The "Price Action" method of trading refers to the practice of buying and selling securities based on the fluctuations, or "action," of their prices; typically the data of these price changes is represented in easily-readable candlestick or bar charts, which are the bread and butter of the price action trader. What are Chart Patterns? How to Use Chart Patterns Trading Classic Chart Patterns Head and Shoulders Double Top and Double Bottom Day Trading Chart Patterns Intraday Chart Patterns Lastly What are Chart Patterns? Chart patterns and candlestick patterns may seem similar, but they have distinct characteristics.

Stock Chart Patterns Forex Trading Trading Charts

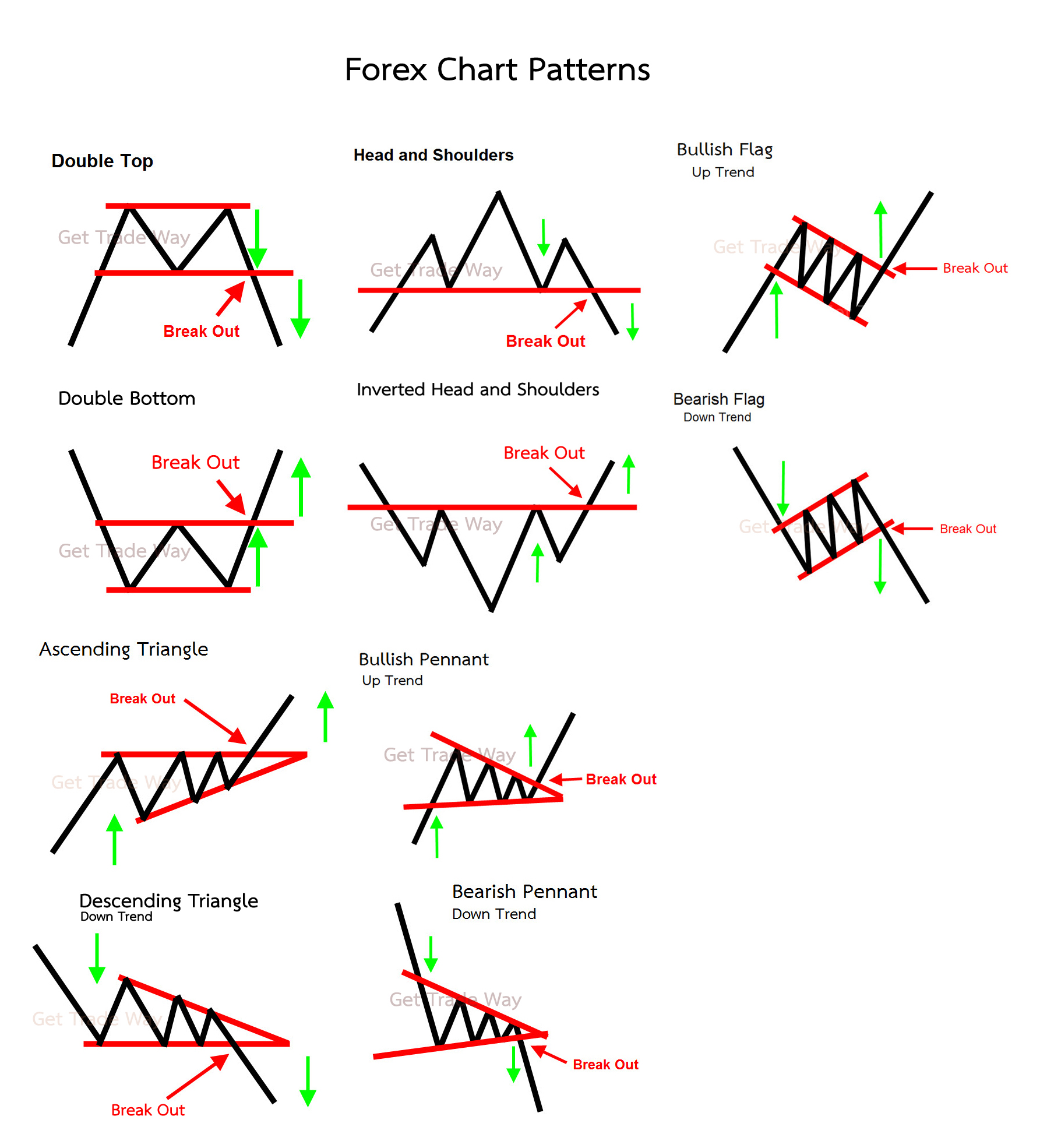

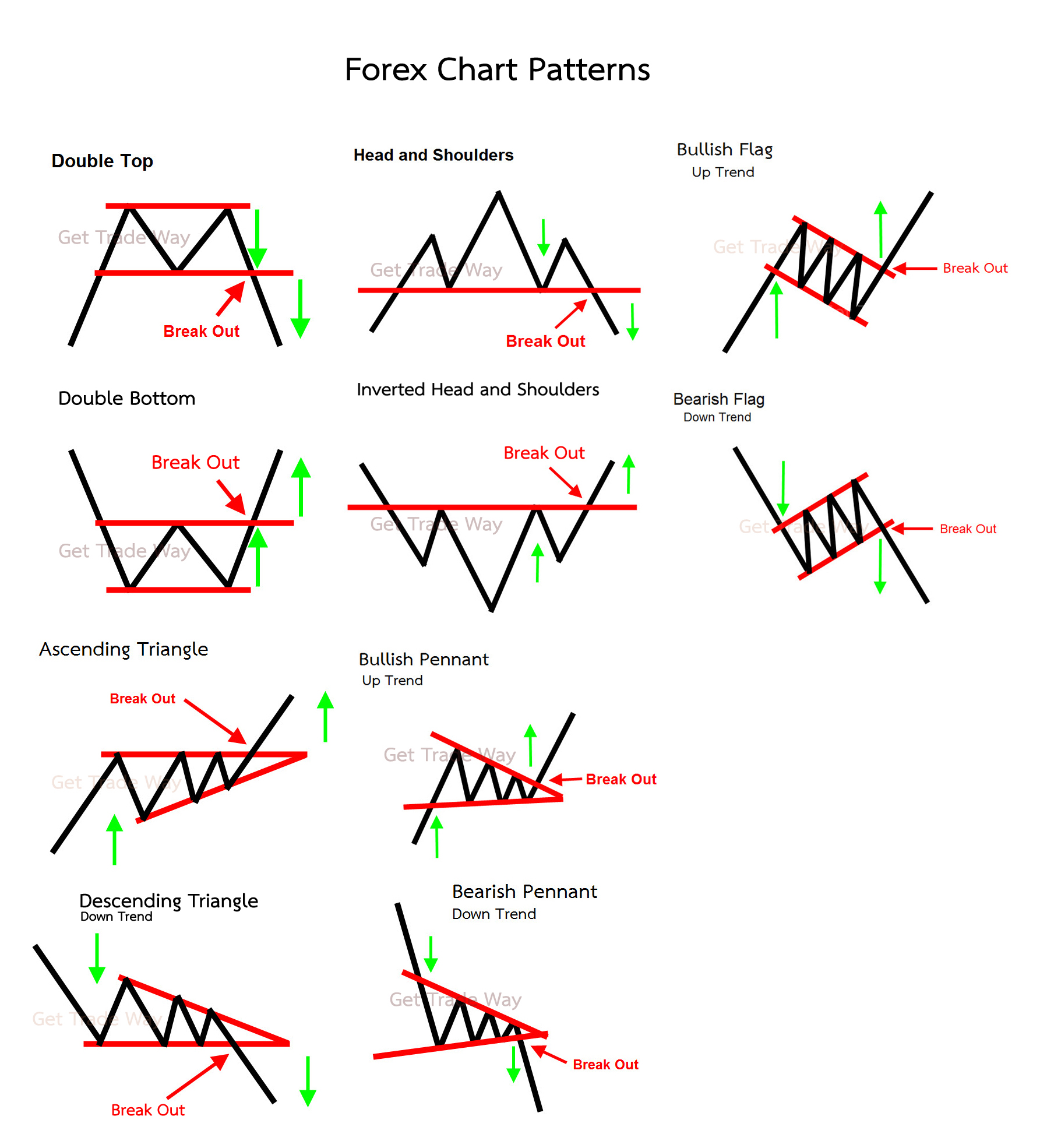

A pattern is bounded by at least two trend lines (straight or curved) All patterns have a combination of entry and exit points Patterns can be continuation patterns or reversal patterns Patterns are fractal, meaning that they can be seen in any charting period (weekly, daily, minute, etc.) Final Word Chart Patterns Cheat Sheet Download (PDF File) First, here's our chart patterns cheat sheet with all the most popular and widely used trading patterns among traders. You can print it and stick it on your desktop or save it in a folder and use it whenever needed. Chart Patterns Cheat Sheet PDF [Download] The Ultimate Guide To Price Action Trading - Free PDF Download - 128 Pages - Year: 2014 - price action - Read Online @ PDF Room.. Price action trading uses tools like charts patterns, candlestick patterns, trendlines, price bands, market swing structure like upswings and downswings, support and resistance levels, consolidations, Fibonacci. Jul 19, 2021 Written by: Al Hill Price action trading strategies are dependent solely upon the interpretation of candles, candlestick patterns, support, and resistance, pivot point analysis, Elliott Wave Theory, and chart patterns [1].

Price Action Trader on Twitter in 2022 Stock chart patterns, Candlestick chart patterns, Chart

Price action trading is an effective trading approach where traders make decisions based on the movement of prices shown on charts, without relying on complex indicators. It focuses solely on price history and doesn't consider external factors. Price charts reflect the collective behavior of traders in the market. Price Action is best described as a technique used to observe and study the current market. It gives traders the ability to anticipate the trend and make assumptions and decisions based on current/actual price movement. Traders who use this method should keep in mind that it relies solely on technical analysis. There are many patterns you can use for short term trading and patterns that can also be used to make intraday or scalp trades. How to Use Chart Patterns You can use chart patterns in different ways in your trading, but the most popular is to find and then make high probability trade entries. Chart patterns repeat time and time again. (PDF) The Ultimate Guide To Price Action Trading | Wilson Mota - Academia.edu Download Free PDF The Ultimate Guide To Price Action Trading Wilson Mota I just stood there and watched helplessly. After what seemed like an eternity, the trade was closed by broker at the worst possible price way-way-way-down below!

IQ Option วิธีเล่น เล่นยังไงให้ได้กำไร ด้วยกฎเหล็ก 11 ข้อ Riwwee รีวิวRiwwee รีวิว

significant price moves. The chart below demonstrates some of the innumerable patterns formed by candlesticks in the context of a daily price action chart. These patterns will be discussed and elaborated upon in the remainder of this guide. Doji This candle has zero or almost zero range between its open and close. Candlestick patterns are the foundation for traders. It helps traders read the price action in the stock chart. This blog post offers 35 powerful candlestick patterns for beginners to understand price action in stock charts and improve their trading skills. Plus, you can download a PDF to keep as a reference while trading.

These are 10 chart patterns that every price action trader should see when they look at a price chart. Reversal Chart Patterns 1. Head & Shoulders 2. Double Top / Double Bottom 3. Triple Top / Triple Bottom 4. Rounding Top / Rounding Bottom 5. Island Reversal Continuation Chart Patterns 6. Rectangle 7. Wedge 8. Triangle 9. Flag 10. Cup & Handle The price action guide covers all imaginable angles (let us know if anything is missing!) from candles to candlestick patterns and from path of least resistance to price swings. It offers a full 360 degree overview of everything connected to price action. The article has more than 10,000 words and 50 pages, but don't let that scare you.

📊 Chart Pattern Cheatsheet for BINANCEBTCUSDT by QuantVue — TradingView

Price action charts are a great way to identify patterns in the price of a security. A common pattern is a reversal pattern, which is when the price of a security goes down and then goes back up. Price action generally refers to the changes of a security's price over time. Different looks can be applied to a chart to make trends in price action more obvious for traders. This is.