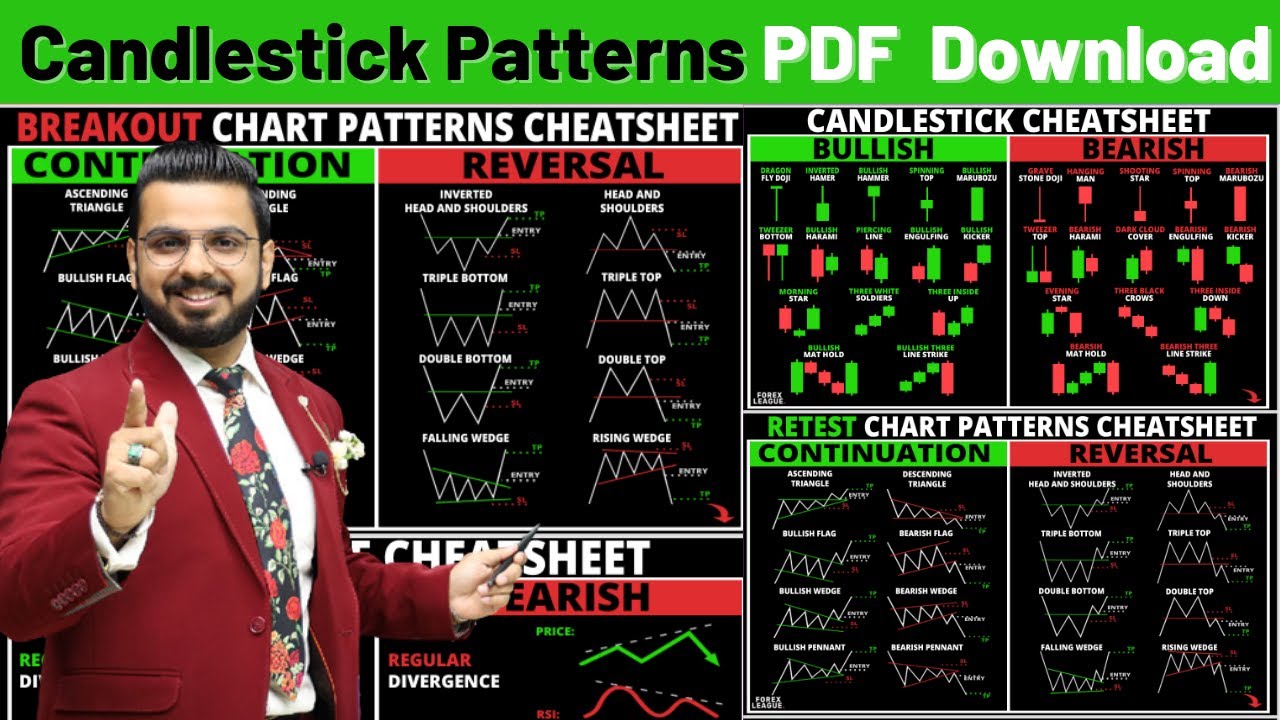

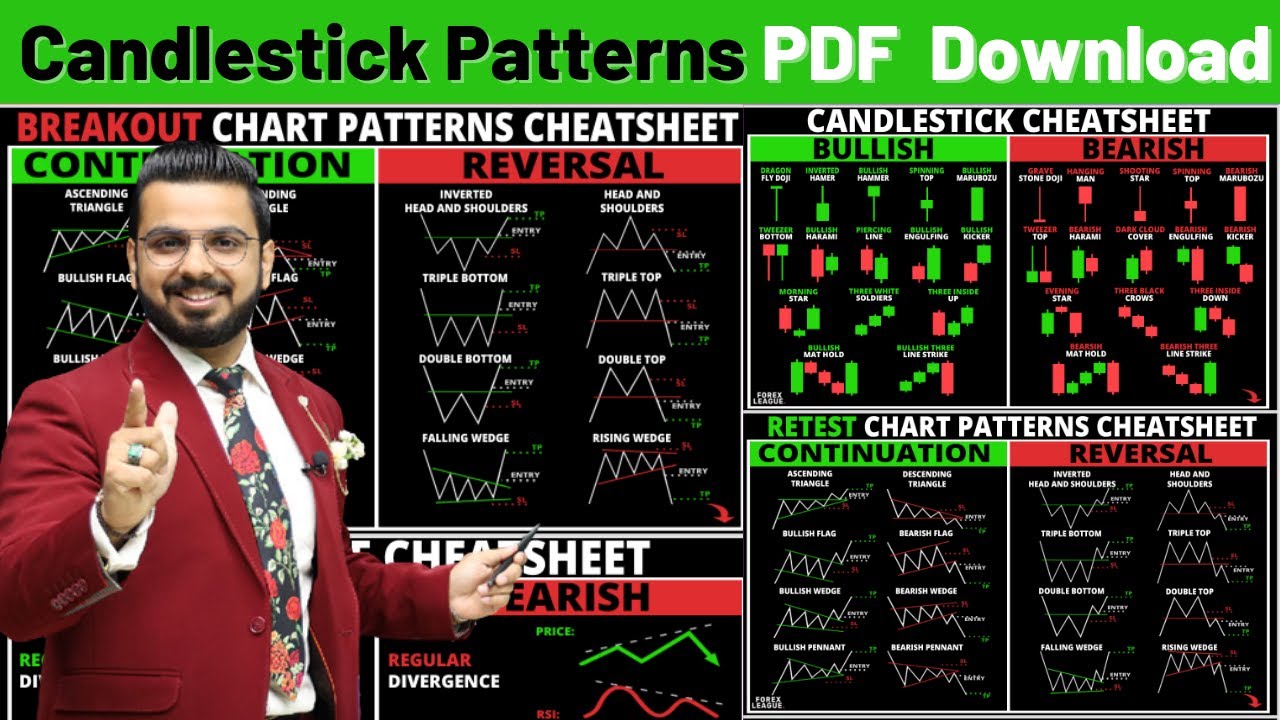

A pattern is bounded by at least two trend lines (straight or curved) All patterns have a combination of entry and exit points Patterns can be continuation patterns or reversal patterns Patterns are fractal, meaning that they can be seen in any charting period (weekly, daily, minute, etc.) Successful Intraday Trading Strategies - With Free PDF Intraday trading is a very popular method of trading the markets because you can use it in many different markets and assets and you will be able to find many trading opportunities.

Candlestick patterns dictionary Candlestick patterns, Candlesticks, Stock chart patterns

Head and Shoulders Double Top and Double Bottom Day Trading Chart Patterns Intraday Chart Patterns Lastly What are Chart Patterns? Chart patterns and candlestick patterns may seem similar, but they have distinct characteristics. Chart patterns cheat sheet is an essential tool for every trader who is keen to make trading decisions by identifying repetitive patterns in the market. This is a short illustrated 10-page book. You're about to see the most powerful breakout chart patterns and candlestick formations, I've ever come across in over 2 decades. This works best on shares, indices, commodities, currencies and crypto-currencies. By the end you'll know how to spot: Introduction CHAPTER - 1 Types of Charts 1.1: Line Charts: 1.2: Bar Charts: 1.3: Candlestick Chart: CHAPTER - 2 Trends 2.1: Market Trend and Range-Bound Consolidation: 2.2: Trendline & Channels: 2.3 Role Reversal: 2.4: Channels CHAPTER - 3 Volume CHAPTER- 4 Classical Chart patterns 4.1: Head and Shoulder & Inverse Head & Shoulder:

Chart Patterns Cheat Sheet [FREE Download]

patterns you can use for short term trading and patterns that can also be used to make intraday or scalp trades. How to Use Chart Patterns You can use chart patterns in different ways in your trading, but the most popular is to find and then make high probability trade entries. Chart patterns repeat time and time again. Trading Patterns Chart patterns form a key part of day trading. Candlestick and other charts produce frequent signals that cut through price action "noise". The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency or forex pairs. Top Brokers For Day Trading Patterns #1 move against them. This behavior causes distinct intra-day patterns with decreasing (L-shaped) spreads and increasing (reverse L-shaped) volume and probability of in-formed trading (PIN). Competition increases market participation and causes more pronounced spread and less pronounced volume patterns. Systematic improvements ThinkMarkets | Award Winning Investing & CFD trading Broker

Chart Patterns PDF Download Candlestick Pattern PDF Download Technical Chart Patterns Cheat

Experienced day traders most commonly utilize: 15-minute charts - The 15-minute time frame is ideal for tracking overall intraday swings, support/resistance and momentum. The 15-minute chart for day trading provides a broad context. 5-minute - For nearer-term price action and entry timing, the 5-minute is ideal. 1. An indication that an increase in volatility is imminent. This affords traders. the opportunity to create trades that speculate not so much on direction, but rather on an increase in volatility on a breakout in any specific direction. 2. In the context of a trend, a harami/inside bar can be indicative of exhaustion.

The "Price Action" method of trading refers to the practice of buying and selling securities based on the fluctuations, or "action," of their prices; typically the data of these price changes is represented in easily-readable candlestick or bar charts, which are the bread and butter of the price action trader. Intraday Trading Strategies Using Chart Patterns - Case Study - Tesla. Tesla stock is a popular target of intraday traders. Its sky-high and disputable valuation, along with maverick CEO Elon Musk's willingness to release tweets, mean that trends can quickly form.

Intraday Chart Patterns PDF Download

Intraday Chart Patterns Feb 10 2022 6 Min Read Intraday trading is a lot about technical analysis. Since the buying and selling are executed on the same day, there is no room for holding positions in intraday trading. Therefore, the fundamental analysis does not help intraday traders much. Free Chart Patterns Book with PDF Cheat Sheet Free For Beginners TrustedBrokers.com, 6 Pages, 2022 Download TrustedBrokers' free chart patterns book. It includes a printable PDF cheat sheet with 20 classical chart patterns, links to free interactive charts to help you place each chart in its broader context, plus free technical analysis tools.