india motor tariff india motor tariff the tariff advisory committee (hereinafter called tac) have laid down rules, regulations, rates, advantages, terms and conditions as contained herein, for transaction of motor insurance in india in accordance with the provisions of part ii b of the insurance act, 1938. herein, for transaction of motor insurance in india in accordance with the provisions of part ii b of the insurance act, 1938. this tariff supersedes the provisions of the india motor tariff in existence upto 30 th june 2002. the provisions of this tariff are binding on all concerned and any breach of the tariff shall be a

Motor Tariff PDF

ORIENTAL INSURANCE COMPANY LIMITED (ALL INDIA MOTOR TARIFF Revised as on 01.06.2022 ) TWO WHEELER ZONE ZONE A ZONE B Age of Up to 151 to Above Up to 151 to Above Vehicle 150cc 350cc 350cc 150cc 350cc 350cc INDIAN MOTOR TARIFF Budget 2024: Will interim budget roll out the red carpet for Tesla? Union Budget: India is positioning itself to welcome Tesla, buoyed by efforts to ease import duties and facilitate the electric vehicle (EV) giant's potential investments. erstwhile Indian Motor Tariff (IMT) has been proposed for those private cars identified as Vintage Cars by the Vintage and Classic Car Club of India. A discount of 15% is proposed for Electric Private Cars, Electric Two Wheelers, Electric Goods carrying Commercial Vehicles and Electric Passenger carrying. Introduction. Motor insurance business in India is regulated under the India Motor Tariff 2002 (IMT) issued by the erstwhile Tariff Advisory Committee in 2009.While pricing of the Own Damage segment was de-tariffed in 2007, the basic product structure, including the policy wordings and other standard forms, continues to be governed by the General Regulations (GRs) and various other provisions.

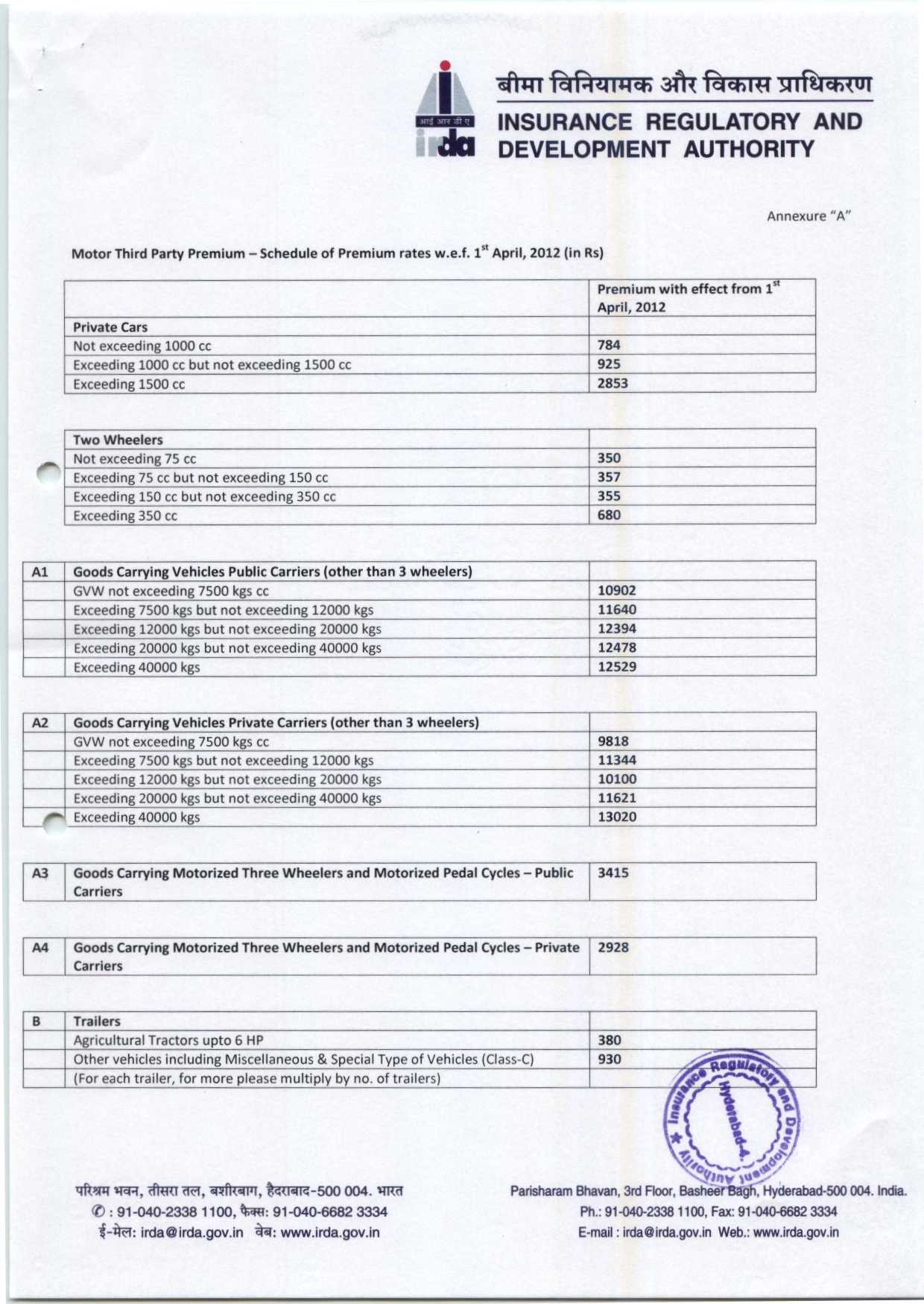

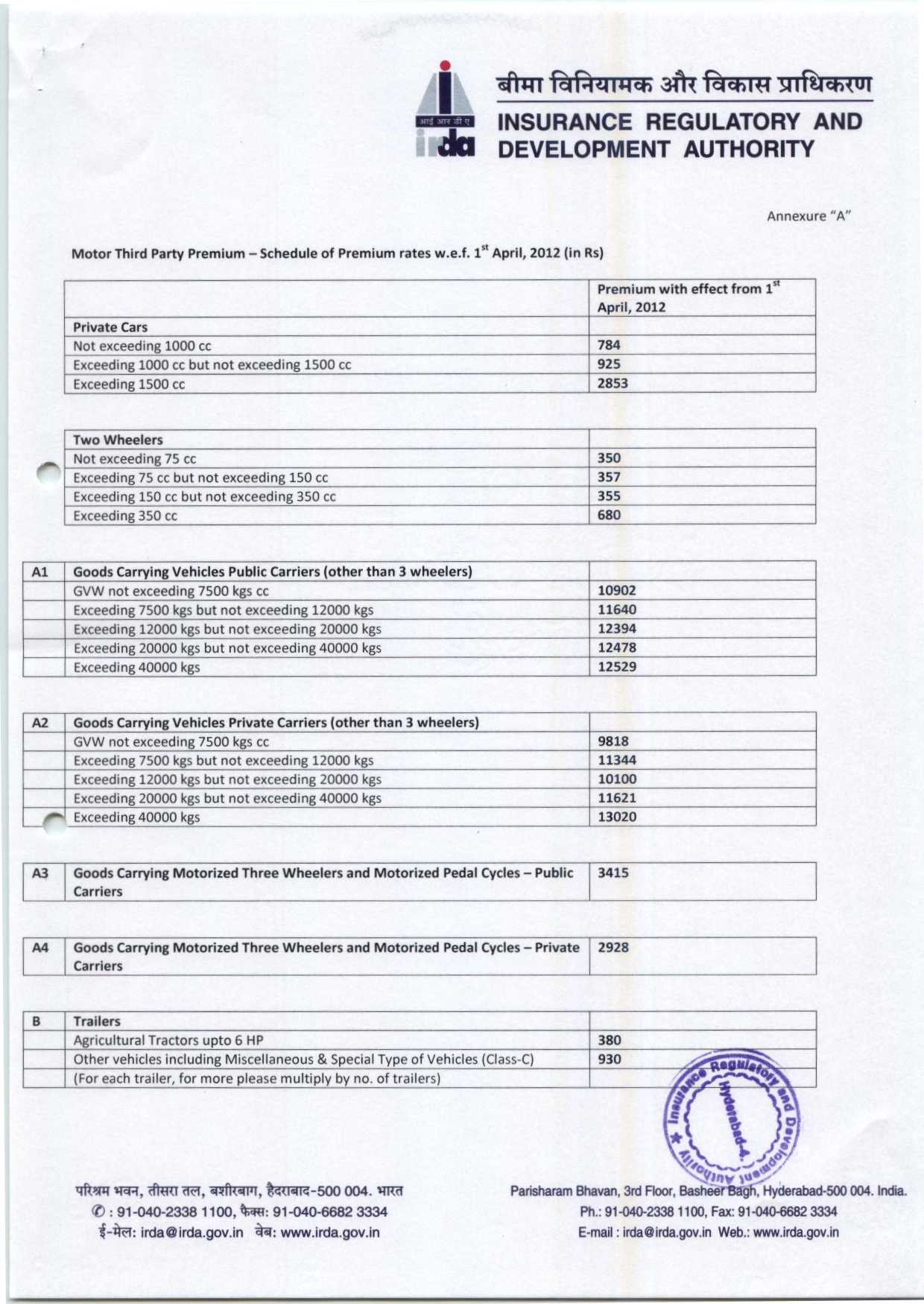

Motor Vehicles (Third Party Insurance Base Premium and Liability) Rules

IMT, short for "Indian Motor Tariff," is a set of guidelines and provisions established by the Insurance Regulatory and Development Authority of India (IRDAI) for motor insurance in India. IMT 29, in particular, plays a crucial role in protecting policyholders against unforeseen events and financial losses. ALL INDIA MOTOR TARIFF ( Revised as on 01st April ,2018 ) TWO WHEELER PRIVATE CAR ZONE A Loss of Accessories cover by Theft @ 3.00% Subject to Minimum Rs.50 /-Above 1500 cc Per Passenger Premium Rs.1241/- ( Multiply with Seat Capacity) The IRDAI has reiterated that in the event that a motor vehicle is sold or transferred, the guidance provided under General Regulation 17 of the India Motor Tariff (ie, transfers) will apply. General Regulation ('GR')-36 of India Motor Tariff('IMT'), 2002 mandates General Insurance Companies carrying on motor insurance business to provide Compulsory Personal Accident (CPA) Cover for Owner-Driver under both Liability Only and Package policies.

[MINDMAP] The challenge of skilling India INSIGHTSIAS

The Indian Motor Tariff 2002 (often abbreviated to "Motor Tariff") has been the defining regulatory framework governing motor insurance policies in India. Within this document, Clause 7 of Section 2 specifically addresses the situation involving a private car owned by an employer and used for transporting employees. tariff advisory committee 1-1-01 2 the tariff advisory committee (hereinafter called the committee) has laid down rules, regulations, rates, advantages, terms and conditions, as contained herein, for transaction of contractor's all risks insurance business in india in accordance with the provisions

An analysis of the above facts shows that the relevant provisions, (General Regulation 8 of All India Motor Tariff, 2002) and those of relevant guidelines indicated under charge no.2 above, have been violated to the extent of having been non-transparent regarding deductions made from the claims. The Insurer has maintained that the claimants. IMT Endorsements IMT (Indian Motor Tariff Act 2002) Endorsements are the series of 65 Endorsements under Motor Insurance ,which are insert into policy, and formed the part of the main policy. IMT (Indian Motor Tariff Act 2002) Endorsements are the series of 65 Endorsements under Motor Insurance ,which are insert into policy, and formed the part of

IRDA Motor Tariff 2023 2024 EduVark

For the transaction of motor business in India in accordance with the provisions of part II-b of the insurance act 1938, the tariff advisory committee have . insures may restrict the cover under the standard B policy form without reduction in premium or they may increase the premium for the same or restricted cover without obtaining the permission of the miscellaneous sub-committee of the. An IDV (Insured Declared Value) in car insurance is nothing complicated but, refers to the market value of your car. In other words, it is the amount your car could receive in today's market. This IDV in car insurance helps your insurer, a.k.a us determine your claim amounts correctly during claim payments.