By using this IS (which includes any device attached to this IS), you consent to the following conditions: -The USG routinely intercepts and monitors communications on this IS for purposes including, but not limited to, penetration testing, COMSEC monitoring, network operations and defense, personnel misconduct (PM), law enforcement (LE), and. Voluntary Provident Fund (VPF) aka Voluntary Retirement Fund is the voluntary fund contribution from the employee towards his Provident Fund (PF) account. This contribution is beyond the 12% of contribution by an employee towards his EPF. The maximum contribution is up to 100% of Basic Salary and Dearness Allowance.

PROBLEMS ON PROJECTION OF POINTS ENGINEERING GRAPHICS UNIT II EG

Acronym Definition; VPF: Vascular Permeability Factor (biology) VPF: Virtual Product Folder: VPF: Vector Product Format: VPF: Virtual Print Fee: VPF: Vertical. A VPF is a contribution that one makes towards their provident fund account over and above their Employee Provident Fund contribution. This is a scheme made specifically for salaried employees who wish to add to their provident fund. August 18, 2022 A government backed savings scheme, with high returns and low risk, VPF full form is Voluntary Provident Fund. It is a type of provident fund scheme in which an employee/depositor can maintain a significant part of his/her provident fund voluntarily. VPF (Voluntary Provident Fund) is a type of regular provident fund scheme under which a depositor can maintain an explicit portion of their provident fund voluntarily. As the name suggests, VPF allows the contributor to electively fix the amount which will be contributed towards the scheme on a monthly basis.

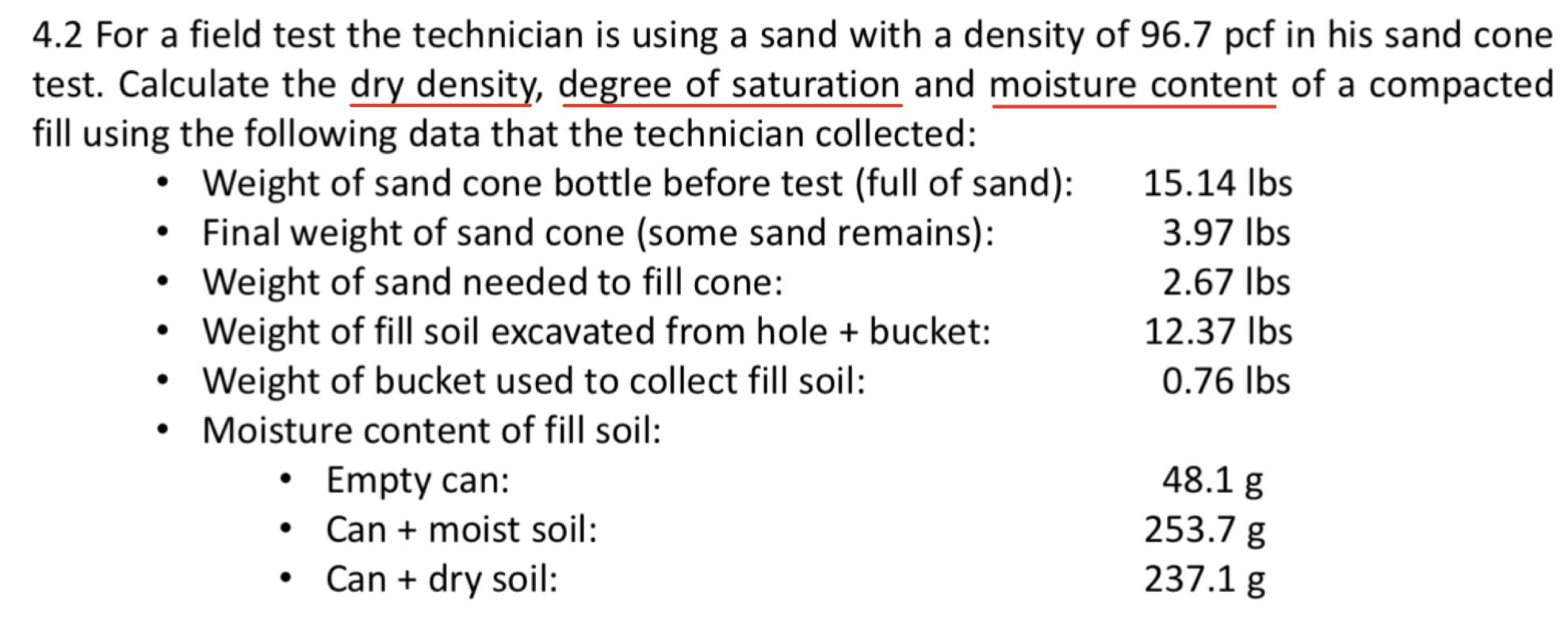

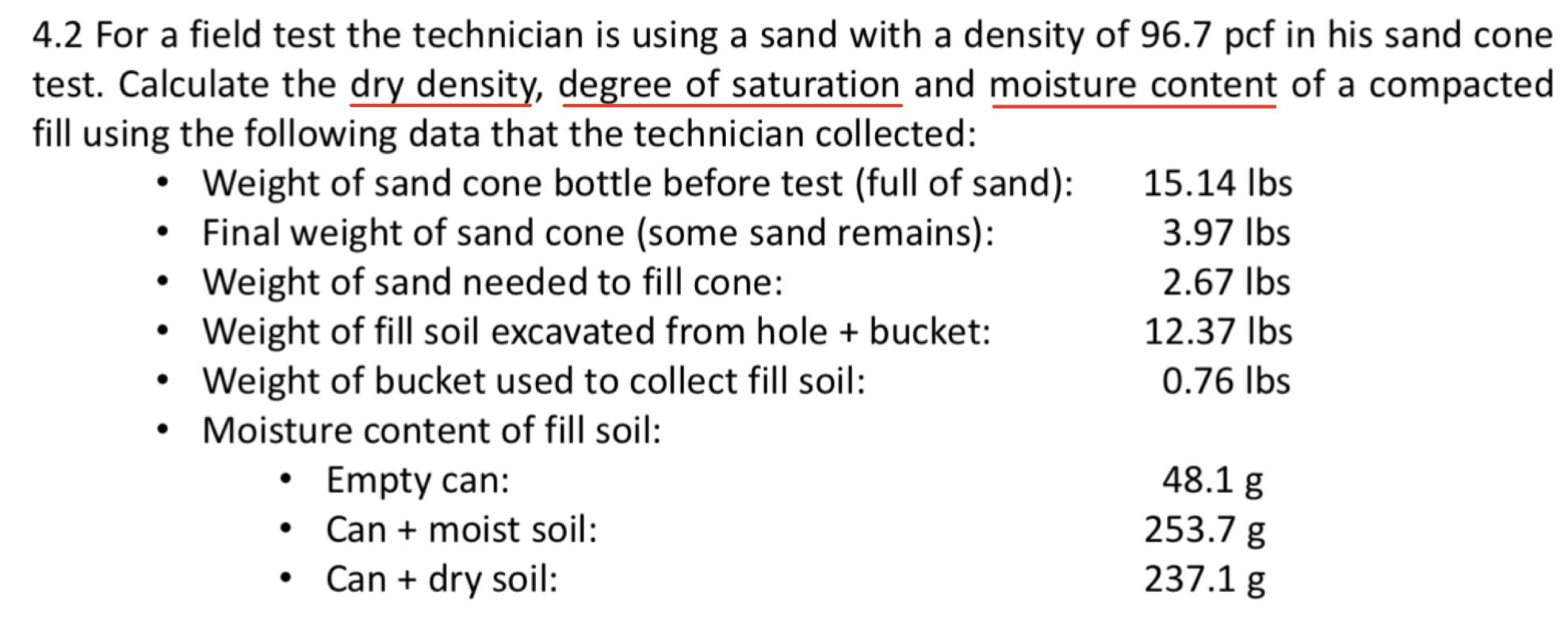

Solved . 4.2 For a field test the technician is using a sand

VPF is a scheme that comes under the traditional provident fund savings scheme. However, under the VPF scheme, the contributor decides on the amount of fixed contribution that is made towards the scheme on a monthly basis. Rate of interest of 8.1% p.a. Risks of investing are minimal Easy to transfer the amount in case of a job change #1 fisico30 374 0 Hello Forum, Work is given by force times distance: W= F d. Power P is work over time: W/t or F v. If the force is constant the velocity is changing with time: v=v (t). So instantaneous power is P_inst= F (t) v (t). Can we have a situation where v is constant and F is constant too, i.e. the instantaneous power is constant? OVERVIEW PaO2/FiO2 ratio is the ratio of arterial oxygen partial pressure (PaO2 in mmHg) to fractional inspired oxygen (FiO2 expressed as a fraction, not a percentage) also known as the Horowitz index, the Carrico index, and (most conveniently) the P/F ratio at sea level, the normal PaO2/FiO2 ratio is ~ 400-500 mmHg (~55-65 kPa) The VPF contributions too earn the same returns that the employee's and employer's contributions earn. It is for this reason that VPF is considered a very attractive option to invest in. The current interest offered on VPF contributions is 8.5%, which is much higher than that of the Public Provident Fund (PPF).

V N F h [ X P [ v f B [ v [ Y3.5 b g

Definition Power is the rate with respect to time at which work is done; it is the time derivative of work : where P is power, W is work, and t is time. We will now show that the mechanical power generated by a force F on a body moving at the velocity v can be expressed as the product: New Delhi: Finance Minister Nirmala Sitharaman has announced in the Union Budget 2021-22 that PF contributions over Rs 2.5 lakh in a financial year will be taxable from the next financial year.This has made some people wonder if they should continue contributing towards a voluntary provident fund (VPF) which earns the same interest as that of EPF and enjoys the same tax treatment.

However, the new Provident Fund(PF) rule introduced recently in the Union Budget 2021 could be a piece of bad news for some employees. As per the new proposal, if the investment in VPF and EPF put together is above Rs 2.5 lakh in a financial year, the returns earned on the contribution above Rs 2.5 lakh will not be exempted from tax.. The No. 1 Michigan Wolverines used a punishing rushing attack to down the No. 2 Washington Huskies in Monday night's College Football Playoff National Championship game.

u L J F p [ v X e 3 b g

VPF Tax Benefits. As mentioned previously, a Voluntary Provident Fund enjoys all the benefits of EPF, including tax benefits. Contributions made to an EPF account in a specific year are exempt from taxation under Section 80C of the Income Tax Act, 1961 up to a maximum of Rs.1.5 lakh. It includes VPF contributions as well. V.P.&F, INC is an Active company incorporated on October 22, 2004 with the registered number P04000145700. This Domestic for Profit company is located at 1601 BISCAYNE BLVD, MIAMI, FL, 33132, US and has been running for twenty years. There are currently three active principals. KEY FACTS ABOUT V.P.&F, INC US Businesses Companies in Florida