Current Charges. Loan processing charge (processing fee) Upto 1% of disbursal amount (Inclusive of applicable Tax) Valuation charge. Rs 250 +applicable tax up to 1.5 lacs per packet per loan. Rs 575 +applicable tax above 1.5 lacs per packet per loan. Premature closure charges (Full or Part payment) 1% on principal outstanding + applicable tax. Yes, you can foreclose or prepay your Gold Loan. However, some charges would be applicable. For foreclosure, the charges would be 1% + GST if closed within 6 months of applying for Loan against Gold. There are nil foreclosure charges if closed after 6 months. Get instant gold loan online at HDFC Bank with lowest interest rate.

HDFC Gold Loan Interest Rates, Gold Schemes, Apply Online

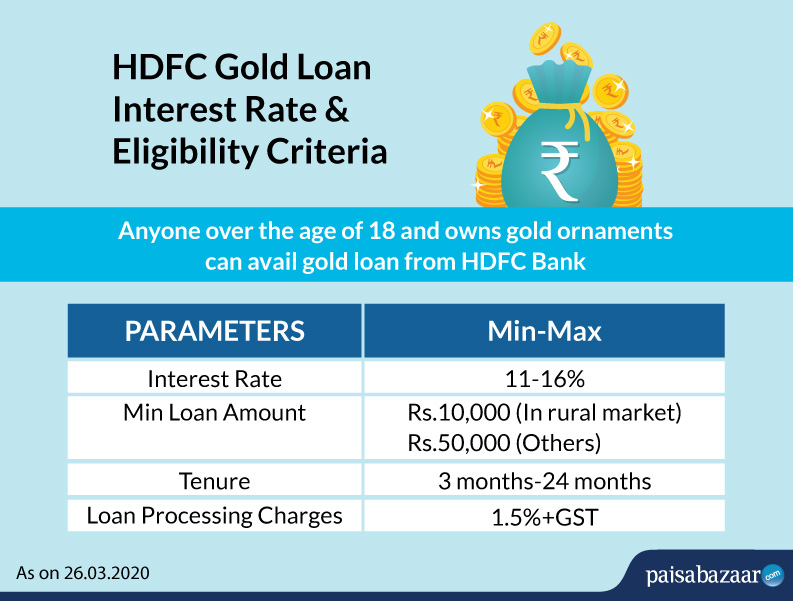

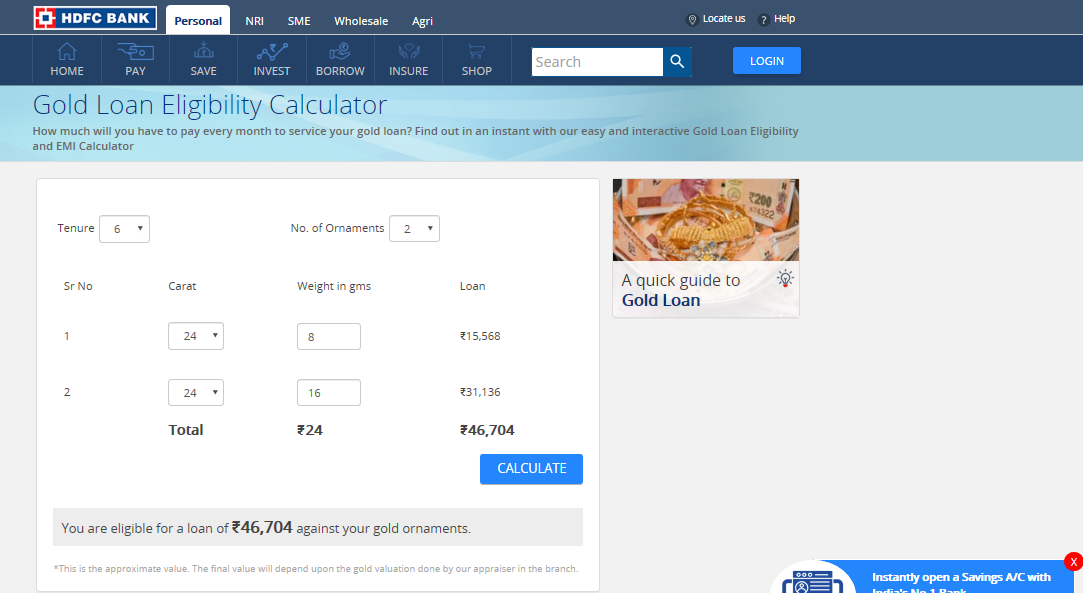

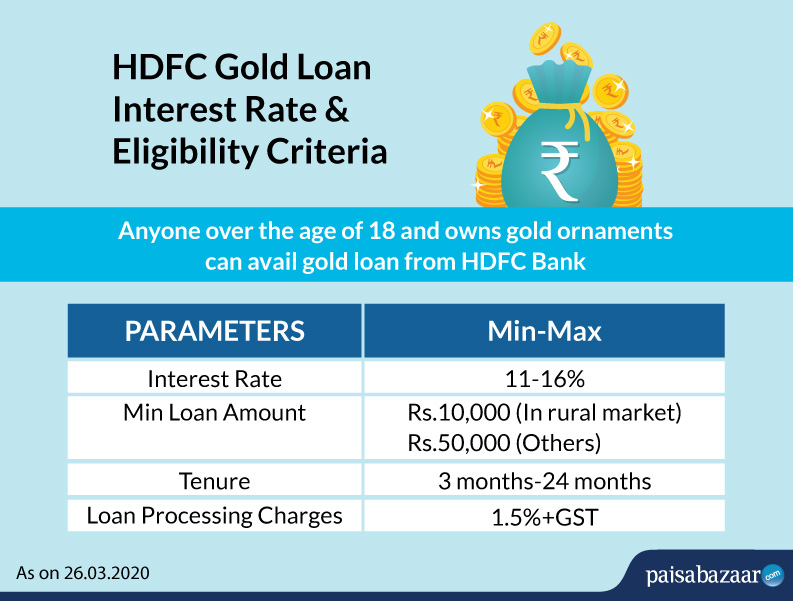

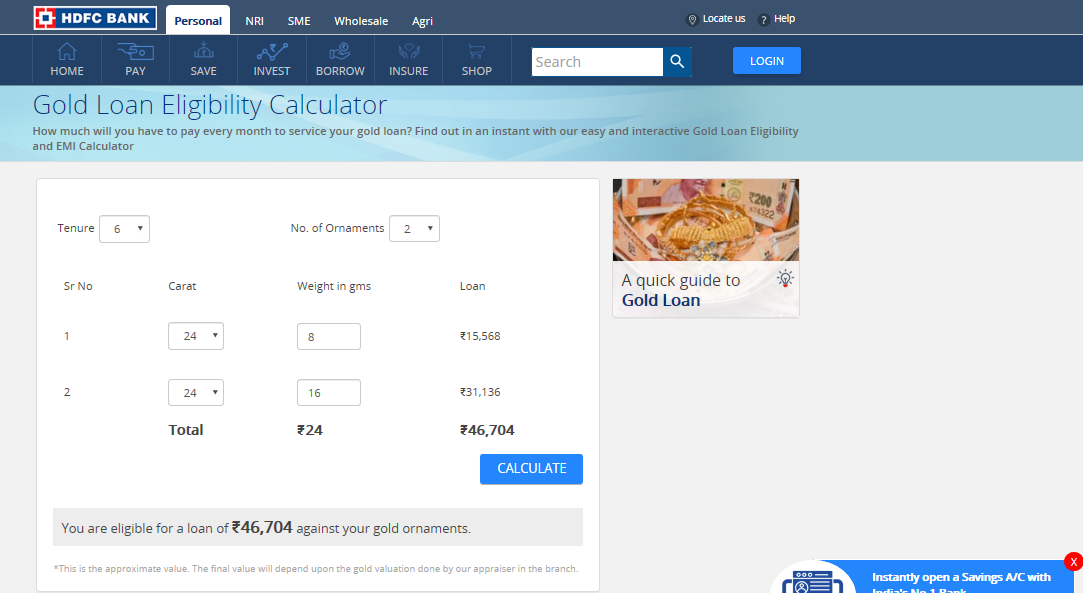

Find out in an instant with our easy and interactive Gold Loan Eligibility and EMI Calculator. Amount you need. ₹. ₹25,000 ₹1,00,00,000. Interest Rate. %. 11% 16%. Calculate. Step 1 - Enter the principal loan amount you need. First, you need to enter the principal loan amount required. Remember to check the minimum and maximum loan amount offered by the lender before entering the amount. For instance, HDFC Bank provides a minimum Gold Loan of Rs. 25,000 (the minimum amount can be lower for rural areas). Interest rates charged by HDFC on its Gold Loan vary depending on the loan tenure, amount and borrower. Current rates range between 8.50% to 15.97% p.a., with the quality of gold also playing an important role in determining this rate. HDFC Bank offers special rates to women and existing customers of their products and services. The HDFC Bank Gold Loan interest rates set for the applicants would most likely depend on their credit profile. As the APR of HDFC Bank Gold loan for the April-June Quarter 2022 ranged between 7.6-16.81%, applicants having good credit profile should also compare the HDFC Bank Personal Loan features and personal loan interest rates offered by.

HDFC Gold Loan Eligibility & Application Procedure IndiaFilings

HDFC Bank offers Gold Loan for loan amounts starting from Rs 25,000 and for tenures of up to 2 years. The minimum gold loan amount offered by the bank in rural areas is Rs 10,000. HDFC Bank claims to disburse Gold Loans within 45 minutes and a triple layer security for the gold pledged as collateral. The bank offers overdraft facility, EMI. HDFC Bank is one of the leading lenders in the country for gold loans. With minimal documentation and disbursal within the hour, an HDFC Bank Gold Loan comes with some unparalleled features. You can avail of loan starting Rs 25,000 at extremely low-interest rates and with no hidden charges. The collateral for the loan (that is, your gold) is. To be eligible for a Gold Loan, you should be in the age group of 18 to 65 years. Loan repayment tenure. Gold Loan eligibility criteria also involve the loan repayment tenure. Typically Gold Loans are offered for minimum and maximum tenures of 6 and 24 months respectively, and you should be able to repay the loan within this tenure. Credit at sole discretion of HDFC Bank Ltd. Explore other products. Gold Loan. Interest rate 9.75% for loans > ₹5 lacs. Apply Now Know More. T&C Apply. Home Loan. Interest rate starting 6.75%* Apply Now Know More. T&C Apply. EEG . Flat Processing Fee. Locate Nearby Branch Know More. T&C Apply.

HDFC Gold Loan Interest Rate 2023 ब्याज दरें

Here are some HDFC Bank Gold Loans benefits to consider before apply. Lower interest rates and processing fees. HDFC Bank offers best interest rates on Gold Loans. Our select customers can also benefit from further discounted rates. You can also look forward to a minimal processing fee of only 1.50% on the loan amount. Minimal documentation. Quick, Easy and Safe loan against Gold ; Avail loans up-to 100% of the appraised value of your gold; Reduce Monthly Obligation - service only interest during loan period; Tamper proof sealing and storage ensures Safety & security of Gold with HDFC Bank

The interest rate for the HDFC Bank Gold loan scheme should, however, be lower than those for HDFC Bank Personal Loans or other unsecured loan products the bank offers because it is a secured loan. Interest rates for HDFC Bank Gold Loans will probably be determined by the applicant's credit history. Welcome to HDFC Bank Gold Loan. Please enter your Mobile Number +91.. Term Loan and Overdraft available; Pay interest only on the amount utilized in Overdraft; Get loans starting at ₹25,000 (Minimum loan amount of ₹ 10000/- available in rural markets) Feel free to chat with. EVA.

HDFC Bank Gold Loan

APPLY ONLINE. Chat With Eva. Use Gold Loan Eligibility Calculator to check your eligibility for a gold loan at HDFC Bank. Calculate the amount of loan you can get against your gold & its worth. Federal Bank. 8.89%. Punjab National Bank. 9.00%. 0.75% of loan amount. Interest rates as on March 9, 2023. Source: Compiled by ETIG. Which ornaments or coins that can be pledged for gold loan. Only gold jewelery between 18 and 22 karats and bank-minted coins (up to 50 gms per client) can be presented for gold loan.