SCRAP PAPER PAPERBOARD - GST RATES & HSN CODE 4707 Save upto 7% in taxes Claim 100% ITC and save ~4% GST Save 2 man days every GSTIN month Home HSN Code Pulp of wood or of other fibrous cellulosic material; recovered SCRAP PAPER PAPERBOARD - GST RATES & HSN CODE 4707 GST rates and HSN code for Scrap Paper Or Paperboard. Origin Chapter: Chapter 47 (waste and scrap) paper or paperboard GST Rate & HSN Code for (waste and scrap) paper or paperboard - Chapter48 GST Rates & HSN Codes for Newsprint in rolls or sheets, Uncoated paper & paperboard, Vegetable parchment - Chapter 48

GST Rate & HSN Code for (waste and scrap) paper or paperboard Chapter 48

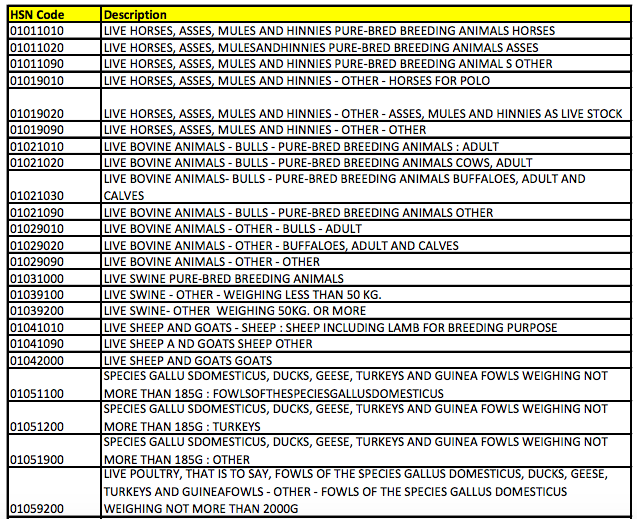

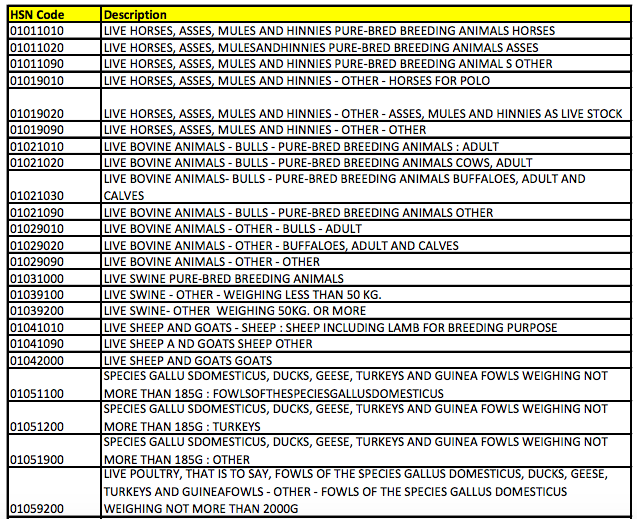

The scrap is the supply of tax under GST norms, its rate of GST has depended upon the nature of the scrap and the HSN code. For determining the value of supply or GST the tax obtained at the source in the provision of income tax 1961, should not be included. GST on sale of scrap or waste to unregistered person It should be noted that supply of used vehicles, seized and confiscated goods, old and used goods, waste, and scrap by the Central Government, State Government, Union Territory, or a local authority to an unregistered person is also a taxable supply under GST. HSN codes and GST rates for (waste and scrap) paper or paperboard that falls under Chapter 48 includes Newsprint in rolls or sheets, Uncoated paper & paperboard, Vegetable parchment HSN Codes (waste and scrap) paper or paperboard: The highest rate for scraps material is 18%. HSN code is a 6-digit code that categorizes 5000+ products. It is a uniform code which is accepted worldwide.

Discover more than 74 paper bag hsn code in.duhocakina

The details of reduced GST rate on Paper waste or scrap is as follows: HSN number: 4707 Paper waste or scrap GST rate before 06th October, 2017: 12% Reduced rate of GST w.e.f 06.10. 2017: 5% I hope, you have satisfied with this information about reduced GST rate on Paper waste or scrap. April 27, 2021 Under the GST regime, scrap and waste have not been related to the GST Laws but despite that sale of scrap is considered as 'supply' in course of business which is why the GST rate and HSN code are applicable. The GST rate for waste and scrap paper or paperboard is 12%. This rate is applicable to all types of waste and scrap paper or paperboard, including those that have been sorted or graded. Therefore, businesses dealing with waste and scrap paper or paperboard must charge a GST rate of 12% on their products. GST rates for all HS codes. You can search GST tax rate for all products in this search box. You have to only type name or few words or products and our server will search details for you. Tax rates are sourced from GST website and are updated from time to time. Note: You are adviced to double check rates with GST rate book.

an invoice form with the words tech guruplus on it

04 Oct, 2023 Explore GST rates & HSN code for Paper & Paperboard Waste in Chapter 48. Find tax info for recycling materials. Stay compliant with tax regulations. READ Original Engravings - GST Rates & HSN Code 9702 Explore GST rates & HSN code for Paper & Paperboard Waste in Chapter 48. Find tax info for recycling materials. GST Tax Rate: 12%. Note! The above result is only for your reference. Kindly consult the professional before forming any opinion. Hubco.in shall not be responsible for any damages or problem that may arise to you on relying on the above search results. Harmonized System of Nomenclature (HSN) is an internationally recognized product/items coding.

Discover GST rates & HSN code 4707 for Scrap Paper Paperboard. Get tax insights for efficient business operations. Learn more now! HSN Code Description Rate (%) CESS (%) Effective Date Rate Revision; 4707: Recovered (Waste And Scrap) Paper Or Paperboard: 5: 0: 13/10/2017: 5% has replaced 12%: 47072000 : Recovered (Waste And Scrap) Paper Or Paperboard Other Paper Or Paperboard Made Mainly Of Bleached Chemical Pulp, Not Coloured In The Mass 47073000 : Recovered (Waste And Scrap) Paper Or Paperboard Paper Or Paperboard Made Mainly Of Mechanical Pulp (For Example, Newspapers, Journals And Similar Printed Matter)

Hsn Explanatory Notes ticketsintensive

4701 to 4823. Chapter 48. Paper and paperboard, articles made of paper pulp, or articles made of paper or paperboard. 4801 to 4823. Chapter 49. Printed books, pictures, newspapers, and other products of the printing industry, typescripts, manuscripts and plans. 4901 to 4911. Section XI. Textile and Textile Articles. Home GST GST HSN Code HSN Code & GST Rate for Paper, Paperboard Articles & Newsprint - Chapter 48 Updated on: 23 Nov, 2023 01:22 AM HSN Code & GST Rate for Paper, Paperboard Articles & Newsprint - Chapter 48 File with us to win your taxes Ready to File! Start Now! Smart, Simple and 100% free filing Personalised Tax Filing experience