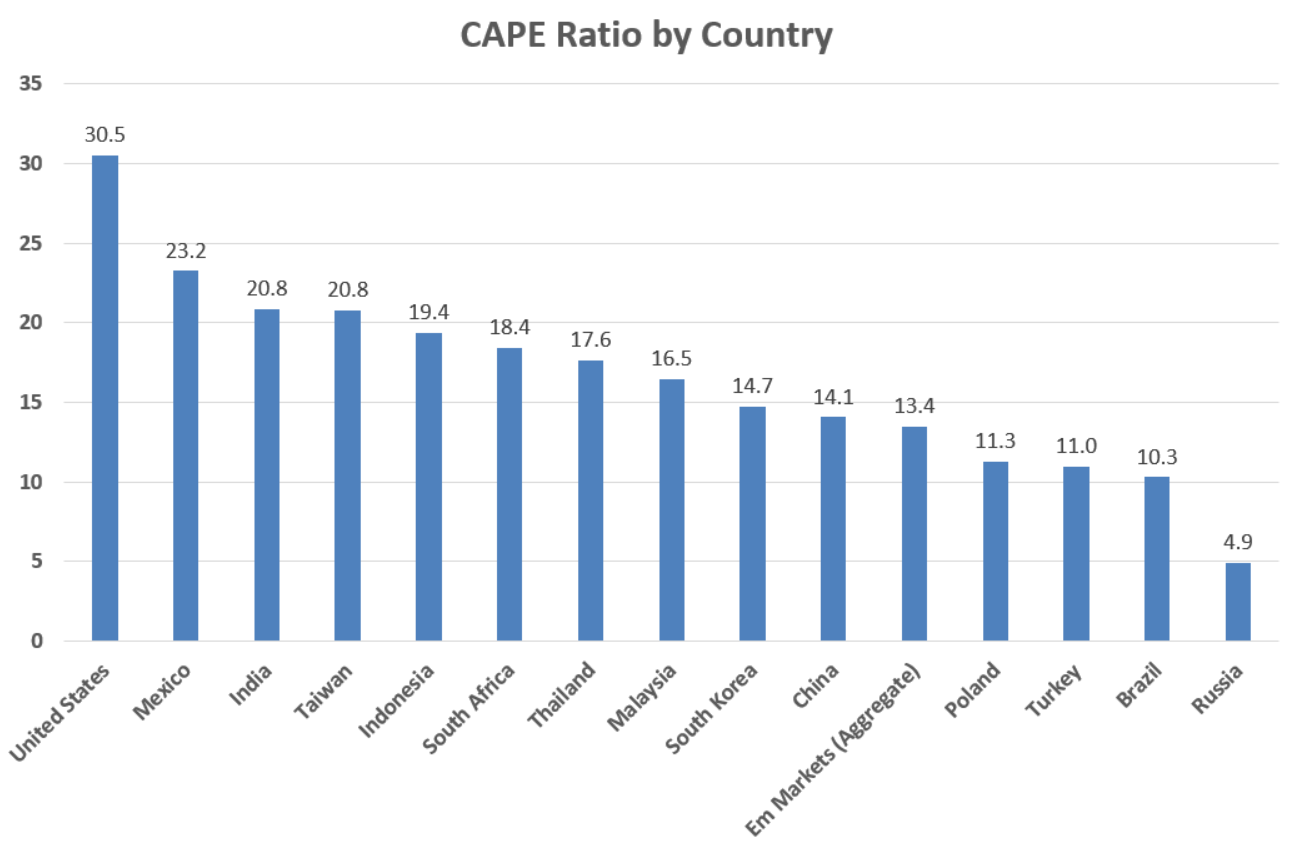

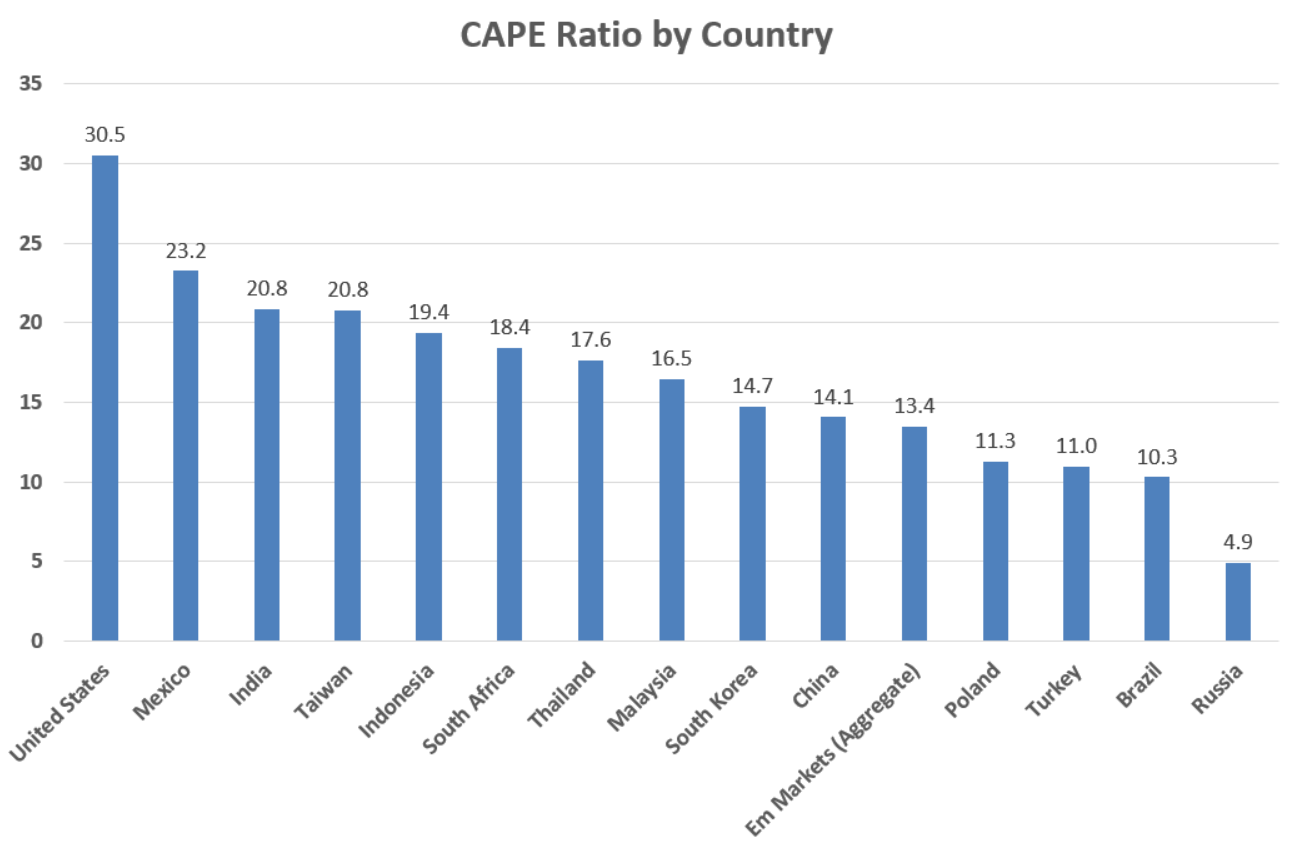

CAPE Ratios by Country (Global Shiller PE Ratios) The table below lists the historical and current CAPE ratios of the largest equity markets in the world. Among the largest economies, the most expensive stock markets can be found from India, the U.S. and Japan. The CAPE ratio or Shiller P/E stands for the cyclically adjusted price-to-earnings ratio ( CAPE ). CAPE is a stock market valuation signal. It is mildly predicative of long-term equity returns. (The CAPE ratio is even more predictive of furious debate about its accuracy). In brief:

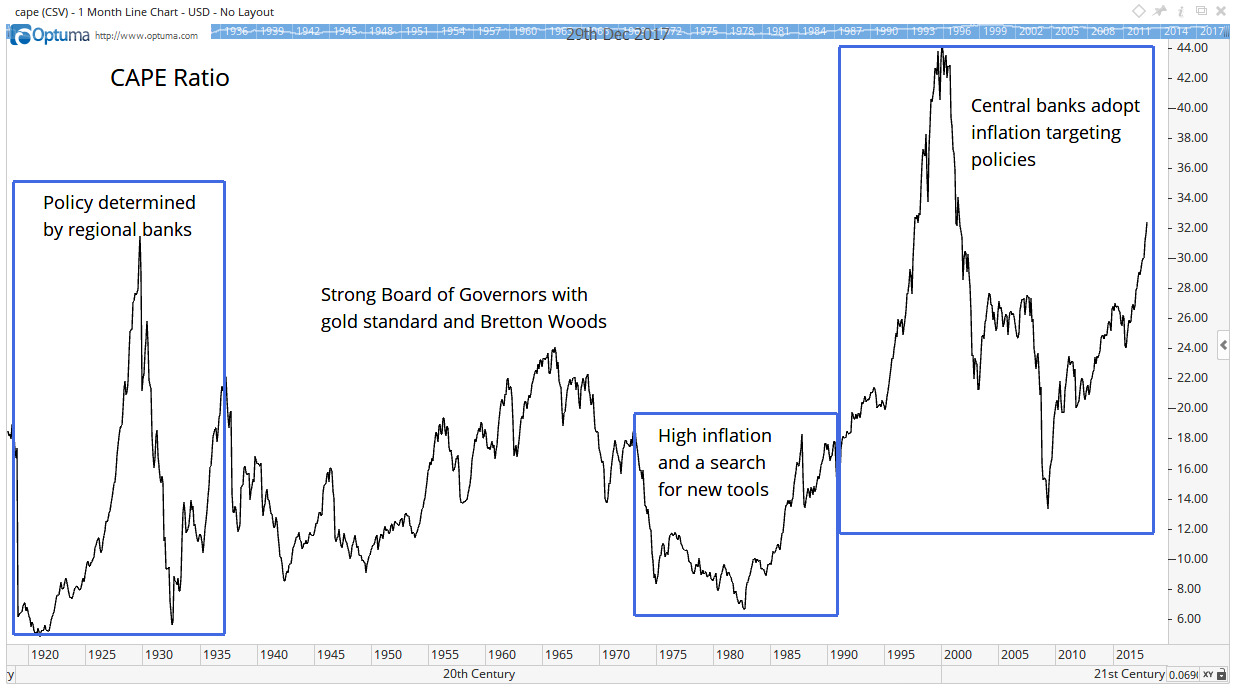

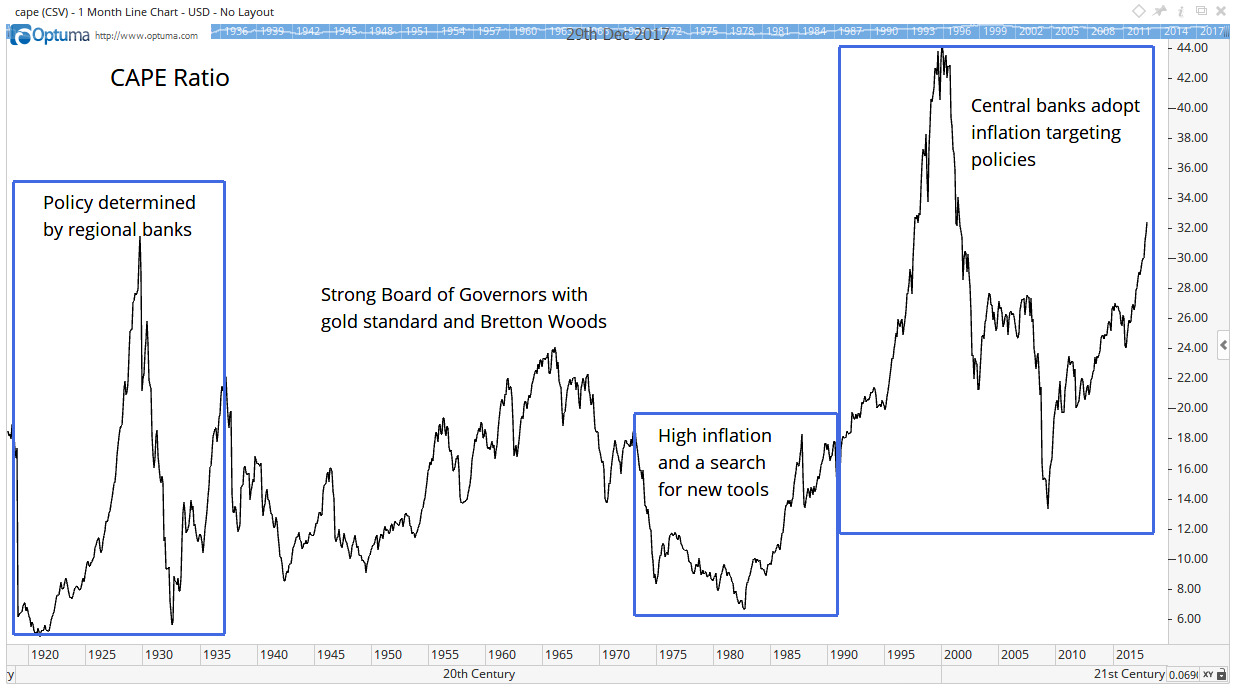

CAPE Ratio Charts Show Why the Stock Market Isn't Overvalued

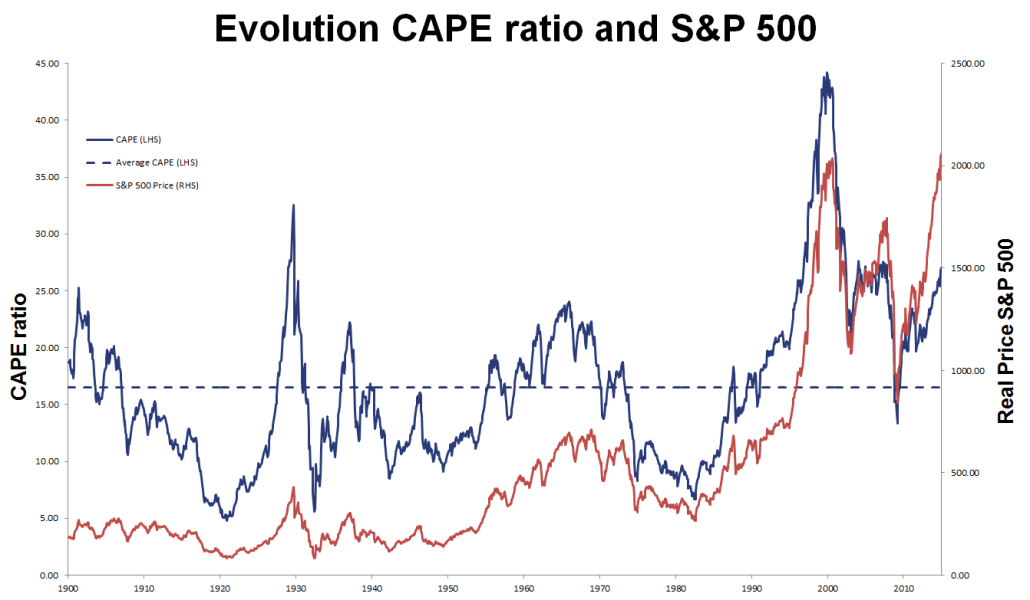

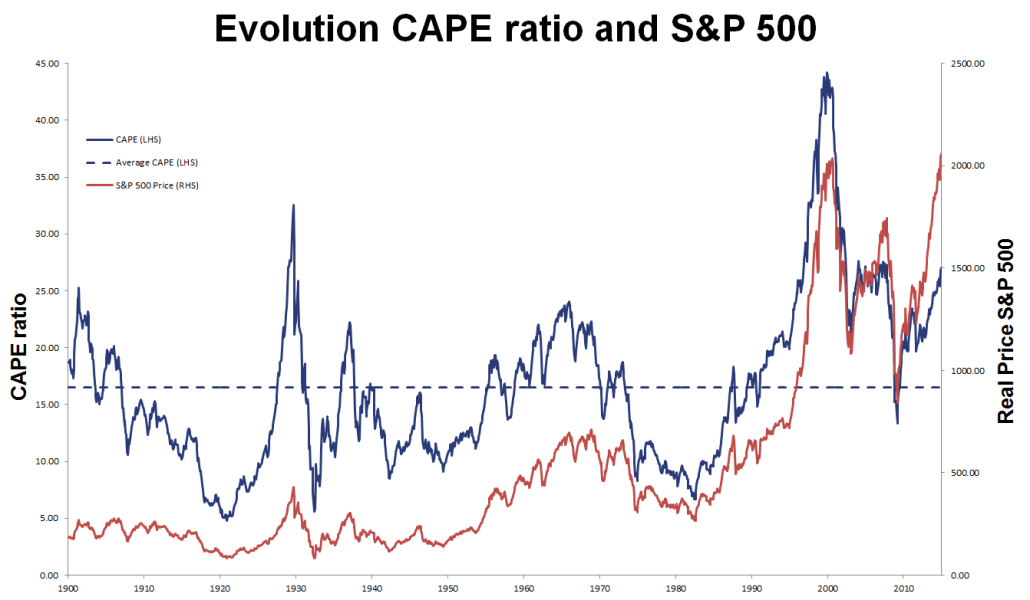

The CAPE ratio stands for cyclically adjusted price-to-earnings ratio and is also known as the Shiller P/E, named after Yale University professor Robert Shiller, or the PE 10 ratio. The cyclically-adjusted price-to-earnings (CAPE) ratio of a stock market is one of the standard metrics used to evaluate whether a market is overvalued, undervalued, or fairly-valued. This metric was developed by Robert Shiller and popularized during the Dotcom Bubble when he argued (correctly) that equities were highly overvalued. The CAPE ratio ( Shiller PE) of the global stock market is currently 21.45 (July 1st, 2023). This global stock market is calculated using an index of the 3,000 largest public companies around the world, including the United States, developed world and emerging markets. Stock screener for investors and traders, financial visualizations.

The Mousetrap 07/13/2014 Calculating the True CAPE Ratio

CAPE ratio by country / region / world Region / Country Research Affiliates (31/5/22) Barclays Research (31/5/22) Cambria Investment (10/4/22) Historical median (Research Affiliates) Global 25 n/a 18 22 Developed markets 27 n/a 23 23 Emerging markets 15 n/a 16 16 Europe 18 21 - 17 UK 14 18 16 14 US 32 32 36 Price-to-earnings ratio is maybe the most fundamental metric used by investors when both individual companies and markets as a whole are evaluated. The ratio is easy to understand and calculate but the problem arrives when it's time to select which earnings should you actually use. Total Market Value of the U.S. Stock Market CAPE Ratios by Country (Global Shiller PE Ratios) NASDAQ 100 Index P/E, EPS & CAPE Ratio EV/EBITDA (Enterprise Multiple) by Sector/Industry (U.S. Large Cap) FTSE 100 / 250 / All-Share Dividend Yield & Total Return Latest Datasets Japan Stock Market Valuation (2023) NASDAQ 100 Index P/E, EPS & CAPE Ratio The CAPE ratio is calculated by dividing the current price of a single stock or a broad stock market index by the average inflation-adjusted earnings of the stock or the index components over the past 10 years.

CAPE Ratio Definition, Interpretation and Criticisms

The Cyclically Adjusted Price to Earnings Ratio, also known as CAPE or the Shiller PE Ratio, is a measurement from Robert Shiller. It adjusts past company earnings by inflation to present a snapshot of stock market affordability at a given point in time. This page contains a Shiller PE ratio which calculates the number for the last 10 years. The CPI-U (Consumer Price Index-All Urban Consumers) published by the U.S. Bureau of Labor Statistics begins in 1913; for years before 1913 1 spliced to the CPI Warren and Pearson's price index, by multiplying it by the ratio of the indexes in January 1913. December 1999 and January 2000 values for the CPI-Uare extrapolated.

Median CAPE Ratio: 25% most expensive: 23 (U.S. in this bucket) 25% cheapest 10 Average of Foreign Developed 17 Average of Foreign Emerging 14 We've mentioned this a lot in the past but bears repeating. We use the MSCI Investable Market Indices below, but MSCI also calculates their Standard Indices too. CAPE Ratio: The CAPE ratio is a valuation measure that uses real earnings per share (EPS) over a 10-year period to smooth out fluctuations in corporate profits that occur over different periods of.

3 Investments to Consider for an Expensive Market RHS Financial

Methodology The Average P/E (μ) and the Standard Deviation (σ) are calculated excluding 20% outliers (i.e. it's calculated over a range of values excluding 10% of observations from the top and 10% from the bottom of the dataset). In this website, a P/E between (μ - σ) and (μ + σ) is considered "Neutral" or "Normal", over a specific timeframe. The purpose of this page is to provide an overview of the stock market valuations of the 26 largest economies in the world. The indicators we use are still the percentages of the total market caps of these countries over their own GDPs and the modified indicator, TMC / (GDP + Total Assets of Central Bank) ratio.