This is an exclusive library available only to Funded Lab members, offering you access to hundreds of diverse set files and strategies. These set files are continually optimized on a daily and weekly basis to ensure that you're utilizing the most up-to-date and effective strategies for the current market, giving you the highest chance of success! 📈| Refined Supply & Demand Trading 📅| Weekly Trade Recaps 🌎| London & NY

Black Swan Events Definition & Theories in Forex Trading LiteFinance

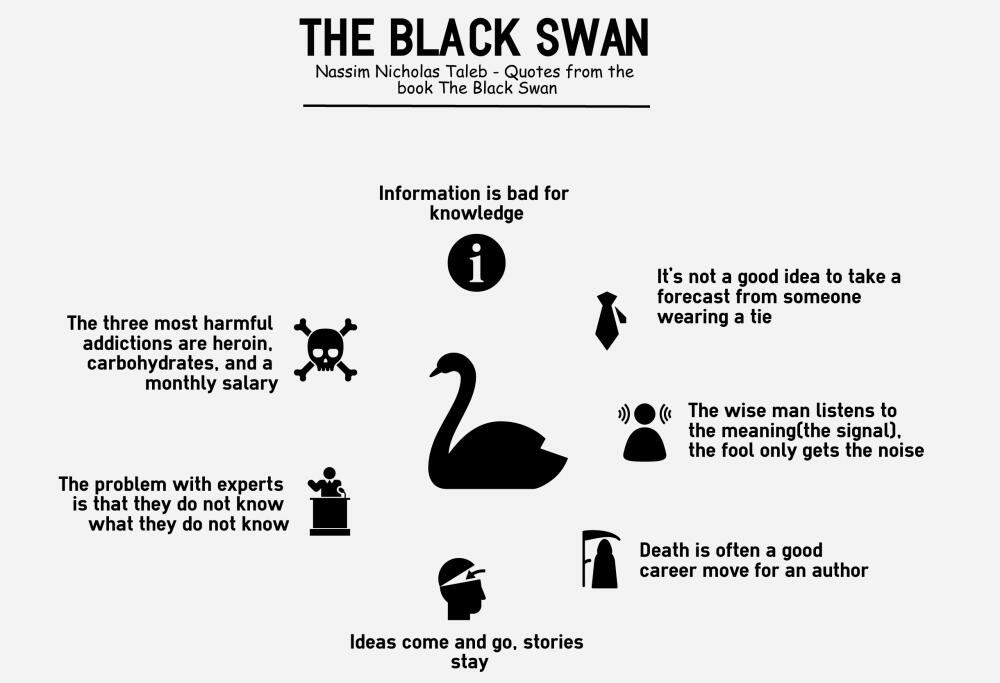

Black swan theory is the idea that events can arise completely unheralded - are unpredictable based on our current monitoring - which are then incorrectly classed as predictable after the fact. It is used to describe the effect that unforeseen events have on human history. The Phenomenon of Black Swans in Forex FXOpen 14 Dec 2023, 08:35 In becoming a successful forex trader, understanding the impact of Black Swans in 2023 and beyond becomes crucial. Black Swan events, unpredictable and with significant repercussions, constantly reshape the financial landscape. Black swans are a term that was introduced by Nassim Taleb, denoting global unpredictable events that can radically change the situation. They cannot be predicted, but you can prepare: be flexible, do not be overconfident, react instantly to non-standard news, develop critical thinking and decision-making skills in conditions of uncertainty. The term "Black Swan" is used within the context of the financial markets to describe an event that comes as a surprise but has a significant effect on the world. A popular book that also helped coin the black swan event definition was Black Swan by Nassim Taleb. He is also considered the founder of today's black swan theory.

Black Swan Events In Trading

The term 'black swan' is used to describe economic, political and social accidents that are inevitable and impossible to predict. This is exactly what Nassim Nicholas Taleb, a former Wall Street trader and the author of the black swan theory, calls them. A black swan is an unpredictable event that is beyond what is normally expected of a situation and has potentially severe consequences. Black swan events are characterized by their extreme. Classic black swan events include the rise of the internet and personal computer, the September 11 attacks, and World War I. However, many other events such as floods, droughts, epidemics, and so. One well-known example of a black swan event is the financial crisis of 2008, which was caused by the housing market's collapse and resulted in a global economic recession. The mortgage crash had a substantial impact on financial markets, with many investors losing a sizeable portion of their portfolios.

Forex Black Swan! Look Out For The Signs Before It’s To Late! Forex Academy

The forex market is the most liquid market in the world, with $5 trillion being exchanged daily by institutions, businesses, and retail traders. Sometimes, unexpected events can cause huge price swings in currency values, leading to substantial losses for traders. These unforeseen events are commonly referred to as "black swan" events. What is a black swan event? Black Swan Event Convulses FX MarketIn the forex space, the most noteworthy of these events over the past few decades have been the Swiss National Bank (SNB) Crisis which convulsed currency.

A "black swan" is a rare and nearly impossible to predict event that has deep and wide-ranging consequences for the global economy. Because black swan events have generally not happened previously, they are hard to plan for.. Forex trading is challenging and can present adverse conditions, but it also offers traders access to a large, liquid. A black swan event is metaphorically used to explain an event that occurs unexpectedly. Even the observers tend to miss the potential signs. By the time a black swan event occurs, it is too late to realize.

Forex Black Swan Event Update! What Should You Be Trading & Avoiding Forex Academy

The term 'black swan' originates from Latin in the form of an expression "a rare bird on Earth, like a black swan." For a long time in Europe, people believed that swans other than white did not exist. However, in the 17th century, a population of black swans was discovered in Western Australia, but the expression is still used to describe. Black swan events in forex refer to unexpected and rare events that can have a significant impact on the currency exchange rates. These events are unpredictable, and their impact can be severe and sudden, causing sharp movements in the forex market.