Looking for the Best Personal Loan? Use Our Comparison Site Now. Explore Top Lenders that Offer You Flexible Terms along with the Lowest APR & Fees Fill-in-the-Blank Loan Agreement Template. Customize to Fit Your Unique Situation. Outline the Terms of Your Loan and Repayment. Takes Under 10 Minutes. Create Now.

Personal Loan Agreement Sample Free Printable Documents

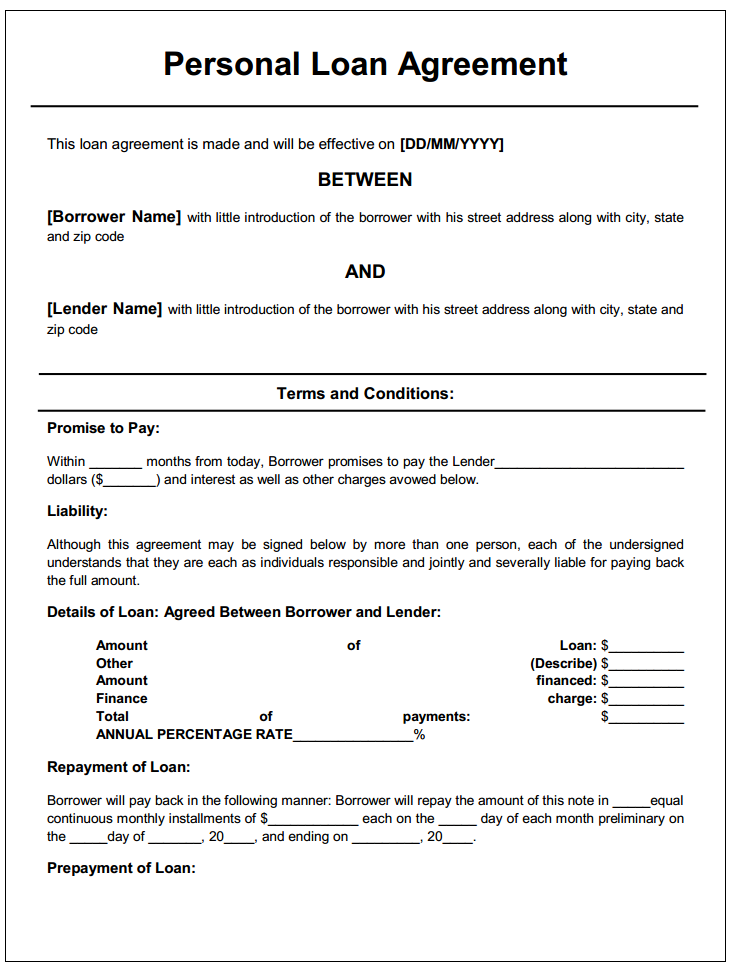

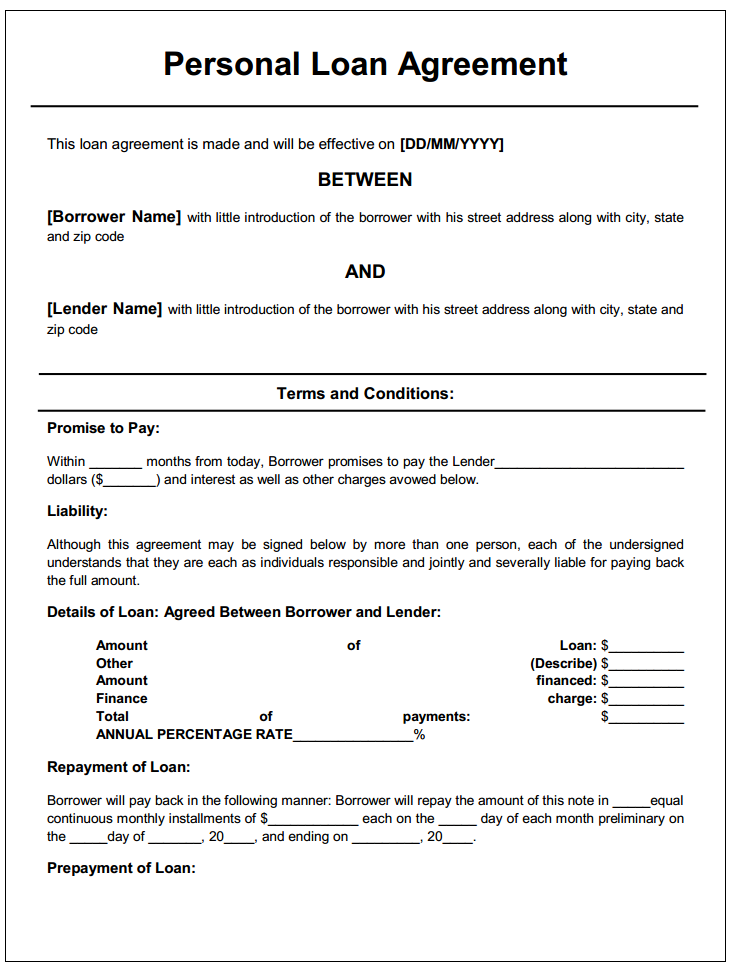

Although it's a legal document, writing a promissory note doesn't have to be difficult. There are even websites online that offer fill-in-the-blank templates, like eForms or LegalZoom. At its. Explain the Purpose of the Loan: Clearly articulate why you need the loan. Be specific and honest. Outline Your Repayment Plan: Demonstrate your plan for repaying the loan. This shows responsibility and planning. Conclude Politely: End your letter with a polite conclusion, thanking the lender for considering your application. Personal Example A personal loan request letter is a letter written by a loan applicant and addressed to a financial institution, introducing the applicant, and supporting their loan application. Anyone wanting to take out a personal loan should write a personal loan request letter to introduce themselves to their target banking institution. A personal loan agreement is a written contract between two parties, generally a borrower and a lender. It outlines how much money is being borrowed, the repayment schedule and what should be done if there's a dispute over paying it back. If you need to borrow money from a bank or financial institution, you can expect to sign a loan agreement.

52 FREE LOAN LETTER DOC PDF DOWNLOAD DOCX * Loans

Loan amount: Include the total amount being borrowed. This is the principal of the loan. Collateral: If applicable, include what is being used to secure the loan, its value, and the. Step 1: Check your credit 1. Chat your bank 1. Some rewards are inconvenient and tedious to earn Mint vs. NerdWallet at a glance The process of applying for a personal loan may feel. Updated April 14, 2023 A personal loan agreement outlines the terms of how money is borrowed and when it will be paid back. It is a simple agreement that includes the borrowed amount, interest rate, and when the money must be repaid. What is a personal loan pre-approval letter? A pre-approval letter is a document from a financial institution stating it is tentatively willing to approve a personal loan up to a certain amount.

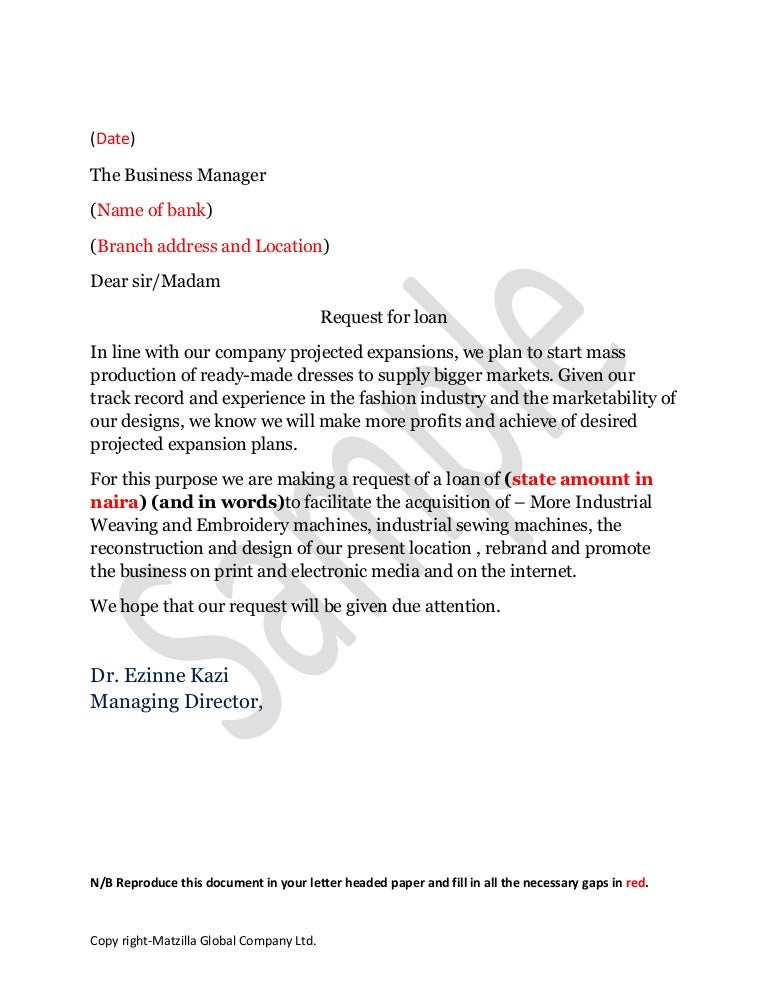

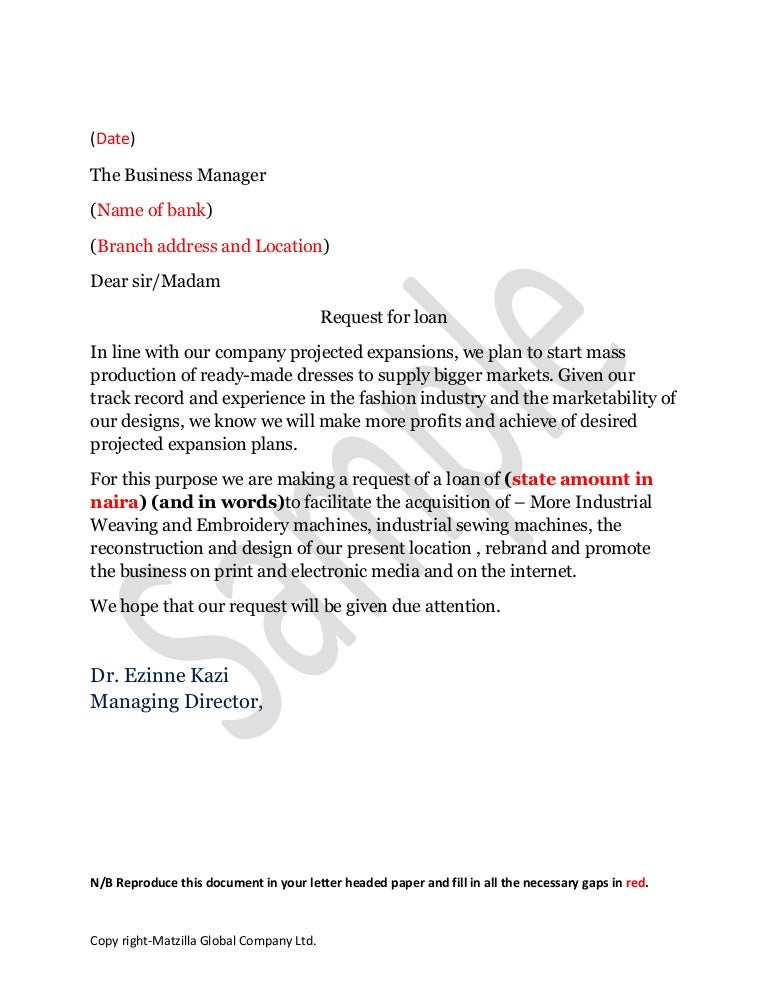

request for loan letter

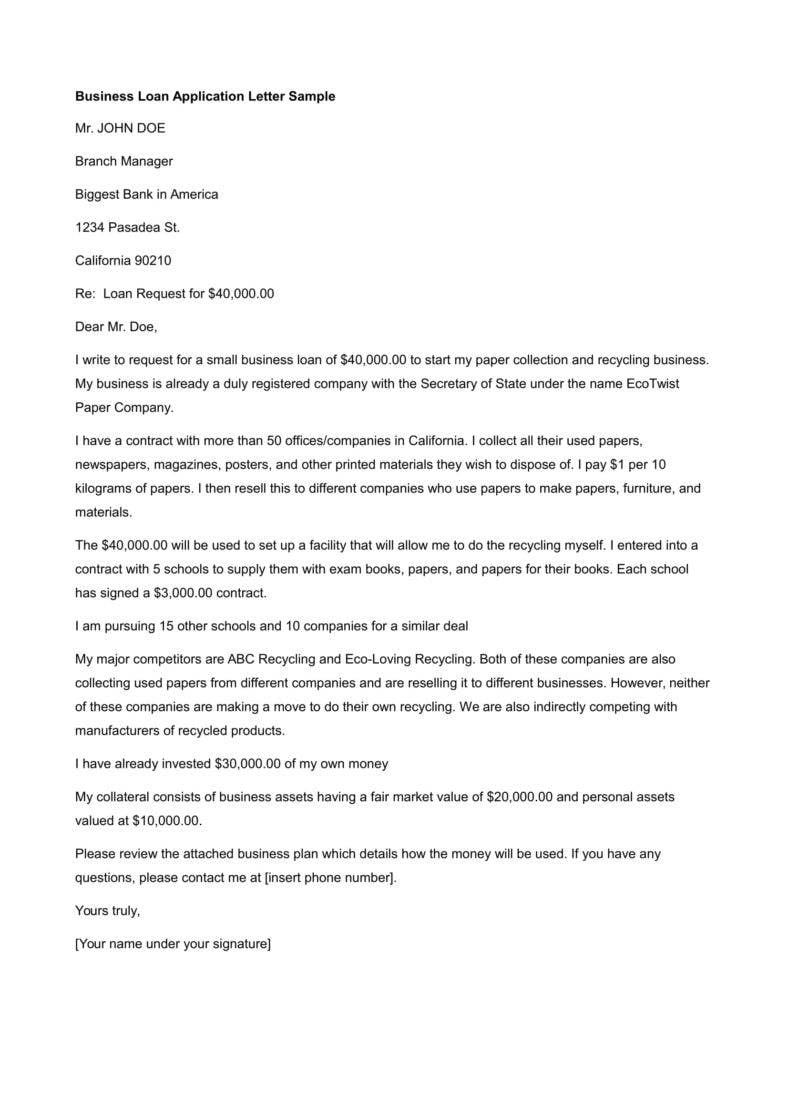

An Application Letter for a Loan Officer is a formal document submitted by an individual to a bank or financial institution, expressing interest in obtaining a specific loan. This letter outlines the purpose of the loan, provides personal and financial information, and might also detail the applicant's creditworthiness and repayment strategy. Borrowers get the funds they need and avoid risky loans from payday and installment lenders. Lenders get the satisfaction of helping a friend or relative - plus regular interest payments. In today's low-interest rate environment, even a low-interest personal loan may provide better returns than a CD or bond. Our advice?

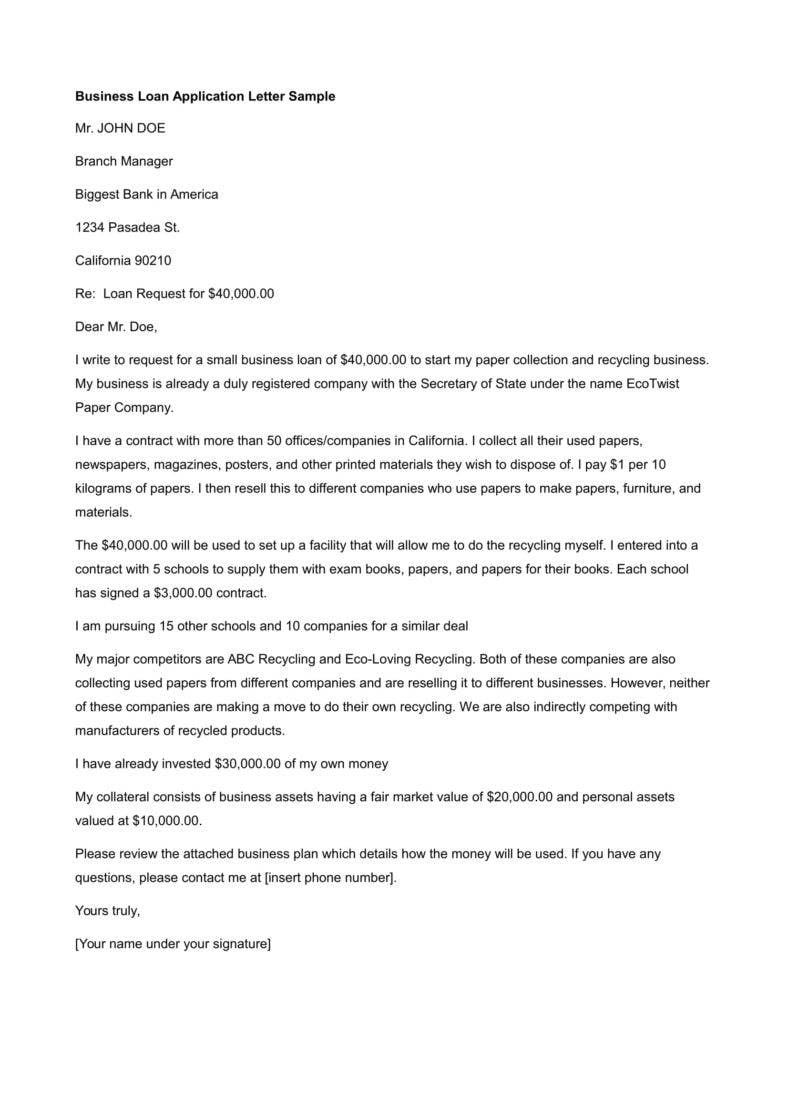

Here is a sample letter based on the above format. The purpose of this letter is to request a personal loan in the amount of $6,000. I intend to use the funds to renovate my home's outdated bathroom. I have attached the best estimate for the renovation and an estimate of the return on investment for this renovation. A Loan Agreement is a legal contract regulating the terms and conditions of a loan, and can be used by both individuals and corporations to lend or borrow money. Shareholders can also draft a Loan Agreement to borrow money from a corporation.

4+ Loan Application Letters Perfect for Starting Up a Business

1. Make Header Relevant. The header is very important before writing this letter to your company for a personal loan, you should include these details. You need to add the date, month, day, and year when you're writing the loan application letter. Make sure the date is correct. Your name is necessary of course. Anyone who applies for personal or business loan should write a loan request letter and enclose it with their loan application. This letter is often the lending institution's first impression of you as a borrower. Therefore, it should be professional, clear, and concise, easily fitting into one page.