The Central Board of Trustees administers a contributory provident fund, pension scheme and an insurance scheme for the workforce engaged in the organized sector in India. The Board is assisted by the Employees' PF Organization (EPFO), consisting of offices at 138 locations across the country. Yes, you can definitely submit Form 15G online via EPFO's online portal. If you are wondering how to fill out Form 15G for PF withdrawal, follow the steps given below: Firstly, log in to the EPFO UAN portal. Then, select 'Online Services' and click on 'Claim'. For verification, enter your bank account number and click on 'Verify'.

EPFO SSA, Stenographer Recruitment 2023 Apply Application Form at epfindia.gov.in

Central Govt. Industrial Tribunal; EPF Training Institutes; MIS; नराकास; For Office Use; Miscellaneous . Ease of Doing Business; Downloads; Recruitments; Tenders / Auctions; Citizen's Charter; RTI Act; Integrity Pledge - Central Vigilance Commission; Whistle Blower Policy - CVC; Guidelines on filing of complaints with EPFO Vigilance Form 15H is for senior citizens (60 years & above) and Form 15G is for individuals having no taxable income. Form 15G & 15H are self declarations and may be accepted as such in duplicate. 4. Members must quote PAN in Form No.- 15G / 15H and in Form No. 19. FORM NO. 19 - TDS Employee withdrawal >= Rs. 30,000/- Central Govt. Industrial Tribunal;. Annexures to be attached with the claim form for withdrawal under para 68-BD of EPF Scheme, 1952 [Download 31-01-2019 (491.6KB)] Want my LIC Policy to be financed through my PF Account. Please Apply in FORM 14* 31-01-2019 (1.1MB) Want to settle my Pension Fund as I have crossed 58 years of service.. Go to Online Services. Claim (Form 31, 19, 10C) Verify Last 4 Digits of Bank Acc. Click "I want to apply for". Upload form 15G. 5. Calculate the years of service for PF Claim. The minimum years of service is 5 years doesn't mean that you have to complete the 5 years on the same organisation. If you have completed 4 years in company1 and.

Download Form 15g For Pf Withdrawal 2023 Printable Forms Free Online

Form 15G and 15H. Form 15G is a declaration that can be filled out by fixed deposit holders (individuals less than 60 years of age and HUFs) to ensure that no TDS (tax deduction at source) is deducted from their interest income in a year. As per the income tax rules, it's mandatory for banks to deduct tax at source (TDS) in case the interest. EPFO Member Portal Link - https://unifiedportal-mem.epfindia.go. EPFO Website Link - https://www.epfindia.gov.in/site_en/i.Form 15G link - https://income. Dear EPF Members !! Filing of nominations by members is mandatory as per para 33, 34 and 61 of EPF Scheme,1952. It is also required for filing online Death Claims (Form10-D, 20 and 5-IF). E-Nominations can be filed and updated by member during his/her service period. Important notice about Aadhaar linking. Click here. 1. This facility is to view the Member Passbook for the members registered on the Unified Member Portal. 2. Passbook will be available after 6 Hours of registration at Unified Member Portal. 3. Changes in the credentials at Unified Member Portal will be effective at this Portal after after 6 Hours. 4.

Download Form 15h For Pf Withdrawal 2023 Printable Forms Free Online

Know how to fill form 15G for PF withdrawal in 2021-22, and how to submit form 15G in the PF portal online.Download form 15G: https://www.incometaxindia.gov.. Validity Period: The validity period of Form 15G is for one financial year. Therefore, a new form needs to be submitted for each financial year if the individual continues to meet the eligibility criteria. Form 15G Download - Process to Follow. The EPFO online portal and all major banks' websites provide Form 15G for PF withdrawal.

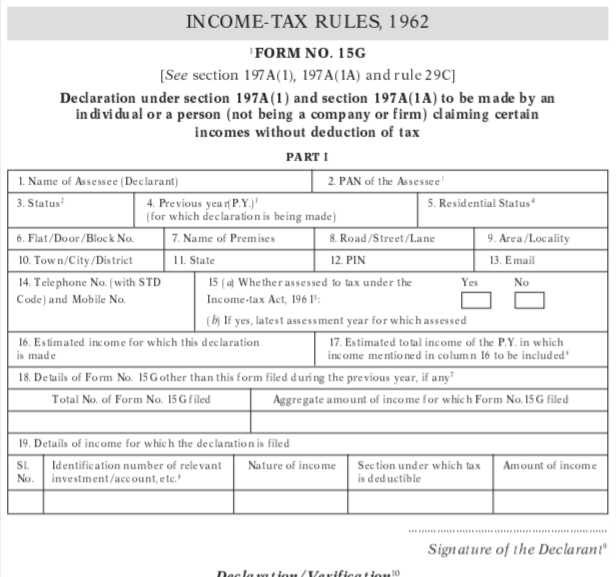

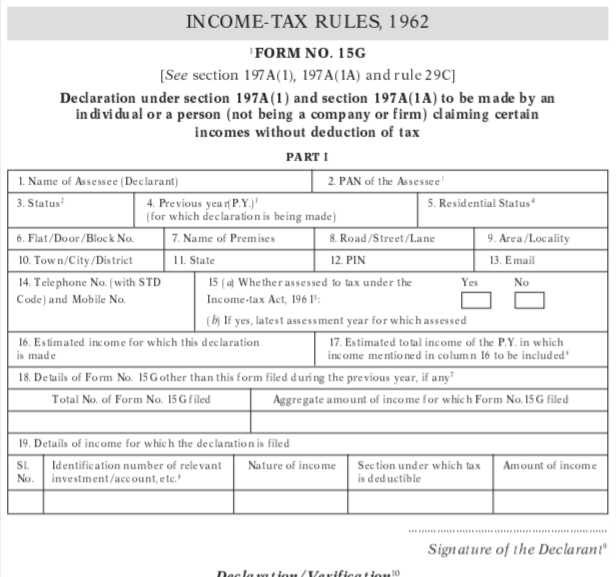

www.epfindia.gov.in 1952 Employees Provident Fund Scheme, 1952 — 19 Form -19 (UAN). Whether submitting Form 15G/15H, if applicable (YES/NO) 15Gfr/15ViT à / Please enclosed two copies of Form No. 15G/15H, if applicable 5 à àa-r / Only in case of service less than 5 years / Form 15G lets you do that. 15G Form EPFO is essentially a self-declaration form that any individual under the age of 60 or HUF (Hindu Undivided Family) can fill and submit to the Income-tax department. Under sections 197A (1) and 197A (1A), this declaration allows the applicant to claim certain incomes without tax deduction.

EPFO New Recruitment 2023 SSA & Stenographer Vacancy Notification Pdf Online Form epfindia.gov

Step 2: Once you log in, click on the online services drop-down list and find "Online Claim (Form 31, 19, 10C).". Step 3: Now, enter the last 4 digit bank account number, as shown below: Step 4: Once you verify your bank details, an EPF Withdrawal form will be displayed. Step 5: Here, you will see the option of uploading FORM -15G, Upload. Online Method. Go to the EPF portal website and do the following steps. 1-Enter your UAN and password into the UAN Member Portal. 2-From the top menu bar, pick 'Online Services' and then 'Claim (Form-31, 19,10C & 10D)' from the drop-down menu. 3-The screen will show member details.