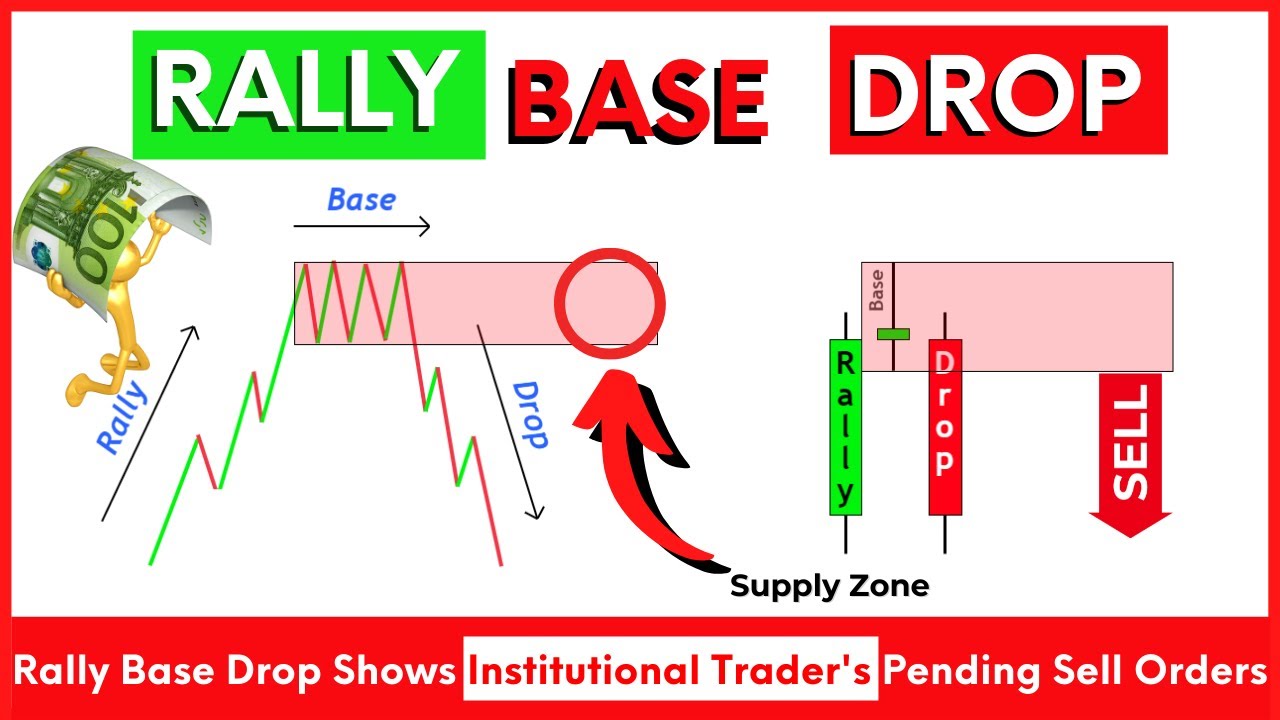

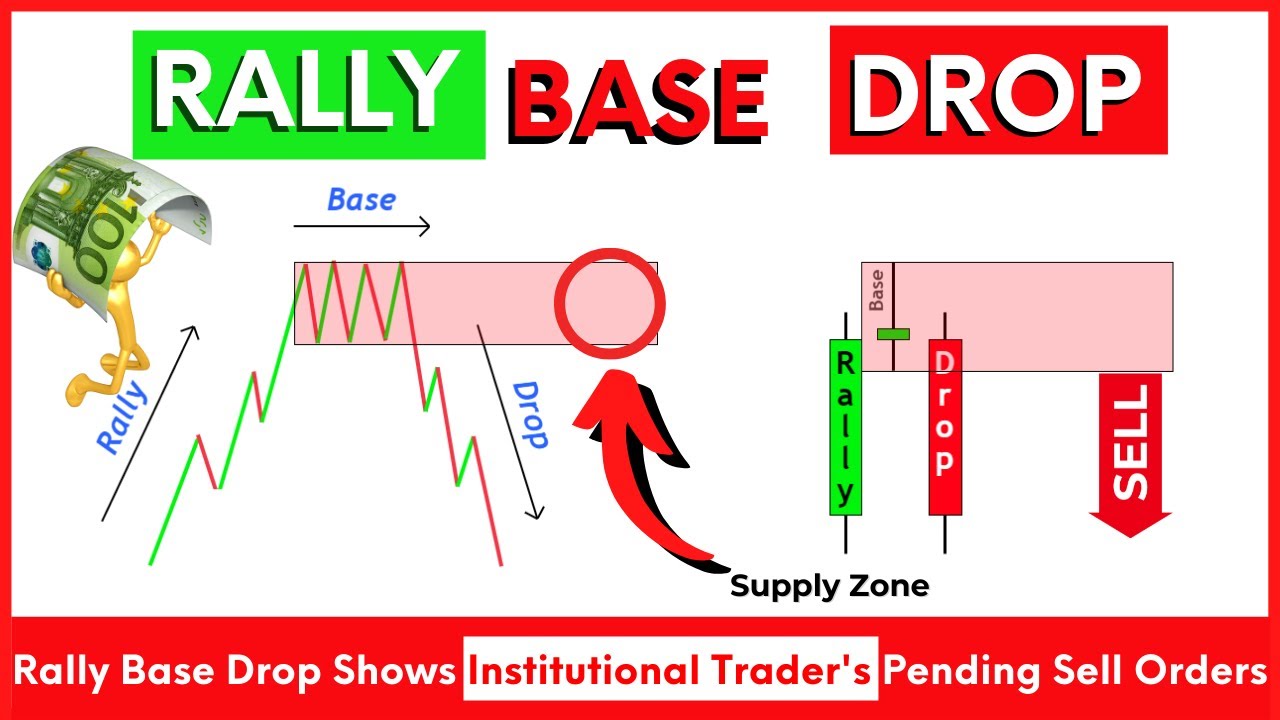

One strategy consists of taking a long position after a drop base rally pattern forms and the price returns to the rally's origin. Conversely, the other strategy takes a short position after a rally base drop pattern forms and the price returns to the drop's origin. You can use this strategy on any timeframe and with any currency pairs. Rally Base Drop is a price pattern that indicates the formation of a supply zone in forex trading. Big institutions and big traders place their pending sell orders at the supply zone to go short in trading. It is a type of supply and demand; retail traders use it to find out hidden sell orders of market makers.

Drop Base Rally Pattern PDF Guide Trading PDF

Rally base drop is a price pattern that indicates the formation of a supply zone on the candlestick chart of a financial asset or currency pair. It consists of a big bullish candlestick, one or more doji candlesticks and a big bearish candlestick. Supply and demand zone is a price action method that shows retail traders the footprints of the. A rally base drop (RBD) is a supply and demand price pattern in financial markets that indicates a potential reversal of a downtrend. It is characterized by three phases: RBDs are often seen as a bearish reversal pattern, as they suggest that the bulls are losing momentum and that the bears are taking over. However,… A rally base drop is a pattern that can occur in financial markets, such as the stock market, where an asset or security experiences a significant price increase followed by a period of consolidation or sideways movement. This consolidation period is known as the rally base. After the rally base has formed, the price of the asset may then drop, resulting in the rally base drop pattern. How to Trade Rally Base Rally? The second concept is the idea of a "rally" or "drop." This refers to a period of time when the price of a currency pair is moving in a particular direction, either up or down. During this time, buyers or sellers are in control of the market, and there is a clear trend in that direction.

Rally Base Drop reveals FOOTPRINTS of Institutional Traders YouTube

The drop base rally pattern in technical analysis is a chart pattern that appears when the market falls, then enters a period of sideways price action, and finally, shows explosive upward movements. Market makers open buy orders from demand zones to have a long position in trading. This is some kind of study for technical analysis known as DBR. A Rally Base Drop is a Price pattern that indicates the formation of a Supply Zone. Explaining further, a Rally Base Drop is a Price pattern that occurs when prices have been rising, peaking and then sharply dropping. This indicates that the sellers are now more aggressive and have overwhelmed the buyers to form a Supply Zone. Drop base rally (DBR) is a price pattern that represents the formation of a demand zone on the price chart in technical analysis. Market makers open buy orders from demand zones to go long in trading. It is a type of supply and demand in technical analysis and known as DBR. These patterns are the basics of supply and demand. RBR vs Rally Base Drop. Rally Base Rally (RBR) and Rally Base Drop (RBD) are distinct price patterns that can provide insight into market trends. While RBR focuses on the formation of a demand zone between two bullish trends (rallies), RBD is formed by a supply zone that occurs between a bullish trend (rally) and a subsequent bearish trend (drop).

A Complete Guide to Rally Base Drop Pattern Trading PDF

Rally Base Rally (RBR) is a simple price action pattern that shows a strong demand zone on the chart. This means a specific area on the chart where the number of buyers are increasing. It is based on the concept of supply and demand in Trading, which states that prices move according to the imbalance between buyers and sellers. Rally-base-rally (RBR) and drop-base-drop (DBD) zones take shape when banks decide to execute trades or take profits, similar to how rally-base-drop (RBD) and drop-base-rally (DBR) zones form. As the banks undertake these actions, price shifts away, giving birth to the zone. Up to this point, it all seems fairly straightforward - supply and.

RALLY-BASE-DROP (RBD) MARKET STRUCTURE IN PRICE ACTION TRADING EXPLAINEDRegister for Lifetime mentorship program :- https://forms.gle/EjkGm23kFdC6iSvn8What. Rally Base Drop is a price pattern that indicates the formation of a supply zone in forex trading. Big institutions and big traders place their pending sell.

Rally Base Drop A Forex Trading Strategy ForexBee

The tool shows where lots of trading took place in the market. Super high trading activity often means banks are getting involved. So, if a rally-base-rally or drop-base-drop zone has a lot of trading behind it, that suggests the banks might be interested in using the zone. This could make it more likely for a price reversal to happen. The Rally Base Rally (RBR) is a widely recognized chart formation in the world of forex trading. It is a technical analysis pattern that tries to provide insights into potential market reversals and continuation trends. Traders often use RBR patterns to identify favorable entry and exit points in the foreign exchange market.