Household expenses represent a per person breakdown of general living expenses. It includes the amount paid for lodging, food consumed within the home, utilities paid and other expenses. The sum. Key Takeaways. Common household expenses include mortgage payments, transportation, food, health care, and child care costs. You can create a budget to cut down on expenses and reduce impulse buying and overspending. Eating out at restaurants less can help significantly reduce your food costs.

How to create a Household budget in Excel The Excel Club

These accounts grow tax-free and can be used tax-free for qualified education expenses. As for retirement, a traditional 401(k) or IRA offers an immediate tax deduction on contributions . Create a balanced budget. Many financial experts advise people to allocate their budgets using the 50-30-20 method.Fifty percent of your take-home income should go toward basic living expenses. Step 2: Make a list of all your monthly expenses (yes, even the easily forgotten ones). Step 3: Subtract your expenses from your income—and that number should equal zero. This method is called zero-based budgeting . Now, a zero-based budget doesn't mean you have zero dollars in your bank account. Add Up Your Expenses. Calculate Your Net Income. Adjust Your Expenses. Track Your Spending. Photo: JGI/Jamie Grill / Getty Images. Making a budget is a key piece of a strong financial foundation. Having a budget helps you manage your money, control your spending, save more money, pay off debt, or stay out of debt.

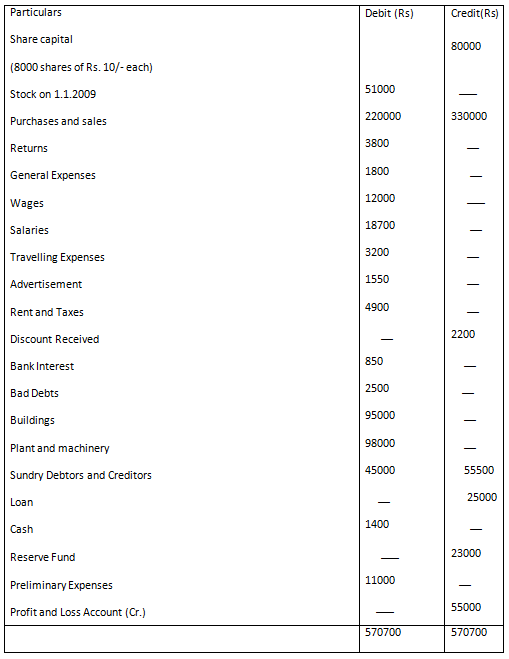

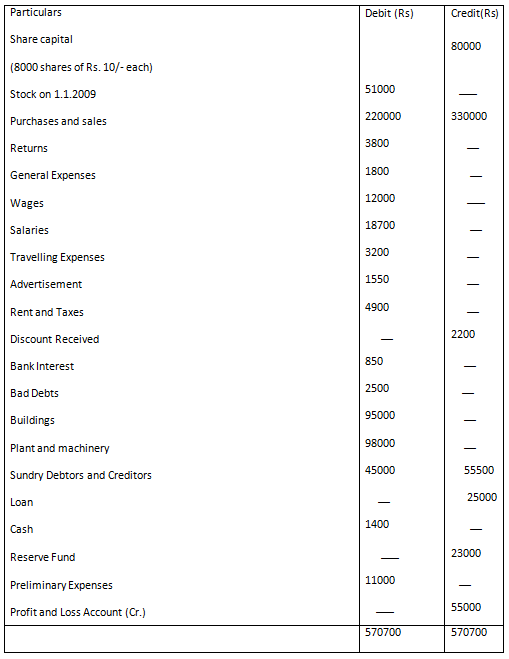

Final Accounts Definition and Explanation Tutor's Tips

Review Your Expenses and Close Accounts. One of the first steps in simplifying your budget is reviewing your bank statements and identifying all your expenses. Categorize them into "unnecessary" expenses (like unused subscriptions) and "necessary" expenses (like utilities) so you can make decisions about where to cut back. Related topics. Household spending is the amount of final consumption expenditure made by resident households to meet their everyday needs, such as food, clothing, housing (rent), energy, transport, durable goods (notably cars), health costs, leisure, and miscellaneous services. It is typically around 60% of gross domestic product (GDP) and is. published June 18, 2020. A good budget helps you reach your spending and savings goals. Work out a proposed household budget by inputting your sources of income and projected expenses into. Health insurance is one way that people can pay for routine medical expenses and protect against the financial burden of large, unexpected expenses. In 2021, 91 percent of adults had health insurance, a slight uptick from 2020. Those without health insurance were nearly twice as likely to forgo medical treatment because they couldn't afford it.

Sample Household Budget Spreadsheet —

Step 2: Add Your Income. Click "Tell us your monthly income" which will take you to a page where you input your monthly income. If you have your bank accounts connected to the Mint app, this will auto-populate. Once finished, click "Done-now add expenses". A family budget is a plan for your household's incoming and outgoing money. Try the 50/30/20 method, and explore tools like worksheets and apps.

Household expenses are the essential costs of running a home. Common types of household expenses include rent and mortgage payments, utilities, cell phone bills, and groceries. Knowing exactly what household expenses are and when they're due can potentially help people stay on top of their budget, take control of spending, and plan for the. Financial Accounts. Financial Accounts of the United States - Z.1; Household Finance. Consumer Credit - G.19; Household Debt Service and Financial Obligations Ratios;. To understand more about covering household expenses, the survey asked about adults' ability to pay their monthly bills. More than one-fourth of adults had one or more bills.

Final Accounts, Trial Balance, Financial Statements

Examples of monthly expenses to include in a budget. 1. Housing. Housing expenses frequently take up the largest chunk of monthly expenses and include monthly mortgage or rent payments, depending. It's important to confront your finances and create an effective household budget to help you get a grasp on your finances and limits. Follow these tips to creating an effective budget for your home and family: 1. Get a Clear Idea of Your Spending Habits. You might have an idea of how much you spend each month, but without cold-hard math, you.