Create unique wall planners, trackers, charts & more. Add up to 6 customisable columns. Over 100 designs to choose from. Add cover photo & column photos. Premium design. Share the workload between employees, managers & accountants and save time. Easily manage employee expenses. Fully integrated w/ Employees, Invoicing, Project & more.

Printable Budget Planner for Weekly Fortnightly and Monthly Etsy Budget planner template

Our free online budget planner helps you track, plan and prioritise where your money is going. Budget Planner This free detailed budget planner will help you take control of your finances and reach your savings targets Written by Savvy Editorial Team , updated on July 28th, 2023 Fact checked Taking charge of your finances starts right here with our budget planner 2 minutes On this page Having a budget helps you see where your money is going. You can put aside money for bills and expenses and set up a plan to reach your financial goals. Follow these steps to get started. Use how often you get paid as the timeframe for your budget. For example, if you get paid weekly, set up a weekly budget. 1. Budget calculator This handy tool figures out where your money goes and how much you should have left over, for a simple and complete picture of your financial situation. Income Net (after tax) salary and bonuses Amount Annual amount $0 Investment income (interest, dividends, rent) Amount Annual amount $0 Allowances Amount Annual amount $0

Unlock Your Financial Potential Smart Money Management with Aesthetic

A budget plan is an accounting tool which lets you easily track your income and expenditure. A budget plan is a crucial part of an effective financial plan, and can be created to track short, medium, or long-term financial goals. Budget Planner Organise your budget It's easy finding out how much more you can put away regularly to meet your goals sooner. Simply enter your current income and expenses in the table below, picking from our suggested fields or adding your own to configure it just the way you want. A budget planner is a tool, such as a worksheet, that you can use to design your budget. A successful budget planner helps you decide how to best spend your money while avoiding or. Work out how much you're spending. To do this, look at any of these: Centrelink Deduction Statements. Use the simple money manager to do your budget. You can then see if you have money left over. You could use this for your savings. You don't need to have a large savings goal. Small goals are just as good.

Penny Pinchers’ Paradise The Crème de la Crème of Budget Planners

Our free online budget planner is here to help. Try our online budget planner to get an overview of your personal finances and how you're spending your money on a weekly, monthly or yearly basis. For more information on how to budget and plan your financial future, book a no-obligation chat with a My Money Sorted team member to reach your. Our interactive free budget planner tool helps you understand your current financial situation. Using it is simple - just enter your income and expenses to find out where you are spending your money and how much money you have left to save or help repay your debts. How to use the planner

Budgets are essential for tracking the financial health of your business. Your budget is your planned income and spending. It helps you to allocate funds for particular items and activities. Your budget also helps you to: set business goals. make good business decisions. get finance. Use our free budget planner template to create a personalised budget to track your expenses so you can spend less, save more and make the most of your money.

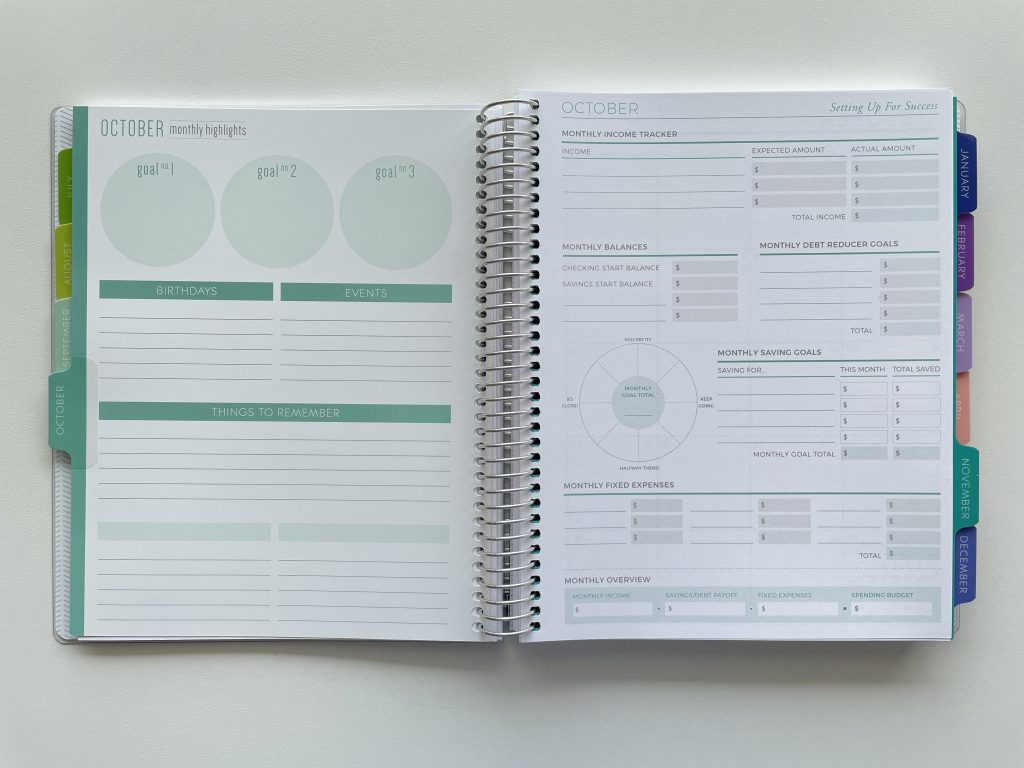

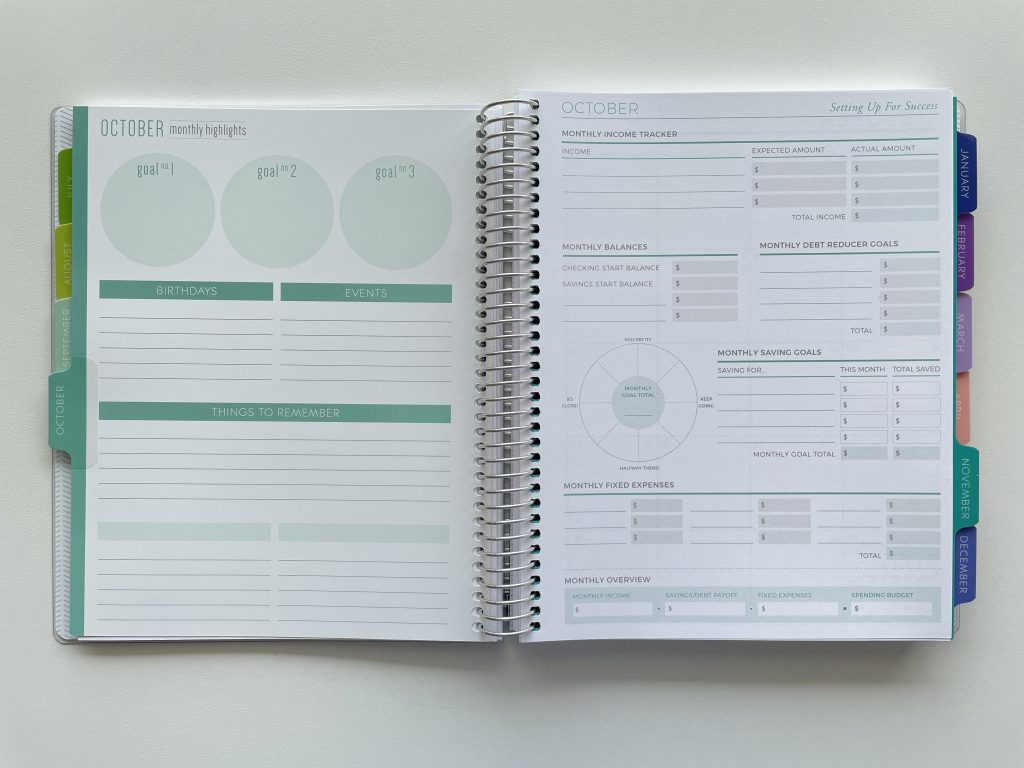

Plum Paper Budget Planner Review (and comparison with the budgeting add

The ANZ Budget Planner is a tool provided for illustrative purposes only. The results generated by using the ANZ Budget Planner tool are based only on the information you have provided. It does not constitute a quote or financial advice, and ANZ does not endorse or approve any budget calculated using ANZ Budget Planner.. A more basic approach is what's known as the "50:30:20 rule": Budget 50% of your income for essential living expenses (such as rent, bills and groceries) Budget 30% of your income for lifestyle costs (like dining out, buying clothes) Save 20% of your income into a savings account. The first step is to decide how many buckets you need and what.