This Online Banking Simulation allows you to see what it is like to manage your own online bank account. With OnlineBank Sim you can: View account activity for both checking and savings Look at monthly bank statements Pay bills, transfer funds, and make check deposits and more! GET STARTED NOW Here are three common bank scams and how to avoid them. 1. Automatic debit scams An automatic debit scam occurs when a scammer gets your checking account information (including the bank's.

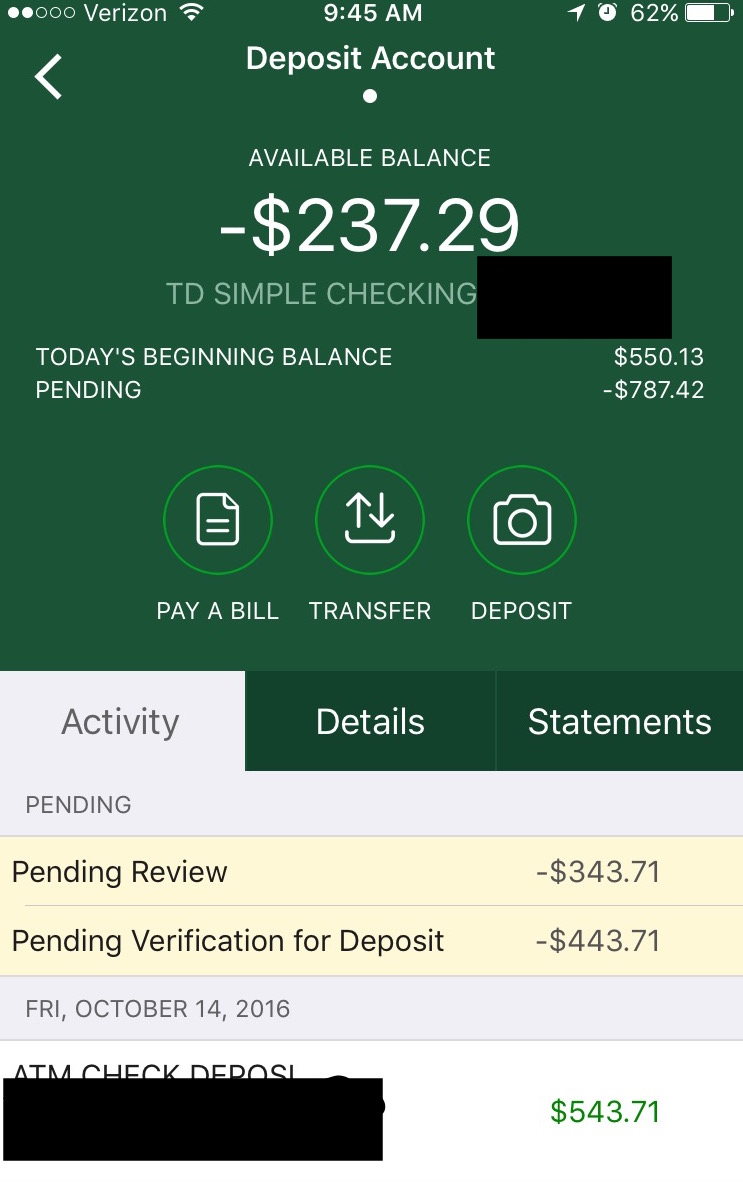

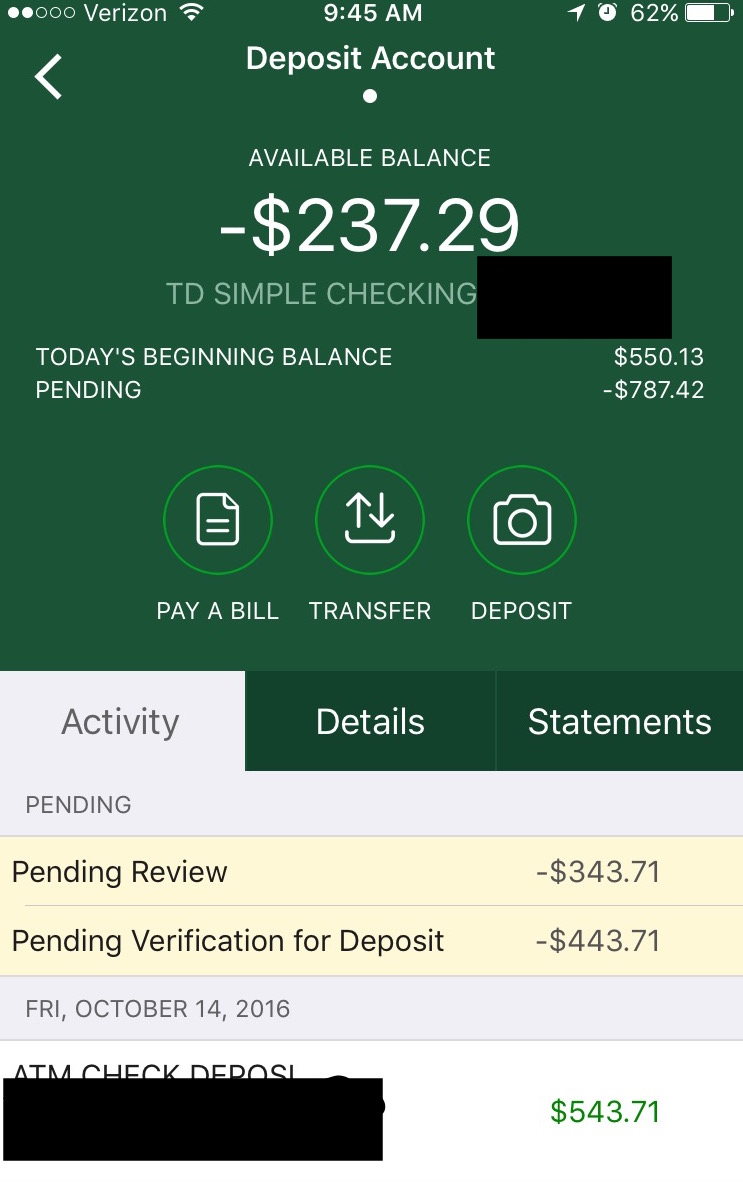

Checking Account Mobile Fake Bank Account Balance

The Online Banking Simulator is intended for demonstration purposes only. Visit our Mobile Banking Simulator Interest rate. 4%. A browser based, retro sandbox game that let's you see the impact of your financial decisions. 1. Overpayment Scams If you provide services or sell products online, you could fall victim to an overpayment scam. Overpayment scams typically begin with someone sending you a counterfeit check or. What Is A Fake Bank Account Balance? Many want to know what fake cash is in their bank account balance. In short, it's a phony bank account screenshot generated using any website or app after editing or modifying some digits or pictures. Simply put, it's the cash that appears to be real online but is fake.

Fake Cash App Balance Screenshot 500 cash app YouTube A cash app user tweeted at

Bank of America, N.A. Member FDIC ©2022 Bank of America Corporation - MAP 5700850 Additional Resources - FC Additional Resources - CC. Updated 12/2023. #1. Check for errors #2. Check your account balance #3. Check the mobile app #4. Check the SMS #5. Check your bank account statement #6. Check your email address Fake Bank Account Balance Screenshots List of Fake Bank Account Websites Fake Bank Balance App Fake Bank Pro Prank Bank FLLC fake bank account Millionaire Fake Bank Account Pro When companies or websites (fake or not) have look- or sound-alike names, the potential confusion created for consumers is real.. The victim then received an email representing their account balance as $50,580.59. However, to withdraw the money, the victim would have to pay taxes of 15% on the earnings, which 100Ex calculated to be $7,437.31. Then it handed the fraudster $19,000. Denise Denton, 41, recently received a legitimate-looking fraud alert from Chase notifying her about a $505 purchase at Walmart. The text message asked her to.

Lolz r/meth

By Amelia Jacob Posted on November 22, 2023 In the intricate web of financial transactions, the bedrock of trust lies in the authenticity of documentation. This article meticulously unveils the multifaceted dangers associated with counterfeit bank account balances, keeping a laser focus on the scrutiny of 3 Month Bank statements. 10 Best Fake Bank Account Balance Apps & Websites (2023) #1. Money Prank Pro Positive Negative #2. Fake Money Prank Positive Negative #3. FakePay - Money Transfer Prank Positive Negative #4. Money Transfer Prank - FakePey Positive Negative

The first way to spot a fake bank account balance is by looking at the account number. If the account number is not valid, then the balance is likely fake. Another way to spot a fake bank account balance is by looking at the transactions. Bank Check Generator Choose the bank number (see bellow) you like and insert it into the field "Bank": 1 - Bank Of America 2 - Citibank 3 - Chase Bank 4 - Goldman Sachs 5 - Wells Fargo 6 - CFSB 7 - VOLVE If the desired bank is not in the list, you can enter its name in the "Bank" field. Our features

Create fake bank statement template software managerlasopa

The allure of having a fake bank account balance can be enticing for various reasons. Some may be motivated by the desire to impress others or gain social status, while others may see it as a way to secure loans, investments, or even personal relationships. However, engaging in such deceptive practices is highly unethical and can lead to severe. A: Presenting a fake bank account balance can lead to severe financial fallout, including damage to financial credibility and erosion of trust. Lenders, employers, and others may sever ties upon discovering dishonesty, emphasizing the lasting repercussions of deceptive financial practices. 6. Q: How often should I review my 3-month bank statements?