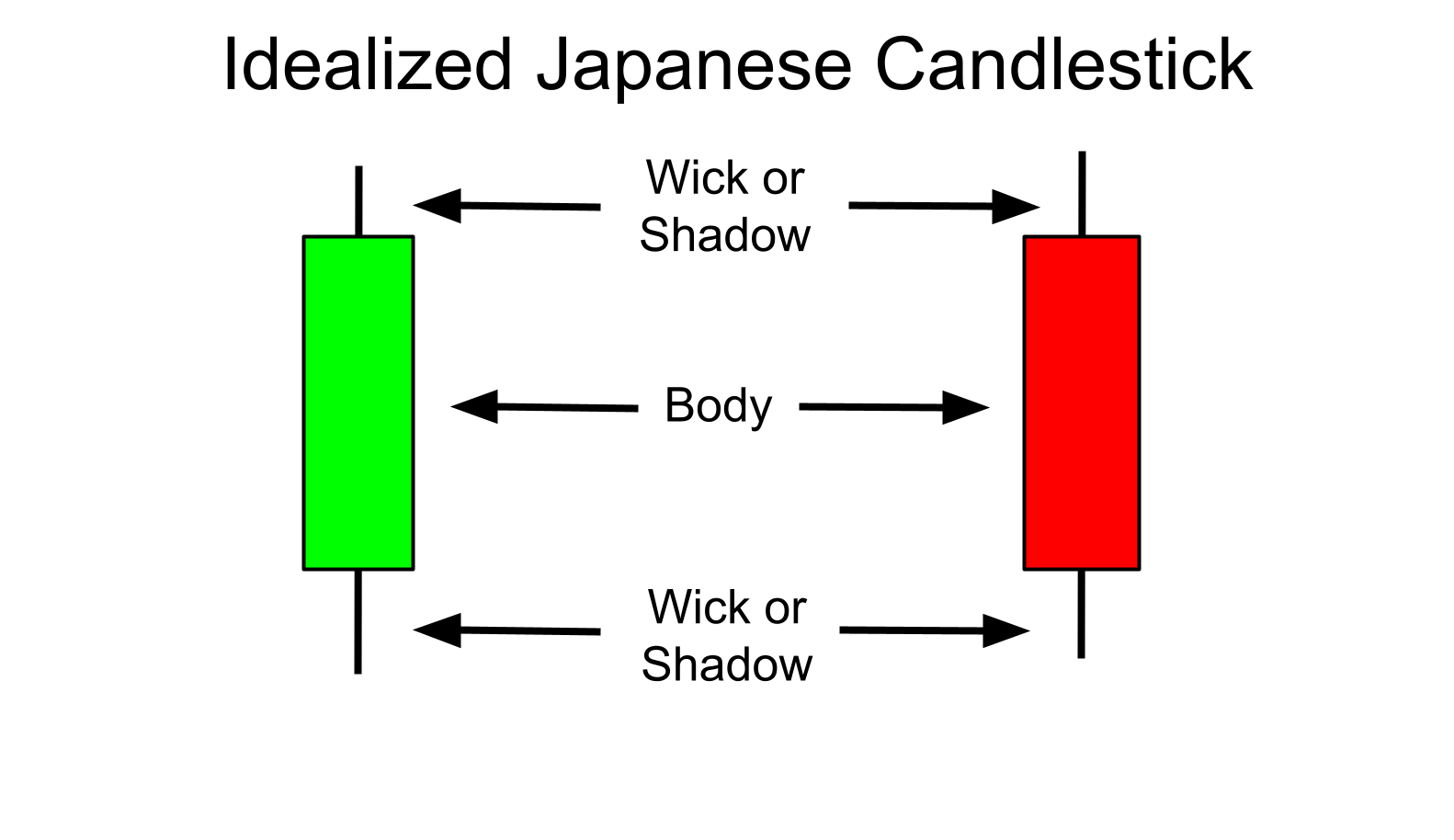

What are Japanese candlestick patterns? Japanese candlestick patterns are motifs that appear on trading charts. Technical traders believe that you can use them to predict future price action - which makes them useful for finding new potential opportunities. A Japanese candlestick is a type of price chart that shows the opening, closing, high and low price points for each given period. It was invented by Japanese rice merchants centuries ago, and popularised among Western traders by a broker called Steve Nison in the 1990s.

Japanese Candlestick How To Read and Why I Use it

Japanese Candlesticks: What They Are + How to Trade in the UK | IG International Find out everything you need to know to start trading Japanese candlesticks with our complete guide: including 18 top patterns to watch out for. Skip to content We want to clarify that IG International does not have an official Line account at this time. Japanese Candlesticks are a technical analysis tool that traders use to chart and analyze the price movement of securities. The concept of candlestick charting was developed by Munehisa Homma, a Japanese rice trader. Japanese candlesticks with a long upper shadow, long lower shadow, and small real bodies are called spinning tops. The color of the real body is not very important. The Spinning Top pattern indicates the indecision between the buyers and sellers. Japanese Candlesticks: A Comprehensive Guide to Understanding Price Patterns in Financial Markets by: Gaurav Heera Posted on: December 2, 2023 Introduction: In the vast realm of technical analysis, Japanese candlesticks stand as an ancient yet powerful tool for deciphering market sentiment and predicting price movements.

The Japanese Candlestick Chart Explained Easy And Simple

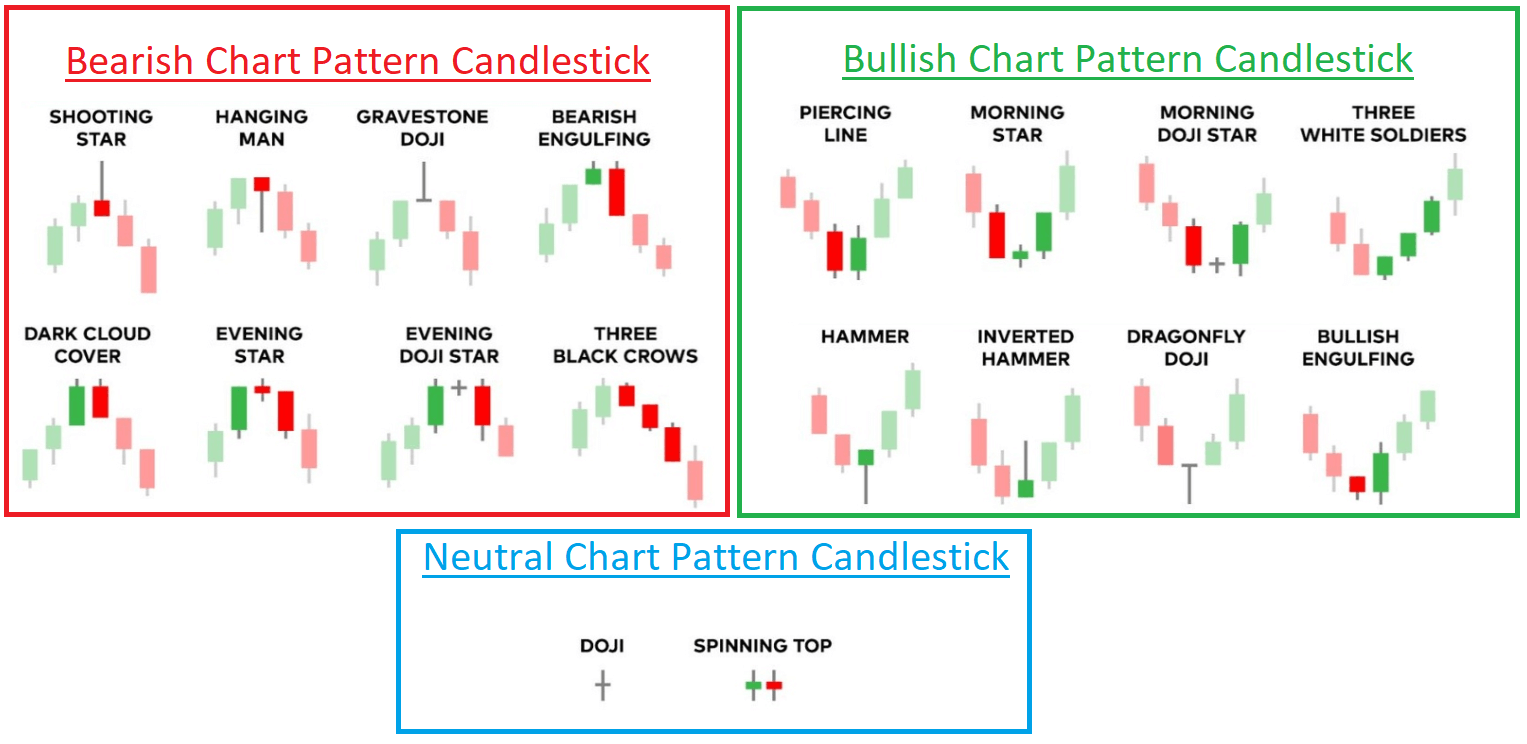

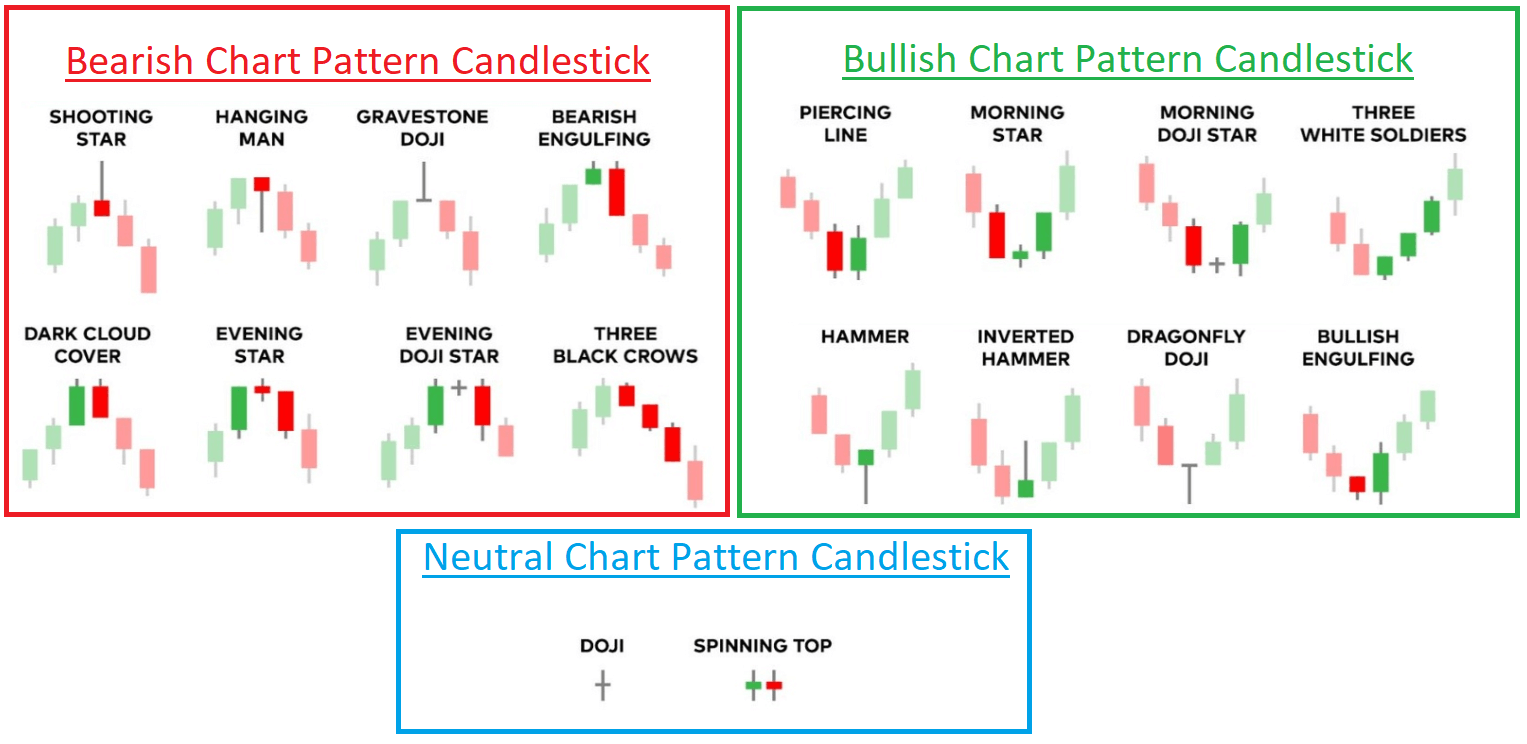

The Dual Candlestick patterns learned in this course include the Bullish momentum engulfing candlestick pattern, the bearish engulfing candlestick pattern, and tweezer Japanese candlesticks (a Tweezer bottom green candle, a Tweezer top red candlestick ). Triple Candlestick Patterns Candlestick charts originated in Japan over 100 years before the West developed the bar and point-and-figure charts. In the 1700s, a Japanese man named Homma discovered that, while there was a. If you're REALLY done with those, here's a quick one-page reference cheat sheet for single, dual, and triple Japanese candlestick formations. This cheat sheet will help you to easily identify what kind of candlestick pattern you are looking at whenever you are trading. Go ahead and bookmark this page…. No need to be shy! Number of Bars. A candlestick is a way of displaying information about an asset's price movement. Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars. This article focuses on a daily chart, wherein each candlestick details a single day's trading.

How to Use Marubozu Candlestick Pattern to Predict the Trend Direction

Ovidiu Popescu 7/14/2023 Candlestick patterns have long been recognized as a powerful tool in the world of financial markets. First used in Japan in the early 16th Century, candlestick charts provide valuable insights into market sentiment and price movement dynamics. Candlestick Patterns. You Should Know. Find more about most common Japanese candlestick patterns: Marubozu, Spinning Top, Hammer candlestick, Dragonfly Doji, Inverted Hammer, Bullish Engulfing, Shooting Star, Gravestone Doji, Hanging Man, Bearish Engulfing & The Long-Legged Doji candlestick. October 3, 2023. Steve Miley.

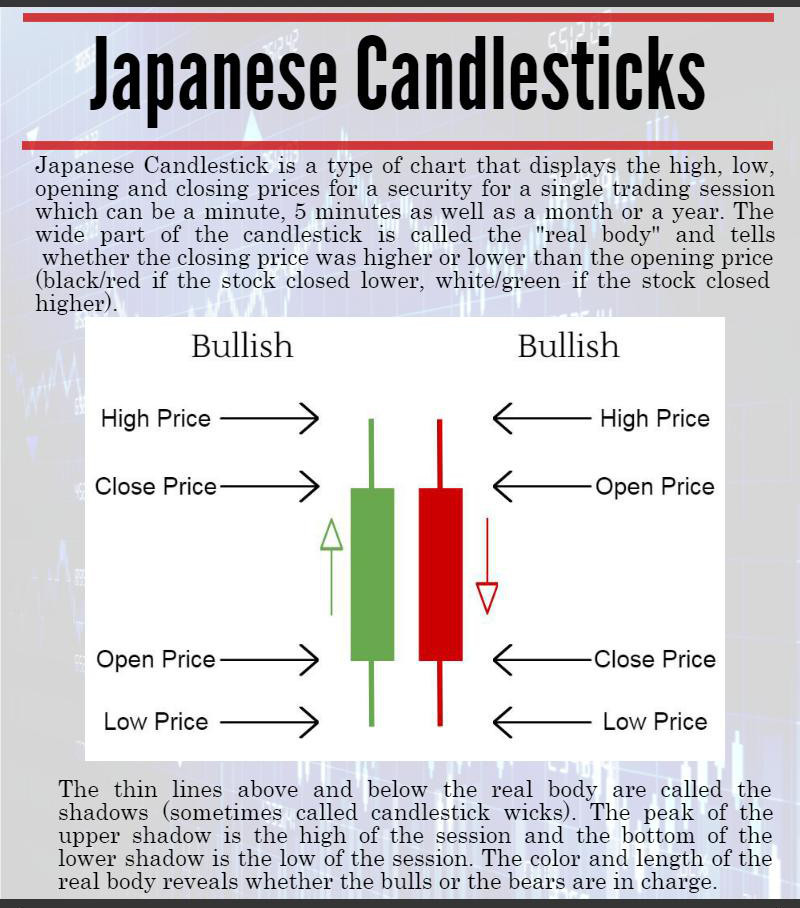

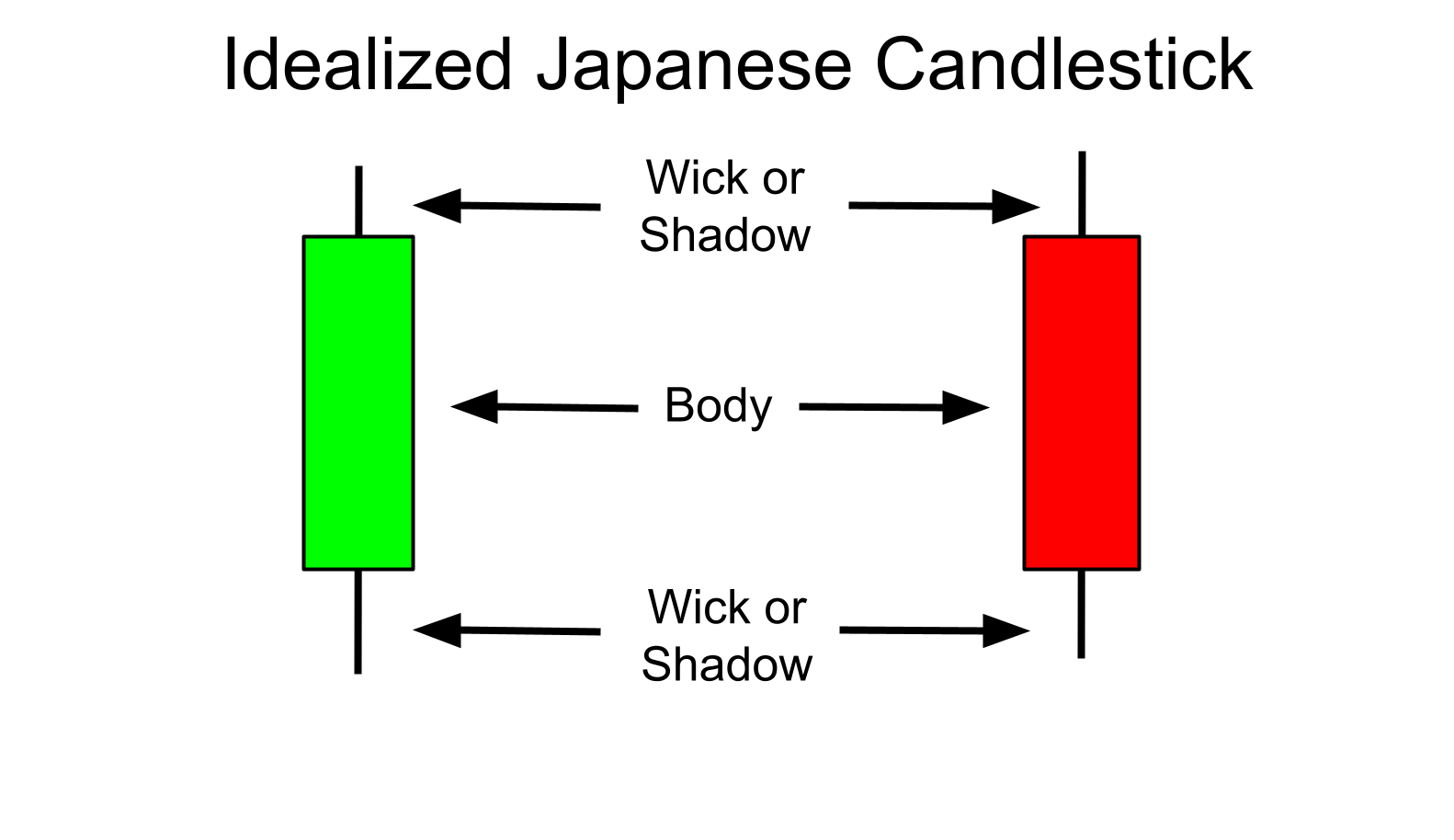

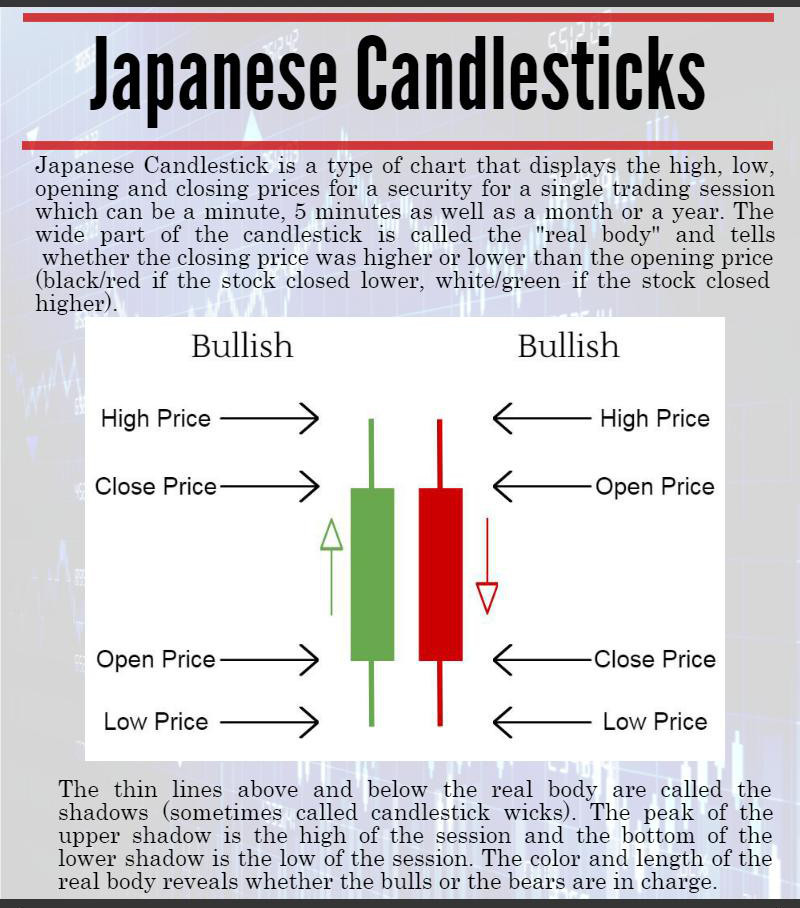

What is a Japanese Candlestick? A Japanese candlestick chart displays a security's opening, closing, high and low prices for a given period. The central part of the candlestick, or the. 29.09.2023 Japanese candlestick patterns offer a vivid and insightful way to analyze market trends and investor behavior. Originating in 17th-century Japan, these charts have survived for centuries and traveled the world to become an essential tool for modern traders across various markets.

Understanding Japanese Candlesticks The Basics TrendSpider Learning

Japanese Candlestick Patterns provide a visual representation of price action, capturing the open, close, high, and low prices within a specific timeframe. Each candlestick tells a story, unveiling the battle between buyers and sellers and revealing shifts in market sentiment. Over time, individual Japanese candlesticks form patterns that traders can use to recognize major support and resistance levels. There are many candlestick patterns that indicate an opportunity within a market - some provide insight into the balance between buying and selling pressures, while others identify continuation patterns or market.