Save on transfers, payments, and currency exchange with revolut business. get started now. Boost your team's efficiency with business debit cards and simple spend controls. Check Multiple Banks. Compare Accounts From Across The UK Current Account Market. Open Your New Current Account Online with Uswitch Who Can Help You Throughout The Process

India ICICI Bank statement template in .doc and .pdf format

ICICI Bank Salary Account is a benefit-rich payroll account for Employers and Employees. As an organisation, you can opt for our Salary Accounts to enable easy disbursements of salaries. Apply Now Benefits & FEATURES Free Personalised Chequebook Free Phone Banking Annual statement of accounts Free Titanium Debit Card Select Plus Salary Account is aimed at benefitting high income or net worth individuals looking to gain premium features from their bank account. This Salary Account can help such individuals in making smart investments to secure their family's future. Salary Account Opening at your Doorstep +91 I authorise ICICI Bank and its representatives to contact me through phone, email and SMS. I also agree to ICICI Bank's Terms & Conditions. Apply Now Benefits 16,600+ ATM/CRM across India 5,200+ Branches across India *Terms and Conditions of ICICI Bank apply. www.icicibank.com Corporate Office Address:- 1: Regular Salary Account 2: Silver Salary Account (Silver and Silver Plus) 3: Gold Salary Account (Gold and Gold Plus) 4: Titanium Salary Account 5: M2O Salary Account 6: Regular Plus Salary Account 7: Salary Privilege Account 8: Defence Salary Account 9: Standard Salary Account 10: Retiral and Pension Salary Account

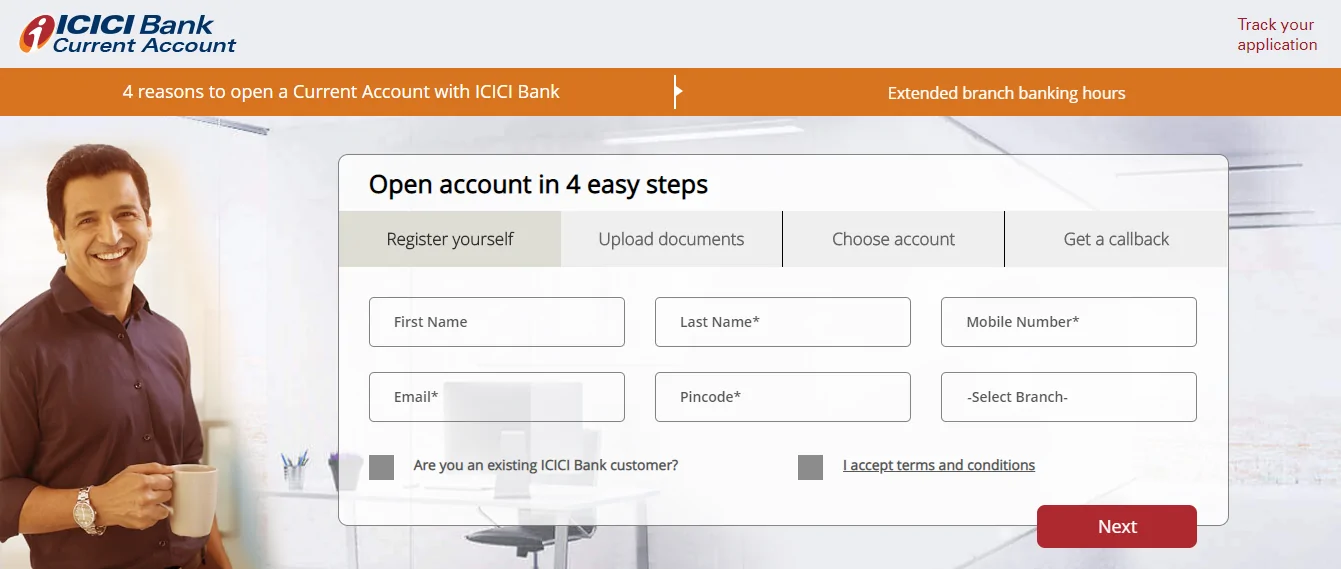

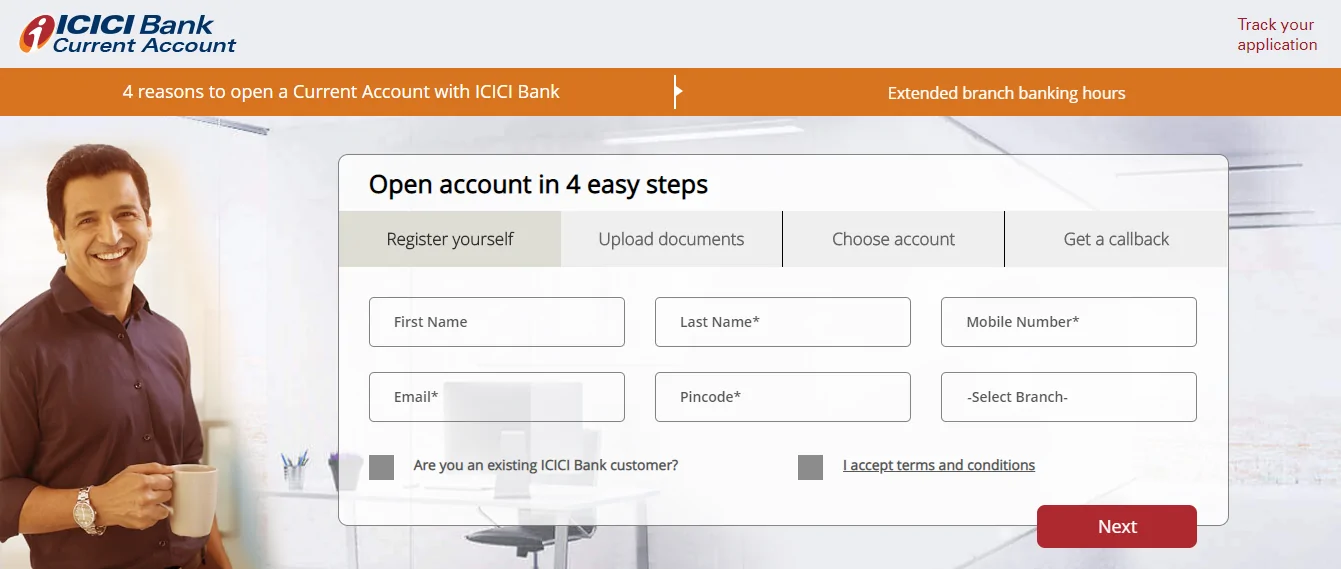

ICICI Current Account Minimum Balance, Fees & Charges, How to Apply

A salary account is a type of savings bank account in which an employee receives their salary from the employer every month. Major companies and corporations have their tie-ups with specific banks where they open the salary account of all of their employees. Subscribed 32K views 9 months ago #icicibank #salaryaccount ICICI Bank Salary Account is a benefit-rich payroll account for Employers and Employees. As an organization, you can opt for. If you are a salaried person, then you would need a bank account to get your salary credited.Your company or firm would want you to have a dedicated salary a. ICICI Bank UK - Personal, Business and Corporate Banking. Please be advised in order to keep our systems up to date and to carry out essential/routine maintenance, there will be a scheduled downtime across our network from 09 January 2024, between the hours of 10:00 pm GMT to 00:00 GMT and you will be unable to access your debit card.

ICICI Bank Insta FlexiCash feature for salary account holders introduced Zee Business

ICICI Bank Salary Account is a merit-rich payroll account for best suited for both the parties alike. For balances under Rs. 50 lakh and for amounts over Rs. 50 lakh, the interest rate is set at 3% and 3.50 %, respectively. As of March 30, 2016, interest will be paid quarterly in March, June, September, and December. Types Of ICICI Bank Salary Account Regular Salary Account

1 AU Bank Savings A/C Interest rate: Upto 7.25% Balance required: INR 2,000 onwards Special feature: Monthly interest payouts On AU Bank's secure website 2 Yes Bank Savings Account Interest. #SALARY ACCOUNT ONLINE, #ICICI

ICICI Bank Assistant Manager II Offer Letter Salary Details EmploymentGuruji YouTube

Loans Benefits: ICICI Bank salary account holders may also avail the benefits of various popular loans as well. These loans include home loans, personal loans, two-wheeler loans, car loans, Loan against Securities, etc. Investment Options: The salary account offers multiple investment options to the customers. Apply and Open Insta Account online at ICICI Bank and get instant approval for your bank account to manage your daily business banking tasks.