The stochastic momentum index (SMI) is a technical analysis tool that analyzes price momentum. It's calculated using the closing price relative to the median range (high-low) of the security's price over a specified period. The indicator is represented on a chart as an oscillator, not to be confused with the stochastic oscillator, as seen. The Stochastic Momentum Index, or SMI, shows the closing momentum and its relation to the median high/low range for that period. Stochastic Oscillator The stochastic oscillator is a.

What Is Stochastic Momentum Index (SMI) Indicator Earnfo

The Stochastic Momentum Index (SMI) is a technical indicator that measures the momentum of an asset's price. The SMI is a refinement of the stochastic oscillator developed by George Lane in the 1950s. The Stochastic Momentum Index (SMI) is an enhanced version of the regular stochastic oscillator, designed to be a more reliable indicator that minimizes false swings by measuring the distance between the current closing price and the median of the high/low price range. What is the Stochastic Momentum Index? The Stochastic Momentum Index (SMI) is an indicator of momentum for a security. The SMI is used in technical analysis as a refined alternative to a traditional stochastic oscillator. The SMI (stochastic momentum index) Ergodic indicator is a technical analysis tool that predicts trend reversals in the price of an asset by measuring the ratio between the smoothed price change and the smoothed absolute price change of a certain number of previous periods.

CUSTOM Stochastic Momentum Index Indicators ProRealTime

The stochastic momentum index (SMI) is like the stochastic oscillator on steroids and was brought to the trading world by William Blau. Instead of reading the closing price of the asset as the standard stochastic indicator, the SMI will calculate the closing price in relation to the average of the high/low range. Commonly abbreviated to SMI, Stochastic Momentum Index is advancement in the Stochastic Oscillator. Stochastic Oscillator is primarily used to calculate the distance between the Current Close and Recent High/Low Range for n-period. Stochastic Momentum Index shows the distance of Current Close relative to the center of High/Low Range. The Stochastic Momentum Index (SMI) is similar to Stochastic Oscillator with the difference that it finds position of the Close price relative to the High-Low range's midpoint, not the range itself. This difference results in the oscillator being plotted on the -100 to +100 scale. Volume Moving Average ^. Volume Oscillator ^. VWAP (Volume Weighted Average Price) ^. Vortex Indicator ^. Weighted Alpha ^. Weighted Close ^. Welles Widler Volatility ^. Wilder Accumulative Swing Index ^. Technical Indicators and Chart Studies: Definitions and Descriptions.

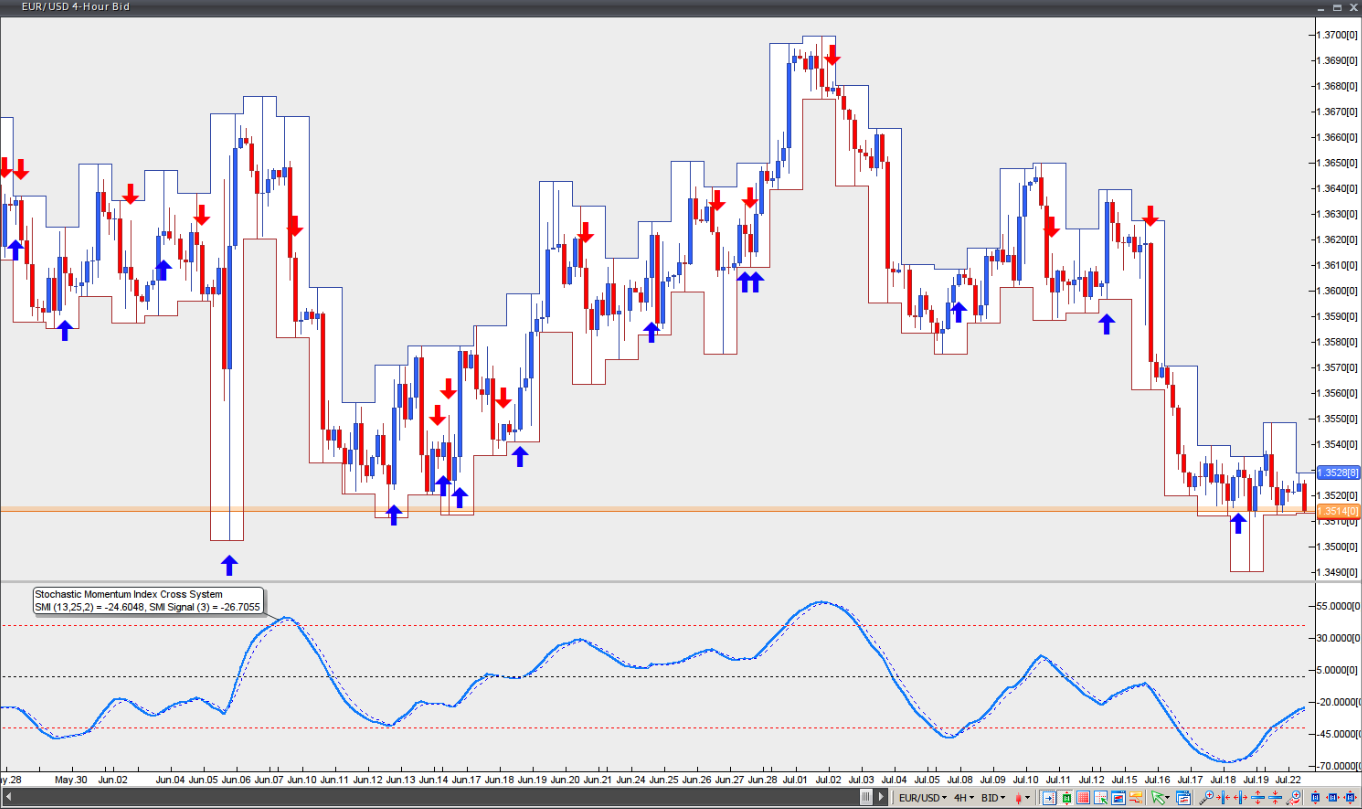

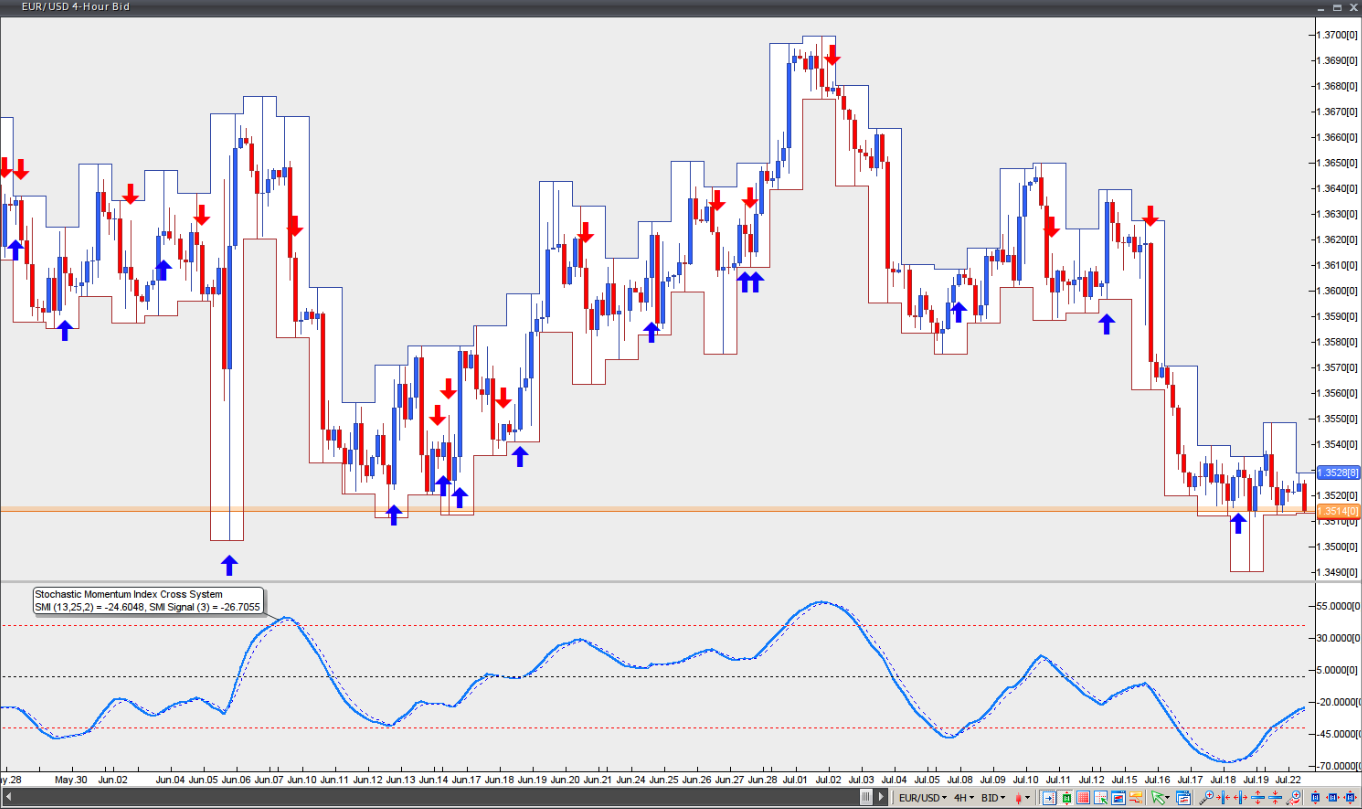

Stochastic Momentum Index Forex Trading Indicators

A stochastic oscillator is a momentum indicator comparing a particular closing price of a security to a range of its prices over a certain period of time. The sensitivity of the oscillator to. Stochastic Momentum Index. everget Wizard Updated May 9, 2018. Stochastic Oscillator Centered Oscillators Momentum Indicator (MOM) SMI blau Stochastics. 2094. 10. Mar 27, 2018. Stochastic Momentum Index indicator script. This indicator was originally developed by William Blau (Stocks & Commodities V. 11:1 (11-18)). May 9, 2018.

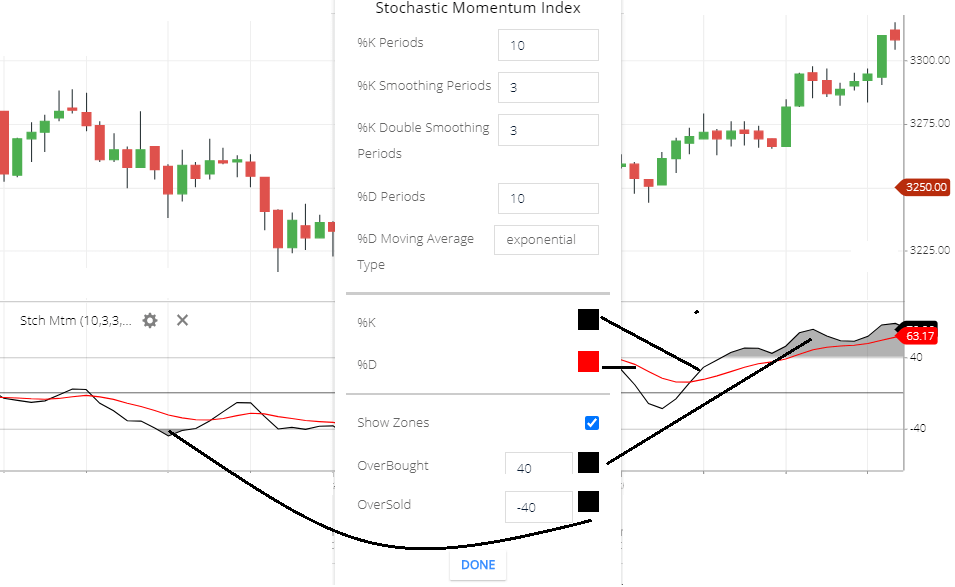

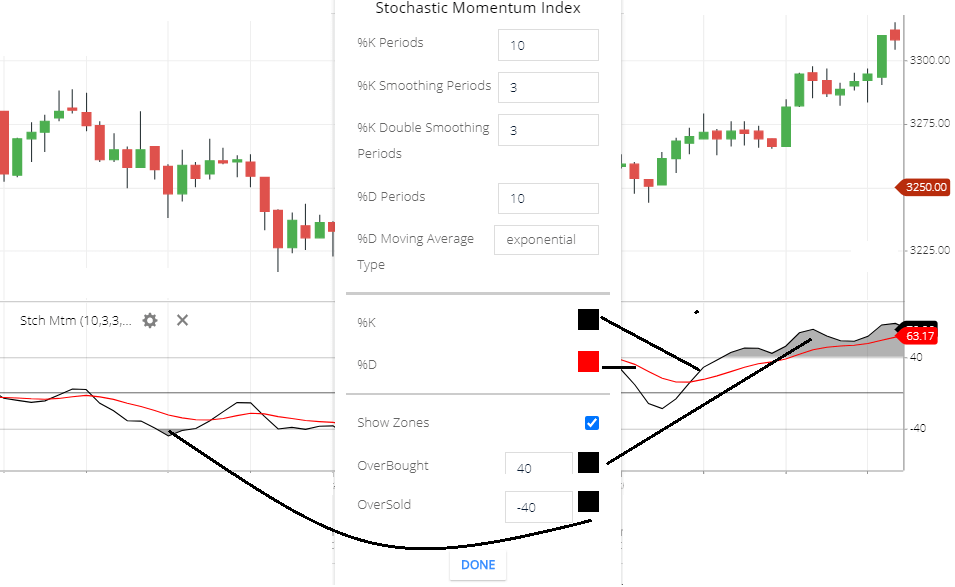

The Stochastic Momentum Index (Stoch) normalizes price as a percentage between 0 and 100. Normally two lines are plotted, the %K line and a moving average of the %K which is called %D. A slow stochastic can be created by initially smoothing the %K line with a moving average before it is displayed. The Stochastic Momentum Index can be utilized in technical analysis as an alternative to the traditional stochastic oscillator. SMI is a calculation of the distance from the current close price of an asset concerning the high and low-price range. This is visually reflected in the chart, usually with an exponential moving average (EMA).

boutique trading strategies Can you Use A Stochastic Momentum Index

What is the Stochastic Momentum Index Indicator? First of all, Stochastic Momentum Index Indicator is an advancement in the Stochastic Oscillator. Traders primarily use the stochastic Oscillator to calculate the distance between the Current Close and Recent High/Low Range for the n-period. Stochastic Momentum Index (SMI) or Stoch MTM is used to find oversold and overbought zones. It also helps to figureout whether to enter short trade or long trade. Red Shade in the Top indicates that the stock is oversold and the Green shade in the bottom indicates overbought. Strategy: