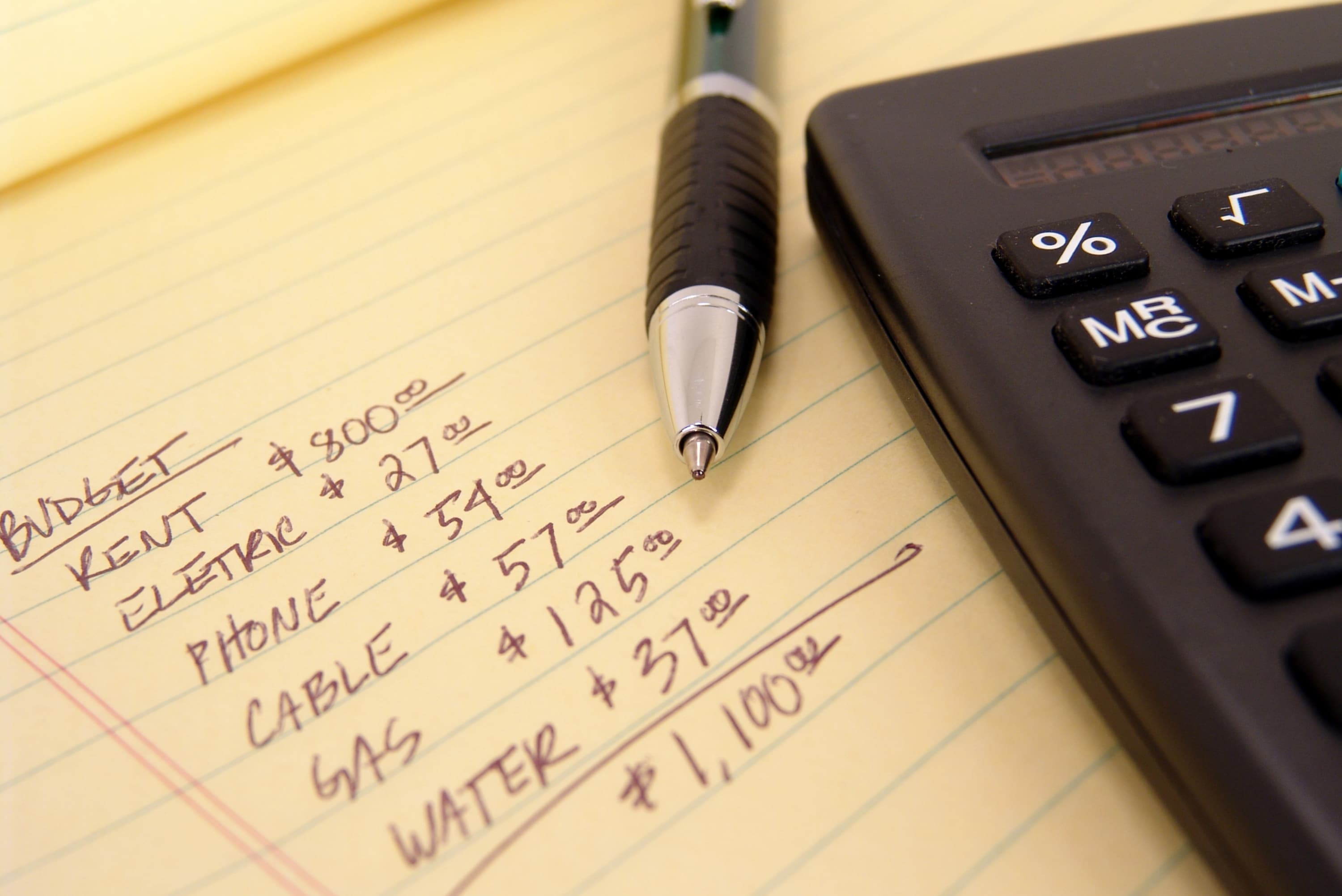

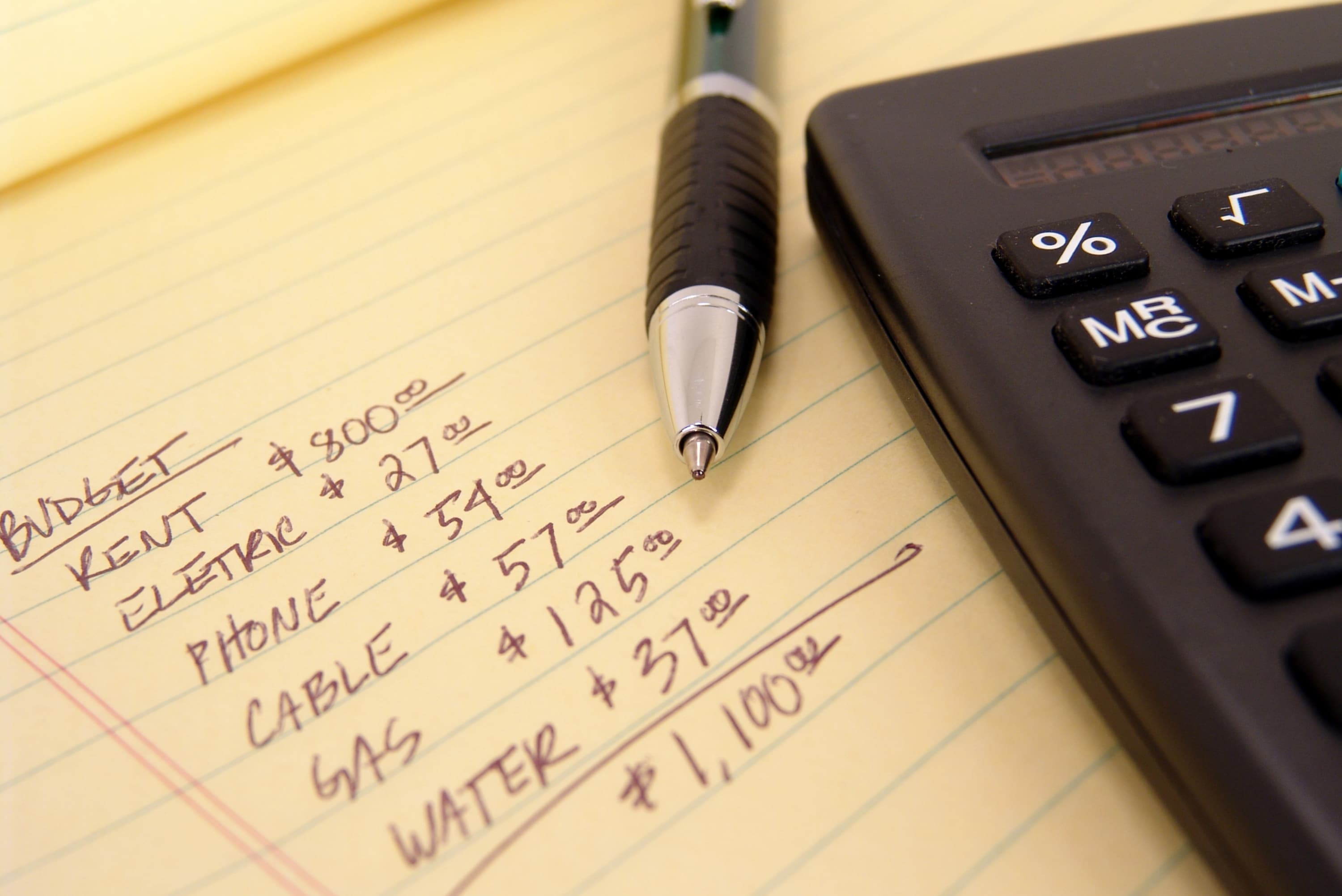

What is a budget planner? A budget planner is a tool, such as a worksheet, that you can use to design your budget. A successful budget planner helps you decide how to best spend your money. Having a budget helps you manage your money, control your spending, save more money, pay off debt, or stay out of debt. Without an accurate picture of what's coming into and going out of your bank account, you can easily overspend or find yourself relying on credit cards and loans to pay your bills.

3 Easy Steps To Create A Budget To Fit Your Needs Coaching with Kaylee

The cheapest foods to buy are: Eggs Peanut butter Chicken thighs Canned tuna Ground turkey Long-lasting vegetables, such as broccoli, carrots, spinach, celery, and sweet potatoes Inexpensive fruit, such as apples, bananas, and oranges Oats Brown rice Beans How? By breaking down the process a bit. Because no one eats an elephant by swallowing it whole. (You go one bite at a time.) And no one leaps into budgeting like a pro. (You take it one step at a time.) So, here we go—bite by bite, step by step. Here's how to make a budget in five steps. List Your Income List Your Expenses 1 Decide how you will document your household spending, earnings, and budget. [2] You can use a simple pen and paper but it is much easier to use a spreadsheet program or a simple accounting program if you have access to one. You can find sample budget worksheets from Kiplinger here. . A home budget is a spending plan that accounts for a household's income and expenditures. It helps people allocate money for certain expenses, save for financial goals and identify areas.

The best way to setup Your Financial Budget Mee Fund

Step 1. Embrace the Ongoing Process of Budgeting We often tend to think of budgeting as a one-and-done kind of chore. You sit down with your accounts and receipts. You figure out how much you have. How to Budget in 5 Simple Steps 1 Identify Goals Identify important goals you want to achieve that will require money. Set 3-5 financial goals and priorities you hope to achieve, e.g. make a 10% down payment on a home in 5 years. 2 Record Expenses When you move out for the first time, you'll have to pay a security deposit on your new apartment (typically it's one month's rent). Many rental applications have fees that you'll have to pay, which are typically around $50. Make sure you have money for these costs before you move out. This home budget calculator helps you do just that. By entering income and monthly expenditures, view how much money is left to save and how much money is being spent. In addition, click the "view.

Looking for tips on budgeting out you paycheck? Get the budget percentages for your

74 Cheap Dinner Ideas for Weeknight Meals Lesley Balla Updated: Nov. 21, 2023 Easy weeknight meals on a budget are possible. We've rounded up our favorite cheap dinner ideas that will easily feed a family of four without breaking the bank. 1 / 75 Inside-Out Stuffed Cabbage Saving for a House on a Budget. To figure out your homebuying budget, calculate how much you need for a down payment and initial expenses to purchase a new home—for example, $40,000. If you have $10,000 now, calculate how long it will take to save the rest of the $30,000 when you're making monthly contributions toward your goal, the Slagles.

The budget parameter that many experts recommend is the 50-30-20 budget, where 50% of your take-home pay goes to your needs, 30% to your wants and 20% to savings for your financial future. Go to Recipe Find out our smartest ways to save money at the grocery store. 3 / 79 Creamy Spinach Chicken Dinner Cleanup is a breeze with this creamy spinach chicken. To make things even easier, tear the spinach with your hands instead of cutting it. — Taste of Home Test Kitchen Go to Recipe

How To Make A Budget For Saving Money HEWQME

One of the easiest ways to calculate your homebuying budget is the 28% rule. This rule of thumb dictates that your mortgage shouldn't be more than 28% of your gross income each month. The Federal. 4. Factor In Closing Costs. When budgeting for a home, you'll also need to make sure you can cover the closing costs. These include any fees and additional costs, such as the appraisal, that are associated with the home buying process. Typically, you can expect to pay 3% - 6% of the total loan amount in closing costs.