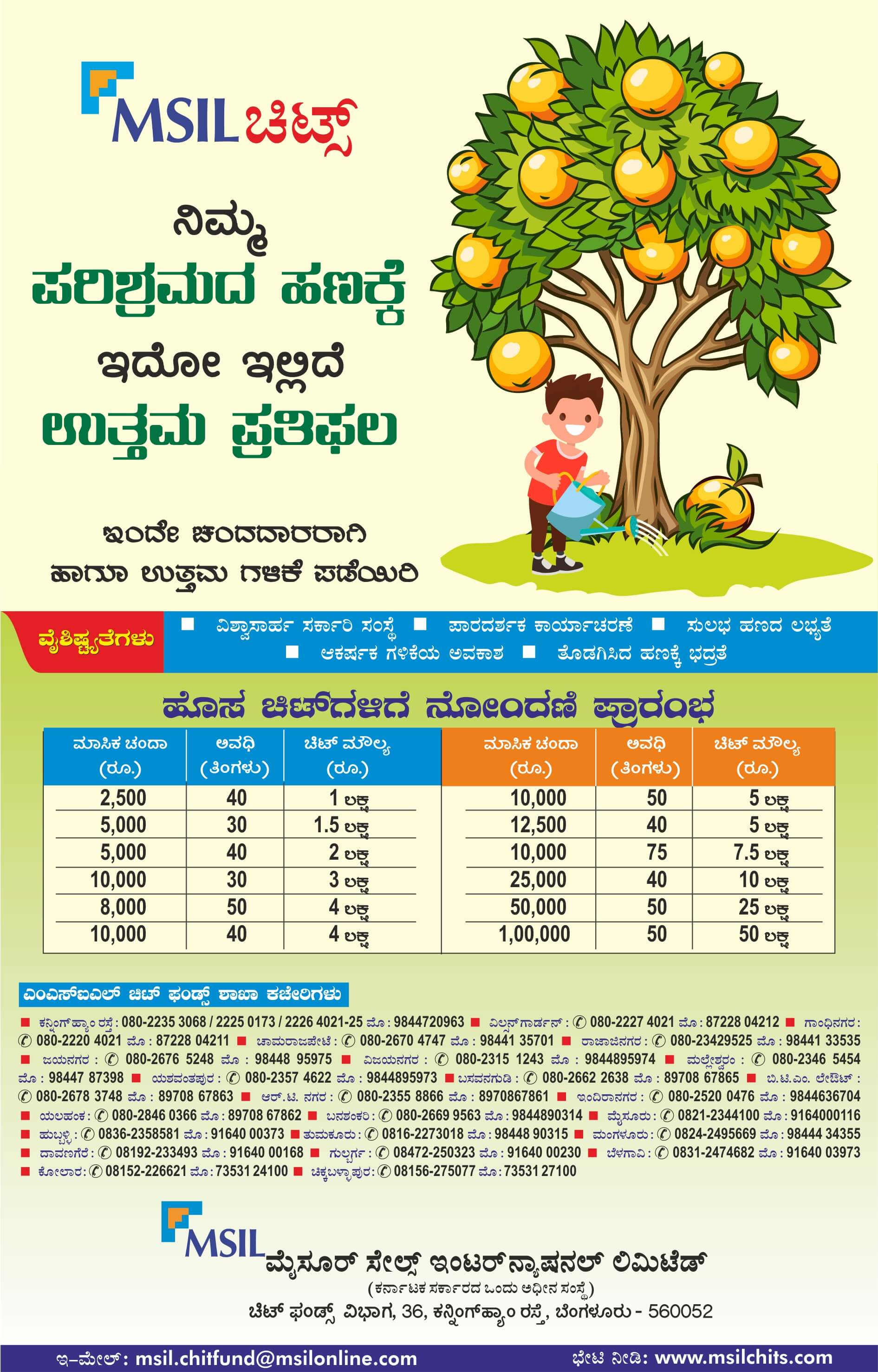

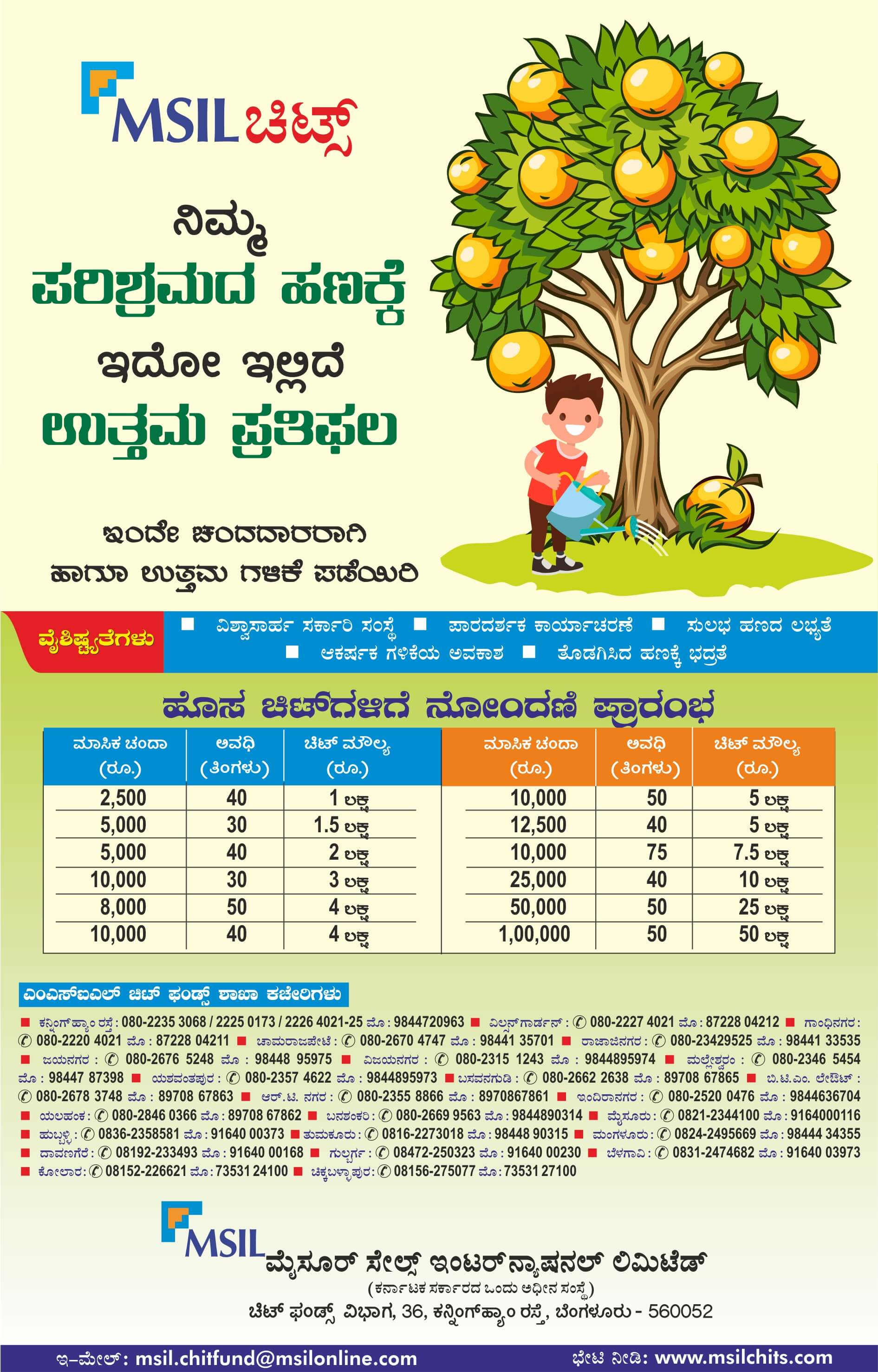

A chit fund is a type of rotating savings and credit association system practiced in India, Bangladesh, Sri Lanka, Pakistan and other Asian countries. [1] Chit fund schemes may be organized by financial institutions, or informally among friends, relatives, or neighbours. In some variations of chit funds, the savings are for a specific purpose. Chit fund Base: The way an chit fund operates amazes me. A group of people get jointly also decide to pay an equal sum of money for a few months. Each choose the group members bid on the total volume collected. Chit funds are financial instruments that people use both for savings and borrowing. It is primarily a rotating scheme that people, especially the residents of rural and semi-urban areas use in place of banking facilities. Chit funds have been a part of the financial system in our country for a very long time now. Our diverse range of chit fund schemes offers you a world of opportunities to save, invest, and grow your wealth. Join any Chit Scheme today with us! Download #KASH app on your mobile now One Step Solution for all your financial needs! We are always available and open to answer your questions and concerns. Talk to us, to have a better clarification

Brilliant Chit Fund Balance Sheet Format Excel Accounting Equation Questions For Class 11 With

Mutual Funds Chit funds are one of the most popular return-generating saving schemes in India. It is a financial arrangement in which a group of people contribute money to a fund on a regular basis. Each member of the group is eligible to receive a cash prize or loan, usually on a rotating basis. A chit fund offers the following benefits to its investors: Quick access to money: If you are in sudden need of a large amount of money, then you can do it with the help of a chit fund. No collateral required: There is no need of putting in a collateral in order to invest in a chit fund. Flexible use: Unless it's a special purpose chit fund.

Long-term wealth accumulation, capital appreciation, and achieving specific financial goals. Management. Typically managed by chit fund companies or organizers. Professionally managed by fund managers. Returns. Depend on the bidding process, with the potential for higher returns for the winner of the auction. 1. Multiple Usages. You can use these funds for various purposes such as children's education, festivals, religious ceremonies, medical expenses, travel, shopping, and marriage. 2. Low-interest rate. Bidders determine the rate of interest mutually; it differs from auction to auction.

Chits Chit Funds Chit Fund Scheme MSIL

Mentioned below are a few of the key elements of chit funds. A lump sum amount is collected from deposits made by each member. Chit funds can be a way of providing financial assistance to those in need. Compared to moneylenders and other means, a chit fund has less rate of interest. Once chit fund begins it has to register itself with the authority and submit 100% amount of chit as security amount. Suppose one chit fund start with 50 members with a monthly contribution of Rs.10,000 per month. 50 people x Rs 10,000 = 5 Lakh. The amount collected from all member in a group called as pot.