Home Products Insurance Plans LIC's Jeevan Umang (Plan No. 945, UIN No. 512N312V02) Date of Launch : 01.02.2020 Last modified date : Thu, 15 Jun 2023 05:15:54 +0000 Things you must know Why Life Insurance Why Invest Go Mobile Last Updated on : 04/05/2023 LIC Jeevan Umang Plan is a whole-life assurance plan, designed to offer a dual benefit Read more Benefits of LIC Plans — Buy LIC policy online hassle free Tax saving under Sec 80C & 10 (10D)^ High returns market link plans Sovereign guarantee as per Sec 37 of LIC Act We are rated ~ 6.7 Crore Registered Consumers 51 Insurance Partners 3.4 Crore

LIC Jeevan Umang Policy 45 रूपये डेली में 36000 रूपये सालाना का लाभ, इस सुनहरे अवसर का लाभ उठाये

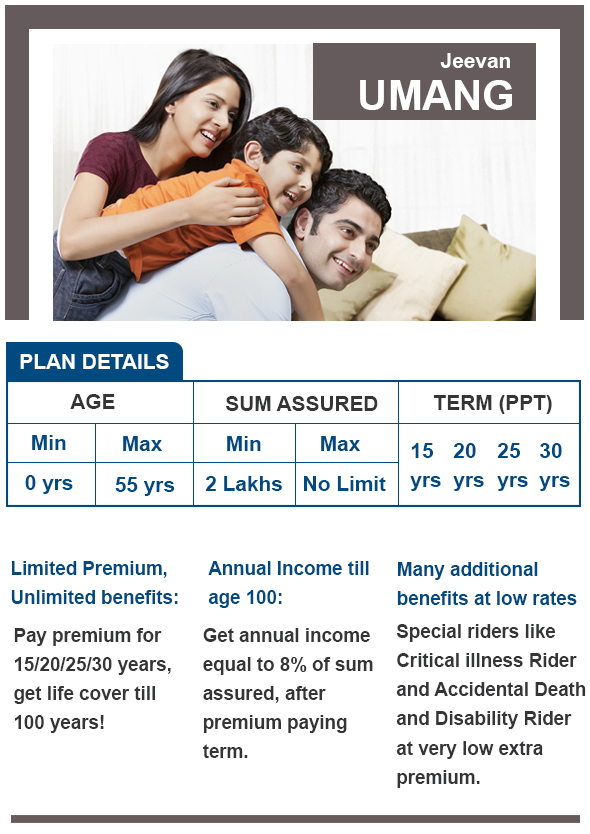

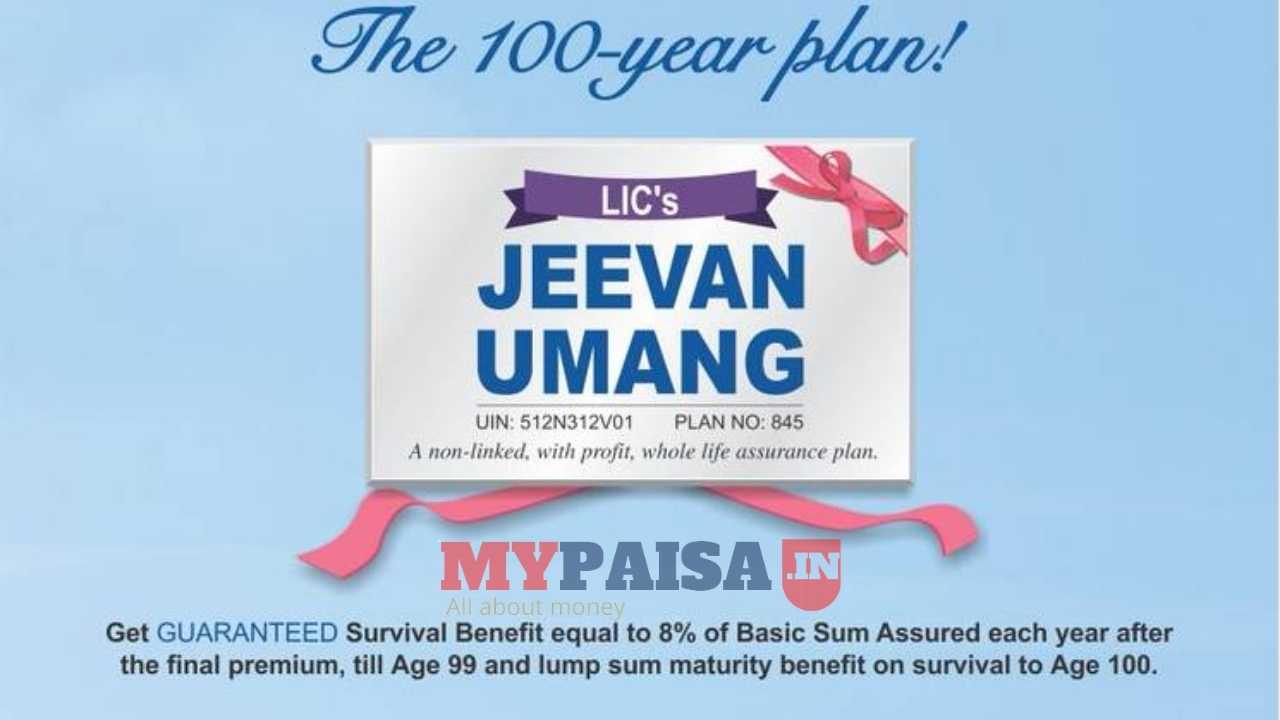

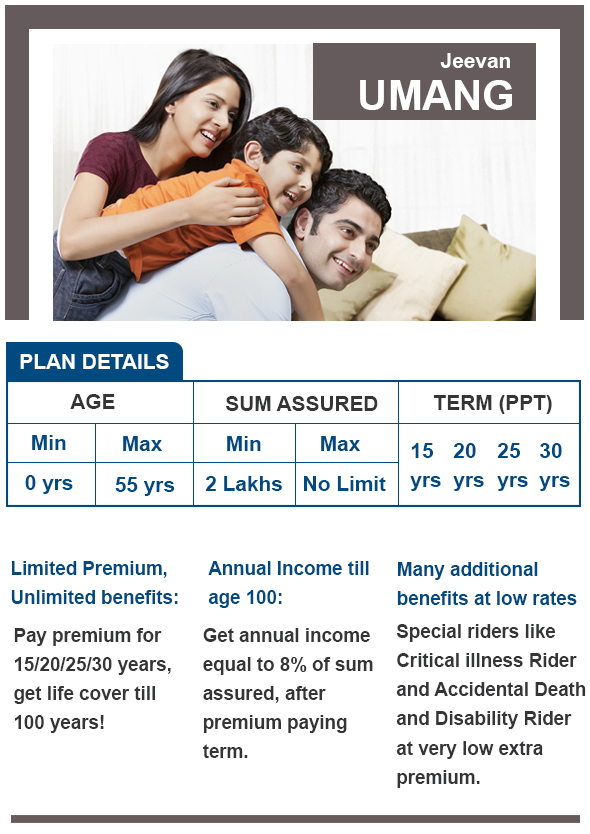

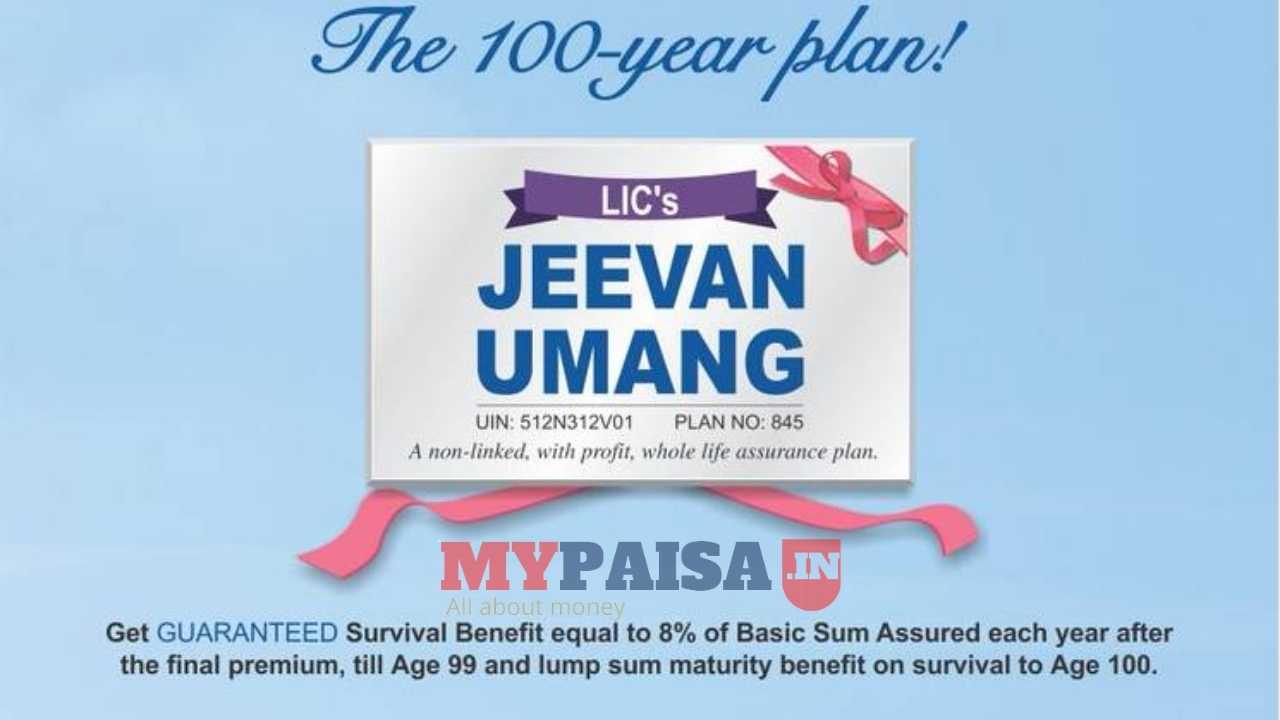

Highlights of LIC Jeevan Umang Plan. The insurance plan is a blessing as it offers coverage for the entire life i.e. for 100 years. 8% of the Sum Assured is paid every year as money back on survival at the end of the policy term. Large Sum Assured available under this plan. Riders like LIC Accidental Death Disability Benefit Rider and Term. LIC's Jeevan Umang is a whole life insurance plan that offers guaranteed annual income and lump sum benefits at maturity. It also provides protection against death and critical illnesses. To know more about the features, benefits and eligibility of this plan, download the brochure in PDF format. LIC's Jeevan Umang (T-845) - All details with premium, maturity and benefit calculators with examples. LIC Jeevan Umang (T-845) is a versatile, 'with profit whole life plan' which has several benefits of erstwhile popular plan Jeevan Tharang (T 178). Off late, this plan has gained immense popularity owing to its innovative benefit pattern. LIC's Jeevan Umang (Plan No. 945) is a non-linked, participating, individual, whole-life assurance plan that covers the policyholder till s/he turns 100 years of age. The limited premium paying plan provides guaranteed annual survival benefits at the end of the premium paying term till maturity. Also, the policyholder gets a lump sum payment.

945 Jeevan Umang Finmantra

LIC Jeevan Umang & Returns Calculation. Below is the IRR (return on investment) calculation on Jeevan Umang policy. The above calculation is for sum assured of Rs 2 Lakh, PPT is 25 years, for a 30 year old male and no optional riders have been chosen. The premium of around Rs 7,879 is payable for 25 years. LIC's Jeevan Umang - Plan 945 (revised with effect from 01/02/2020) - All details with premium and maturity benefit calculators. Jeevan Umang is a popular 'with profit' insurance plan from LIC of India with several innovative benefits to boast off. The initial version of Jeevan Umang Plan 845 was revised with effect from 1st February. LIC of India new plan launched on 1st. February, 2020 which name is LIC Jeevan Umang 945 (LIC Table no. 945) is a non-linked, with-profits whole life assurance plan. This plan provides for annual survival benefits from the end of the premium paying term till maturity and a lump sum payment at the time of maturity or on death of the policyholder during the policy term. It has been decided to. LIC Jeevan Umang's Key Features. The essential characteristics of the LIC Jeevan Umang Plan are listed below: It consists of both monthly income and a lump sum payment. Choose from 15 years, 20 years, 25 years, or 30 years as a premium-paying term. It's a profit-generating non-linked life insurance plan.

Why Investing in LIC's Jeevan Umang is beneficial?

Mentioned below are the key features of the LIC Jeevan Umang Plan: It is a combination of both regular income and Lumpsum payment. Offers an option to choose a premium paying term of 15 years, 20 years, 25 years or 30 years. It is a non-linked life insurance plan with profits. Offers life cover till the policyholder turns 100 years. LIC's Jeevan Umang plan offers a combination of income and protection to your family. This plan provides for annual survival benefits from the end of the premium paying term till maturity and a lump sum payment at the time of maturity or on the death of the policyholder during the policy term. In addition, this plan also takes care of.

LIC Jeevan Umang Plan (Table: 945) Maturity Calculator Enter Your Age, Premium Paying Term (PPT) and Basic Sum Assured along with optional riders to generate illustration for you. Related Article: How to plan retirement with LIC plans? Age Premium Paying Term Year of Purchase Basic Sum Assured Accidental & Disability Benefit Rider Term Rider The death benefit of LIC Jeevan Umang Plan is a higher 125% of the Basic Sum Assured or seven times the annualized premium. However, the total payout will not be less than 105% of all premiums paid up to the date of death. This death benefit amount includes the Sum Assured, Vested Bonus, and Final Additional Bonus (FAB), if any.

LIC Jeevan Umang New Whole Life Plan Paisa Portal

LIC Jeevan Umang plan is a conventional, with-profit, non-linked endowment plan that also comes with full life insurance coverage. The plan was launched in 2017, and at its core, it aims to combine both the income and protection of the insurer from a single policy. One of the most significant advantages of Jeevan Umang's policy is that it. LIC of India new plan launched on 1st. February, 2020 which name is LIC Jeevan Umang 945 (LIC Table no. 945) is a non-linked, with-profits whole life assurance plan. This plan provides for annual survival benefits from the end of the premium paying term till maturity and a lump sum payment at the time of maturity or on death of the policyholder during the policy term.